| View previous topic :: View next topic |

| Author |

COPPER ~ POSITIONAL [WELGRO] |

bharatpatel

White Belt

Joined: 26 Oct 2011

Posts: 401

|

Post: #16  Posted: Wed Aug 28, 2013 9:07 am Post subject: Posted: Wed Aug 28, 2013 9:07 am Post subject: |

|

|

| welgro wrote: | | pavan29 wrote: | | welgro wrote: | MADE LOW ::::::::::::::::::::: 436.60 ::::::::::::::::::::::::

CHART IS GREAT  |

Can you explain what pull back is ? |

How to Trade Pullbacks

Buying weakness and selling strength is the art of buying pullbacks. Stocks that are in up trends will pull back offering a low risk buying opportunity and stocks that are in down trends will rally offering a low risk shorting opportunity.

As a swing trader, you have to WAIT for these opportunities to happen because...

Doesn't it make more sense to buy a stock after a wave of selling has occurred rather than getting caught in a sell-off?

Doesn't it make more sense to short a stock after a wave of buying has occurred rather than getting caught in a rally?

Absolutely! If you are buying a stock then you want as many sellers out of the stock before you get in. On the other hand, if you are shorting a stock, then you want as many buyers in the stock before you get in. This gives you a low risk entry that you can manage effectively.

Buying Pullbacks And Shorting Rallies

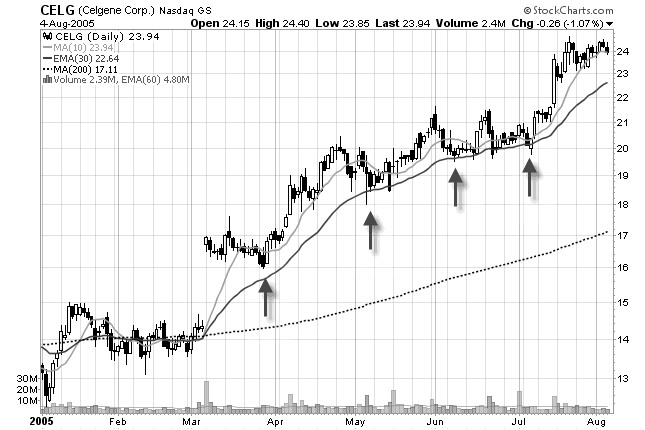

Where do you buy a pullback and where do you short a rally? You buy them and short them in the Traders Action Zone (TAZ). Here is and example on the long side:

See how you are buying stocks in strong up trends after a wave of selling has occurred? Ok, now here is an example on the short side:

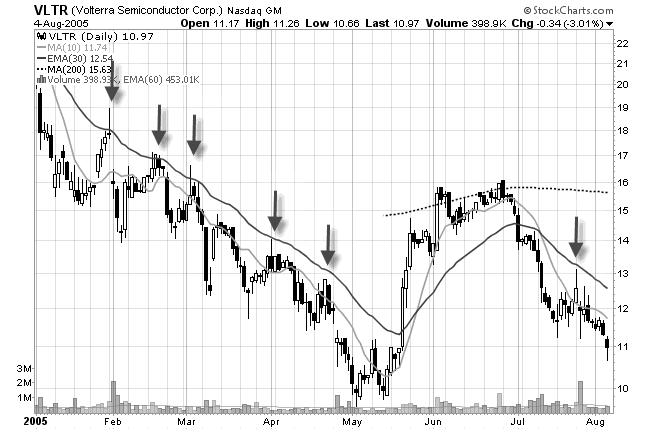

Now you can see how you are shorting stocks after a wave of buying has occurred.

When going long, wait for the decline into the TAZ and when going short, wait for the rally into the TAZ.

Are all of them created equal? Nope. You have just a standard pullback like in the example above and then you have...

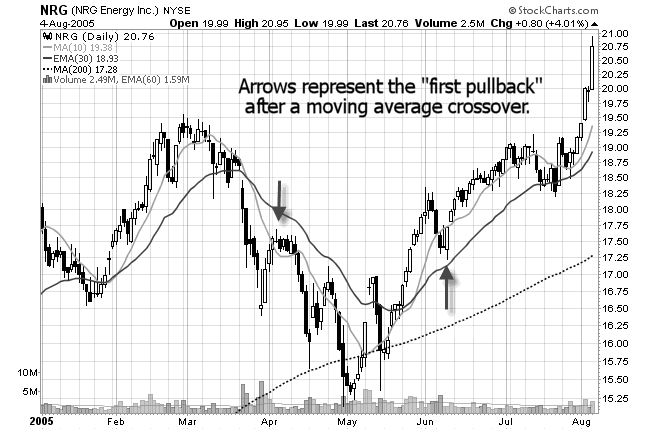

The First Pullback

These are exactly what the name implies. It is the first one after a change in trend. How do you identify a change in trend - when the 10 SMA crosses the 30 EMA. After that happens, you look for an entry when the stock gets into the TAZ. Here is an example:

This is the most reliable type of entry into a stock and this is the likely area where institutional money is going to come into the stock. If you only trade one pattern, this should be it! You can get into a stock at the beginning of a trend, at a point of low risk, and you can take partial profits and ride the trend to completion! What more could you ask for?

Oh yeah, speaking of getting in on the beginning of a trend. This next setup fits neatly into an Elliott Wave Pattern...

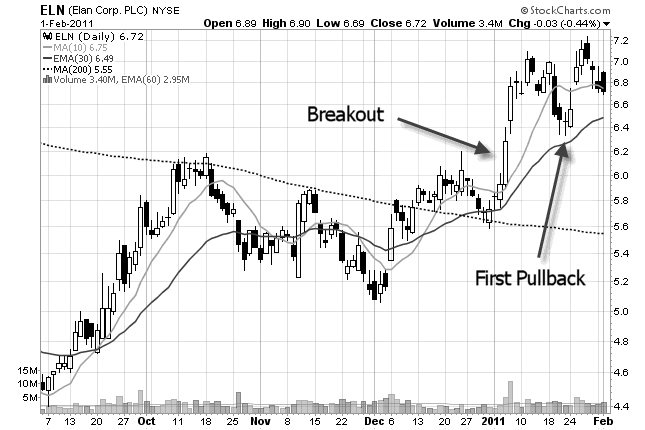

First Pullback After A Breakout

There is one other type of pullback worth mentioning and that is the first pullback after a breakout.

If you are looking at a stock that is trading sideways or forming a basing pattern, and it suddenly breaks out of the pattern, you can look to buy the first pullback after the breakout. This also gives you a low risk entry into a stock that will likely continue the current trend.

Here is an example:

Most traders are going to buy break outs. The word break outs sounds so exciting doesn't it? The problem with buying break outs is that it is hardly every low risk. Think about it. If you are buying stocks when everybody else is, then who is left to buy the stock after you get in?

Forget buying break outs? Step away from the crowd. Wait for the breakout buyers to get scared and sell. This sets up the pullback that you can get into with low risk, high odds, and a profitable reward. |

Dear Friend,

The best set up for swing .

Thanks.

|

|

| Back to top |

|

|

|

|

|

jacky75

White Belt

Joined: 19 Feb 2012

Posts: 47

|

Post: #17  Posted: Sun Nov 24, 2013 4:00 pm Post subject: Playing first pullback in down trend Posted: Sun Nov 24, 2013 4:00 pm Post subject: Playing first pullback in down trend |

|

|

Welgrow sir

Could we treat present status of Copper as first pullback in down trend and if yes how to play going short.

Could we go short below low of 22.11 i.e. at 442.60 with Stop above high of 22.11 at 446.35.

Please share your thoughts with us.

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #18  Posted: Thu May 29, 2014 7:31 pm Post subject: Posted: Thu May 29, 2014 7:31 pm Post subject: |

|

|

|

|

| Back to top |

|

|

hardik0007

White Belt

Joined: 16 Mar 2011

Posts: 53

|

Post: #19  Posted: Mon Jun 16, 2014 8:59 am Post subject: Posted: Mon Jun 16, 2014 8:59 am Post subject: |

|

|

| whats your view on Nickel and copper?

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #20  Posted: Mon Jun 16, 2014 9:30 am Post subject: Posted: Mon Jun 16, 2014 9:30 am Post subject: |

|

|

| hardik0007 wrote: | | whats your view on Nickel and copper? |

Nickel chart will update later...

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #21  Posted: Mon Jun 16, 2014 10:22 am Post subject: Posted: Mon Jun 16, 2014 10:22 am Post subject: |

|

|

|

|

| Back to top |

|

|

hardik0007

White Belt

Joined: 16 Mar 2011

Posts: 53

|

Post: #22  Posted: Mon Jun 16, 2014 1:52 pm Post subject: Posted: Mon Jun 16, 2014 1:52 pm Post subject: |

|

|

| welgro wrote: |  |

1300 candle close well above 1092.50

|

|

| Back to top |

|

|

hardik0007

White Belt

Joined: 16 Mar 2011

Posts: 53

|

Post: #23  Posted: Mon Jun 16, 2014 11:29 pm Post subject: Posted: Mon Jun 16, 2014 11:29 pm Post subject: |

|

|

| welgro wrote: |  |

good call 1125 high

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #24  Posted: Mon Jun 16, 2014 11:34 pm Post subject: Posted: Mon Jun 16, 2014 11:34 pm Post subject: |

|

|

| And welgros target of 1300 for nickel opening above 1118

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #25  Posted: Tue Jun 17, 2014 1:08 pm Post subject: Posted: Tue Jun 17, 2014 1:08 pm Post subject: |

|

|

| nickel ~ safe traders better to exit here or cost as stoploss.Take decision at your end.

|

|

| Back to top |

|

|

hardik0007

White Belt

Joined: 16 Mar 2011

Posts: 53

|

Post: #26  Posted: Tue Jun 17, 2014 1:45 pm Post subject: Posted: Tue Jun 17, 2014 1:45 pm Post subject: |

|

|

| welgro wrote: | | nickel ~ safe traders better to exit here or cost as stoploss.Take decision at your end. |

sold in mrng at good rate 1128.7

thx

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #27  Posted: Tue Jun 17, 2014 7:14 pm Post subject: Posted: Tue Jun 17, 2014 7:14 pm Post subject: |

|

|

Today I bought LEADMINI14JULFUT 6 lots at 127.40 with stoploss 122.50 for positional .Lets see what will be happen.

High risky ...Safe traders don't try...

|

|

| Back to top |

|

|

hardik0007

White Belt

Joined: 16 Mar 2011

Posts: 53

|

Post: #28  Posted: Tue Jun 17, 2014 11:29 pm Post subject: Posted: Tue Jun 17, 2014 11:29 pm Post subject: |

|

|

| welgro wrote: | Today I bought LEADMINI14JULFUT 6 lots at 127.40 with stoploss 122.50 for positional .Lets see what will be happen.

High risky ...Safe traders don't try... |

you are viewing chart in weekly tf

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #29  Posted: Tue Jun 17, 2014 11:54 pm Post subject: Posted: Tue Jun 17, 2014 11:54 pm Post subject: |

|

|

| hardik0007 wrote: | | welgro wrote: | Today I bought LEADMINI14JULFUT 6 lots at 127.40 with stoploss 122.50 for positional .Lets see what will be happen.

High risky ...Safe traders don't try... |

you are viewing chart in weekly tf |

LEADMINI14JULFUT EOD Chart :-

|

|

| Back to top |

|

|

hardik0007

White Belt

Joined: 16 Mar 2011

Posts: 53

|

|

| Back to top |

|

|

|