| View previous topic :: View next topic |

| Author |

Are retail investors being fooled around Gold ETFs? |

trendy

White Belt

Joined: 16 Oct 2006

Posts: 40

|

Post: #1  Posted: Thu Aug 29, 2013 11:59 pm Post subject: Are retail investors being fooled around Gold ETFs? Posted: Thu Aug 29, 2013 11:59 pm Post subject: Are retail investors being fooled around Gold ETFs? |

|

|

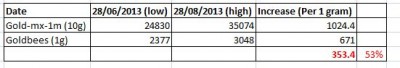

53% diff in increase between Gold futures and Goldbees.

Is this fooling ETF investors or are we missing something?

| Description: |

|

| Filesize: |

23.24 KB |

| Viewed: |

464 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

prst

White Belt

Joined: 24 Sep 2011

Posts: 87

|

Post: #2  Posted: Fri Aug 30, 2013 10:32 am Post subject: Posted: Fri Aug 30, 2013 10:32 am Post subject: |

|

|

I THINK there is mistake in your calculations.

gold future, % increase is 41%.

gold bees, % increase is 28%.

I dont think that is too much difference.

u should also consider the risks involved in futures and options.

bees is safer and can be held for any length of time.

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #3  Posted: Fri Aug 30, 2013 10:39 am Post subject: Posted: Fri Aug 30, 2013 10:39 am Post subject: |

|

|

| one of the biggest scams worldwide is that gold ETFs are not secured by equal amount of solid gold, which is actually mandatory.

|

|

| Back to top |

|

|

opportunist

White Belt

Joined: 27 Apr 2010

Posts: 356

|

Post: #4  Posted: Fri Aug 30, 2013 11:05 am Post subject: Posted: Fri Aug 30, 2013 11:05 am Post subject: |

|

|

| prst wrote: | I THINK there is mistake in your calculations.

gold future, % increase is 41%.

gold bees, % increase is 28%.

I dont think that is too much difference.

u should also consider the risks involved in futures and options.

bees is safer and can be held for any length of time. |

I think diwakar has a point. On 28th Aug Gold was hovering around 33,000 per 10 gm that is 3300 whereas Goldbees shows a good 10% less (3000). I cannot believe that could be due to impurities etc. as these are spot price comparisons of spot price against 24 K gold. Admin charges are deducted separately anyway.

|

|

| Back to top |

|

|

trendy

White Belt

Joined: 16 Oct 2006

Posts: 40

|

Post: #5  Posted: Fri Aug 30, 2013 1:29 pm Post subject: Posted: Fri Aug 30, 2013 1:29 pm Post subject: |

|

|

| prst wrote: | I THINK there is mistake in your calculations.

gold future, % increase is 41%.

gold bees, % increase is 28%.

I dont think that is too much difference.

u should also consider the risks involved in futures and options.

bees is safer and can be held for any length of time. |

If there is so much of difference, it means

- ETF rates are not rightly correlated with Gold rates (futures/spot).

- Correlation ratio itself has big range.

- Gold ETFs can NOT be taken as proxy for physical/futures Gold.

|

|

| Back to top |

|

|

pkholla

Black Belt

Joined: 04 Nov 2010

Posts: 2890

|

Post: #6  Posted: Fri Aug 30, 2013 3:23 pm Post subject: Posted: Fri Aug 30, 2013 3:23 pm Post subject: |

|

|

Friends: Please distinguish between

1) Newspaper/ website listed price of gold in 22c, 24c etc

2) Physical gold coin, ingot, jewelry

3) Regular gold funds like SBIGETS, GOLD BEES, RELGOLD they buy gold, keep in vaults and issue shares = 1 gm each

4) Fund of fund: They invest in other Gold ETFs and issue you shares!

5) Fund which invests in gold mines world wide (I dont think any India mine is publicly listed) These funds also suffer or gain thru $-Re rate fluctuation

I suggest you compare investments within each class only as there is different risk, return etc ( as suggested by someone else). Even comparing to newspaper listed price may not be correct as that price may not actually be seen when you buy/ sell!

Eg: gold coins are issued by Reliance, PSBs, Private Banks, Bangalore Refinery etc : compare them

( eg: I have always invested in virtual gold ONLY thru SBIGETS. This trades at a premium to remaining similar ETFs as PUBLIC PERCEPTION IS THAT THERE IS LEAST GOLMAAL in running this fund)

Jai Hind, Prakash Holla

|

|

| Back to top |

|

|

amexhui

White Belt

Joined: 26 May 2009

Posts: 45

|

Post: #7  Posted: Sun Sep 01, 2013 12:20 am Post subject: Posted: Sun Sep 01, 2013 12:20 am Post subject: |

|

|

The issue mentioned by OP is also a function of what Vinay28 mentioned below.

The very reason all these gold ETFs and other substitutes get people's investment is because of the blind faith reposed by the public. As a matter of fact, the returns between the two methods should have been comparable. 13% difference in 2 months is MASSIVE by any standards.

I cannot comment on the gold ETFs in India, but the ones in the US do not have any audits for checking if the gold bar holdings are numbered and correctly allocated to the investors. It really will not be a surprise if all the so called gold holdings of these ETFs disappear one fine day a la the goldfinger plan from a james bond movie.

| vinay28 wrote: | | one of the biggest scams worldwide is that gold ETFs are not secured by equal amount of solid gold, which is actually mandatory. |

|

|

| Back to top |

|

|

|