| View previous topic :: View next topic |

| Author |

Best Tool for Charting Analysis |

sanmen

White Belt

Joined: 28 Apr 2008

Posts: 88

Location: Delhi

|

Post: #16  Posted: Wed Feb 08, 2012 10:20 pm Post subject: Posted: Wed Feb 08, 2012 10:20 pm Post subject: |

|

|

Hello RR Sir!

its great to see you back in the forum. Still have fresh memories of us waiting for you to come to the SB post market to share knowledge!!!!

Hope to get more from you Sir!

regards

Sandeep

|

|

| Back to top |

|

|

|

|

|

mayurnsk

Moderator

Joined: 18 Jan 2007

Posts: 216

Location: Nasik, Maharashtra

|

Post: #17  Posted: Wed Feb 08, 2012 11:58 pm Post subject: Posted: Wed Feb 08, 2012 11:58 pm Post subject: |

|

|

ProTrader

rightly said & put.....

Regards

mayurnsk

|

|

| Back to top |

|

|

rainbow

White Belt

Joined: 25 Feb 2010

Posts: 202

|

Post: #18  Posted: Thu Feb 09, 2012 6:28 am Post subject: Thanks Mr RR Posted: Thu Feb 09, 2012 6:28 am Post subject: Thanks Mr RR |

|

|

Dear Mr RR

I have looked at your 'kiss' related posts and have just marveled at the sheer simplicity of it.

What you have done for the lay person is to take abstract concepts, encapsulated them into bare essentials and laid it down for all to use. and benefit by it. almost with parasitic dependency. Thank you sir!

For someone like me who does not have the intellect to create a trading system, this is something like a godsend. Look forward to more education from you.

*take range for the day/week/month, use your favourite TA, and place your buy/sell orders* it cant seem to get any simpler than that.

btw, I use Spec's 34 ema rejection strategy as my TA tool, and it has stood me in good stead thus far. Thank you Spec

btw-2, I have customised your excel sheet to add a few tabs with favourite instruments i trade (futures are not my cup of tea actually) and shall be happy to share that with folks who are interested. the only caveat is that your interests and psychology have to match with mine for *that* customisation to work. I am more at home with ITM options.

Have a great day all, and happy trading.

some of us are meeting for lunch at the bowring institute on st. marks road, Bangalore on saturday, the 18th feb. 12 noon. those interested to join, please ping me.

Cheers

DJ

| rameshraja wrote: | Mr RK

In sideways market, no technical tool will work efficiently and this is not going to be an exception. |

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #19  Posted: Thu Feb 09, 2012 9:48 pm Post subject: Posted: Thu Feb 09, 2012 9:48 pm Post subject: |

|

|

Hello Mr DJ ( Rainbow )

Simple tools always rock but get unnoticed in the ocean of technical analysis.

Spec has given a nice strategy of 34 EMA rejection .. importantly he had explained the strategy in a nice way that even a layman can understand.

Spec strategy can be effectively used if Ichimoku and super trend methods are tagged, to get clear signal of breakouts and breakdowns.

Best wishes

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #20  Posted: Thu Feb 09, 2012 10:05 pm Post subject: Posted: Thu Feb 09, 2012 10:05 pm Post subject: |

|

|

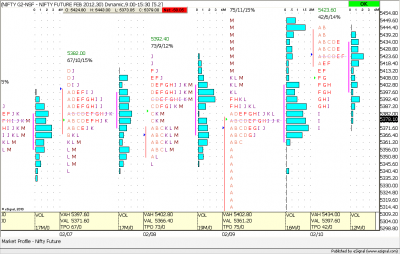

Today also Nifty took support at 5360 and not a single price bar closed below 5350 of "Y" Axis scale, (which I consider as trading level), and advanced by 92 points and made the high of 5452 for the day.

I was pretty sure from morning, that today will be the highest close not only since NF took support above 5350 of Y axis scale, but also Market Profile clearly suggested for a strong upmove when it opened below the Value Area Low and pushed into Value Area zone.

Simplicity at its Best !!

| Description: |

|

| Filesize: |

16.69 KB |

| Viewed: |

662 Time(s) |

|

| Description: |

|

| Filesize: |

22.32 KB |

| Viewed: |

632 Time(s) |

|

|

|

| Back to top |

|

|

rainbow

White Belt

Joined: 25 Feb 2010

Posts: 202

|

Post: #21  Posted: Fri Feb 10, 2012 8:01 am Post subject: Clarification on Ichimoku and Super Trend methods Posted: Fri Feb 10, 2012 8:01 am Post subject: Clarification on Ichimoku and Super Trend methods |

|

|

Dear Mr RR

Yes, concur with your view on Spec's strategy. It has become quite popular on the forum too.

Would appreciate if you could share some thoughts on how the ichimoku and super trend methods can be tagged to add to an existing strategy to help determine bo/bd.

Thanks!

Cheers

DJ

| rameshraja wrote: | Hello Mr DJ ( Rainbow )

Simple tools always rock but get unnoticed in the ocean of technical analysis.

Spec has given a nice strategy of 34 EMA rejection .. importantly he had explained the strategy in a nice way that even a layman can understand.

Spec strategy can be effectively used if Ichimoku and super trend methods are tagged, to get clear signal of breakouts and breakdowns.

Best wishes |

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #22  Posted: Fri Feb 10, 2012 1:23 pm Post subject: Posted: Fri Feb 10, 2012 1:23 pm Post subject: |

|

|

Nifty Future moving exactly opposite of yesterday.

NF closed below 5400 of 'Y" axis scale in 12 to 12.30 Price bar and has fallen to 5367 now.

If we look at Market Profile Chart, NF opened above Value Area and declined to close below Value Area High. Now stop for NF short trade as per Market Profile is at 5408 and downside target appears to be 5350 - 5315.

| Description: |

|

| Filesize: |

35.83 KB |

| Viewed: |

582 Time(s) |

|

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #23  Posted: Fri Feb 10, 2012 1:41 pm Post subject: Posted: Fri Feb 10, 2012 1:41 pm Post subject: |

|

|

Gann Levels for the Day[/u]

| Description: |

|

| Filesize: |

14.26 KB |

| Viewed: |

503 Time(s) |

|

|

|

| Back to top |

|

|

ayan1979

White Belt

Joined: 13 Jul 2011

Posts: 30

|

Post: #24  Posted: Mon Feb 13, 2012 9:06 pm Post subject: Posted: Mon Feb 13, 2012 9:06 pm Post subject: |

|

|

dear rr sir

thankyou for the information its easily understandable for an beginner like me ,sir what is y axis,shall we use this in lower tfs

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #25  Posted: Mon Feb 13, 2012 9:36 pm Post subject: Posted: Mon Feb 13, 2012 9:36 pm Post subject: |

|

|

Mr Ayan

See the right side of the chart. It has the scale showing the various price levels. You can use 30MTF.

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #26  Posted: Mon Feb 13, 2012 10:00 pm Post subject: Posted: Mon Feb 13, 2012 10:00 pm Post subject: |

|

|

| dear rameshraja, are these NF or NS levels? If NF, today it closed above ~5391

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #27  Posted: Mon Feb 13, 2012 10:29 pm Post subject: Posted: Mon Feb 13, 2012 10:29 pm Post subject: |

|

|

Mr Vinay

This is for NF for 30 MTF.

|

|

| Back to top |

|

|

ayan1979

White Belt

Joined: 13 Jul 2011

Posts: 30

|

Post: #28  Posted: Tue Feb 14, 2012 3:44 pm Post subject: Posted: Tue Feb 14, 2012 3:44 pm Post subject: |

|

|

dear rr sir

thankyou for the reply,y axis is the line which connects price on the right side isnt it,you have kept 50 pts as diff,sir two questions 1.shall we enlarge and reduce the diff to 20 pts etc, in futures trading,2.shall we use this concept in options,if i had disturbed you sorry thankyou

|

|

| Back to top |

|

|

rainbow

White Belt

Joined: 25 Feb 2010

Posts: 202

|

Post: #29  Posted: Tue Feb 14, 2012 5:57 pm Post subject: query on fib levels Posted: Tue Feb 14, 2012 5:57 pm Post subject: query on fib levels |

|

|

Dear Mr RR

Apologies for mixing threads, had a query.

your excel spreadsheet shows 5462 as top of the range for tomorrow, with values from NSEINDIA.

can these values be written on stone, have been observing this and found it to be fairly accurate.

asking this since nifty seems to be quite bullish near the close, and almost formed a marubozu candle on 15tf.

Thanks

Cheers

DJ

|

|

| Back to top |

|

|

jyothi2011

White Belt

Joined: 10 Oct 2011

Posts: 81

|

Post: #30  Posted: Tue Feb 14, 2012 10:49 pm Post subject: Posted: Tue Feb 14, 2012 10:49 pm Post subject: |

|

|

| what is marbazou candle?

|

|

| Back to top |

|

|

|