| View previous topic :: View next topic |

| Author |

a layman's approach to break out and break down |

anand1234

Yellow Belt

Joined: 17 Jul 2010

Posts: 830

|

Post: #1891  Posted: Mon Feb 14, 2011 12:46 pm Post subject: Posted: Mon Feb 14, 2011 12:46 pm Post subject: |

|

|

hi...........sumesh

to day we r missed u.....................pls help me.............I purchased dwarkesh sugar @ 118 and hcc @ 68.................now both r very much down...........how long I can wait to reach atleast my booking price?........if poss. pls guide me

thanks

anand

|

|

| Back to top |

|

|

|

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #1892  Posted: Mon Feb 14, 2011 2:13 pm Post subject: Posted: Mon Feb 14, 2011 2:13 pm Post subject: |

|

|

| anand1234 wrote: | hi...........sumesh

to day we r missed u.....................pls help me.............I purchased dwarkesh sugar @ 118 and hcc @ 68.................now both r very much down...........how long I can wait to reach atleast my booking price?........if poss. pls guide me

thanks

anand |

Anand,

Please check the buy prices Both of these stocks , if u have purchased for intraday.. they do not seems to be correct...

|

|

| Back to top |

|

|

anand1234

Yellow Belt

Joined: 17 Jul 2010

Posts: 830

|

Post: #1893  Posted: Mon Feb 14, 2011 2:23 pm Post subject: Posted: Mon Feb 14, 2011 2:23 pm Post subject: |

|

|

hi............sumesh

infact I bought both dwarkesh @118 & hcc @68 few week before.............

now both r so down dwarkesh @ 71 & hcc @35...............wt shd I do ?.............how long shd I wait??...............pls help me for nearest tgt??...........

thanks

anand

|

|

| Back to top |

|

|

maooliservice

White Belt

Joined: 04 Aug 2010

Posts: 93

|

Post: #1894  Posted: Mon Feb 14, 2011 3:43 pm Post subject: Posted: Mon Feb 14, 2011 3:43 pm Post subject: |

|

|

hi

can anybody sugesst buy & sell levels of cipla

Thanks

Mohan

|

|

| Back to top |

|

|

NS0420

White Belt

Joined: 20 Jan 2011

Posts: 32

|

Post: #1895  Posted: Mon Feb 14, 2011 5:59 pm Post subject: Nifty -ve divergence ? Posted: Mon Feb 14, 2011 5:59 pm Post subject: Nifty -ve divergence ? |

|

|

Attached is the Nifty 15 min chart. Can someone please check and confirm is this a -ve divergence?

| Description: |

|

| Filesize: |

33.92 KB |

| Viewed: |

204 Time(s) |

![jcharts[1].PNG](files/thumbs/t_jcharts1_550.png)

|

|

|

| Back to top |

|

|

singh.ravee

Yellow Belt

Joined: 12 Aug 2010

Posts: 678

|

Post: #1896  Posted: Mon Feb 14, 2011 6:54 pm Post subject: Posted: Mon Feb 14, 2011 6:54 pm Post subject: |

|

|

NS0420

According to me, by definition its a bearish divergence, However, this doesnot appeal to the eyes, so i would not trade it. Moreover higher tf are not supporting it.

Thanks and Regards

ravee

|

|

| Back to top |

|

|

NS0420

White Belt

Joined: 20 Jan 2011

Posts: 32

|

Post: #1897  Posted: Mon Feb 14, 2011 7:05 pm Post subject: Posted: Mon Feb 14, 2011 7:05 pm Post subject: |

|

|

| Thanks A Lot...

|

|

| Back to top |

|

|

rohit44

White Belt

Joined: 05 Jan 2010

Posts: 279

|

Post: #1898  Posted: Mon Feb 14, 2011 9:05 pm Post subject: Posted: Mon Feb 14, 2011 9:05 pm Post subject: |

|

|

| Nice casper....once again hit bull's eye....hindalco opened made base at 203 odd levels ( near 200 ) and once crossed atp it nevere comes back....made high 219.9.....Thanks again

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #1899  Posted: Mon Feb 14, 2011 9:12 pm Post subject: Posted: Mon Feb 14, 2011 9:12 pm Post subject: |

|

|

| rohit44 wrote: | | Nice casper....once again hit bull's eye....hindalco opened made base at 203 odd levels ( near 200 ) and once crossed atp it nevere comes back....made high 219.9.....Thanks again |

thanks to Sumesh bhai and dr Alexander Elder

it formed a kangaroo-tail last day, i mean on Friday closing

|

|

| Back to top |

|

|

rohit44

White Belt

Joined: 05 Jan 2010

Posts: 279

|

Post: #1900  Posted: Mon Feb 14, 2011 9:18 pm Post subject: Posted: Mon Feb 14, 2011 9:18 pm Post subject: |

|

|

| Any upside tgt before expiry or levels to see in hindalco.....as per my little knowledge when euro is fallinng, metal share show some beating but today i observerd just opposite of the theory even if euro/usd broke 1.35 crucial level....can this rally considered as short covering....eager t learning so is disturbing you more often..hope you don't mind....Rgds

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #1901  Posted: Mon Feb 14, 2011 10:02 pm Post subject: Posted: Mon Feb 14, 2011 10:02 pm Post subject: |

|

|

| rohit44 wrote: | | Any upside tgt before expiry or levels to see in hindalco.....as per my little knowledge when euro is fallinng, metal share show some beating but today i observerd just opposite of the theory even if euro/usd broke 1.35 crucial level....can this rally considered as short covering....eager t learning so is disturbing you more often..hope you don't mind....Rgds |

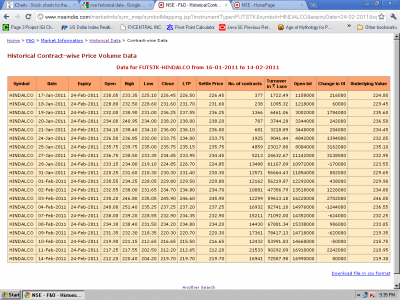

hi rohit, here are a few points to consider

1.what u interpret as euro falling, is in other words a dollar rally, u know traders, mostly FIIs are from U.S and whenever dollar makes rally, they have to pay back more per dollar investments, so they generally sell out their other than dollar investments and maintain investments in dollar instead

thats why we generally see a decline in other assets price

2.a short or long covering is marked by a DECLINE in OPEN INTEREST which did not happen today, in fact we have change of OI in positive numbers in HINDALCO

so this rally in the stock in particular cant be credited to short covering only, some long have been made here

3. apart from "covering" aspect, we have good volume in hindalco, which shows an enthusiasm of the buyers, and its likely to continue a few days again (just an assumption)

4.given the rally in copper, in fact there was not much shorter in hindalco

5.look at the eod charts, 34 ema is at 229 and bb upper is at 245 level

if this upside is sustained, then we can expect to reach up to that

| Description: |

|

| Filesize: |

85.13 KB |

| Viewed: |

193 Time(s) |

|

| Description: |

|

| Filesize: |

97.5 KB |

| Viewed: |

219 Time(s) |

|

|

|

| Back to top |

|

|

rohit44

White Belt

Joined: 05 Jan 2010

Posts: 279

|

Post: #1902  Posted: Mon Feb 14, 2011 10:42 pm Post subject: Posted: Mon Feb 14, 2011 10:42 pm Post subject: |

|

|

| Nice explanation....very grateful to you casper..

|

|

| Back to top |

|

|

manass

White Belt

Joined: 21 Sep 2009

Posts: 172

|

Post: #1903  Posted: Tue Feb 15, 2011 12:09 am Post subject: A Layman approach Posted: Tue Feb 15, 2011 12:09 am Post subject: A Layman approach |

|

|

Thanks Casper for your Nice explanations, really helpful for people like me, who is poor at Technical Analysis. As per your assumption if it goes to 240 - 245 then this rally may touch 260 - 285.

Again what is your view on STER.

Like HINDALCO patern few others charts are there, they are IFCI, AXISBANK, ICICIBANK, ABAN, SESAGOA, ALOKTEXT, RELIANCE, L&T.

Even if Nifty & BANKNIFTY, please put your remarks on the above. I know it is little bit cumbersome still request you for the same.

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #1904  Posted: Tue Feb 15, 2011 9:14 am Post subject: Posted: Tue Feb 15, 2011 9:14 am Post subject: |

|

|

rohit, thanks and welcome

manass, as of now, i expect 230 then 245 max, u know crossing 230 is a prb and it will show huge profit booking once it goes up to there, apart from day trader's reason like monthly/weekly pivots, we have 34 ema too in that place in daily chart

so crossing that will be tough and once crossed successfully, this should act as a strong support too

I wish i could explain all other stocks mentioned by u,by as market timing is nearing on, so im afraid that i may not be able to finish all of them

just one point, in a hurry, im sharing wid u

see all the stock rallied but most of them have very small amount of volume

that shows peoples are less enthusiastic about these stocks means a level of uncertainty in them as of yesterday

even ster, ifci, hv not rallied in spite of such a bullish day

so as a whole, these are looking a lil bit suspicious to me

i will try to update them as and when i get some free time

|

|

| Back to top |

|

|

singh.ravee

Yellow Belt

Joined: 12 Aug 2010

Posts: 678

|

Post: #1905  Posted: Tue Feb 15, 2011 9:25 am Post subject: Posted: Tue Feb 15, 2011 9:25 am Post subject: |

|

|

casper bhai,

word of caution in hindalco. although the candle will complete at 10am, however it seems as if evening doji star is being formed that too at previous resistance.

thanks and regards

ravee

|

|

| Back to top |

|

|

|