| View previous topic :: View next topic |

| Author |

A FUSION TRADING STRATEGY |

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

|

| Back to top |

|

|

|

|

|

amitkbaid1008

Yellow Belt

Joined: 04 Mar 2009

Posts: 540

|

Post: #2  Posted: Wed Nov 09, 2011 10:59 pm Post subject: Posted: Wed Nov 09, 2011 10:59 pm Post subject: |

|

|

Good One

Ha Ha Ha Ha Ha

|

|

| Back to top |

|

|

sonila

Brown Belt

Joined: 04 Jun 2009

Posts: 1786

|

Post: #3  Posted: Wed Nov 09, 2011 11:22 pm Post subject: Posted: Wed Nov 09, 2011 11:22 pm Post subject: |

|

|

| Very complex.

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #4  Posted: Thu Nov 10, 2011 5:30 am Post subject: Posted: Thu Nov 10, 2011 5:30 am Post subject: |

|

|

Oh! I thought.... I made it as simple as possible.

What is complex in it?  . .

Go through it peacefully..... it's not as complex as you think.

| sonila wrote: | | Very complex. |

|

|

| Back to top |

|

|

Arjun20

Yellow Belt

Joined: 23 Jun 2011

Posts: 945

|

Post: #5  Posted: Thu Nov 10, 2011 9:44 am Post subject: Posted: Thu Nov 10, 2011 9:44 am Post subject: |

|

|

| rk_a2003 wrote: | Oh! I thought.... I made it as simple as possible.

What is complex in it?  . .

Go through it peacefully..... it's not as complex as you think.

| sonila wrote: | | Very complex. |

|

Not much are aware with CCI/BB. Awareness means we had heard these terms. But don't know their interpretations or their role.

RSI/STOCH/MACD are more familiar

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #6  Posted: Thu Nov 10, 2011 11:51 am Post subject: Posted: Thu Nov 10, 2011 11:51 am Post subject: |

|

|

| Arjun20 wrote: | | rk_a2003 wrote: | Oh! I thought.... I made it as simple as possible.

What is complex in it?  . .

Go through it peacefully..... it's not as complex as you think.

| sonila wrote: | | Very complex. |

|

Not much are aware with CCI/BB. Awareness means we had heard these terms. But don't know their interpretations or their role.

RSI/STOCH/MACD are more familiar |

Arjun.

The beauty of the stratagies lies in the fact that one can trade them even with out knowing the components employed in it ( though i don't advocate it to do so)

One can go to an EOD candle stick chart and plot Bollinger Bands(20), Commodity Channel Index (5),Volume and look up for other conditions ....once they are fullfilled..... can strike.

Before that please backtest it on historical charts. One can find good number of trades though they are not quite often.Once ...convinced with the result one can start implementing it,and also get the insigths of the components used in it for mastering the technique.

Once settings were done it hardly takes a minute to check for this set up....You are already in the look out for possible WW's.

How ever I will be posting the possible trades whenever I find them and request all of you to do the same( You may observe that UNITECH chart posted is an on going trade.).

I have already discussed about this with Casper in an embrionic form.Now I am looking for his and other Experts suggestions...... anticipating further fine tuning.

Once It was done ..I am confident that this Strategy will have more success rate than WW and I am ready to bet My Capital on it..... if not my life.

|

|

| Back to top |

|

|

girishhu1

White Belt

Joined: 17 Aug 2009

Posts: 316

|

Post: #7  Posted: Thu Nov 10, 2011 2:54 pm Post subject: Posted: Thu Nov 10, 2011 2:54 pm Post subject: |

|

|

hi rk,

i m enclosing 60min chart of abb-1m.i think it fulfills all conditions listed by you.i have tried to mark the conditions on chart pl confirm the correctness and pl clarify whether rising channel for bullish target may pose problem.

the change of guard candle and long tailed candle are different in this case.pl clarify whether the sl should be modified from the low of change of guard candle to low of long tailed candle ( and further to lower trendline now) on trailing basis, if one would have taken the trade?

regards,

girish

| Description: |

|

| Filesize: |

72.95 KB |

| Viewed: |

886 Time(s) |

|

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #8  Posted: Thu Nov 10, 2011 6:35 pm Post subject: Posted: Thu Nov 10, 2011 6:35 pm Post subject: |

|

|

Hi Girish

Sorry! for delayed response.Yes your concern is right A +WW is not possible in rising channel. A -WW is possible in future in ABB 60M TF.

One caution.... I devised it for EOD and tested it on EOD Time frame.Though I am confident that it should work on all TF's.Testing was not done in other TF's.

|

|

| Back to top |

|

|

amitkbaid1008

Yellow Belt

Joined: 04 Mar 2009

Posts: 540

|

Post: #9  Posted: Thu Nov 10, 2011 6:41 pm Post subject: Posted: Thu Nov 10, 2011 6:41 pm Post subject: |

|

|

This strategy should be named (Con)Fusion Trading Strategy

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #11  Posted: Thu Nov 10, 2011 11:36 pm Post subject: Posted: Thu Nov 10, 2011 11:36 pm Post subject: |

|

|

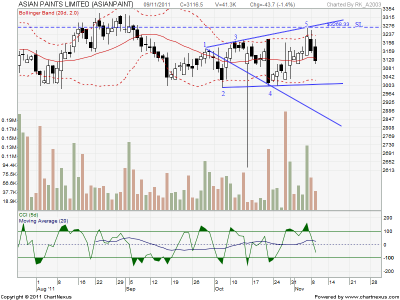

Posting Latest Ongoing EOD Chart of Asian paints with -WW and other conditions fulfilled as per Fusion Strategy.

| Description: |

|

| Filesize: |

45.1 KB |

| Viewed: |

747 Time(s) |

|

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #12  Posted: Fri Nov 11, 2011 10:48 pm Post subject: Posted: Fri Nov 11, 2011 10:48 pm Post subject: |

|

|

Hi All,

It's a good start for the strategy.From the intraday chart of it I can read the following.

Asian Paints opened at 3117.90 and climbed up to 3168. From the after noon all the Guns which were lined up and pointed downwards displayed their fire power and nailed it down to 3046 and it finally closed at 3057.15 .More than 100 points slide from the peak.Even the late recovery of the Index could not come for it's rescue. Partial profits may be booked at Lower B.B and for the rest- Set TSL to cost to cost.

A very good start indeed .It's not you and me who are firing those guns, infact it's beyond our capacity.Even we are not aware of.... who are firing those guns.Only thing we did was identifying those guns that were lined up and about to fire .We were simply banking on them.... that's it.

You already have a strategy presented in front of you.This week end I may present the theory and working dynamics of it.

A latest chart attached.

(P.S:A latest chart attached for Unitech too Partial profit booking advised here too as the price crossed BTL )

RK

| Description: |

|

| Filesize: |

49.2 KB |

| Viewed: |

720 Time(s) |

|

| Description: |

|

| Filesize: |

47.6 KB |

| Viewed: |

699 Time(s) |

|

Last edited by rk_a2003 on Sat Nov 12, 2011 7:53 am; edited 2 times in total |

|

| Back to top |

|

|

Vinodz

White Belt

Joined: 13 Aug 2011

Posts: 78

|

Post: #13  Posted: Fri Nov 11, 2011 11:45 pm Post subject: good Posted: Fri Nov 11, 2011 11:45 pm Post subject: good |

|

|

good going rk.

look forward to more such insights

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #14  Posted: Sat Nov 12, 2011 9:46 am Post subject: Posted: Sat Nov 12, 2011 9:46 am Post subject: |

|

|

Hi rk_a2003,

the combination worked out by you seems to good as per examples given.

Good show !

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #15  Posted: Sat Nov 12, 2011 10:18 am Post subject: Posted: Sat Nov 12, 2011 10:18 am Post subject: |

|

|

rk,

pls check this fusion setup on nifty_spot.

the first arrow is setup day and the 2nd arrow shows the trade execution day.

pls ignore the volume and rsi panes.

| Description: |

|

| Filesize: |

11.85 KB |

| Viewed: |

723 Time(s) |

|

|

|

| Back to top |

|

|

|