|

|

| View previous topic :: View next topic |

| Author |

a layman's approach to break out and break down |

singh.ravee

Yellow Belt

Joined: 12 Aug 2010

Posts: 678

|

Post: #1426  Posted: Sat Jan 15, 2011 10:35 am Post subject: Posted: Sat Jan 15, 2011 10:35 am Post subject: |

|

|

casper,

thank u so much for your analysis on ongc. Points are noted.

regards

ravee

|

|

| Back to top |

|

|

|

|  |

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #1427  Posted: Sat Jan 15, 2011 10:35 am Post subject: Posted: Sat Jan 15, 2011 10:35 am Post subject: |

|

|

| vishytns wrote: | Ravee/Casper,

Rocking guys, good trading strategies explained. Keep up the good work.

Casper,

Congrats on your profits in ONGC. Great execution.

Vishy |

sorry vishy

things are not that rocking

ravee has made some elementary mistakes as per my believe, i hope he may not end up losing like RAKESH

rakesh finally came in direct contact with me some how, i dont want to advertise myself as BIG BOY

but at least u know personally,how he lost in past by getting wrongly influenced by others and how we have spent our day and night, right from 9 am to 12.30 am in night to recover him

dont u think that.a fresher/beginner with no idea is okey (coz he will learn later) but a fresher with wrong notion is a horrible thing. becoz he has to erase all the wrong ideas first to come in the path of profitability??

market is not a kind thing, it is all time ready to suck the blood of a new comer.

that is why i am so concerned now

( sorry for putting the personal experience of 3IDIOTS in open forum, but u know, i cant resist when i see something harmful might happen)

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #1428  Posted: Sat Jan 15, 2011 11:00 am Post subject: Posted: Sat Jan 15, 2011 11:00 am Post subject: |

|

|

Experts,

Check the attached graph. Please correct me if i am wrong. If I am correct please provide targets of this pattern. I have taken the position, please look at the chart and tell me whether i can carry forward from monday on wards. Also please mention how long can I hold this position.

Thanks and regards

Vishy

| Description: |

|

| Filesize: |

215.88 KB |

| Viewed: |

174 Time(s) |

|

|

|

| Back to top |

|

|

chetan83

Brown Belt

Joined: 19 Feb 2010

Posts: 2036

|

Post: #1429  Posted: Sat Jan 15, 2011 11:13 am Post subject: Query.... Posted: Sat Jan 15, 2011 11:13 am Post subject: Query.... |

|

|

| casper wrote: | hi all

2 days ago i had made a huge loss in HDFC. today i hv got almost same set up in ONGC, and going by my experience of hdfc and some testing which i made yesterday, i traded ONGC today.

here i am sharing the same with u, see if any of u could use /refine it

HDFC SITUATION

hdfc in real time chart. was an at, in 60 min tf it had got + div while in 5 min tf it had got -div. the stock opened in gap up manner which was not shown in 60 min chart. and i have mistaken it for a break out candle and taken position with the candle close. then due to the - div in smaller tf and gap up opening, it came down heavily to form a sort of bearish flag. which had a strong support around 650 and after getting the support, it went on to make some 684 as new high.

during the going down of 2nd hourly candle i had to close my position with heavy loss

ONGC

PRE-MARKET: ongc was just like hdfc, an at real time tf, 60min chart had got +div and 5 min chart had got - div, u can say a photo copy of hdfc

OPENING: just like hdfc, it made a gap up opening, which was not visible in 60 min chart but was clearly visible in 5 min, and as i expected it came down heavily within 15 minutes of opening and was arrested around 1180 range, forming a sort of bearish flag

MY TRADES:

1. i switched immediately to 5 min tf and never get back in 60 min , i knew if this flag breaks out then i will be simply wiped out. so i waited to find the bottom

2.then after some time, i saw an at is forming in 5 min tf, now after the fall, i was sure that the effect of negative divergence in lesser tf paid off its the turn of the + div now

3. i bought in large quantity, almost double of what i usually trade, the picture of HDFC day was in my eyes, i was tensed but some how manged to buy and after buying i started cursing myself. i bought it aprox 1182 level

4.within a few minutes of buying that at broken out reaching near 1200 range, i was so happy, i thought to book some, but instead of booking, i kept a trailing sl

5.then i think, due to inflation number or something like this, we got a one candle correction which immediately covered in the very next candle, confirming the bullishness even more

6.after some time, i got a divergence, a negative div, i got really scarred now, but as the candle closed higher so double top had not formed , i thanked my god

7. now i see we are at previous resistance level of 1208, so i was waiting to break it for even more up move, vishy shouted, " buddy we got an inv h/s, neck line is at 1208"

i said to myself, "dont wait man, off load at least half of ur bulk now and keep strict sl for the rest " so i booked 50% at 1207 some thing

8. then it broken out, price zoomed to 1215 aprx, naturally i could not book it there, i got trailing sl which was hit at 1210 and i was out of long trade, but with good money

9. finally in 5 min tf i saw a small dt, just above the neck line of 1208, but 34 ema was supporting

very casually i shorted it while chatting with ali, and said him that let me make up my brokerage by this short but bhai u dont enter, it has strong support, u dont have chart so u wont be able to book, i need to book it very fast

10. i hv not checked nifty, so i was clueless of what is going to happen. again after shorting, i started cursing myself, becoz my short was bouncing back. ali bhai was asking me" bhai whats ur sl? its going up?"

i said let it be 1210 and i will be out. i was short at 1207

then it went down suddenly, it was 1200, i did not waited, nor i trailed it, just booked it at 1200, only to see price going down 1198,1195,1190..... 1180

again i started blaming my luck, why i have not waited for merely two more minutes? i booked it near 89 ema in 5 min tf, but price broken that ema like someone cutting butter with a knife

but then, i had no chance left

so this was my experience with ONGC, one of the best trades i have ever taken,

one thing i am sure of, if there is any more case like HDFC/ONGC. i will be more confident next time |

Hi Casper,

1st of all, my hearty congratulations for ur success in ONGC. It is truely satisfying result for me to know that ur hard work is paying here doing TA. I hope even my midnight oil will pay me off some day (don't know when).

I think u must be knowing better last week I was trapped in ICICI future badly at 1150, and my broker sold it off as I was not having suffecient margin at 1022 (u may guess the loss amount).

Then this week Bank Nifty had trapped me, where I was short at 10950 levels, but when 11150 broke and closed abv 11140, I closed by short at loss and went long there!!! (as we had some bullish harami pattern), but next day it slide and closed at 10740, i.e on 12/01/10, but in the morning only I covered it at 11050 with 100 points loss. (so altogether around 400 points loss again).

As I am also a full time employee in an insurance co. here at Jamshedpur like most of the brothers here, luckily in my office, I manage to open i-charts and check some patterns which is described by you in this thread.

I don't know where I go wrong, or is it my fear and greed by which I incur loss often till date with no return at least in past 5 years!!! But after getting to know abt TA in past 6-8 month I was thinking to cope up my losses but nothing good is happening either.

Even I had written to Sumesh in facebook also, but I have got any reply from him, I think he must be busy with his work schedule.

Casper, if u dont mind, u can just polish my skill as I know that I am not that bad either, as trading in front of the terminal with Charts and trading on phone from office is very different. Money management skill is poor as very often my profit turned trades in Bank-Nifty was not squared off on time.

Your nice piece of write-up and explaining things is very good, but still frankly speaking I am not that good in distance learning programme (as my distance MBA is still pending for more than a year now )

I wud be oblidged if u cud just help me out in some other way.

Regards,

Chetan Kumar.

|

|

| Back to top |

|

|

deepakms

White Belt

Joined: 13 Aug 2009

Posts: 194

|

Post: #1430  Posted: Sat Jan 15, 2011 12:26 pm Post subject: Posted: Sat Jan 15, 2011 12:26 pm Post subject: |

|

|

Hey Casper,

Ur explanation of the trades is like a exciting novel,just can't stop reading.

When u retire u should plan on an autobiography (just kidding)............

But just in case that happens I'm sure it'll sell like hot cakes !!!

As always u have shared and helped all here in the forum most of the time.

Wish u sucessful trades always.

Rgds

Deepak

Now back to business buddy:Ur views of UNITECH pls(with all the bad news how much more will it go down,down side tgt ...approx)

| Description: |

|

| Filesize: |

11.24 KB |

| Viewed: |

666 Time(s) |

|

| Description: |

|

| Filesize: |

12.03 KB |

| Viewed: |

136 Time(s) |

|

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #1431  Posted: Sat Jan 15, 2011 5:17 pm Post subject: Posted: Sat Jan 15, 2011 5:17 pm Post subject: |

|

|

hi chetan

yes i know about icici and that gave we 3idiots(  ) a sleepless night ) a sleepless night

sumesh bhai was out to puri for winter vacation, i think that is the reason of delay, he has just came back a few days ago but i am sure that he is under tremendous pressure in his office

u found sumesh bhai, now with anticipated permission from sumesh bhai, i am asking u to search his friend list to find a guy named tushar chatterjee

this one may help u

i am really eager to help not only u but all of u whomever ask for help, off-course for educational purpose and strictly not for commercial purpose but the problem is if i post my contact info here, the result will be immediatle banning my id

if u are a real time chart subscriber then only one thin ray of hope exists, u and me have to be in SB at the same time, and we need to ask STSIR/PTSIR/KAMALSIR'S permission to exchange our contact details

if u r already a member dont try to find me in this weekend in sb, bcoz my subscription is already expired, and only after Monday 9 am i will be able to get it reactivated

and let me think about the ways to improve ur trading skills, i will be back with a few recommendation soon

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #1432  Posted: Sat Jan 15, 2011 5:33 pm Post subject: Posted: Sat Jan 15, 2011 5:33 pm Post subject: |

|

|

| deepakms wrote: | Hey Casper,

Ur explanation of the trades is like a exciting novel,just can't stop reading.

When u retire u should plan on an autobiography (just kidding)............

But just in case that happens I'm sure it'll sell like hot cakes !!!

As always u have shared and helped all here in the forum most of the time.

Wish u sucessful trades always.

Rgds

Deepak

Now back to business buddy:Ur views of UNITECH pls(with all the bad news how much more will it go down,down side tgt ...approx) |

hii brother

if market remain this kinds of volatile for more than another week, i really have to search another job, at least part time

thanks for advising a profession   i will really consider this if nifty remains like ATLANTIC i will really consider this if nifty remains like ATLANTIC

now unitech

i have no real time data now, so i am drawing some TL on ur posted chart

in real time chart u posted , it looks like it made a BROADENING TOP FORMATION whose support was around weekly pivot

now the target is 56 but it is already at monthly s2 level, so we can expect the stock to take support here

below this level we have support at 54 and 50 level, among them 54 seems to be quite good one becoz apart from being a weekly support level, it is also the lower bollinger band level in eod chart

| Description: |

|

| Filesize: |

22.88 KB |

| Viewed: |

141 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #1433  Posted: Sat Jan 15, 2011 9:19 pm Post subject: Posted: Sat Jan 15, 2011 9:19 pm Post subject: |

|

|

Experts,

I have attached the nifty weekly chart. Please see and comment.

Bullish scenario...

==============

If we close above the channel in chart. We have already closed below the channel upper trend line. All these time this channel was supporting the nifty. If we consistently close above this channel then we can head higher.

200ema( 5648 is supporting nifty now)

200sma(5606 should support nifty if 200ema is broken), we can also expect some bounce back from here that can take us towards 5700 levels again. If 200 sma is broken the see the bearish scenario

Bearish scenario

============

S2- 5548 should be the support,

if S2 is broken then the break out level of previous rally from 5348 to 6350 levels should be tested. S2 is 5348.

If S2 5348 level is broken then we should test the lower end of the channel. Lower end of the channel is 5050. Lets us pray this situation will not come.

Please comment experts..

regards

Vishy.

| Description: |

|

| Filesize: |

177.93 KB |

| Viewed: |

165 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #1434  Posted: Sat Jan 15, 2011 9:44 pm Post subject: Posted: Sat Jan 15, 2011 9:44 pm Post subject: |

|

|

Experts,

I have attached BANKNIFTY chart. Please comment.

This chart is very comfortable to see that Bank nifty has taken support, from nifty point of view. But, there is a bearish head and shoulders formed and broken down in this index(Mentioned in my previous post on Bank Nifty). Are we going to break this support? Only time will say. I have already taken short position in this index. Let us see what happens on monday. Experts, have to tell me whether this level will be broken.

I have also mentioned the next support levels

1. Break out level at 10100

2. Next support at 9970

3. Next Support at 9291

I am waiting for your comments, as i have taken short position in this index. I am in profits, but i need your feedback so that i can exit in proper way.

regards

Vishy.

| Description: |

|

| Filesize: |

144.65 KB |

| Viewed: |

149 Time(s) |

|

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #1435  Posted: Sat Jan 15, 2011 11:05 pm Post subject: Re: Query.... Posted: Sat Jan 15, 2011 11:05 pm Post subject: Re: Query.... |

|

|

| chetan83 wrote: | | casper wrote: | hi all

2 days ago i had made a huge loss in HDFC. today i hv got almost same set up in ONGC, and going by my experience of hdfc and some testing which i made yesterday, i traded ONGC today.

here i am sharing the same with u, see if any of u could use /refine it

HDFC SITUATION

hdfc in real time chart. was an at, in 60 min tf it had got + div while in 5 min tf it had got -div. the stock opened in gap up manner which was not shown in 60 min chart. and i have mistaken it for a break out candle and taken position with the candle close. then due to the - div in smaller tf and gap up opening, it came down heavily to form a sort of bearish flag. which had a strong support around 650 and after getting the support, it went on to make some 684 as new high.

during the going down of 2nd hourly candle i had to close my position with heavy loss

ONGC

PRE-MARKET: ongc was just like hdfc, an at real time tf, 60min chart had got +div and 5 min chart had got - div, u can say a photo copy of hdfc

OPENING: just like hdfc, it made a gap up opening, which was not visible in 60 min chart but was clearly visible in 5 min, and as i expected it came down heavily within 15 minutes of opening and was arrested around 1180 range, forming a sort of bearish flag

MY TRADES:

1. i switched immediately to 5 min tf and never get back in 60 min , i knew if this flag breaks out then i will be simply wiped out. so i waited to find the bottom

2.then after some time, i saw an at is forming in 5 min tf, now after the fall, i was sure that the effect of negative divergence in lesser tf paid off its the turn of the + div now

3. i bought in large quantity, almost double of what i usually trade, the picture of HDFC day was in my eyes, i was tensed but some how manged to buy and after buying i started cursing myself. i bought it aprox 1182 level

4.within a few minutes of buying that at broken out reaching near 1200 range, i was so happy, i thought to book some, but instead of booking, i kept a trailing sl

5.then i think, due to inflation number or something like this, we got a one candle correction which immediately covered in the very next candle, confirming the bullishness even more

6.after some time, i got a divergence, a negative div, i got really scarred now, but as the candle closed higher so double top had not formed , i thanked my god

7. now i see we are at previous resistance level of 1208, so i was waiting to break it for even more up move, vishy shouted, " buddy we got an inv h/s, neck line is at 1208"

i said to myself, "dont wait man, off load at least half of ur bulk now and keep strict sl for the rest " so i booked 50% at 1207 some thing

8. then it broken out, price zoomed to 1215 aprx, naturally i could not book it there, i got trailing sl which was hit at 1210 and i was out of long trade, but with good money

9. finally in 5 min tf i saw a small dt, just above the neck line of 1208, but 34 ema was supporting

very casually i shorted it while chatting with ali, and said him that let me make up my brokerage by this short but bhai u dont enter, it has strong support, u dont have chart so u wont be able to book, i need to book it very fast

10. i hv not checked nifty, so i was clueless of what is going to happen. again after shorting, i started cursing myself, becoz my short was bouncing back. ali bhai was asking me" bhai whats ur sl? its going up?"

i said let it be 1210 and i will be out. i was short at 1207

then it went down suddenly, it was 1200, i did not waited, nor i trailed it, just booked it at 1200, only to see price going down 1198,1195,1190..... 1180

again i started blaming my luck, why i have not waited for merely two more minutes? i booked it near 89 ema in 5 min tf, but price broken that ema like someone cutting butter with a knife

but then, i had no chance left

so this was my experience with ONGC, one of the best trades i have ever taken,

one thing i am sure of, if there is any more case like HDFC/ONGC. i will be more confident next time |

Hi Casper,

1st of all, my hearty congratulations for ur success in ONGC. It is truely satisfying result for me to know that ur hard work is paying here doing TA. I hope even my midnight oil will pay me off some day (don't know when).

I think u must be knowing better last week I was trapped in ICICI future badly at 1150, and my broker sold it off as I was not having suffecient margin at 1022 (u may guess the loss amount).

Then this week Bank Nifty had trapped me, where I was short at 10950 levels, but when 11150 broke and closed abv 11140, I closed by short at loss and went long there!!! (as we had some bullish harami pattern), but next day it slide and closed at 10740, i.e on 12/01/10, but in the morning only I covered it at 11050 with 100 points loss. (so altogether around 400 points loss again).

As I am also a full time employee in an insurance co. here at Jamshedpur like most of the brothers here, luckily in my office, I manage to open i-charts and check some patterns which is described by you in this thread.

I don't know where I go wrong, or is it my fear and greed by which I incur loss often till date with no return at least in past 5 years!!! But after getting to know abt TA in past 6-8 month I was thinking to cope up my losses but nothing good is happening either.

Even I had written to Sumesh in facebook also, but I have got any reply from him, I think he must be busy with his work schedule.

Casper, if u dont mind, u can just polish my skill as I know that I am not that bad either, as trading in front of the terminal with Charts and trading on phone from office is very different. Money management skill is poor as very often my profit turned trades in Bank-Nifty was not squared off on time.

Your nice piece of write-up and explaining things is very good, but still frankly speaking I am not that good in distance learning programme (as my distance MBA is still pending for more than a year now )

I wud be oblidged if u cud just help me out in some other way.

Regards,

Chetan Kumar. |

Hi,

I hope i am not interfering as the post is directed to casper. It good that you relaize some thing is going wrong in your trading and you want to improve it. good first step.

you said you have been trading for 5 yrs now but you are not getting results (profits) rather loss. you metioned your two trades one in icici and one in bank nifty.both futures. you had big losses that means you had not maintained the SL.

ASK YOU SELF WHY HAVE YOU TRADED IN FUTURES R U SUCCESSFUL TRADING EQUITY IN CASH?

futures are very different ball game and it require some exp and success in trading equity in cash and load of discipline.

most of the ppl do trading for earning quick money but always remember this is gambling you are doing not trading and in gambling its the house who always win.

another mistake ppl do they don't treat trading as business/ part time business. so they dont have plan in turn they fail miserably. and dent their self confidence.

most of us never do introspection and try to understand why do we fail as a trader when we are successful is our life in our jobs in our sports and in other so many things in life.

trading basically is against life against wht we believe and follow in our general life. its our upbringing which is against trading.

i can quote an example that in life we celebrate both happiness and sorrows. some dear one dies we celebrate the sorrow for min 13 days and we also celebrate the happiness by enjoying festivals BUT FOR 1-2 DAYS. this is wht we are doing.

in trading happiness is profit and sorrow is loss. now since we have brought and taught to celebrate sorrow for long duration we hold our loss for long duration never cut it off we hold it till our a/c blow off.

profit is happiness in trading. now we have been taught to celebrate happiness for short duration we cut our profit too quick never hold it even though we know it will further go up.

this is wht trading is its against life and most of us dont know and dont understand the difference.

methods, systems set ups i am sure you know very well and i am sure you know much better than me or anybody else abt them. but these methods, systems, set ups etc are useless they will never make you a successful trader.

its the discipline which makes the difference. its the psyche which makes difference.

if you are having a mediocre strategy but have steel discipline and a positive approach towards trading you will be a very successful trader. work on them. its not easy to do and not many ppl are doing it thats why not many ppl are successful in trading.

trading is the highest paid job/business in the world and when something is highest paid it has to be very difficult. you have to put lots of efforts and hard work but problem is most of us do not know where and which direction we need to put efforts as due to which our learning curve is too pain full and too long before we start making profits by that time not many are left.

regards,

|

|

| Back to top |

|

|

chetan83

Brown Belt

Joined: 19 Feb 2010

Posts: 2036

|

Post: #1436  Posted: Sat Jan 15, 2011 11:27 pm Post subject: Re: Query.... Posted: Sat Jan 15, 2011 11:27 pm Post subject: Re: Query.... |

|

|

| sherbaaz wrote: | | chetan83 wrote: | | casper wrote: | hi all

2 days ago i had made a huge loss in HDFC. today i hv got almost same set up in ONGC, and going by my experience of hdfc and some testing which i made yesterday, i traded ONGC today.

here i am sharing the same with u, see if any of u could use /refine it

HDFC SITUATION

hdfc in real time chart. was an at, in 60 min tf it had got + div while in 5 min tf it had got -div. the stock opened in gap up manner which was not shown in 60 min chart. and i have mistaken it for a break out candle and taken position with the candle close. then due to the - div in smaller tf and gap up opening, it came down heavily to form a sort of bearish flag. which had a strong support around 650 and after getting the support, it went on to make some 684 as new high.

during the going down of 2nd hourly candle i had to close my position with heavy loss

ONGC

PRE-MARKET: ongc was just like hdfc, an at real time tf, 60min chart had got +div and 5 min chart had got - div, u can say a photo copy of hdfc

OPENING: just like hdfc, it made a gap up opening, which was not visible in 60 min chart but was clearly visible in 5 min, and as i expected it came down heavily within 15 minutes of opening and was arrested around 1180 range, forming a sort of bearish flag

MY TRADES:

1. i switched immediately to 5 min tf and never get back in 60 min , i knew if this flag breaks out then i will be simply wiped out. so i waited to find the bottom

2.then after some time, i saw an at is forming in 5 min tf, now after the fall, i was sure that the effect of negative divergence in lesser tf paid off its the turn of the + div now

3. i bought in large quantity, almost double of what i usually trade, the picture of HDFC day was in my eyes, i was tensed but some how manged to buy and after buying i started cursing myself. i bought it aprox 1182 level

4.within a few minutes of buying that at broken out reaching near 1200 range, i was so happy, i thought to book some, but instead of booking, i kept a trailing sl

5.then i think, due to inflation number or something like this, we got a one candle correction which immediately covered in the very next candle, confirming the bullishness even more

6.after some time, i got a divergence, a negative div, i got really scarred now, but as the candle closed higher so double top had not formed , i thanked my god

7. now i see we are at previous resistance level of 1208, so i was waiting to break it for even more up move, vishy shouted, " buddy we got an inv h/s, neck line is at 1208"

i said to myself, "dont wait man, off load at least half of ur bulk now and keep strict sl for the rest " so i booked 50% at 1207 some thing

8. then it broken out, price zoomed to 1215 aprx, naturally i could not book it there, i got trailing sl which was hit at 1210 and i was out of long trade, but with good money

9. finally in 5 min tf i saw a small dt, just above the neck line of 1208, but 34 ema was supporting

very casually i shorted it while chatting with ali, and said him that let me make up my brokerage by this short but bhai u dont enter, it has strong support, u dont have chart so u wont be able to book, i need to book it very fast

10. i hv not checked nifty, so i was clueless of what is going to happen. again after shorting, i started cursing myself, becoz my short was bouncing back. ali bhai was asking me" bhai whats ur sl? its going up?"

i said let it be 1210 and i will be out. i was short at 1207

then it went down suddenly, it was 1200, i did not waited, nor i trailed it, just booked it at 1200, only to see price going down 1198,1195,1190..... 1180

again i started blaming my luck, why i have not waited for merely two more minutes? i booked it near 89 ema in 5 min tf, but price broken that ema like someone cutting butter with a knife

but then, i had no chance left

so this was my experience with ONGC, one of the best trades i have ever taken,

one thing i am sure of, if there is any more case like HDFC/ONGC. i will be more confident next time |

Hi Casper,

1st of all, my hearty congratulations for ur success in ONGC. It is truely satisfying result for me to know that ur hard work is paying here doing TA. I hope even my midnight oil will pay me off some day (don't know when).

I think u must be knowing better last week I was trapped in ICICI future badly at 1150, and my broker sold it off as I was not having suffecient margin at 1022 (u may guess the loss amount).

Then this week Bank Nifty had trapped me, where I was short at 10950 levels, but when 11150 broke and closed abv 11140, I closed by short at loss and went long there!!! (as we had some bullish harami pattern), but next day it slide and closed at 10740, i.e on 12/01/10, but in the morning only I covered it at 11050 with 100 points loss. (so altogether around 400 points loss again).

As I am also a full time employee in an insurance co. here at Jamshedpur like most of the brothers here, luckily in my office, I manage to open i-charts and check some patterns which is described by you in this thread.

I don't know where I go wrong, or is it my fear and greed by which I incur loss often till date with no return at least in past 5 years!!! But after getting to know abt TA in past 6-8 month I was thinking to cope up my losses but nothing good is happening either.

Even I had written to Sumesh in facebook also, but I have got any reply from him, I think he must be busy with his work schedule.

Casper, if u dont mind, u can just polish my skill as I know that I am not that bad either, as trading in front of the terminal with Charts and trading on phone from office is very different. Money management skill is poor as very often my profit turned trades in Bank-Nifty was not squared off on time.

Your nice piece of write-up and explaining things is very good, but still frankly speaking I am not that good in distance learning programme (as my distance MBA is still pending for more than a year now )

I wud be oblidged if u cud just help me out in some other way.

Regards,

Chetan Kumar. |

Hi,

I hope i am not interfering as the post is directed to casper. It good that you relaize some thing is going wrong in your trading and you want to improve it. good first step.

you said you have been trading for 5 yrs now but you are not getting results (profits) rather loss. you metioned your two trades one in icici and one in bank nifty.both futures. you had big losses that means you had not maintained the SL.

ASK YOU SELF WHY HAVE YOU TRADED IN FUTURES R U SUCCESSFUL TRADING EQUITY IN CASH?

futures are very different ball game and it require some exp and success in trading equity in cash and load of discipline.

most of the ppl do trading for earning quick money but always remember this is gambling you are doing not trading and in gambling its the house who always win.

another mistake ppl do they don't treat trading as business/ part time business. so they dont have plan in turn they fail miserably. and dent their self confidence.

most of us never do introspection and try to understand why do we fail as a trader when we are successful is our life in our jobs in our sports and in other so many things in life.

trading basically is against life against wht we believe and follow in our general life. its our upbringing which is against trading.

i can quote an example that in life we celebrate both happiness and sorrows. some dear one dies we celebrate the sorrow for min 13 days and we also celebrate the happiness by enjoying festivals BUT FOR 1-2 DAYS. this is wht we are doing.

in trading happiness is profit and sorrow is loss. now since we have brought and taught to celebrate sorrow for long duration we hold our loss for long duration never cut it off we hold it till our a/c blow off.

profit is happiness in trading. now we have been taught to celebrate happiness for short duration we cut our profit too quick never hold it even though we know it will further go up.

this is wht trading is its against life and most of us dont know and dont understand the difference.

methods, systems set ups i am sure you know very well and i am sure you know much better than me or anybody else abt them. but these methods, systems, set ups etc are useless they will never make you a successful trader.

its the discipline which makes the difference. its the psyche which makes difference.

if you are having a mediocre strategy but have steel discipline and a positive approach towards trading you will be a very successful trader. work on them. its not easy to do and not many ppl are doing it thats why not many ppl are successful in trading.

trading is the highest paid job/business in the world and when something is highest paid it has to be very difficult. you have to put lots of efforts and hard work but problem is most of us do not know where and which direction we need to put efforts as due to which our learning curve is too pain full and too long before we start making profits by that time not many are left.

regards, |

Dear Casper and Sherbaaz ji,

Thanks a lot for ur concern towards me. I guess now I m approaching a right platform, as now I realize where I lack. Still I have hope left by which I can make RAYEE KA PAHARD.

Trading is a difficult art but I use to take it as passion but in a lighter way, as I dint followed discipline. Hope coming week will see a newer me, and would surely discuss my trading plan by the end of the week (whether profit or loss).

Regards,

Chetan Kumar.

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #1437  Posted: Sun Jan 16, 2011 10:26 am Post subject: Posted: Sun Jan 16, 2011 10:26 am Post subject: |

|

|

hi vishy, sorry for late,

what u wrote about BNF and nifty seems to me correct,

i am a lil ill today, so not going in details

but i feel watch bnf around 10k level, it might reverse form here

and for nifty, if it closes below 5700 in monday also, then i think we will see 5500 level

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #1438  Posted: Sun Jan 16, 2011 10:29 am Post subject: Posted: Sun Jan 16, 2011 10:29 am Post subject: |

|

|

hi all

i have got so many posts about profit booking and risk management. generally u ask me question

but now i am asking u a question

plz tell me what do u mean by uptrend and what do u mean by down trend?

this question is for those who could not book their profits like chetan and ultimately suffered heavy loss

plz do reply me, any of u , all of u, whomever has a problem to trail the profit

|

|

| Back to top |

|

|

singh.ravee

Yellow Belt

Joined: 12 Aug 2010

Posts: 678

|

Post: #1439  Posted: Sun Jan 16, 2011 10:48 am Post subject: Posted: Sun Jan 16, 2011 10:48 am Post subject: |

|

|

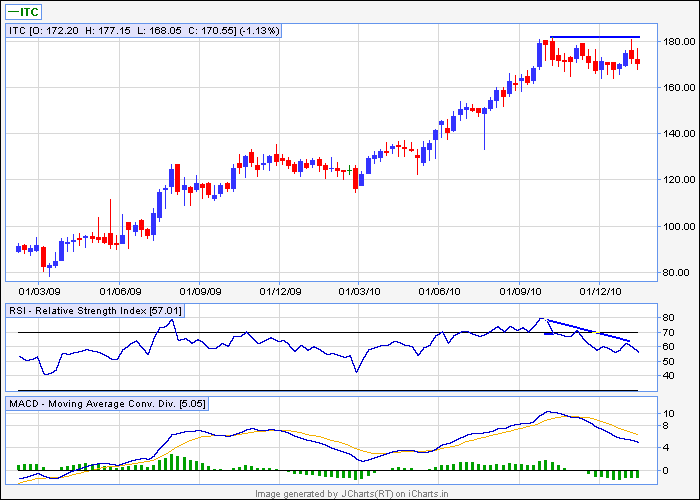

casper hello,

hope u r doing gr8.

i m attaching weekly chart of itc. is it a bearish divergence in itc? if yes, then probable tgt and sl.

thanks and regards

ravee

| Description: |

|

| Filesize: |

11.21 KB |

| Viewed: |

648 Time(s) |

|

|

|

| Back to top |

|

|

singh.ravee

Yellow Belt

Joined: 12 Aug 2010

Posts: 678

|

Post: #1440  Posted: Sun Jan 16, 2011 10:52 am Post subject: Posted: Sun Jan 16, 2011 10:52 am Post subject: |

|

|

casper,

i use 50 ema as a tool to decide trend. price above 50ema= uptrend; price below 50 ema = downtrend. price negotiating with 50ema= flattish hence avoidable.

rgds

ravee

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|