| View previous topic :: View next topic |

| Author |

Delta neutral Theta biased trading |

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #316  Posted: Tue Jun 27, 2017 2:33 pm Post subject: Posted: Tue Jun 27, 2017 2:33 pm Post subject: |

|

|

A quick summary of results of all trades taken in this thread since Sep 16

Sep trade : BNF profit booked 596 points

Oct trade : BNF profit booked 465 points

Nov trade : BNF 50 points profit (800 points if I include puts bought)

Dec 2 trades : BNF 90 points profit (just held for one day) & Nifty 365 points profit

Jan trade : BNF 464 points profit

Feb Trade : BNF 437 points profit

March Trade : BNF 463 points profit

April Trade : BNF 108 points profit

May 2017 - BNF 220 points profit

June 2017 - BNF 346 points profit

Every month has been a profitable month till now since last 10 months , thats the magic of delta neutral strategy.

Cheers

SH

|

|

| Back to top |

|

|

|

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #317  Posted: Wed Jun 28, 2017 1:07 pm Post subject: Posted: Wed Jun 28, 2017 1:07 pm Post subject: |

|

|

Nifty strategy opened for June

Nifty adjustments made in last few days:

Exited 9600 PE at 18 and sold 9700 PE at 51

Exited 9650 PE (2 lots) at 68 and sold 9550 PE 2 lots at 26

Exited 9700 PE at 119

Exited 9800 PE at 265 and bought 9650 PE at 119 instead

Exited both lots 9550 PE at 56, sold 9500 PE (2 lots) at 33

Positions currently open

Bought 9650 PE at 119

Sold 9500 PE (2 lots) at 33

Positions booked till now

9300PE sold at 15, exited at 5 = 10 points profit

9550 PE sold at 26, exited at 18 = 8 points profit

9500 PE sold at 46, exited at 12 = 34 points profit

9600 PE sold at 74, exited at 18 = 56 points profit

9650 PE sold 2 lots at 41, exited at 68 = 27 x 2 = 54 points loss

Sold 9700 PE at 51, exited at 119 = 68 points loss

9800 PE bought at 192, exited at 265 = 73 points profit

Sold 9550 PE at 26 (2 lots), exited at 56 = Loss 2 x 30 = 60 points

Total profit booked till now = -1 points

Cheers

SH

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #318  Posted: Thu Jun 29, 2017 7:12 pm Post subject: Posted: Thu Jun 29, 2017 7:12 pm Post subject: |

|

|

Nifty strategy opened for June

Nifty positions closed today with roughly 28 points profits. Nifty has not given any significant profits as compared to Bank Nifty due to low IVs in Nifty. I will be updating only BNF strategy here going forward.

Below were the adjustment trade in Nifty yesterday and today.

Exited one lot 9500 PE at 39 and sold 9450 PE at 18, exited at 2

Sold 9550 CE at 9, Exited at 21

Sold 9550 PE at 24, exited at 38

Exited 9650 PE at 135

Exited second lot 9500 PE at 4

Positions booked till now

9300PE sold at 15, exited at 5 = 10 points profit

9550 PE sold at 26, exited at 18 = 8 points profit

9500 PE sold at 46, exited at 12 = 34 points profit

9600 PE sold at 74, exited at 18 = 56 points profit

9650 PE sold 2 lots at 41, exited at 68 = 27 x 2 = 54 points loss

Sold 9700 PE at 51, exited at 119 = 68 points loss

9800 PE bought at 192, exited at 265 = 73 points profit

Sold 9550 PE at 26 (2 lots), exited at 56 = Loss 2 x 30 = 60 points

Sold 9500 PE at 33, exited at 39 = 6 point loss

Sold 9500 PE at 33, Exited at 4 = 29 points profit

Sold 9450 PE at 18, exited at 2 = 16 points profit

Sold 9550 CE at 9, exited at 21 = 12 points loss

Sold 9550 PE at 24, exited at 38 = 14 points loss

9650 PE bought at 119, exited at 135 = 16 points profit.

Total profit booked till now = 28 points profit

Cheers

SH

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #319  Posted: Fri Jun 30, 2017 3:50 pm Post subject: Posted: Fri Jun 30, 2017 3:50 pm Post subject: |

|

|

BNF July strategy opened today

Bought 23000 CE at 375

Sold 23200 CE (6th Jul) at 92

Sold 24000 CE (2 lots) at 51

Excel sheet updated.

Cheers

SH

| Description: |

|

Download |

| Filename: |

BNF Delta hedging trade book.xlsx |

| Filesize: |

26.03 KB |

| Downloaded: |

626 Time(s) |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #320  Posted: Mon Jul 03, 2017 3:47 pm Post subject: Posted: Mon Jul 03, 2017 3:47 pm Post subject: |

|

|

Few adjustments made, sheet updated.

Cheers

| Description: |

|

Download |

| Filename: |

BNF Delta hedging trade book.xlsx |

| Filesize: |

26.12 KB |

| Downloaded: |

539 Time(s) |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #321  Posted: Tue Jul 11, 2017 3:45 pm Post subject: Posted: Tue Jul 11, 2017 3:45 pm Post subject: |

|

|

Was travelling for last few days hence couldn't update the forum with the trades.

The attached file has all trades taken this month till now, we are in 150 points profit this month as well.

Cheers

SH

| Description: |

|

Download |

| Filename: |

BNF Delta hedging trade book.xlsx |

| Filesize: |

26.43 KB |

| Downloaded: |

495 Time(s) |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #322  Posted: Wed Jul 12, 2017 3:38 pm Post subject: Posted: Wed Jul 12, 2017 3:38 pm Post subject: |

|

|

Some adjustments today

Exited 23700 CE (13 JUL) at 47 and sold 23700 CE (20 JUL) at 127 instead

Exited 23900 CE (Jul) at 145 and sold 24200 CE at 57 instead.

Excel file updated and attached.

The M2M profit for July month is 191 points now.

Cheers

SH

| Description: |

|

Download |

| Filename: |

BNF Delta hedging trade book.xlsx |

| Filesize: |

26.43 KB |

| Downloaded: |

487 Time(s) |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #323  Posted: Thu Jul 13, 2017 3:54 pm Post subject: Posted: Thu Jul 13, 2017 3:54 pm Post subject: |

|

|

BNF continues its bull run, some adjustments made today :

Exited 24200 CE at 91 and sold 24500 CE at 35 instead

Exited 23700 CE (20 Jul) at 252 and sold 23900 CE (20 JUL) at 139 instead.

Excel file updated and attached.

The M2M profit for July month is 185 points now.

Cheers

SH

| Description: |

|

Download |

| Filename: |

Copy of BNF Delta hedging trade book.xlsx |

| Filesize: |

26.53 KB |

| Downloaded: |

483 Time(s) |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #324  Posted: Fri Jul 14, 2017 3:35 pm Post subject: Posted: Fri Jul 14, 2017 3:35 pm Post subject: |

|

|

BNF continues its bull run, one adjustment made today :

Exited 24000CE at 192 and sold 24100 CE at 145 instead

Excel file updated and attached.

The M2M profit for July month is 221 points now as of today's closing price.

Cheers

SH

| Description: |

|

Download |

| Filename: |

BNF delta hedging trade book.xlsx |

| Filesize: |

26.28 KB |

| Downloaded: |

484 Time(s) |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #325  Posted: Tue Jul 18, 2017 3:44 pm Post subject: Posted: Tue Jul 18, 2017 3:44 pm Post subject: |

|

|

BNF continues its bull run, few adjustments made in last two days:

Monday adjustments

Exited 24100 CE at 146 and sold 24200 CE at 105 instead

Exit 23900 CE at 187 and sold 24100 CE (Jul end) at 170 instead

Today's adjustments

Exited 24200 CE at 156 and sold 24300 CE at 112 instead.

Excel file updated and attached.

The M2M profit for July month is 245 points now as of today's closing price.

Cheers

SH

| Description: |

|

Download |

| Filename: |

BNF Delta hedging trade book.xlsx |

| Filesize: |

26.62 KB |

| Downloaded: |

500 Time(s) |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #326  Posted: Thu Jul 20, 2017 3:46 pm Post subject: Posted: Thu Jul 20, 2017 3:46 pm Post subject: |

|

|

BNF continues its bull run and we continue to accumulate profits !

few adjustments made in last two days:

19th July adjustments

Exited 24300 CE at 115 and sold 24500 CE at 57 instead

Exit 24100 CE at 239 and sold 24200 CE at 182 instead

Today's adjustments

Exited BNF fut at 24230

Exited 24200 CE at 177

Sold 2 lots 24000 PE at 76, exited at 78

Sold 2 lots 23900 PE at 56 instead, exited one lot at 51 and carried the second lot.

Exited one lot 24500 CE at 51 (still holding the second lot short)

Excel file updated and attached.

The M2M profit for July month is 303 points now as of today's closing price.

Cheers

SH

| Description: |

|

Download |

| Filename: |

BNF Delta hedging trade book.xlsx |

| Filesize: |

26.72 KB |

| Downloaded: |

577 Time(s) |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #327  Posted: Fri Jul 21, 2017 12:49 pm Post subject: Posted: Fri Jul 21, 2017 12:49 pm Post subject: |

|

|

Exited July's strategy today and closed the outstanding positions this morning as follows:

24500 CE exited at 45

23900 PE exited at 35

The total profit this month is 328 points.

August strategy will be opened next week.

Excel updated

Cheers

SH

| Description: |

|

Download |

| Filename: |

BNF Delta hedging trade book.xlsx |

| Filesize: |

26.7 KB |

| Downloaded: |

476 Time(s) |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #328  Posted: Fri Jul 21, 2017 12:52 pm Post subject: Posted: Fri Jul 21, 2017 12:52 pm Post subject: |

|

|

A quick summary of results of all trades taken in this thread since Sep 16

Sep trade : BNF profit booked 596 points

Oct trade : BNF profit booked 465 points

Nov trade : BNF 50 points profit (800 points if I include puts bought)

Dec 2 trades : BNF 90 points profit (just held for one day) & Nifty 365 points profit

Jan trade : BNF 464 points profit

Feb Trade : BNF 437 points profit

March Trade : BNF 463 points profit

April Trade : BNF 108 points profit

May 2017 - BNF 220 points profit

June 2017 - BNF 346 points profit

July 2017 - BNF 328 points profit

Every month has been a profitable month till now since last 11 months , thats the magic of delta neutral strategy.

Cheers

SH

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #329  Posted: Sat Jul 22, 2017 7:33 pm Post subject: Posted: Sat Jul 22, 2017 7:33 pm Post subject: |

|

|

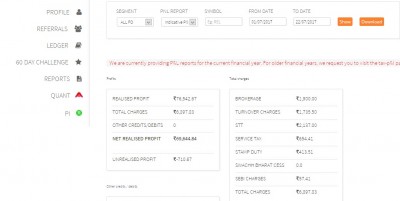

Some traders just give calls and not track results. Some others track on excel sheets.

No one uploads broker's P&L statement or ledgers... I am doing it.

Attached is a snapshot of one of my firm's trading account's P&L (one of many accounts).. the capital deployed is 12 Lakhs and profits for July is 76000 gross and 69000 net.

This turns out to be a healthy 6% returns this month, that too risk free (risk free means with 1/10 risk involved as compared to normal trading where there is no hedge)

Cheers

SH

| Description: |

|

| Filesize: |

68.44 KB |

| Viewed: |

439 Time(s) |

|

Last edited by Alchemist on Mon Jul 24, 2017 10:13 pm; edited 1 time in total |

|

| Back to top |

|

|

manojkr78

Green Belt

Joined: 07 Mar 2011

Posts: 1014

|

Post: #330  Posted: Sun Jul 23, 2017 7:14 pm Post subject: Posted: Sun Jul 23, 2017 7:14 pm Post subject: |

|

|

| very good one.....are you posting any live trades during market hours

|

|

| Back to top |

|

|

|