| View previous topic :: View next topic |

| Author |

a layman's approach to break out and break down |

S.S.

White Belt

Joined: 09 Feb 2011

Posts: 241

|

Post: #2866  Posted: Fri Oct 28, 2011 11:38 pm Post subject: Posted: Fri Oct 28, 2011 11:38 pm Post subject: |

|

|

| casper wrote: | hi ss

as for island reversal

i read about it but i have no personal exp of trading them, (simply bcoz they are so rare)

so i hope for the best

|

yes u r right its very rare . . . . .

|

|

| Back to top |

|

|

|

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #2867  Posted: Sat Oct 29, 2011 9:38 am Post subject: Posted: Sat Oct 29, 2011 9:38 am Post subject: |

|

|

Thanks! S.S & Casper.

Casper, You are throwing mouth watering possible scenario for Monday.In case it materialises I wish I should not miss it.

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #2868  Posted: Sun Oct 30, 2011 9:30 pm Post subject: Posted: Sun Oct 30, 2011 9:30 pm Post subject: |

|

|

| rk_a2003 wrote: | Nifty Filled up the gap down it made on 5-8-2011.During these 3 months this gap acted as an effective resistance for 4 times, on 5th attempt it jumped up and filled that gap.

If it is able to survive above this gap for a couple of days.This gap may effectively serve as a strong support in near future.

Then can We take long positions with a stop loss just below it?!. For a Target of 5500 and then 5700. |

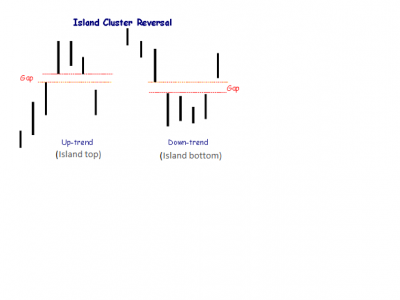

What Nifty made on 28th is called Island cluster reversal where an island is formed by several bars rather than one. These are even stronger signals compared to normal island reversals(Have a look at attached Chart.)Island bottoms — along with island tops — are rare… But when you are able to spot them, they have an amazing level of accuracy.

In a recent study, the island bottom was found to have a success rate of 85%, versus a failure rate of 13%. For island tops, the success rate was 77% versus a failure rate of 10%.

Island bottoms ( *Gaps below *Forms Base * gaps back up )

It's short term in nature.The measurement rule for island bottoms involves adding the formation size of the bottom of the pattern (In this case of Nifty approx 450 points). Here, a formation size of roughly 450 points add to the value at upper gap of the pattern gives a upside projection of 5750 the most probable outcome in the near-term ( 5300+450= 5750 approx)

Sucess: 85%

Failure:13%

Typical gain :34%

Island tops: (Reverse of the Bottoms)

Sucess: 77%

Failure:10%

Typical gain :21%

The mesurement rules are just reverse of the Bottoms

Hope this data is usefull for I charts Trader community.

| Description: |

|

| Filesize: |

12.61 KB |

| Viewed: |

414 Time(s) |

|

|

|

| Back to top |

|

|

t.chatterjee

White Belt

Joined: 07 May 2010

Posts: 66

|

Post: #2869  Posted: Mon Oct 31, 2011 8:52 am Post subject: Posted: Mon Oct 31, 2011 8:52 am Post subject: |

|

|

hi rk

thanks, by the way, have u checked it with bulkowslie's site?

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #2870  Posted: Mon Oct 31, 2011 9:25 am Post subject: Posted: Mon Oct 31, 2011 9:25 am Post subject: |

|

|

Not sure Tushar! ( Am i right?)

I googled and collected information in bits and pieces not from one site.

How ever I will check that site.

|

|

| Back to top |

|

|

t.chatterjee

White Belt

Joined: 07 May 2010

Posts: 66

|

Post: #2871  Posted: Mon Oct 31, 2011 9:35 am Post subject: Posted: Mon Oct 31, 2011 9:35 am Post subject: |

|

|

hii

absolutely right and here is a link of that site

its a great site for pattern or chart formation recognition

http://thepatternsite.com

bulkowski is one of the most celebrated pattern traders and an eminent author about it too

(here u can find statistics too, like success percentage and failure percentage and how to automate ur terminal for pattern recognition... though i never understood it clearly)

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #2872  Posted: Mon Oct 31, 2011 7:28 pm Post subject: Posted: Mon Oct 31, 2011 7:28 pm Post subject: |

|

|

As per Bulkowski's site referred by casper the success rate for Island bottom is 69% and Island top is 62%.And they were described as worst perfomance rank of any chart patterns.

So ball is in our court.

Contradictory assessments from different websites.So we can not take this pattern for guidance as of now .Let us rely on other factors.

| rk_a2003 wrote: | | rk_a2003 wrote: | Nifty Filled up the gap down it made on 5-8-2011.During these 3 months this gap acted as an effective resistance for 4 times, on 5th attempt it jumped up and filled that gap.

If it is able to survive above this gap for a couple of days.This gap may effectively serve as a strong support in near future.

Then can We take long positions with a stop loss just below it?!. For a Target of 5500 and then 5700. |

What Nifty made on 28th is called Island cluster reversal where an island is formed by several bars rather than one. These are even stronger signals compared to normal island reversals(Have a look at attached Chart.)Island bottoms — along with island tops — are rare… But when you are able to spot them, they have an amazing level of accuracy.

In a recent study, the island bottom was found to have a success rate of 85%, versus a failure rate of 13%. For island tops, the success rate was 77% versus a failure rate of 10%.

Island bottoms ( *Gaps below *Forms Base * gaps back up )

It's short term in nature.The measurement rule for island bottoms involves adding the formation size of the bottom of the pattern (In this case of Nifty approx 450 points). Here, a formation size of roughly 450 points add to the value at upper gap of the pattern gives a upside projection of 5750 the most probable outcome in the near-term ( 5300+450= 5750 approx)

Sucess: 85%

Failure:13%

Typical gain :34%

Island tops: (Reverse of the Bottoms)

Sucess: 77%

Failure:10%

Typical gain :21%

The mesurement rules are just reverse of the Bottoms

Hope this data is usefull for I charts Trader community. |

|

|

| Back to top |

|

|

S.S.

White Belt

Joined: 09 Feb 2011

Posts: 241

|

|

| Back to top |

|

|

S.S.

White Belt

Joined: 09 Feb 2011

Posts: 241

|

Post: #2874  Posted: Tue Nov 01, 2011 12:05 am Post subject: Posted: Tue Nov 01, 2011 12:05 am Post subject: |

|

|

| t.chatterjee wrote: | hi rk

thanks, by the way, have u checked it with bulkowslie's site? |

dada where is casper????

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #2875  Posted: Tue Nov 01, 2011 8:24 am Post subject: Posted: Tue Nov 01, 2011 8:24 am Post subject: |

|

|

Thanks SS

It looks like first Island top shown in your chart met target price approx.after 2 months

|

|

| Back to top |

|

|

S.S.

White Belt

Joined: 09 Feb 2011

Posts: 241

|

Post: #2876  Posted: Tue Nov 01, 2011 9:08 am Post subject: Posted: Tue Nov 01, 2011 9:08 am Post subject: |

|

|

| rk_a2003 wrote: | Thanks SS

It looks like first Island top shown in your chart met target price approx.after 2 months  |

now lets see whether island bottom accomplish its target or not???? time will tell us

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #2877  Posted: Wed Nov 02, 2011 7:33 am Post subject: Posted: Wed Nov 02, 2011 7:33 am Post subject: |

|

|

I am reposting Nifty chart posted by Shaadoo in which I was able to see w's ( double bottoms) and also double tops. Why is this phenomena coming up so often?!.

Is it just a combination of double bottom OR NVK and double tops in a down trend or anything else?!

Is there a method to catch them at tops and bottoms too?!.

I can see a double bottom forming at mid level between two Double bottoms formed at lower TL( It happened alternatively) where as all double tops formed at upper TL.

A red TL drawn by me for that middle double bottoms. If this pattern repeats there is a double top due and a double bottom in midrange i.e on red TL is also due.

I would like to examine Nifty chart break up for each year.

Is this phenomena limited to certain type of markets or is it present in all types of markets?!

Can some one explain it please.

| Description: |

|

| Filesize: |

268.98 KB |

| Viewed: |

493 Time(s) |

|

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #2878  Posted: Wed Nov 02, 2011 8:55 am Post subject: Posted: Wed Nov 02, 2011 8:55 am Post subject: |

|

|

hi rk

what u posted is an example of big W/big M theory

whereas nvk is a simple b grade divergence, there is no guarantee that during w or m formation, it will be always b grade div, simply bcoz what u call double top/bots are not exactly double tops/bots every time, so some time it will be a grade , and in some rare occasion it will be c grade too

and what i can make out is........ call it a divergence, be it a/b/c , its the generic name indeed

this w/m formation feature can be explained by various methods and can be traded also, but best way i have seen is using bollinger band to find such formations and carrying out trades as per BB's signals

its a method which is not so easy to describe through forum but if understood, can provide amazing results, specially in positional trades

u told me through "pm" that u have gone through/going through this thread from starting, then an ichartian, calling himself "vishytns" may not be unknown to u

if possible, try to contact him, he is a master of this method, otherwise, collect a copy of "bollinger on bollinger bands" book, its very nicely (and briefly) described there too

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #2879  Posted: Wed Nov 02, 2011 10:36 am Post subject: Posted: Wed Nov 02, 2011 10:36 am Post subject: |

|

|

Thanks! casper

I shall go through this book.

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #2880  Posted: Wed Nov 02, 2011 3:47 pm Post subject: Posted: Wed Nov 02, 2011 3:47 pm Post subject: |

|

|

| rk_a2003 wrote: | Thanks! casper

I shall go through this book. |

one point i forgot in morning

use ur cci 5 along with bb14, and train ur eyes to look at bb like M or W (the book will give u some idea about spotting of theW/M), almost every time, u will be bale to catch major swings at very nascent phase

|

|

| Back to top |

|

|

|