|

|

| View previous topic :: View next topic |

| Author |

Best Tool for Charting Analysis |

rainbow

White Belt

Joined: 25 Feb 2010

Posts: 202

|

|

| Back to top |

|

|

|

|  |

jyothi2011

White Belt

Joined: 10 Oct 2011

Posts: 81

|

Post: #32  Posted: Tue Feb 14, 2012 11:22 pm Post subject: Posted: Tue Feb 14, 2012 11:22 pm Post subject: |

|

|

| thanks

|

|

| Back to top |

|

|

jyothi2011

White Belt

Joined: 10 Oct 2011

Posts: 81

|

Post: #33  Posted: Tue Feb 14, 2012 11:45 pm Post subject: Posted: Tue Feb 14, 2012 11:45 pm Post subject: |

|

|

| Mr.Rainbow pls check ur mailbox

|

|

| Back to top |

|

|

opportunist

White Belt

Joined: 27 Apr 2010

Posts: 356

|

Post: #34  Posted: Wed Feb 15, 2012 7:57 am Post subject: Posted: Wed Feb 15, 2012 7:57 am Post subject: |

|

|

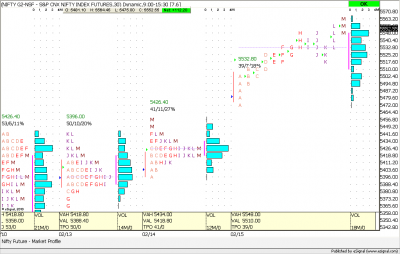

| rameshraja wrote: | Nifty Future moving exactly opposite of yesterday.

NF closed below 5400 of 'Y" axis scale in 12 to 12.30 Price bar and has fallen to 5367 now.

If we look at Market Profile Chart, NF opened above Value Area and declined to close below Value Area High. Now stop for NF short trade as per Market Profile is at 5408 and downside target appears to be 5350 - 5315. |

Rameshji,

Glad to see experts like you talking about so many tools in the same breath. I also use a number of tools including gann levels, ichimoku etc. to decide market direction before entering a trade. The idea is to not get confused but have a proper sense of direction.

I had studied Market profile too. However, due to lack of software I dont use it. Can you please tell me which software you have used for market profile studies? Also can you tell me please how you define value area early in the day?

Regards,

Oppo

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #35  Posted: Wed Feb 15, 2012 8:38 am Post subject: Posted: Wed Feb 15, 2012 8:38 am Post subject: |

|

|

Mr Rainbow (DJ)

Nifty is trading at the top of the trading range. It will find difficult to penetrate above 5470.. 5470 -5510 very difficult area in the Zone.

Best Wishes

|

|

| Back to top |

|

|

ajayhkaul

Yellow Belt

Joined: 18 Jun 2009

Posts: 866

|

Post: #36  Posted: Wed Feb 15, 2012 11:36 am Post subject: Posted: Wed Feb 15, 2012 11:36 am Post subject: |

|

|

| On the contrary Rameshraja, it appears to me that this range will be a cakewalk , maybe today itself

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #37  Posted: Wed Feb 15, 2012 11:42 am Post subject: Posted: Wed Feb 15, 2012 11:42 am Post subject: |

|

|

Mr Ajay

If it does it on closing basis also, then it shows the supremacy of Bull campaign. I am neither BULL nor BEAR in market. My agenda is simple.. At the end of the day money matters.. Whichever breed gives me money, I will grab it. I love both.

Best wishes

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #38  Posted: Wed Feb 15, 2012 11:52 am Post subject: Posted: Wed Feb 15, 2012 11:52 am Post subject: |

|

|

well said! well said!

|

|

| Back to top |

|

|

rainbow

White Belt

Joined: 25 Feb 2010

Posts: 202

|

Post: #39  Posted: Wed Feb 15, 2012 12:05 pm Post subject: JLT Posted: Wed Feb 15, 2012 12:05 pm Post subject: JLT |

|

|

'whichever breed gives me money.....'

to quote mcdonalds, *i am loving it*

yes, the range was broken today ~ on open, i was holding calls overnight, exited 5400ce (at decent profits) and entered 5500 ce.

a friend from another forum is trying to get the right fix on ID strategy to be *married to this spreadsheet*

Thanks a ton, RR. can we pick your brains some more, interactively?

Cheers

DJ

| rameshraja wrote: | Mr Ajay

If it does it on closing basis also, then it shows the supremacy of Bull campaign. I am neither BULL nor BEAR in market. My agenda is simple.. At the end of the day money matters.. Whichever breed gives me money, I will grab it. I love both.

Best wishes |

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #40  Posted: Wed Feb 15, 2012 12:23 pm Post subject: Posted: Wed Feb 15, 2012 12:23 pm Post subject: |

|

|

Mr Rainbow

Frankly speaking.. what we need at the end of the day? Either profit from trading or contain the loss if we are at the wrongside of market.

I don't enter trading with preconceived notions about the behaviour of market. Levels are meant for breaking.. so too trendlines.

I am also long in Nifty Future from icharts level and trailing it with stop at 5507. Icharts levels are great boon to people here, but its under utilised by traders here, which I notice from the number of Downloads being done.

Many traders here, don't utilise icharts levels to their advantage and if they have done that.. then you would be seeing Shout Box empty during trading time.

Icharts levels are ATM .. you can draw money how much ever you want.

Its a fact, several times I have mentioned about this to Mr Srikanth (ST). Both ST and PT have big heart to place their trading levels in public domain, and if I am in their place, I would have kept it to myself with selfish attitude.

Month after month I make a killing with icharts level and I owe them a lot.

Best Wishes

|

|

| Back to top |

|

|

ajayhkaul

Yellow Belt

Joined: 18 Jun 2009

Posts: 866

|

Post: #41  Posted: Wed Feb 15, 2012 12:37 pm Post subject: Posted: Wed Feb 15, 2012 12:37 pm Post subject: |

|

|

| rameshraja wrote: | Mr Ajay

If it does it on closing basis also, then it shows the supremacy of Bull campaign. I am neither BULL nor BEAR in market. My agenda is simple.. At the end of the day money matters.. Whichever breed gives me money, I will grab it. I love both.

Best wishes |

Well said Mr Rameshraja ! However I haven't studied GANN and ICHIMOKU , so I am curious to know from you what in these and other tools indicated today's bull move ?

|

|

| Back to top |

|

|

ajayhkaul

Yellow Belt

Joined: 18 Jun 2009

Posts: 866

|

Post: #42  Posted: Wed Feb 15, 2012 3:38 pm Post subject: Posted: Wed Feb 15, 2012 3:38 pm Post subject: |

|

|

| AJAYHKAUL wrote: | | rameshraja wrote: | Mr Ajay

If it does it on closing basis also, then it shows the supremacy of Bull campaign. I am neither BULL nor BEAR in market. My agenda is simple.. At the end of the day money matters.. Whichever breed gives me money, I will grab it. I love both.

Best wishes |

Well said Mr Rameshraja ! However I haven't studied GANN and ICHIMOKU , so I am curious to know from you what in these and other tools indicated today's bull move ? |

EOD 5520+ ....a cakewalk , wasnt it ?

You must be a happy bull today Mr Rameshraja!

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #43  Posted: Wed Feb 15, 2012 4:29 pm Post subject: Posted: Wed Feb 15, 2012 4:29 pm Post subject: |

|

|

Mr Ajayhkaul

I am happy sir.. Yesterday, I had bought NF above 5408 as per icharts level and sold partly today at 5490 and holding the balance quantity. My TSL will be today's 2 to 2.30 PM low of 5518.

Regarding your question, what triggered this big move today, you can see from Gann chart posted here on 10.02.2012. Yesterday 3 to 3.30 price bar closed at 5452.30 which is above Gann Level, reinforcing bullishness in Nifty Future. Secondly. in ichimoku chart in 30 minutes time frame, yesterday it touched the cloud and bounced on upside with last price bar witnessed highest volume of over 25L. Thirdly, as per "Y" scaling, 3 to 3.30 PM price bar of yesterday closed above 5450, which also confirmed the uptrend.

I was aware of all these before market open, but as usual at the back of my mind I was thinking about Daily Gann level resistance at 5470 and 5505. I have not done any emotional trades, and allowed my position to run and kept moving my TSL when market started advancing.

Trust, I clarified your querry fully.

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #44  Posted: Wed Feb 15, 2012 5:17 pm Post subject: Posted: Wed Feb 15, 2012 5:17 pm Post subject: |

|

|

Mr Opportunist

GE. Sorry for my late reply to you.

Before I start answering to your query, its an appeal to you and to everyone here, Kindly don't call me "Expert". I am not, and I don't deserve this title which I know for myself, as I also go wrong in my trading and book losses.

I am only sharing my experience in trading. To advise anyone in trading is easy, but in real time, we are exposed to big turf of market, where our fear and greed tries to overrules us since its a question of our hard earned money that we don't want to loose. Probably, I could turnout to be a great expert, if I don't trade even a single lot of Nifty and then preach people how to overcome emotions and to follow money management principles.

Coming to your point of query, I use Gann and other tools for trend identification and likely places of Support and Resistance to have an edge for trading.

I use market profile chart from Esignal and there are lot issues in the software which need to be addressed by them. To your question of defining value Area early in the day, its difficult to earmark valuearea with certainty of an evolving profile. You might be knowing, the value area is one standard deviation of a bell curve of price and volume distribution. I use the evolving profile to my advantage to find likely support and resistance during the day.

I extensively use previous day/s profile taking into account VAH/ POC/ VAL. I see where market opens.. and if it opens above VAH, I wait for market to come closer to VAH to have entry and keep Stop below VAH on closing basis in 30MTF. Reverse is true for shorting when it opens below VAL.

Incase of market opening above VAH and few TPOs closing above that, and if by anychance if it drifts into Value Area, I get myself prepared for short. If market opens within the Value area of previous day, then wait for breakout or breakdown of sorts for entry.

I invariably trade on all single prints and its very powerful for takingup trades. Single Print will show you the direction for the day and manytimes, I have made good money by trading in single print.

When you know the previous day Value Area, I suggest you to have a look at this. Take the value area High and Low and plug into any Fib calc and see how market behaves with this level. From market profile, by mere look at profiles of previous days, you will come to know if market is going to advance or decline ahead.

I have devised myself a few strategies to trade by market profile and I am successful in pulling the trigger correctly most of the time.

Best Wishes

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #45  Posted: Wed Feb 15, 2012 6:00 pm Post subject: Posted: Wed Feb 15, 2012 6:00 pm Post subject: |

|

|

Mr Opportunist

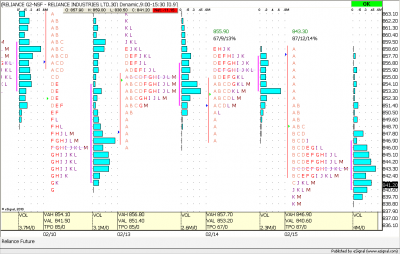

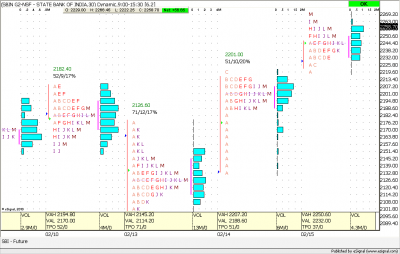

Further to my earlier description about Market Profile.. I show you below Charts of Nifty Future, Reliance Industries and SBI of today.

Nifty Future

I have Split the TPOs of today and its very clear how one could have trailed the trades with every support.

Reliance Industries

Today it breached the single Print of Yesterday's alphabet "A" low at 846.90 and fell to 838.

State Bank of India

Yesterday when it crossed single Print of 13.02.2012 of alphabet "A" at 2176.20, its movedup on momentum to 2220 and again today, when it crossed yesterday's single print of "C" at 2219.60, there is no lookback and stock blasted to 2266.

Best Wishes

| Description: |

|

| Filesize: |

31.52 KB |

| Viewed: |

580 Time(s) |

|

| Description: |

|

| Filesize: |

37.35 KB |

| Viewed: |

523 Time(s) |

|

| Description: |

|

| Filesize: |

34.33 KB |

| Viewed: |

467 Time(s) |

|

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|