| View previous topic :: View next topic |

| Author |

A B C D E F T - NITIN POTADE |

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #1  Posted: Tue Jul 09, 2013 9:01 am Post subject: A B C D E F T - NITIN POTADE Posted: Tue Jul 09, 2013 9:01 am Post subject: A B C D E F T - NITIN POTADE |

|

|

ANY BODY CAN DO EQUITY & FUTURE TRADING without opening a/c with any broking house.

I am posting here an excel file whereby you can do paper trading before real trading in NIFTY & BANK NIFTY.

I hope that you will find it useful for trading.

Dear Admin - I have understood the mistake which I have made while posting excel file in the earlier thread. I assure you that the mistake will not repeat again. Thanks for co-operation.

|

|

| Back to top |

|

|

|

|

|

pkholla

Black Belt

Joined: 04 Nov 2010

Posts: 2890

|

Post: #2  Posted: Tue Jul 09, 2013 9:45 am Post subject: Posted: Tue Jul 09, 2013 9:45 am Post subject: |

|

|

Nitin: Thank you most sincerely for the trouble you are taking.

After practicing on your excel sheet we will be knowledgeable not only about ABCDEF of BNF/NF trading but also upto UVWXYZ! (I am paying a serious compliment and NOT being sarcastic etc, please note). Prakash Holla

PS: Please post the Excel sheet not only as .xlsx but also as .xls (for those like me who are satisfied with 2003 version)

|

|

| Back to top |

|

|

ajit602

White Belt

Joined: 11 Sep 2012

Posts: 370

|

Post: #3  Posted: Tue Jul 09, 2013 10:36 am Post subject: Re: A B C D E F T - NITIN POTADE Posted: Tue Jul 09, 2013 10:36 am Post subject: Re: A B C D E F T - NITIN POTADE |

|

|

| ndpotade wrote: | ANY BODY CAN DO EQUITY & FUTURE TRADING without opening a/c with any broking house.

I am posting here an excel file whereby you can do paper trading before real trading in NIFTY & BANK NIFTY.

I hope that you will find it useful for trading.

Dear Admin - I have understood the mistake which I have made while posting excel file in the earlier thread. I assure you that the mistake will not repeat again. Thanks for co-operation. |

sir please post excel sheet for nifty as you were posted for bank nifty auto updated. thanks

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #4  Posted: Sun Jul 14, 2013 8:36 pm Post subject: Posted: Sun Jul 14, 2013 8:36 pm Post subject: |

|

|

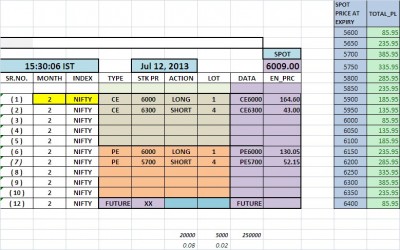

WHY ONLY FIIs or BIG INVESTORS ARE MAKING CONSISTANT PROFIT FROM TRADING ???

WHY 96% INVESTORS/TRADERS ARE IN LOSS & 4% INVESTORS/TRADERS ARE IN PROFIT ???

WANT TO GIVE JUST ONE EXAMPLE.

TRADE : NIFTY EXPIRY : AUGUST'2013 AMT REQUIRED : 2.50 LACS EXP. RETURN 1 TO 4 % P.M.

IF NIFTY CLOSE AT 5600 OR AT 6400 ON AUGUST EXPIRY, HERE PROFIT IS CONFIRMED.

| Description: |

|

| Filesize: |

139.04 KB |

| Viewed: |

852 Time(s) |

|

|

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #5  Posted: Sun Jul 14, 2013 11:00 pm Post subject: Posted: Sun Jul 14, 2013 11:00 pm Post subject: |

|

|

| GOOD ONE NITIN JI

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #6  Posted: Mon Jul 15, 2013 6:50 am Post subject: Posted: Mon Jul 15, 2013 6:50 am Post subject: |

|

|

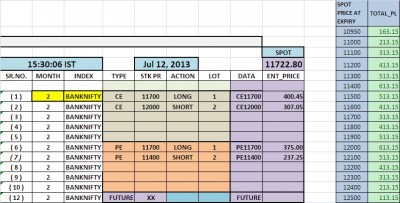

GOOD MORNING...

TRADE : BANK NIFTY

EXPIRY : AUGUST'2013 AMT REQUIRED : 1.50 LACS EXP. RETURN 2 TO 5 % P.M.

IF BANKNIFTY CLOSE BETWEEN 11000 - 12400 ON AUGUST EXPIRY, HERE PROFIT OF 200 POINTS IS EXPECTED.

11000 - 12400 CAN BE TAKEN AS STOP LOSS.

THIS IS NOT RECOMMENDATIONS AND IT IS FOR STUDY PURPOSE ONLY.

FOR TRADERS, WHO DONT KNOW THE RISK & REWARD OF OPTION HEDGE TRADE, PLEASE WATCH & TRY TO LEARN.

| Description: |

|

| Filesize: |

134.58 KB |

| Viewed: |

597 Time(s) |

|

|

|

| Back to top |

|

|

saumya12

Brown Belt

Joined: 21 Dec 2011

Posts: 1509

|

Post: #7  Posted: Mon Jul 15, 2013 10:03 am Post subject: Posted: Mon Jul 15, 2013 10:03 am Post subject: |

|

|

| Thanks

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #8  Posted: Mon Jul 15, 2013 10:07 am Post subject: Posted: Mon Jul 15, 2013 10:07 am Post subject: |

|

|

| ndpotade wrote: | GOOD MORNING...

TRADE : BANK NIFTY

EXPIRY : AUGUST'2013 AMT REQUIRED : 1.50 LACS EXP. RETURN 2 TO 5 % P.M.

11000 - 12400 CAN BE TAKEN AS STOP LOSS.

. |

Nitin,

Can we somehow anticipate, how much will be the loss when stoploss is triggered say BNF crosses 12400 in next 7 to 10 days time from now. As we will be net short CE 12000 one lot at the given point, and will be gaining a smalll premium benefit from PE short.

SHEKHAR

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #9  Posted: Mon Jul 15, 2013 2:04 pm Post subject: Posted: Mon Jul 15, 2013 2:04 pm Post subject: |

|

|

| shekharinvest wrote: | | ndpotade wrote: | GOOD MORNING...

TRADE : BANK NIFTY

EXPIRY : AUGUST'2013 AMT REQUIRED : 1.50 LACS EXP. RETURN 2 TO 5 % P.M.

11000 - 12400 CAN BE TAKEN AS STOP LOSS.

. |

Nitin,

Can we somehow anticipate, how much will be the loss when stoploss is triggered say BNF crosses 12400 in next 7 to 10 days time from now. As we will be net short CE 12000 one lot at the given point, and will be gaining a smalll premium benefit from PE short.

SHEKHAR |

If Bank Nifty goes up, then

We will be in MTM LOSS in

2 SHORT CE 12000 & 1 LONG PE 11700

And at the same time, we will be in MTM PROFIT in

2 SHORT PE 11400 & 1 LONG CE 11700...

Same will apply reverse if Bank Nifty goes down...

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #10  Posted: Mon Jul 15, 2013 10:08 pm Post subject: Posted: Mon Jul 15, 2013 10:08 pm Post subject: |

|

|

Nitin,

Thanks for responding.

What you have said is quite clear from the table posted by you.

MTM profit and MTM loss at the end of expiry are quite obvious.

Probably I failed to make myself clear. Here is an another attempt.

If we close position after 10 day at 12400 (SL) and still one month to go there is still enough time value and premium hike because of increased volatility remains, Will MTM profit/loss will be more or less same as you have shown in the table.

What have been your experience. ?

Here are some observations which shows that BNF gives large move and one will need to cut position before expiry, to come out of net one lot short CE/PE

Position taken in middle of month (10th-20th) for next months expiry

Values and time are just approximation.

In mid Feb: BNF was at 12500 and it droped to 11100 in less than 2 weeks. Move of 1400 points

mid April: BNF was at 11100 and rose to 12800 in less than 2 weeks. Move of 1700 points

mid may: BNF 13200 dropped to 11700 in just over 2 weeks. Move of 1500 points.

Trade taken at 11700, I assume market is moving up for the given example as posted by you. And we are at 12400 after 10 days and need to close the position (SL hit)

Max gain from 1 long PE and 2 short PE is 99 until the Expiry in the end of Aug so it will be less if we close after 10days

Gain from 1 long CE 11700 bot @ 400 and 1 short CE 12000 sold @ 300 max gain possible is 200 until the Expiry in the end of Aug so it will be less if we close after 10 days

Now we are net short 1 lot CE 12000 sold at 300 approx. BNF at 11700 , Now BNF reaching 12400 a gain of 700 points this CE premium will increase substantially my guesstimate is it will gain min. 50% that is 350 hence it will be trading at 650 approx. hence loss would be 350

NET loss = 99+ 200 - 350 = 50 approx. this is minimum actual may be higher.

SHEKHAR

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #11  Posted: Tue Jul 16, 2013 11:03 pm Post subject: Posted: Tue Jul 16, 2013 11:03 pm Post subject: |

|

|

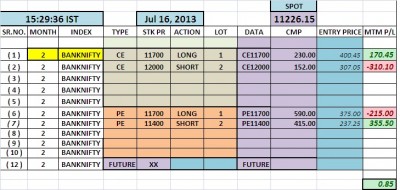

EOD POSITION ON 16-07-2013

| Description: |

|

| Filesize: |

112.75 KB |

| Viewed: |

524 Time(s) |

|

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #12  Posted: Tue Jul 16, 2013 11:06 pm Post subject: Posted: Tue Jul 16, 2013 11:06 pm Post subject: |

|

|

| BANKNIFTY DOWN BY 500 POINTS BUT THERE IS NO MAJOR LOSS...

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #13  Posted: Wed Jul 17, 2013 12:02 pm Post subject: Posted: Wed Jul 17, 2013 12:02 pm Post subject: |

|

|

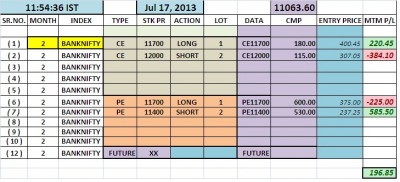

TARGET OF 2% ie 200 points achieved almost...

If you have doubt about strategy means you dont have faith and you wont have patience to hold position.

Lack of faith, patience & discipline can leads to LOSS...

I hope that now most of the doubts got cleared till now.

| Description: |

|

| Filesize: |

105.76 KB |

| Viewed: |

531 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #14  Posted: Wed Jul 17, 2013 1:48 pm Post subject: Posted: Wed Jul 17, 2013 1:48 pm Post subject: |

|

|

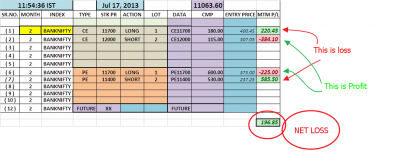

| ndpotade wrote: | TARGET OF 2% ie 200 points achieved almost...

If you have doubt about strategy means you dont have faith and you wont have patience to hold position.

Lack of faith, patience & discipline can leads to LOSS...

I hope that now most of the doubts got cleared till now. |

Nitin,

Is it not a loss of 196 points ?

Please recalculate ?

SHEKHAR

| Description: |

|

| Filesize: |

258.07 KB |

| Viewed: |

570 Time(s) |

|

|

|

| Back to top |

|

|

pkholla

Black Belt

Joined: 04 Nov 2010

Posts: 2890

|

Post: #15  Posted: Wed Jul 17, 2013 2:01 pm Post subject: Posted: Wed Jul 17, 2013 2:01 pm Post subject: |

|

|

Shekhar: you are correct

Nitin: Please simplify the spreadsheet and your trading approach if possible. More complex the approach, more likely you are to make mistakes

Jai Hind, Prakash Holla

Last edited by pkholla on Wed Jul 17, 2013 2:08 pm; edited 1 time in total |

|

| Back to top |

|

|

|