| View previous topic :: View next topic |

| Author |

Crudeoil Positional Analysis ~ Welgro Corner |

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #316  Posted: Sun Dec 14, 2014 11:42 am Post subject: Posted: Sun Dec 14, 2014 11:42 am Post subject: |

|

|

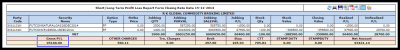

MCX Crudeoil Long Term View :-

| Description: |

|

| Filesize: |

126.69 KB |

| Viewed: |

392 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

AMBY

Yellow Belt

Joined: 05 Sep 2014

Posts: 503

|

Post: #317  Posted: Sun Dec 14, 2014 11:49 am Post subject: GREAT JOB OF UPDATING CHARTS IN $ & INR. Posted: Sun Dec 14, 2014 11:49 am Post subject: GREAT JOB OF UPDATING CHARTS IN $ & INR. |

|

|

AFTER WATCHING YOUR CHARTS AND COMMENTS,

HOW TO SAY THANKS TO YOU?

EXCELLENT WORK , U R AN  , ,

|

|

| Back to top |

|

|

acharyams

Yellow Belt

Joined: 04 Jul 2010

Posts: 552

|

Post: #318  Posted: Sun Dec 14, 2014 2:20 pm Post subject: Posted: Sun Dec 14, 2014 2:20 pm Post subject: |

|

|

| Got a close shave. I was about to buy ONGC for long term. Thanks a lot for saving me.

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #319  Posted: Mon Dec 15, 2014 4:38 am Post subject: Re: Crudeoil positional analysis 12.12.14 Update II Posted: Mon Dec 15, 2014 4:38 am Post subject: Re: Crudeoil positional analysis 12.12.14 Update II |

|

|

| welgro wrote: |

|

Made low : 56.20

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #320  Posted: Mon Dec 15, 2014 11:03 am Post subject: Crudeoil positional analysis 15.12.14 Update I Posted: Mon Dec 15, 2014 11:03 am Post subject: Crudeoil positional analysis 15.12.14 Update I |

|

|

Pre-Trend Chart Patterns Every Trader Should Know: Part I

Talking Points:

Benefits of Pattern Recognition

The First Pre-Trend Pattern: Zig-Zag

Setting Stops & Profit Targets

“…markets are chaotic in nature, but within this chaos are non-random patterns that repeat and are predictable” -Larry Pesavento,

Some traders love to look for common price action patterns before entering in the direction of the overall trend to improve the risk: reward ratio. Others however, prefer to steer clear from patterns and focus solely on price action. However, the two are not mutually exclusive and can be combined for a powerful trading combination whether you’re swing trading or day trading.

Read more : http://www.dailyfx.com/forex/education/trading_tips/post_of_the_day/2014/07/11/Pre-Trend-Chart-Patterns-You-Should-Know.html

| Description: |

|

| Filesize: |

104.83 KB |

| Viewed: |

374 Time(s) |

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #321  Posted: Mon Dec 15, 2014 3:10 pm Post subject: Crudeoil positional analysis 15.12.14 Update II Posted: Mon Dec 15, 2014 3:10 pm Post subject: Crudeoil positional analysis 15.12.14 Update II |

|

|

Crudeoil positional analysis 15.12.14 Update II

| Description: |

|

| Filesize: |

145.9 KB |

| Viewed: |

351 Time(s) |

|

|

|

| Back to top |

|

|

Rahulsharmaat

Black Belt

Joined: 04 Nov 2009

Posts: 2766

|

Post: #322  Posted: Mon Dec 15, 2014 9:43 pm Post subject: Posted: Mon Dec 15, 2014 9:43 pm Post subject: |

|

|

| it was a short always

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #323  Posted: Mon Dec 15, 2014 10:02 pm Post subject: Posted: Mon Dec 15, 2014 10:02 pm Post subject: |

|

|

| Rahulsharmaat wrote: | | it was a short always |

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #324  Posted: Tue Dec 16, 2014 7:15 am Post subject: Crudeoil positional analysis 16.12.14 Update I Posted: Tue Dec 16, 2014 7:15 am Post subject: Crudeoil positional analysis 16.12.14 Update I |

|

|

Part 2 : RSI

I use RSI because it’s a forex indicator that follow the Big Trend

with more accuracy. It doesn’t give many false signals when

prices do a little pullback. It’s an advantage

My RSI period is 21

Normally, I use RSI only to find little pullbacks, but sometimes

it can help me to go out of my day trades.

Part 3 : William’s %R

For me William’s %R is the King of forex indicators. I use it to

find the turn point of pullback. One minute, I’ll explain with my

simple english words. William’s %R shows me when the end of

a pullback is near. Did you understand me ?

Now pay attention, please.

William’s %R value are between [-100 ; 0], but for me, when I

write I do [0 ; +100]. Why ? I don’t know. May be I don’t like

negative numbers.

Hey, I lost three times my money, so I’am a little paranoïd.

Download pdf here : http://www.forexstrategiesresources.com/app/download/5902736280/Forex+day+trading+system.pdf?t=1402518367

http://www.forexstrategiesresources.com/scalping-forex-strategies-ii/190-forex-day-trading-system/

| Description: |

|

| Filesize: |

131.04 KB |

| Viewed: |

368 Time(s) |

|

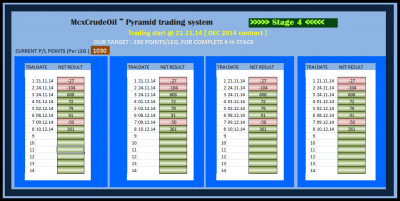

| Description: |

| DEC2014 contract Profit/Loss update 16.12.14 |

|

| Filesize: |

32.82 KB |

| Viewed: |

352 Time(s) |

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #326  Posted: Tue Dec 16, 2014 2:42 pm Post subject: Posted: Tue Dec 16, 2014 2:42 pm Post subject: |

|

|

|

|

| Back to top |

|

|

reachchirag

White Belt

Joined: 28 Nov 2012

Posts: 102

|

Post: #327  Posted: Tue Dec 16, 2014 7:19 pm Post subject: Super call Posted: Tue Dec 16, 2014 7:19 pm Post subject: Super call |

|

|

Dear sir,

Superb call. What is next level.

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #328  Posted: Tue Dec 16, 2014 9:22 pm Post subject: Re: Super call Posted: Tue Dec 16, 2014 9:22 pm Post subject: Re: Super call |

|

|

| reachchirag wrote: | Dear sir,

Superb call. What is next level. |

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #329  Posted: Tue Dec 16, 2014 10:30 pm Post subject: Crudeoil positional analysis 16.12.14 Update III Posted: Tue Dec 16, 2014 10:30 pm Post subject: Crudeoil positional analysis 16.12.14 Update III |

|

|

Crudeoil positional analysis 16.12.14 Update III

| Description: |

|

| Filesize: |

97.2 KB |

| Viewed: |

337 Time(s) |

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #330  Posted: Tue Dec 16, 2014 10:49 pm Post subject: Posted: Tue Dec 16, 2014 10:49 pm Post subject: |

|

|

What Should a Trading Diary Look Like

Describing the components of a trading journal

Part of trading is learning from your mistakes and not repeating them. This is why a trading diary is something all traders should have in their toolkit. By being able to look back at the market and at your decision to enter or exit a trade, you’ll be able to find where you might’ve gone wrong, but also when you got it right.

How should you go about creating your personal trading diary? You have to look at the purpose of the diary and translate it into the contents: It should describe the decision for entering the trade – a technical level or a gut feeling. It should cover the components of a trade – its date, time, direction. They may seem unimportant but could reveal systematic mistakes later on. And finally the diary should provide a look into your thoughts at the moment of trading – how you interpret the raw data and why you’re acting on it.

Here are the specific items/columns that we recommend you include:

Date – A no-brainer

Time – Useful if you’re day trading, or if you’re using pending orders

Entry/exit – One trade won’t equal one row of information, you have to describe the entry and the exit. There might also be times when you partially exit a trade, or increase another that have to be noted

Instrument – Another must have. Use it as a filter later on to see where you’re winning and losing. Beginners will usually test more instruments when they start, but professionals usually stick to two or three for long periods of time

Direction – A buy or a sell. You might find that your success rate and consequently your prediction skills are better suited to one of the two

Order type – The vast majority of trades fall within the simple buy and sell, but there are many other types of orders that might be used. If you do employ them, or you’re mixing it up, then you should definitely note it

Price – The price at which your order was executed. Can also be used for future reference as a proven point of entry, or as a bad one

Quantity – Money management is crucial in trading, so keep track of how much you invest

Stop Loss & Take Profit – You can choose to write them as a distance from the entry price and check how often they’re executed

Indicators – If you use one or more indicators for decision making, then their levels might be used as proof of their validity

Comments – Not all trades need additional explanation if they’re based on technical analysis, but additional comments, even for them, can be extremely valuable and reveal your actual decision-making process

Spreadsheet programs are suitable for creating your trading diary and can be customized easily for arranging and connecting the different data sets. This is your personal sample and you won’t find one that’s more relevant, so look at it from all possible angles.

In any case, a journal is something that can never harm your trading. It’s a constant learning process and having a clear, unbiased record of your slumps and jumps can give you that much desired edge over the markets.

http://blog.trading212.com/what-should-a-trading-diary-look-like/

| Description: |

| Holding long position (took @ 16.12.14) |

|

| Filesize: |

51.55 KB |

| Viewed: |

358 Time(s) |

|

|

|

| Back to top |

|

|

|