|

|

| View previous topic :: View next topic |

| Author |

a layman's approach to break out and break down |

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #241  Posted: Sun Nov 14, 2010 12:05 pm Post subject: Posted: Sun Nov 14, 2010 12:05 pm Post subject: |

|

|

hi vishy,

so u r in action again!!!!  i have not studied the probability of retracement yet, its a good topic, we need to work on it surely i have not studied the probability of retracement yet, its a good topic, we need to work on it surely

lets jump to the charts

apollotyre: perfect broadening top. a break below 60 will complete the pattern, target will be 30 after that bd

airtel:perfect h/s, target 270

bpcl: its forming a descending triangle, but has to go a long way before it finishes the pattern

dlf: h/s. target 290-300,

rcom: yes it has broken down, but let us use a 3% filter here as the bd target is higher (almost 1/3 of the stock value), if it breaches 164 go short, it may reach 100-110 level in coming days(gradually)

sbin= right again buddy, target 2950

essaroil= broadening top, a break below 135 will confirm the pattern, target will be 110-115

ibrealest= same case, a break below 183 will confirm, target will be 150-140

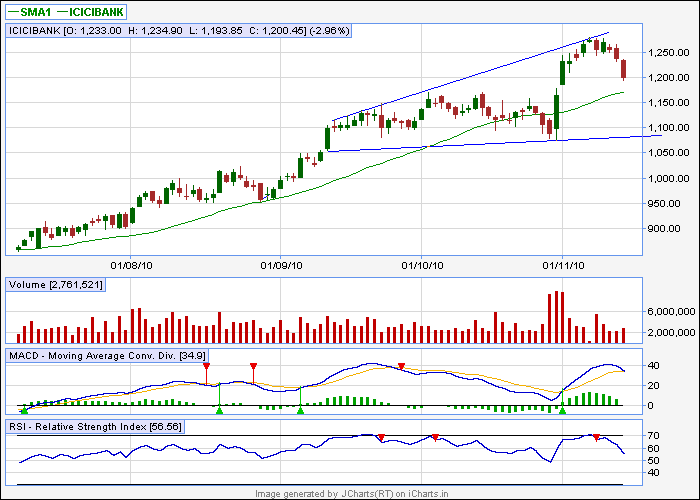

icicibank=in order to qualify it has to break down below 1000 level, in that case target will be around 850

| Description: |

|

| Filesize: |

10.46 KB |

| Viewed: |

1378 Time(s) |

|

| Description: |

|

| Filesize: |

11.71 KB |

| Viewed: |

1378 Time(s) |

|

| Description: |

|

| Filesize: |

10.6 KB |

| Viewed: |

1378 Time(s) |

|

|

|

| Back to top |

|

|

|

|  |

girishhu1

White Belt

Joined: 17 Aug 2009

Posts: 316

|

Post: #242  Posted: Sun Nov 14, 2010 12:20 pm Post subject: Posted: Sun Nov 14, 2010 12:20 pm Post subject: |

|

|

hi casperji,

in case of apollo tyres 1m, bd occured at 71 as per desc triangle and target is 55. m i correct?

regards

girish

| Description: |

|

| Filesize: |

46.36 KB |

| Viewed: |

342 Time(s) |

|

|

|

| Back to top |

|

|

mrvishal_g

White Belt

Joined: 17 Sep 2010

Posts: 89

|

Post: #243  Posted: Sun Nov 14, 2010 12:29 pm Post subject: Posted: Sun Nov 14, 2010 12:29 pm Post subject: |

|

|

Hello Casper,

Best of luck for your new efforts.

God bless you.

Vishal

|

|

| Back to top |

|

|

svrathi

White Belt

Joined: 05 Jul 2010

Posts: 14

|

Post: #244  Posted: Sun Nov 14, 2010 12:33 pm Post subject: Posted: Sun Nov 14, 2010 12:33 pm Post subject: |

|

|

| casper wrote: | hi vishy,

so u r in action again!!!!  i have not studied the probability of retracement yet, its a good topic, we need to work on it surely i have not studied the probability of retracement yet, its a good topic, we need to work on it surely

lets jump to the charts

apollotyre: perfect broadening top. a break below 60 will complete the pattern, target will be 30 after that bd

airtel:perfect h/s, target 270

bpcl: its forming a descending triangle, but has to go a long way before it finishes the pattern

dlf: h/s. target 290-300,

rcom: yes it has broken down, but let us use a 3% filter here as the bd target is higher (almost 1/3 of the stock value), if it breaches 164 go short, it may reach 100-110 level in coming days(gradually)

sbin= right again buddy, target 2950

essaroil= broadening top, a break below 135 will confirm the pattern, target will be 110-115

ibrealest= same case, a break below 183 will confirm, target will be 150-140

icicibank=in order to qualify it has to break down below 1000 level, in that case target will be around 850 |

Hi casper,

I m new to the website,

may i plz know the SL level for SBI , BHarti & DLF (all short).

Regards

sachin rathi

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #245  Posted: Sun Nov 14, 2010 1:21 pm Post subject: Posted: Sun Nov 14, 2010 1:21 pm Post subject: |

|

|

hi girish bhai,

yes u r right, and the fact that apollo tyre is going to go down heavily can be confirmed from the broadening top pattern also.

vishal, thanks and welcome!

mr. sachin rathi,

sir plz let me know if u r considering an intraday or a positional short here? in case of intra day i prefer to decide it after viewing the real time chart(live intra day chart)

if u think to go for positional, u can use 350 by closing in case of dlf.

sbin 3180 by closing and bhartiartl 330 by closing,

special care should be taken in case of sbin, as target is small in comparison with stop loss and 89 ema is present around 3000, if u r not a risky trader, then u can avoid the sbin (in fact we were supposed to short it around 3400 and book around 3000-2950)

again, in case of heavy gap down opening the stocks may open around their respective targets also, in that case, we may see a choppy move or even a bounce back for intraday only, in that case, intra day shorts should be avoided

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #246  Posted: Sun Nov 14, 2010 2:05 pm Post subject: Posted: Sun Nov 14, 2010 2:05 pm Post subject: |

|

|

Casper,

Check unitech, Head and shoulders break down. Provide your comments

Vishy

| Description: |

|

| Filesize: |

120.49 KB |

| Viewed: |

349 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #247  Posted: Sun Nov 14, 2010 2:10 pm Post subject: Posted: Sun Nov 14, 2010 2:10 pm Post subject: |

|

|

Casper,

Looks like IDFC has broken down the brodening top formation. Please confirm.

Vishy

| Description: |

|

| Filesize: |

120.78 KB |

| Viewed: |

358 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #248  Posted: Sun Nov 14, 2010 2:18 pm Post subject: Posted: Sun Nov 14, 2010 2:18 pm Post subject: |

|

|

Casper,

IDBI, very nearly looks like broadening top. Please confirm.

regards

Vishy

| Description: |

|

| Filesize: |

113.08 KB |

| Viewed: |

343 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #249  Posted: Sun Nov 14, 2010 2:25 pm Post subject: Posted: Sun Nov 14, 2010 2:25 pm Post subject: |

|

|

Casper,

Check reliance. I see a double top break down. We can aslo see a broadening top formation. Please confirm.

Vishy

| Description: |

|

| Filesize: |

145.77 KB |

| Viewed: |

347 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #250  Posted: Sun Nov 14, 2010 2:30 pm Post subject: Posted: Sun Nov 14, 2010 2:30 pm Post subject: |

|

|

casper,

GUJNRECOKE, looks like in the verge of head and shoulders break down. Please confirm

Vishy.

| Description: |

|

| Filesize: |

161.38 KB |

| Viewed: |

353 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #251  Posted: Sun Nov 14, 2010 2:36 pm Post subject: Posted: Sun Nov 14, 2010 2:36 pm Post subject: |

|

|

Casper,

Broadening Top in ashok leyland? Please confirm.

Vishy

| Description: |

|

| Filesize: |

154.77 KB |

| Viewed: |

370 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #252  Posted: Sun Nov 14, 2010 2:44 pm Post subject: Posted: Sun Nov 14, 2010 2:44 pm Post subject: |

|

|

Casper,

Check the chart of SESAGOA. Is the pattern head and shoulders? Please confirm.

Vishy.

| Description: |

|

| Filesize: |

150.88 KB |

| Viewed: |

352 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #253  Posted: Sun Nov 14, 2010 6:12 pm Post subject: Posted: Sun Nov 14, 2010 6:12 pm Post subject: |

|

|

Casper,

ONGC, looks like has formed head and shoulders. Please provide your views.

Vishy

| Description: |

|

| Filesize: |

143.91 KB |

| Viewed: |

361 Time(s) |

|

|

|

| Back to top |

|

|

vishytns

White Belt

Joined: 26 Nov 2009

Posts: 206

|

Post: #254  Posted: Sun Nov 14, 2010 6:15 pm Post subject: Posted: Sun Nov 14, 2010 6:15 pm Post subject: |

|

|

Casper,

I was going thru nifty heavyweights. I observed the following. Please check them aslo.

Vishy

Nifty Heavyweights

===================

1. Reliance - Double Top break down, Broadening Top formation

2. LT - Broadening top formation, break down level at 1980

3. Infosys tech - head and shoudlers, break down at 2970-2980 levels

4. ICICI Bank - Taking support at exactly 38.2% FIB retracement levels. break down would lead to next level

50% FIB retracement level - 1177,

5. HDFC Bank - Symmetrical Triangle, triangle support at 2270-2280 levels.

6. HDFC - Symmetrical Triangle

|

|

| Back to top |

|

|

girishhu1

White Belt

Joined: 17 Aug 2009

Posts: 316

|

Post: #255  Posted: Sun Nov 14, 2010 6:26 pm Post subject: Posted: Sun Nov 14, 2010 6:26 pm Post subject: |

|

|

vishytns/casperji,

you have posted charts of a no of stocks. can you now tell us which are 5 TOP stocks best for buy and sell for mondays trade , using any one indicator and any of the patterns you trust most. i think p/l ratio would be important for selecting the top stocks + reliability of the pattern. would you also take into consideration open interest, in case of f&o stocks? kindly elaborate

regards,

girish

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|