| View previous topic :: View next topic |

| Author |

Common Sense trading |

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #1  Posted: Wed Jan 03, 2018 11:55 am Post subject: Common Sense trading Posted: Wed Jan 03, 2018 11:55 am Post subject: Common Sense trading |

|

|

Dear friends,

For a long time, I wanted to start a thread on trading based on common sense, i.e., by looking purely at Price action. No indicators, No EMI.. nothing !

Only Price.

For this we will use 02 time frames. EOD will be used as bigger time frame to look at broad picture of what exactly price is telling. 10tf will be used as lower time frame to make pinpoint entry with suitable SL.

But.... As with other strategies, this also is no sureshot method, we are only trying to have more odds in our favour with money management AND keeping things simple !

To begin with, please check charts of BAJAJ-AUTO on EOD & 10tf. Notes are marked in the chart.

Regards,

| Description: |

|

| Filesize: |

15 KB |

| Viewed: |

506 Time(s) |

|

| Description: |

|

| Filesize: |

19.04 KB |

| Viewed: |

541 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

niilkamal

White Belt

Joined: 06 Dec 2017

Posts: 14

|

Post: #2  Posted: Wed Jan 03, 2018 12:56 pm Post subject: Common sense trading Posted: Wed Jan 03, 2018 12:56 pm Post subject: Common sense trading |

|

|

Sumeshji,

It's a good idea to trade with common sense. Wish your findings for trading (T1, T2, T3 etc) work. wish you all the best

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #3  Posted: Wed Jan 03, 2018 3:16 pm Post subject: Concor Posted: Wed Jan 03, 2018 3:16 pm Post subject: Concor |

|

|

Another example is CONCOR...

It always pays to wait for right opportunity to look for entry, as people tend to react on market established support/resistance zones.

| Description: |

|

| Filesize: |

20.24 KB |

| Viewed: |

443 Time(s) |

|

| Description: |

|

| Filesize: |

19.58 KB |

| Viewed: |

439 Time(s) |

|

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #4  Posted: Wed Jan 03, 2018 7:24 pm Post subject: Posted: Wed Jan 03, 2018 7:24 pm Post subject: |

|

|

Hi Sumesh

All the best and best of luck

Just a contra view

Common sense trading is trading a "simpler" system mechanically (semi algo etc or without it based on manual entries

System should mean some formulae or technicals etc

In fact such systems assimilate price patterns and observations into easily readable numbers to have entry and exits

Pure price action trading is a misnomer

Supply and demand analysis is more complex form of support and resistance breaks

if you have been successfull in past with this it's great but it's next to impossible for readers to gain knowledge of trading through 100 or 1000 price charts ......

also money management rules have to be well defined before trading price action is terms of percentage risk per trade or per day or week or committed capital etc (as for other systems as well)

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #5  Posted: Wed Jan 03, 2018 8:19 pm Post subject: Posted: Wed Jan 03, 2018 8:19 pm Post subject: |

|

|

| amitagg wrote: | Hi Sumesh

All the best and best of luck

Just a contra view

Common sense trading is trading a "simpler" system mechanically (semi algo etc or without it based on manual entries

System should mean some formulae or technicals etc

In fact such systems assimilate price patterns and observations into easily readable numbers to have entry and exits

Pure price action trading is a misnomer

Supply and demand analysis is more complex form of support and resistance breaks

if you have been successfull in past with this it's great but it's next to impossible for readers to gain knowledge of trading through 100 or 1000 price charts ......

also money management rules have to be well defined before trading price action is terms of percentage risk per trade or per day or week or committed capital etc (as for other systems as well)  |

Hi, When I said simple system, I actually meant that..

If I have to use complex formula technicals etc. I'm again going into that trap.. Patterns work if they are put in proper context..I admit it is discretionery system, but supply demand is all evident in price action..Using EMAs and indicators only cloud your judgement..

Simply see what price is doing on larger and smaller timeframe..and enter with favorable risk reward ratio.

Having said that, one can always choose to accept or discard any system / method ..

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #6  Posted: Wed Jan 03, 2018 9:49 pm Post subject: Posted: Wed Jan 03, 2018 9:49 pm Post subject: |

|

|

| That's perfectly fine!

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #7  Posted: Thu Jan 04, 2018 9:50 am Post subject: Re: Concor Posted: Thu Jan 04, 2018 9:50 am Post subject: Re: Concor |

|

|

| sumesh_sol wrote: | Another example is CONCOR...

It always pays to wait for right opportunity to look for entry, as people tend to react on market established support/resistance zones. |

As I know the resitance zone is between 1383 to 1390, the moment it reached that zone , I swithed to even shorted timeframe (2 minutes chart) to check for weakness.

After straight rise to 1382 level it gave three small indicision kind of candles first indication of trouble ahead.

It was followed by another thrust of bullish candle , which was immediately negated by subsequent bearish candle. I shorted below that (1382) some qty, with SL abv 1391.

Now this is aggresive entry so I shorted half qty , another lot I will short after confirmation on 10 tf..

| Description: |

|

| Filesize: |

17.66 KB |

| Viewed: |

447 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #8  Posted: Thu Jan 04, 2018 9:54 am Post subject: Re: Concor Posted: Thu Jan 04, 2018 9:54 am Post subject: Re: Concor |

|

|

| sumesh_sol wrote: | | sumesh_sol wrote: | Another example is CONCOR...

It always pays to wait for right opportunity to look for entry, as people tend to react on market established support/resistance zones. |

As I know the resitance zone is between 1383 to 1390, the moment it reached that zone , I swithed to even shorted timeframe (2 minutes chart) to check for weakness.

After straight rise to 1382 level it gave three small indicision kind of candles first indication of trouble ahead.

It was followed by another thrust of bullish candle , which was immediately negated by subsequent bearish candle. I shorted below that (1382) some qty, with SL abv 1391.

Now this is aggresive entry so I shorted half qty , another lot I will short after confirmation on 10 tf.. |

and Stopped out..

Now let us wait for 10tf confirmation for fresh entry..

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #9  Posted: Thu Jan 04, 2018 10:03 am Post subject: Re: Concor Posted: Thu Jan 04, 2018 10:03 am Post subject: Re: Concor |

|

|

| sumesh_sol wrote: | | sumesh_sol wrote: | | sumesh_sol wrote: | Another example is CONCOR...

It always pays to wait for right opportunity to look for entry, as people tend to react on market established support/resistance zones. |

As I know the resitance zone is between 1383 to 1390, the moment it reached that zone , I swithed to even shorted timeframe (2 minutes chart) to check for weakness.

After straight rise to 1382 level it gave three small indicision kind of candles first indication of trouble ahead.

It was followed by another thrust of bullish candle , which was immediately negated by subsequent bearish candle. I shorted below that (1382) some qty, with SL abv 1391.

Now this is aggresive entry so I shorted half qty , another lot I will short after confirmation on 10 tf.. |

and Stopped out..

Now let us wait for 10tf confirmation for fresh entry.. |

After 10:00 am candle of 10tf, I'm convinced of resistance the stock is facing in this zone, will short below 1378 , SL - 1390 and Tgt 1350

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #10  Posted: Sat Jan 13, 2018 5:26 pm Post subject: Re: Common Sense trading Posted: Sat Jan 13, 2018 5:26 pm Post subject: Re: Common Sense trading |

|

|

| sumesh_sol wrote: | Dear friends,

For a long time, I wanted to start a thread on trading based on common sense, i.e., by looking purely at Price action. No indicators, No EMI.. nothing !

Only Price.

For this we will use 02 time frames. EOD will be used as bigger time frame to look at broad picture of what exactly price is telling. 10tf will be used as lower time frame to make pinpoint entry with suitable SL.

But.... As with other strategies, this also is no sureshot method, we are only trying to have more odds in our favour with money management AND keeping things simple !

To begin with, please check charts of BAJAJ-AUTO on EOD & 10tf. Notes are marked in the chart.

Regards, |

Met all short targets T1, T2 & T3..

| Description: |

|

| Filesize: |

15.69 KB |

| Viewed: |

408 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #11  Posted: Sat Jan 13, 2018 5:38 pm Post subject: Re: Concor Posted: Sat Jan 13, 2018 5:38 pm Post subject: Re: Concor |

|

|

| sumesh_sol wrote: | Another example is CONCOR...

It always pays to wait for right opportunity to look for entry, as people tend to react on market established support/resistance zones. |

The short (at point A) was not forced down, infact it hovered around same level (point B) for 4 consecutive days clearly indicating an impending breakout up or down.. Finally bullish forces won the battle and took it above SL level (Point C)..

| Description: |

|

| Filesize: |

19.27 KB |

| Viewed: |

417 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #12  Posted: Sun Jan 14, 2018 3:18 pm Post subject: PRISM Cement Posted: Sun Jan 14, 2018 3:18 pm Post subject: PRISM Cement |

|

|

PRISM Cement

==============

| Description: |

|

| Filesize: |

41.95 KB |

| Viewed: |

477 Time(s) |

|

| Description: |

|

| Filesize: |

18.21 KB |

| Viewed: |

462 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #13  Posted: Tue Jan 16, 2018 9:46 am Post subject: DISHTV Posted: Tue Jan 16, 2018 9:46 am Post subject: DISHTV |

|

|

DISHTV

=========

| Description: |

|

| Filesize: |

23.98 KB |

| Viewed: |

405 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #14  Posted: Tue Jan 16, 2018 10:08 am Post subject: Re: PRISM Cement Posted: Tue Jan 16, 2018 10:08 am Post subject: Re: PRISM Cement |

|

|

| sumesh_sol wrote: | PRISM Cement

============== |

Up by 13%

| Description: |

|

| Filesize: |

17.63 KB |

| Viewed: |

398 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #15  Posted: Tue Jan 16, 2018 10:19 am Post subject: LAOPALA.. Posted: Tue Jan 16, 2018 10:19 am Post subject: LAOPALA.. |

|

|

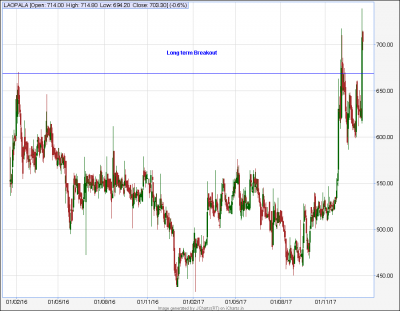

LAOPALA..

===========

If support @ 700 is not sustained, trade may be reviewed

| Description: |

|

| Filesize: |

17.53 KB |

| Viewed: |

379 Time(s) |

|

| Description: |

|

| Filesize: |

17.22 KB |

| Viewed: |

397 Time(s) |

|

|

|

| Back to top |

|

|

|