| View previous topic :: View next topic |

| Author |

Baba'z Cafe |

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

|

| Back to top |

|

|

|

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #3  Posted: Thu Jan 28, 2010 9:39 am Post subject: Posted: Thu Jan 28, 2010 9:39 am Post subject: |

|

|

Baba ki Jai ho...

|

|

| Back to top |

|

|

aarya

White Belt

Joined: 12 Jan 2010

Posts: 4

|

Post: #4  Posted: Thu Jan 28, 2010 6:36 pm Post subject: Posted: Thu Jan 28, 2010 6:36 pm Post subject: |

|

|

Yes BABA Rocks

Baba ki Jai ho !

|

|

| Back to top |

|

|

jkm10

White Belt

Joined: 09 Jan 2010

Posts: 13

|

Post: #5  Posted: Sat Jan 30, 2010 2:07 pm Post subject: Re: Wolfee Effect Posted: Sat Jan 30, 2010 2:07 pm Post subject: Re: Wolfee Effect |

|

|

hi..

nifty is now at 4880 levels...your timing is great.in fact what u have mentioned has come true.

i want to learn your calculations.how are you making thses calculations,wolf fee charts etc..

please share..

thanx..

regards,

jkm

| swaroopbn wrote: | Baba Rocks!!!!

Well those who are short they should either move their SL to 4975 or book near 4800.

4400 will come for sure - but to pocket profit points also is a trait of good trader

We may re-enter shorts again around 4900 zone.

4800 is of utmost importance now - because this zone is the target zone of another wolfee wave which is in effect as well. Refer the attached NF weekly chart for details.

Rgds,

SW |

|

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

Post: #6  Posted: Mon Feb 08, 2010 1:41 am Post subject: Re: Wolfee Effect Posted: Mon Feb 08, 2010 1:41 am Post subject: Re: Wolfee Effect |

|

|

Dear Jkm,

Wolfe works on the simple principle of Equilibrium

Rgds,

Sw

| jkm10 wrote: | hi..

nifty is now at 4880 levels...your timing is great.in fact what u have mentioned has come true.

i want to learn your calculations.how are you making thses calculations,wolf fee charts etc..

please share..

thanx..

regards,

jkm

| swaroopbn wrote: | Baba Rocks!!!!

Well those who are short they should either move their SL to 4975 or book near 4800.

4400 will come for sure - but to pocket profit points also is a trait of good trader

We may re-enter shorts again around 4900 zone.

4800 is of utmost importance now - because this zone is the target zone of another wolfee wave which is in effect as well. Refer the attached NF weekly chart for details.

Rgds,

SW |

|

|

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

|

| Back to top |

|

|

psrao

White Belt

Joined: 02 Apr 2008

Posts: 11

|

Post: #8  Posted: Mon Feb 08, 2010 11:58 am Post subject: Posted: Mon Feb 08, 2010 11:58 am Post subject: |

|

|

Swaroop,

The points 1 3 and 5 needs to be equidistant isn't it? i mean on time scale,

the distant between 1&3 should be equal to distant between 3&5.

Kindly correct me if iam wrong.

rgds

psrao

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #9  Posted: Mon Feb 08, 2010 6:21 pm Post subject: Posted: Mon Feb 08, 2010 6:21 pm Post subject: |

|

|

SW

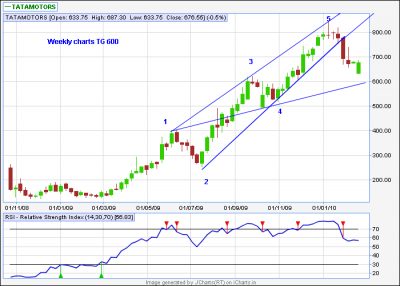

Posted below are two charts

1. tatamotors daily

2. tatamotors weekly

I have marked wolfe wave as per my understating, kindly see if I have got it right .

Could you please suggest when/how to taken entries.

SHEKHAR

| Description: |

|

| Filesize: |

37.55 KB |

| Viewed: |

554 Time(s) |

|

| Description: |

|

| Filesize: |

22.22 KB |

| Viewed: |

555 Time(s) |

|

|

|

| Back to top |

|

|

rajabharani

White Belt

Joined: 16 Jan 2010

Posts: 8

|

Post: #10  Posted: Mon Feb 08, 2010 8:17 pm Post subject: Wolfe wave Posted: Mon Feb 08, 2010 8:17 pm Post subject: Wolfe wave |

|

|

Is this correct sir?

A five point wolfe wave is the complete wave consisting of 5 waves with equal time intervals and symmetry. A bearish trend consists of 3 bearish and 2 bullish trends and a bullish trend consists of 3 bullish and 2 bearish trends. The waves must fulfill certain regulations

The range of wave 3-4 must equal to that of wave 1-2.

There should be regular intervals between all waves.

Waves 3 and 5 should show Fibonacci relationship (127% or 162%) with previous channel points.

Wave 5 should extend beyond the trend line formed by wave 1 and 3.

The channel formed by the first three waves is the support and resistance levels. The point 5 is the breakout point and is the best time to buy or sell. The point six, which is derived by connecting the points 1 and 4 with the 5th wave; it is the most profitable position.

|

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

Post: #11  Posted: Tue Feb 09, 2010 12:40 am Post subject: Posted: Tue Feb 09, 2010 12:40 am Post subject: |

|

|

Rao ji,

Yes that's correct. However, this is not a hard and first rule

Rgds,

Sw

| psrao wrote: | Swaroop,

The points 1 3 and 5 needs to be equidistant isn't it? i mean on time scale,

the distant between 1&3 should be equal to distant between 3&5.

Kindly correct me if iam wrong.

rgds

psrao |

|

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

Post: #12  Posted: Tue Feb 09, 2010 12:45 am Post subject: Re: Wolfe wave Posted: Tue Feb 09, 2010 12:45 am Post subject: Re: Wolfe wave |

|

|

Rajabharani ji,

You have provided the picture perfect conditions.

However, in the realtime it's hard to find such ideal setups.

I have following considerations for potential wolfe setup

- A failed C&H and H&S pattern.

- A falling or rising wedge

I will post new age wolfe rules sometime.

You will be surprised to know that there is 4 point wolfe wave as well

Rgds,

Sw

| rajabharani wrote: | Is this correct sir?

A five point wolfe wave is the complete wave consisting of 5 waves with equal time intervals and symmetry. A bearish trend consists of 3 bearish and 2 bullish trends and a bullish trend consists of 3 bullish and 2 bearish trends. The waves must fulfill certain regulations

The range of wave 3-4 must equal to that of wave 1-2.

There should be regular intervals between all waves.

Waves 3 and 5 should show Fibonacci relationship (127% or 162%) with previous channel points.

Wave 5 should extend beyond the trend line formed by wave 1 and 3.

The channel formed by the first three waves is the support and resistance levels. The point 5 is the breakout point and is the best time to buy or sell. The point six, which is derived by connecting the points 1 and 4 with the 5th wave; it is the most profitable position. |

Last edited by swaroopbn on Tue Feb 09, 2010 1:18 am; edited 1 time in total |

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

Post: #14  Posted: Tue Feb 09, 2010 11:46 am Post subject: Posted: Tue Feb 09, 2010 11:46 am Post subject: |

|

|

Friends,

Let's cover the swing LONGs initiated on Monday FULL.

Looks like markets are going to fall to make new intermediate LOWs.

I will post the chart tonight once I get some time.

Current call is SELL NF @ 4770 TGT 4600 SL 4800/4810.

Rgds,

Sw

Last edited by swaroopbn on Tue Feb 09, 2010 12:11 pm; edited 1 time in total |

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #15  Posted: Tue Feb 09, 2010 11:49 am Post subject: Posted: Tue Feb 09, 2010 11:49 am Post subject: |

|

|

SW

Thnx for your comments.

Shall Be waiting for new rules.

SHEKHAR

|

|

| Back to top |

|

|

|