|

|

| View previous topic :: View next topic |

| Author |

Crossovers and Touchovers |

opportunist

White Belt

Joined: 27 Apr 2010

Posts: 356

|

Post: #1  Posted: Mon Apr 13, 2015 10:43 am Post subject: Crossovers and Touchovers Posted: Mon Apr 13, 2015 10:43 am Post subject: Crossovers and Touchovers |

|

|

Dear all,

This is my observation that crossovers generally should be carefully taken. If you enter a trade on a crossover many a times it fails as the trend reverses quickly. But if the crossover comes close to reversal but continues (I have coined a term for it - TOUCHOVER) then it gives a pretty good trade. The attached diagram explains it all.

If this simple idea is adhered to many loss making trades may be avoided and overall profitability may be increased for traders.

Regards,

Oppo

| Description: |

|

| Filesize: |

54.09 KB |

| Viewed: |

638 Time(s) |

|

|

|

| Back to top |

|

|

|

|  |

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #2  Posted: Mon Apr 13, 2015 10:54 am Post subject: Re: Crossovers and Touchovers Posted: Mon Apr 13, 2015 10:54 am Post subject: Re: Crossovers and Touchovers |

|

|

| opportunist wrote: | Dear all,

This is my observation that crossovers generally should be carefully taken. If you enter a trade on a crossover many a times it fails as the trend reverses quickly. But if the crossover comes close to reversal but continues (I have coined a term for it - TOUCHOVER) then it gives a pretty good trade. The attached diagram explains it all.

If this simple idea is adhered to many loss making trades may be avoided and overall profitability may be increased for traders.

Regards,

Oppo |

oppo, your 'touchover' can get confirmed next day only, right?

|

|

| Back to top |

|

|

opportunist

White Belt

Joined: 27 Apr 2010

Posts: 356

|

Post: #3  Posted: Mon Apr 13, 2015 11:04 am Post subject: Re: Crossovers and Touchovers Posted: Mon Apr 13, 2015 11:04 am Post subject: Re: Crossovers and Touchovers |

|

|

| vinay28 wrote: | | opportunist wrote: | Dear all,

This is my observation that crossovers generally should be carefully taken. If you enter a trade on a crossover many a times it fails as the trend reverses quickly. But if the crossover comes close to reversal but continues (I have coined a term for it - TOUCHOVER) then it gives a pretty good trade. The attached diagram explains it all.

If this simple idea is adhered to many loss making trades may be avoided and overall profitability may be increased for traders.

Regards,

Oppo |

oppo, your 'touchover' can get confirmed next day only, right? |

Not necessary Vinay. It depends on the TF. If it is a 15min or 30 min or 1hr TF then it can be confirmed in the same day.

Regards,

Oppo

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #4  Posted: Mon Apr 13, 2015 11:13 am Post subject: Re: Crossovers and Touchovers Posted: Mon Apr 13, 2015 11:13 am Post subject: Re: Crossovers and Touchovers |

|

|

| opportunist wrote: | Not necessary Vinay. It depends on the TF. If it is a 15min or 30 min or 1hr TF then it can be confirmed in the same day.

Regards,

Oppo |

oh ok oppo. I wrongly assumed that yours was on daily chart only. tks

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #5  Posted: Mon Apr 13, 2015 11:45 am Post subject: Re: Crossovers and Touchovers Posted: Mon Apr 13, 2015 11:45 am Post subject: Re: Crossovers and Touchovers |

|

|

| opportunist wrote: | Dear all,

This is my observation that crossovers generally should be carefully taken. If you enter a trade on a crossover many a times it fails as the trend reverses quickly. But if the crossover comes close to reversal but continues (I have coined a term for it - TOUCHOVER) then it gives a pretty good trade. The attached diagram explains it all.

If this simple idea is adhered to many loss making trades may be avoided and overall profitability may be increased for traders.

Regards,

Oppo |

Dear opportunist,

this also similar strategy... (Touchovers) can try it ...

Urban Towers Scalping Strategy

The Strategy :

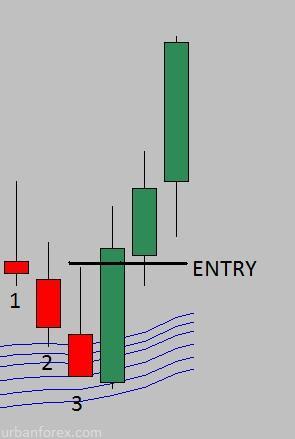

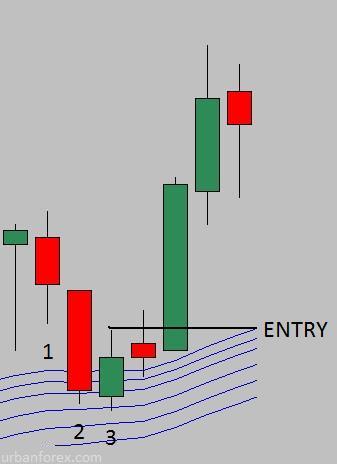

During a trend, when the market retraces to the blue MA with at least 3 consecutive lower highs (3 towers), we enter at the break of the high of the last high. Ok let me explain in details one by one.

Steps to Follow :

- Price is above the blue MA trend is up

- Price is below the blue MA trend is down

- Market retraces towards the blue MA with 3 consecutive lower highs (in a uptrend)

- At the break of the high of the last candle, we enter long (in a uptrend)

Example 1 :

Alright, what do we know right off the bat by looking at this. We know the market is in a uptrend because the market is above the blue MA. The market retraced to the blue line with 3 consecutive lower highs (3 towers) as we can see the red candles above. Next, we entered long at the break of the high of the last retracement candle - which in this case is 3rd tower as we can see above. Ok 1 more example for you guys

Example 2 :

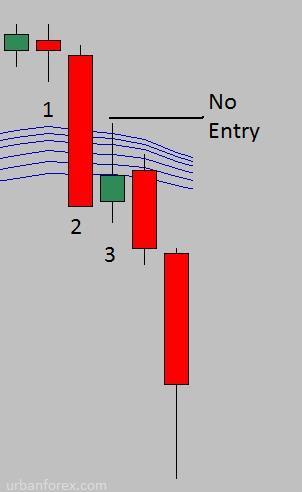

Example of a Do Not Enter Trade

Alright, in this example, the market was in a uptrend, it did a 1, 2, 3 tower retrace but it never had a breakout on the high of the 3rd tower, in fact, the market continued down and changed to a down trend. This example is to show that this strategy helps avoid many fake trades.

Exit Strategies

Option 1

1:1 Risk to reward. If your stop is -12 pips your limit should be +12 pips.

Option 2

Open 2 lots. If your stop is at -10 pips, once your trades goes in your favor and you're at +10 pips, close 1 lot and let the other one run. Exit at Support and Resistance levels.

Option 3

Exit at the nearest 50 or 00 level. These are psychological levels. (make sure your exit is at least the same number of pips as your stop, otherwise dont enter the trade)

Option 4

Trailing Stop. Once in a trade, at the close of each candle, place your stop 1 pip below the low (if in a buy trade). Vise versa for sell trade.[/QUOTE]

It's RainbowMMA

SMA Close = 37

SMA Close = 39

SMA Close = 41

SMA Close = 44

SMA Close = 47

SMA Close = 50

|

|

| Back to top |

|

|

opportunist

White Belt

Joined: 27 Apr 2010

Posts: 356

|

Post: #6  Posted: Mon Apr 13, 2015 1:03 pm Post subject: Re: Crossovers and Touchovers Posted: Mon Apr 13, 2015 1:03 pm Post subject: Re: Crossovers and Touchovers |

|

|

Thanks Welgro,

I am aware of this system from earlier discussions but nevertheless good to be reminded again.

Regards,

Oppo

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|