|

|

| View previous topic :: View next topic |

| Author |

Alchemist 5/200 ema method in Stocks |

kd_100*26

White Belt

Joined: 05 Jan 2015

Posts: 30

|

Post: #196  Posted: Wed May 20, 2015 10:33 am Post subject: one more stock to watch Posted: Wed May 20, 2015 10:33 am Post subject: one more stock to watch |

|

|

| If i am not wrong just in the morning there is 5/200 bullish crossover in SPARC...chk it out...Can we apply the strategy for equity stocks in cash? Is it profitable?

|

|

| Back to top |

|

|

|

|  |

kd_100*26

White Belt

Joined: 05 Jan 2015

Posts: 30

|

Post: #197  Posted: Wed May 20, 2015 3:57 pm Post subject: tatasteel bearish signal...failed Posted: Wed May 20, 2015 3:57 pm Post subject: tatasteel bearish signal...failed |

|

|

hello,

there was a 5/200 bearish crossover signal today in case of tatasteel and i shorted the stock but then stocks didn't move that much and again came up....since i applied this strategy on equity cash segment..i had to cover my position intra day with some loss..similarly there was 5 /200 bullish signal in sparc which was flat and failed ....this is the 3rd time i am not fruiful while applying this yorker method for stocks...is it only applicable to NF & BNF?

any other method on the basis of which we can buy or sell stocks( cash segment)?

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #198  Posted: Wed May 20, 2015 4:56 pm Post subject: Re: tatasteel bearish signal...failed Posted: Wed May 20, 2015 4:56 pm Post subject: Re: tatasteel bearish signal...failed |

|

|

| kd_100*26 wrote: | hello,

there was a 5/200 bearish crossover signal today in case of tatasteel and i shorted the stock but then stocks didn't move that much and again came up....since i applied this strategy on equity cash segment..i had to cover my position intra day with some loss..similarly there was 5 /200 bullish signal in sparc which was flat and failed ....this is the 3rd time i am not fruiful while applying this yorker method for stocks...is it only applicable to NF & BNF?

any other method on the basis of which we can buy or sell stocks( cash segment)? |

As the name of this forum suggests you CAN very well use this method in stocks. Many people have been using this method on stocks successfully.

Regarding Tatasteel, SL has not been hit so far , but u booked loss as your position was intra basis. To use this method consistently , make sure you trade FnO stocks only which you can carry. Of course , it means you must have enough account size(apprx. 2-3 Lacs is fine, the more the better). This I'm saying from my personal experience. You not only have to enter into trade, you need to suitably hedge also by writing options whenever required if u want to stay into trade for longer period of time.

Look closely charts of Tatasteel and Sparc, which one looks more convincing ? I would have avoided tatasteel trade, just see relatively flat 200 ema line which was due to series of whipsaws in recent past. Try to enter into virgin crossover (where crossover have not failed recently).

"Sparc" bullish crossover is good example of virgin crossover. You need to monitor RSI activity also. The moment RSI enter into extremes (80/20) .. be careful. 10:30 candle confirmed, there was RSI divergence. Here, you could have written calls as it is expected to test 34 ema again. Here also, SL is not yet hit. It need to give bearish crossover for initial SL to be hit.

Always book half qty at 1.5% - 2% of move from your entry point.

Again, these are only few LOGICAL steps you can employ to bring odds in your favor and minimize risk. You may be plain unlucky to have entered into wrong stock (using right method). But, if u keep emotions in check and trade method consistently, I'm sure u will be in profit.

PS: Avoid trading on Quarterly Result day and on expiry day . These are times, no technicals work.

Best Luck,

Sumesh

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #199  Posted: Wed May 20, 2015 9:18 pm Post subject: Posted: Wed May 20, 2015 9:18 pm Post subject: |

|

|

Summed up extremely well!!!! Shall try not to miss a point

Thanks

|

|

| Back to top |

|

|

kd_100*26

White Belt

Joined: 05 Jan 2015

Posts: 30

|

Post: #200  Posted: Thu May 21, 2015 7:36 am Post subject: Posted: Thu May 21, 2015 7:36 am Post subject: |

|

|

Wow Sumesh,

What a superb clarification to my queries...You have written the things so well that it would definetly be helpful for any new beginners like me...Want to thank you for that timely reply as well...

Will keep in mind these points for future trades...

Whenever possible pls try posting the entry trades along with the exact stoplosses and hedging strategy (sell calls /or buy puts) just as a guideline..

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #201  Posted: Fri May 22, 2015 6:09 pm Post subject: Re: how do u select the stocks fitting in yorker method Posted: Fri May 22, 2015 6:09 pm Post subject: Re: how do u select the stocks fitting in yorker method |

|

|

| kd_100*26 wrote: | Hello,

Is anyone following any screening tool or method for picking up stocks which fit in this strategy?

One query am i right that for intraday we should follow signals on 10 mins tf confirmed by signal on larger tf such as 60 mins

for longer trade such as for 1-2 weeks one should check the signals on 30 mins tf confirmed by signal on eod chart? |

As this confusion of 10tf/30tf was unintentionally created by me only , so I thought let me take responsibility to clear it

First and foremost, this strategy was tested and developed to be used on 30tf by Alchemist and he still uses 30tf only. I tried to test this method on lower timeframe which could allow me to

1.)Enter and exit fast

2.)Have relatively small SL

3.) Use it as intraday technique where I could take short position without using FnO

But like any other intra based strategy , you are bound to devote more screen time. Can't afford to leave your position bhagwaan bharose to attend meeting etc. Also, relatively more whipsaws . (but not always)

All I want to share with you guys is that please dont get confused , use whichever timeframe suits you with ALL RULES REMAINING SAME in any given trade.

Manytimes, it may so happen that u r in a position which is running in your direction till market close, you have an option either to book profit or let it continue in normal fashion for subsequent days.

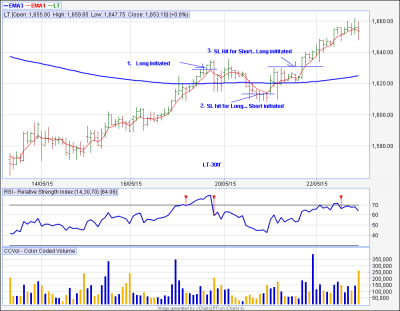

On several occassions , I have had advantage of entering early using 10tf. For an example, see attached charts of LT on 10tf and 30tf . (This is recent so I picked up, although I traded 30tf signals here).Using 10tf I would have entered much earlier and surprisingly without whipsaws  . Of course , I would probably have to exit once in between due to 5/34 .. But again could have entered on 5/34 upside signal... . Of course , I would probably have to exit once in between due to 5/34 .. But again could have entered on 5/34 upside signal...

Cheers to all Yorkers

| Description: |

|

| Filesize: |

30.41 KB |

| Viewed: |

690 Time(s) |

|

| Description: |

|

| Filesize: |

37.25 KB |

| Viewed: |

653 Time(s) |

|

|

|

| Back to top |

|

|

pkholla

Black Belt

Joined: 04 Nov 2010

Posts: 2890

|

Post: #202  Posted: Fri May 22, 2015 7:44 pm Post subject: Re: Great! Posted: Fri May 22, 2015 7:44 pm Post subject: Re: Great! |

|

|

| sumesh_sol wrote: |

1 Avoid trading on Quarterly Result Day and on expiry day . These are times, no technicals work.

2 because we are followers of the market and not the other way round. So, just follow simple rules and common sense

Best Luck, Sumesh

|

Sumesh: this is why it feels great to belong to this fantastic trading community called ICharts: Apart from other strengths, always something new to learn from fellow boarders if we keep our eyes and mind open.

Thanks, Prakash Holla

Last edited by pkholla on Mon May 25, 2015 7:46 pm; edited 1 time in total |

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #203  Posted: Sat May 23, 2015 8:41 am Post subject: Re: tatasteel bearish signal...failed Posted: Sat May 23, 2015 8:41 am Post subject: Re: tatasteel bearish signal...failed |

|

|

| sumesh_sol wrote: | | kd_100*26 wrote: | hello,

there was a 5/200 bearish crossover signal today in case of tatasteel and i shorted the stock but then stocks didn't move that much and again came up....since i applied this strategy on equity cash segment..i had to cover my position intra day with some loss..similarly there was 5 /200 bullish signal in sparc which was flat and failed ....this is the 3rd time i am not fruiful while applying this yorker method for stocks...is it only applicable to NF & BNF?

any other method on the basis of which we can buy or sell stocks( cash segment)? |

Regarding Tatasteel, SL has not been hit so far , but u booked loss as your position was intra basis. To use this method consistently , make sure you trade FnO stocks only which you can carry.

"Sparc" bullish crossover is good example of virgin crossover. You need to monitor RSI activity also. The moment RSI enter into extremes (80/20) .. be careful. 10:30 candle confirmed, there was RSI divergence. Here, you could have written calls as it is expected to test 34 ema again. Here also, SL is not yet hit.

Best Luck,

Sumesh |

Look at both TATASTEEL and SPARC now.... Had u traded in FnO (where u could carry yr positions)AND followed simple rules of Alchemist method , u would have been tired of counting money

|

|

| Back to top |

|

|

sriharikande

White Belt

Joined: 20 May 2014

Posts: 7

|

Post: #204  Posted: Sun May 24, 2015 1:02 pm Post subject: Posted: Sun May 24, 2015 1:02 pm Post subject: |

|

|

hello,

i am new trader,i am in confusion reg SL in this method. SL should be cross over of 34ema ,or any thing else for positional trading.i booked profit in LT &INFY recently &hold position in BHARATAIRTEL.Did i made a mistake.can any body answer me.

thank you,

|

|

| Back to top |

|

|

smile.dhanno

White Belt

Joined: 19 May 2011

Posts: 28

|

Post: #205  Posted: Sun May 24, 2015 5:57 pm Post subject: Posted: Sun May 24, 2015 5:57 pm Post subject: |

|

|

| sriharikande wrote: | hello,

i am new trader,i am in confusion reg SL in this method. SL should be cross over of 34ema ,or any thing else for positional trading.i booked profit in LT &INFY recently &hold position in BHARATAIRTEL.Did i made a mistake.can any body answer me.

thank you, |

Yes......for longs sl or better say target is 5/34 bearish crossover and reverse for shots.

Its good to trail the SL once the position comes in your favour.

|

|

| Back to top |

|

|

sriharikande

White Belt

Joined: 20 May 2014

Posts: 7

|

Post: #206  Posted: Mon May 25, 2015 9:55 am Post subject: Posted: Mon May 25, 2015 9:55 am Post subject: |

|

|

Thank you for early reply,

cesc cross over in 5-200 30 min tf can we short for positional in futures.

|

|

| Back to top |

|

|

smile.dhanno

White Belt

Joined: 19 May 2011

Posts: 28

|

Post: #207  Posted: Mon May 25, 2015 12:32 pm Post subject: Adani Ports Posted: Mon May 25, 2015 12:32 pm Post subject: Adani Ports |

|

|

Adani Ports watch out for a re-entering opportunity.....wait for 5/34 bullish crossover....stock very good.....huge potential to go upside.

I would wait for CESC to sustain or let it bullish cross over 5/34 to enter.

|

|

| Back to top |

|

|

sriharikande

White Belt

Joined: 20 May 2014

Posts: 7

|

Post: #208  Posted: Mon May 25, 2015 12:55 pm Post subject: Posted: Mon May 25, 2015 12:55 pm Post subject: |

|

|

thankyou,

you mean adani ports 5-34 cross over in daily TF and cese waiting to buy.

|

|

| Back to top |

|

|

sriharikande

White Belt

Joined: 20 May 2014

Posts: 7

|

Post: #209  Posted: Mon May 25, 2015 1:39 pm Post subject: Posted: Mon May 25, 2015 1:39 pm Post subject: |

|

|

can any body reply,

many trades are coming in this system,how to choose a good buy/sell,any other parameters to consider.

|

|

| Back to top |

|

|

smile.dhanno

White Belt

Joined: 19 May 2011

Posts: 28

|

Post: #210  Posted: Mon May 25, 2015 2:31 pm Post subject: Posted: Mon May 25, 2015 2:31 pm Post subject: |

|

|

| sriharikande wrote: | can any body reply,

many trades are coming in this system,how to choose a good buy/sell,any other parameters to consider. |

Don't get confused by many trades....I see RSI ADX DMI before entering.....

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|