| View previous topic :: View next topic |

| Author |

A B C D E F T - NITIN POTADE |

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #31  Posted: Mon Jan 27, 2014 9:46 pm Post subject: Posted: Mon Jan 27, 2014 9:46 pm Post subject: |

|

|

| ndpotade wrote: | Please share your opinion about my findings.

I am attaching image of data of COALINDIA - FUTURE for Jan'14 & Feb'14.

Normally we find that Next Month's Price is greater than Current Month's Price.

But due to dividend factor, CoalIndia was showing different picture. Was there any possibility to make profit by

1. SHORT JAN FUTURE & LONG FEB FUTURE ?

For the image, you can find that there was an opportunity to earn atleast Rs.8000 in a month on investment of Rs.80000/-.

May I right or something I am missing ?

Please share your opinion. |

===============================================

Today I found trading opportunity in ACC.

ACC - Feb'2014 ... @ 994.95 ( SHORT )

ACC - Mar'2014 ... @ 985.70 ( LONG )

Diff is 9.25 so Profit can be 9.25 X 250 (lot size) = 2312.50 or more on Margin requirement of Rs.80000.00 it comes to around 3% pm return.

Will watch it till expiry of Feb'2014.

|

|

| Back to top |

|

|

|

|

|

falcon

White Belt

Joined: 17 Nov 2011

Posts: 211

|

Post: #32  Posted: Tue Jan 28, 2014 12:30 pm Post subject: Posted: Tue Jan 28, 2014 12:30 pm Post subject: |

|

|

Hi,

What if ACC Feb '14 closes at 995 and ACC Mar '14 opens at 980? Gap Ups and Gap Downs are very common at the beginning of a new series. Isn't it?

I don't think what you are assuming is so easy.

For example, right now NIFTY Jan'14 is at 6114 and NIFTY Feb'14 is at 6153. So, if I buy at 6114 and sell at 6153, the difference is 39 points x 50 lot = 1950 on a investment of 25,000 works out 7.8% per month. Even if you deduct slippage of 1-2%, you will be left with 5% profit. But, is that possible?

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #33  Posted: Tue Jan 28, 2014 3:13 pm Post subject: Posted: Tue Jan 28, 2014 3:13 pm Post subject: |

|

|

| falcon wrote: | Hi,

What if ACC Feb '14 closes at 995 and ACC Mar '14 opens at 980? Gap Ups and Gap Downs are very common at the beginning of a new series. Isn't it?

I don't think what you are assuming is so easy.

For example, right now NIFTY Jan'14 is at 6114 and NIFTY Feb'14 is at 6153. So, if I buy at 6114 and sell at 6153, the difference is 39 points x 50 lot = 1950 on a investment of 25,000 works out 7.8% per month. Even if you deduct slippage of 1-2%, you will be left with 5% profit. But, is that possible? |

It is not common so we can consider it as trading opportunity. Out of 140 fno stocks, in 1 or 2 stocks, you will find that Far month's price (Mar'2014) is less than Next month's price (Feb'2014).

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #34  Posted: Wed Jan 29, 2014 6:18 pm Post subject: Posted: Wed Jan 29, 2014 6:18 pm Post subject: |

|

|

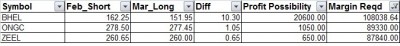

29-JAN-2014

| Description: |

|

| Filesize: |

28.71 KB |

| Viewed: |

461 Time(s) |

|

|

|

| Back to top |

|

|

falcon

White Belt

Joined: 17 Nov 2011

Posts: 211

|

Post: #35  Posted: Fri Jan 31, 2014 2:39 pm Post subject: Posted: Fri Jan 31, 2014 2:39 pm Post subject: |

|

|

Hi,

BHEL spot is trading at 160 levels and futures is trading at 170 levels. Anyone noticed this?

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #36  Posted: Sat Feb 01, 2014 3:07 am Post subject: Posted: Sat Feb 01, 2014 3:07 am Post subject: |

|

|

| Bhel why so much variation - last month or before, it was at 7-8 Rs discount, not if u say premium.....NTPotade..pls comment (any corporate event, dividend, etc)...is options matrix skewed as well...

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #37  Posted: Sat Feb 01, 2014 11:08 am Post subject: Posted: Sat Feb 01, 2014 11:08 am Post subject: |

|

|

| falcon wrote: | Hi,

BHEL spot is trading at 160 levels and futures is trading at 170 levels. Anyone noticed this? |

It's otherwise spot at 172.15, futures at 161.55.The figure is indicating that a dividend of about Rs 10 is due ( I don't know the fact ).

We can not arbitrage this scenario unless you short in cash and hold till expiry( which is not possible) simultaneously long future and hold till expiry.

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #38  Posted: Mon Feb 03, 2014 8:59 am Post subject: Posted: Mon Feb 03, 2014 8:59 am Post subject: |

|

|

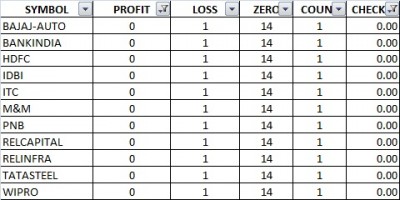

I have back tested data of 125 stock futures for last 13 months and found it end with profit in 83% and I am still working on it to minimise loss making trades so profit ratio can be increased.

62 stocks futures have shown atleast 1 opportunity and which end with profit.

The 11 stocks which is showing loss but had only 1 such opportunity in all such trades as under :-

| Description: |

|

| Filesize: |

51.91 KB |

| Viewed: |

460 Time(s) |

|

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #39  Posted: Mon Feb 03, 2014 9:03 am Post subject: Posted: Mon Feb 03, 2014 9:03 am Post subject: |

|

|

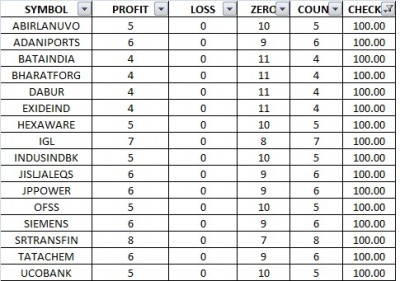

| ndpotade wrote: | I have back tested data of 125 stock futures for last 13 months and found it end with profit in 83% and I am still working on it to minimise loss making trades so profit ratio can be increased.

62 stocks futures have shown atleast 1 opportunity and which end with profit.

The 11 stocks which is showing loss but had only 1 such opportunity in all such trades as under :- |

The stocks which is showing only profit for atleast 4 such opportunities in last 13 months are as under :-

| Description: |

|

| Filesize: |

81.83 KB |

| Viewed: |

457 Time(s) |

|

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #40  Posted: Mon Feb 03, 2014 9:06 am Post subject: Posted: Mon Feb 03, 2014 9:06 am Post subject: |

|

|

| ndpotade wrote: | | ndpotade wrote: | I have back tested data of 125 stock futures for last 13 months and found it end with profit in 83% and I am still working on it to minimise loss making trades so profit ratio can be increased.

62 stocks futures have shown atleast 1 opportunity and which end with profit.

The 11 stocks which is showing loss but had only 1 such opportunity in all such trades as under :- |

The stocks which is showing only profit for atleast 4 such opportunities in last 13 months are as under :- |

If you will check SRTRASFIN had given 8 such trades in last 13 months, we can say that declaration of divident cant be only reason for such trades.

Please do your own anaylysis for taking any decision. I am still working on it.

|

|

| Back to top |

|

|

|