|

|

| View previous topic :: View next topic |

| Author |

a layman's approach to break out and break down |

girishhu1

White Belt

Joined: 17 Aug 2009

Posts: 316

|

Post: #361  Posted: Mon Nov 22, 2010 7:11 am Post subject: Posted: Mon Nov 22, 2010 7:11 am Post subject: |

|

|

hello casperji,

additional info. 13 ema (best buy price for todays trade), 34 ema ( stop loss)and s1 as per ichart levels for hero honda, idea and educomp are 1915, 1878, 1907 ; 72.05, 70.65, 72; 582, 563, 562 respectively.

hope this will be useful for u.

regards,

girish

|

|

| Back to top |

|

|

|

|  |

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #362  Posted: Mon Nov 22, 2010 8:58 am Post subject: Posted: Mon Nov 22, 2010 8:58 am Post subject: |

|

|

[quote="drsureshbs"] | mrvishal_g wrote: | | SwingTrader wrote: | mrvishal_g,

Do not post links to copyrighted content here. Your previous posts have been removed. |

Noted ST sir[/quote

mrvishal _g AND ST honestly i dont know what this copy right all about . when the intension is guinine they should b encouraged.if possible repost it editing the copy right aspect .and hope ST doest mind it . CASPER THE NO OF PAGES ITSELF INDICATE THE POPULARITY OF THE THREAD.Casper no question means things r simple to b uderstood by every body.Ur thead has grown so fast i find it hard to catch with it .only SAIKATS NVK AND CHROMES BO BD HAD MORE PAGES AND MORE DISCUSSION KEEP IT UP |

drsureshbs,

If you do not know what copyright is then I would strongly suggest you to read about it on the net. In short, downloading copyright protected ebooks is exactly like theft. It does not matter what the intention is....theft is theft. Sorry, we will never allow iCharts to be a medium for such things.

You are free to search for ebooks on the net and download it from other websites.

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #363  Posted: Mon Nov 22, 2010 12:29 pm Post subject: Posted: Mon Nov 22, 2010 12:29 pm Post subject: |

|

|

sorry brothers due to huge network faliure from yesterday 1pm, i could not post any thing, now trying to post it from a cyber cafe. all bsnl lines in my area is cut off, i dont know how long it will take to resume the service. once i could login properly, i would reply all the quaries, plz dont mind, thanks for ur postings

drsureshsbs, a copy right violation can destroy the entire website itself. so its better to keep away from it. i guess vishal was not aware (me too not aware) that it was copy righted, other wise i think he wont post it

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #364  Posted: Mon Nov 22, 2010 12:36 pm Post subject: Re: VOLTAS on 60tf... Posted: Mon Nov 22, 2010 12:36 pm Post subject: Re: VOLTAS on 60tf... |

|

|

| sumesh_sol wrote: | Hi Casper & Soldier,

First of all let me congratulate Casper for him extremely good work in sharing the TA with everyone with great enthu... Please keep it up..

Talking of VOLTAS .. I have drawn it on 60tf... It has broken the TL .. now it may again try to retest it at around 249.5 - 250.. If a strong green candle pierces it then, to me it can rebound, or else it will come down again to around 244/241 level..

Thanks and regards,

Sumesh |

Hi Soldier,

Voltas did reach 242 level today.. I hope you have booked..

-Sumesh

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

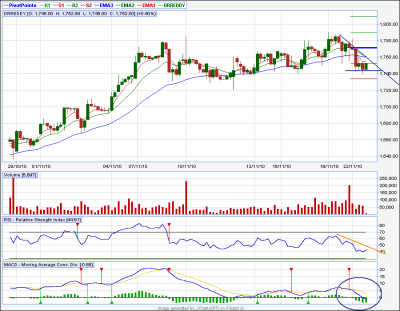

Post: #365  Posted: Mon Nov 22, 2010 1:14 pm Post subject: DRREDDY Posted: Mon Nov 22, 2010 1:14 pm Post subject: DRREDDY |

|

|

DT... as per Caser strategy MACD/RSI both weak... Shorted now with SL 1774.. Let's see.

-Sumesh

| Description: |

|

| Filesize: |

42.83 KB |

| Viewed: |

302 Time(s) |

|

|

|

| Back to top |

|

|

measoldier

White Belt

Joined: 09 Sep 2010

Posts: 36

|

Post: #366  Posted: Mon Nov 22, 2010 1:25 pm Post subject: Voltas Posted: Mon Nov 22, 2010 1:25 pm Post subject: Voltas |

|

|

| Yes i booked at 243

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #367  Posted: Mon Nov 22, 2010 1:50 pm Post subject: ULTRACEMCO Posted: Mon Nov 22, 2010 1:50 pm Post subject: ULTRACEMCO |

|

|

ULTRACEMCO:

Ascending Triangle. Looking good for long, fills all required conditions..

Second trade for me today as per Casper's law

Let's wait & watch..

-Sumesh

Last edited by sumesh_sol on Mon Nov 22, 2010 1:57 pm; edited 1 time in total |

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

|

| Back to top |

|

|

girishhu1

White Belt

Joined: 17 Aug 2009

Posts: 316

|

Post: #369  Posted: Mon Nov 22, 2010 7:51 pm Post subject: Posted: Mon Nov 22, 2010 7:51 pm Post subject: |

|

|

casperji,

reply me at the earliest if bsnl problem is solved.

regards,

girish

|

|

| Back to top |

|

|

mrvishal_g

White Belt

Joined: 17 Sep 2010

Posts: 89

|

Post: #370  Posted: Mon Nov 22, 2010 9:24 pm Post subject: Posted: Mon Nov 22, 2010 9:24 pm Post subject: |

|

|

Yes Casper,

I was not aware?

Well i spoke to my friend from where i got this book (he bought it).

He was saying that now is also availble on net(free).

Anyone who want this can try to search it on google.

Casper, i see your all material which is showing your hard work.

Just one clarification

RSI sell signal means....RSI above 80 or going down.

Is i m right?

Vishal

|

|

| Back to top |

|

|

mrvishal_g

White Belt

Joined: 17 Sep 2010

Posts: 89

|

Post: #371  Posted: Mon Nov 22, 2010 9:27 pm Post subject: Posted: Mon Nov 22, 2010 9:27 pm Post subject: |

|

|

Yes Casper,

I was not aware?

Well i spoke to my friend from where i got this book (he bought it).

He was saying that now is also availble on net(free).

Anyone who want this can try to search it on google.

Casper, i see your all material which is showing your hard work.

Just one clarification

RSI sell signal means....RSI above 80 or going down.

Is i m right?

Vishal

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #372  Posted: Mon Nov 22, 2010 10:23 pm Post subject: Posted: Mon Nov 22, 2010 10:23 pm Post subject: |

|

|

| mrvishal_g wrote: | Hello Casper,

Please comment on

GTL 417....Sell below 410 (decending tringle, it is near to bd)

HindZink 1177.....buy sl 1170 (bb as well as trendline support)

Bata India 362---Buy

(assending trindgle came back to bo level)

Vishal  |

gtl is ok. can reach 390-380 after a bd.

hindzinc= here bb is expanded. expanded bb means a bo/bd has occurred, and the stock is in motion a flat tl is present around 1150. could not find support around 1170. it has broken 50ema at 1187, which shows weakness. a zone of resistance is seen around 1200-1220, as a whole, does not look so promising

bataindia= came down at bo level, can be bought with a sl of 347 closing basis target 370. and can be sold at 345 with a sl of 360, target 320 in case of breaching the support

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #373  Posted: Mon Nov 22, 2010 10:34 pm Post subject: Posted: Mon Nov 22, 2010 10:34 pm Post subject: |

|

|

| girishhu1 wrote: | hi casperji,

i am posting a few charts. kindly comment on them. |

hi girish bhaiya. i am back, sorry for delay.

nelco broken out of channel. target should be around 150

idea u can hold with sl of 69 by closing. with a target of 80

hinddrrol has a resistance 140 as upper bb (20.2) and then another resistance at 145

herohonda is ok

educomp is not a symmetrical triangle. from ur post it looks like an ascending traingle, but upper tl is not drawn correctly, u need at least two highs to draw an upper tl, here no two highs are present.

again, it has a resistance at 630 and 648 range above these two resistance, we can hold it for750-770-800 in mid term ( say one month)

| Description: |

|

| Filesize: |

181.11 KB |

| Viewed: |

320 Time(s) |

|

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #374  Posted: Mon Nov 22, 2010 10:55 pm Post subject: Re: my analysis Posted: Mon Nov 22, 2010 10:55 pm Post subject: Re: my analysis |

|

|

| singh.ravee wrote: | dear casper,

would like to share my research work in the attached file. As u said, there is an analyst and a trader in an individual. The analyst in me is doing a good job, however the trader in me is failing most of the time. I fail to understand, when to trade intraday and when to trade on positional basis. My losses are primarily from intraday trades.

This time I was sure on opening short on nifty from 6250+ levels. However my teacher discouraged my view. I lost my frame of mind to open short and now i find nifty close to 5900 and i feel upset.

It would be nice on your part if u can guide me on the same.

Thanks and Regards

Ravinder Singh. |

out of 18 trades u have lost only on two occasion. its really an admirable performance. u said u lost most during intraday trading, plz tell me do u follow any particular strategy for intraday? how do u find entry and exit points? most importantly, do u get real time chart from ichart or any other provider? i need to know these things to find out where is the possible problem. but as far as an analyst, u have done exceptionally good work.

and one more thing. our teachers are like guru, always respectable, but when ur strategy says go u should check if guru says else but if u cant see any problem in ur strategy then plz go ahead,

we have to take certain risks, calculated risks in this market, we have to bet our RISK MONEY. its not advisable to bet ur last rupee but in this market we need to bet up to the level whose shock can be absorbed easily.our views will vary person to person as the market is too subjective in nature (during our analysis, which is nothing but a guess work) and a same thing can be explained by so many ways that views are bound to differ, but we have to carry on with our views until its proven otherwise

|

|

| Back to top |

|

|

casper

Green Belt

Joined: 02 Oct 2010

Posts: 1315

|

Post: #375  Posted: Mon Nov 22, 2010 11:00 pm Post subject: Posted: Mon Nov 22, 2010 11:00 pm Post subject: |

|

|

| mrvishal_g wrote: | Yes Casper,

I was not aware?

Well i spoke to my friend from where i got this book (he bought it).

He was saying that now is also availble on net(free).

Anyone who want this can try to search it on google.

Casper, i see your all material which is showing your hard work.

Just one clarification

RSI sell signal means....RSI above 80 or going down.

Is i m right?

Vishal |

rsi sell signal means rsi got a software generated sell signal, its an in-built signal of jcharts, u can consider a gradually slopping down rsi as a bearish rsi also, again rsi making lower highs or lower low are also bearish, but rsi above 80 means over bought rsi that needs not to be bearish. during bull charge u will see rsi well above 80 but still going on and some time, its hovering above 80 for months

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|