| View previous topic :: View next topic |

| Author |

Dollor Trader |

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

Post: #391  Posted: Thu Jul 25, 2013 9:36 am Post subject: Re: confused on the time frame Posted: Thu Jul 25, 2013 9:36 am Post subject: Re: confused on the time frame |

|

|

| sjjhala wrote: | intraday.trader:

dude, what is the final time frame for trading USDINR? 10 mins or 6 mins..kindly clarify and confirm once and for all..

thanks.

Sid |

Boss you can use 6 min once and for all, I was testing for difference tfs what is the results..

|

|

| Back to top |

|

|

|

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

Post: #392  Posted: Thu Jul 25, 2013 10:46 am Post subject: Posted: Thu Jul 25, 2013 10:46 am Post subject: |

|

|

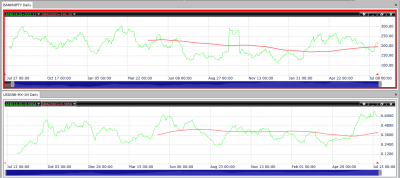

One of the user asked me comparison between USD and NIFTY in PM

Hi,

| intra.trader wrote: | Usually margin is around 1800 for USDINR

Comparison : -

Average(200 days) ATR(14) is around 40 and one can usually try to capture 1/3rd of ATR.. so captures .14paise which comes to rs 2050, which 41 points of nifty.. One other hand average ATR(14) on nifty is 22(rs 1100) and banknifty 67(rs 1650)

but as of now due to RBI interruption margin has increased to 4000

I May be wrong, If wrong do correct me...

To capture 15 paise on an average in a day is easy in USDINR and more possibly then earning 45 points in NIFTY( My opinion only)

|

| Description: |

|

| Filesize: |

109.23 KB |

| Viewed: |

395 Time(s) |

|

| Description: |

|

| Filesize: |

103.12 KB |

| Viewed: |

398 Time(s) |

|

|

|

| Back to top |

|

|

kuldeep.panda

White Belt

Joined: 18 Mar 2013

Posts: 182

|

Post: #393  Posted: Fri Jul 26, 2013 11:25 am Post subject: Posted: Fri Jul 26, 2013 11:25 am Post subject: |

|

|

Thanks man intra...

|

|

| Back to top |

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

Post: #394  Posted: Tue Jul 30, 2013 9:30 am Post subject: Posted: Tue Jul 30, 2013 9:30 am Post subject: |

|

|

Constant intervene in USD-INR..giving whips..Euro sailing smoothly...

| Description: |

|

| Filesize: |

153.4 KB |

| Viewed: |

502 Time(s) |

|

|

|

| Back to top |

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

|

| Back to top |

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

Post: #396  Posted: Mon Aug 19, 2013 4:06 pm Post subject: Posted: Mon Aug 19, 2013 4:06 pm Post subject: |

|

|

| USD-INR should stop 63.40..If EOD close above 63.50, 65 is for most probable target. could finally top out near 67..

|

|

| Back to top |

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

|

| Back to top |

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

Post: #398  Posted: Tue Aug 20, 2013 1:23 pm Post subject: Posted: Tue Aug 20, 2013 1:23 pm Post subject: |

|

|

For usd to fall more it has to break 63.5000 give 6 min CC below it. and Euro below 84.70.. I feel it may go up now.. taking support @ RSI near 40 levels..

| Description: |

|

| Filesize: |

123.43 KB |

| Viewed: |

463 Time(s) |

|

|

|

| Back to top |

|

|

krish_pm

White Belt

Joined: 12 Nov 2012

Posts: 44

|

Post: #399  Posted: Thu Aug 22, 2013 12:03 am Post subject: Posted: Thu Aug 22, 2013 12:03 am Post subject: |

|

|

intra.trader sir,

How the value 63.5000 is derived? I want to learn the stratergy. please tell me

krish.

|

|

| Back to top |

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

Post: #400  Posted: Thu Aug 22, 2013 10:34 am Post subject: Posted: Thu Aug 22, 2013 10:34 am Post subject: |

|

|

| intra.trader wrote: | | USD-INR should stop 63.40..If EOD close above 63.50, 65 is for most probable target. could finally top out near 67.. |

EOD Close above 65.20 ...67.20 May be top out area for USD-INR

If from here it does goes down it should Give to EOD close below 63.50 for down trend..

It in the last leg of I suppose as per dow now..Speculation zone, Gaps vertical highs. Front page of every newspaper..i Am expecting a turn around in USD in a month now..

|

|

| Back to top |

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

Post: #401  Posted: Thu Aug 22, 2013 10:36 am Post subject: Posted: Thu Aug 22, 2013 10:36 am Post subject: |

|

|

| krish_pm wrote: | intra.trader sir,

How the value 63.5000 is derived? I want to learn the stratergy. please tell me

krish. |

Just used some pattern and fibbo to derive the value,

But this not what I trade using. I trade on 6 min charts, With Super Trend and EMA.

|

|

| Back to top |

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

Post: #402  Posted: Thu Aug 22, 2013 11:22 am Post subject: Posted: Thu Aug 22, 2013 11:22 am Post subject: |

|

|

| intra.trader wrote: | | intra.trader wrote: | | USD-INR should stop 63.40..If EOD close above 63.50, 65 is for most probable target. could finally top out near 67.. |

EOD Close above 65.20 ...67.20 May be top out area for USD-INR

If from here it does goes down it should Give to EOD close below 63.50 for down trend..

It in the last leg of I suppose as per dow now..Speculation zone, Gaps vertical highs. Front page of every newspaper..i Am expecting a turn around in USD in a month now.. |

| Description: |

|

| Filesize: |

72.18 KB |

| Viewed: |

418 Time(s) |

|

|

|

| Back to top |

|

|

krish_pm

White Belt

Joined: 12 Nov 2012

Posts: 44

|

Post: #403  Posted: Thu Aug 22, 2013 12:41 pm Post subject: Posted: Thu Aug 22, 2013 12:41 pm Post subject: |

|

|

intra.trader sir,

Thanks for the reply.

I want to learn the stratergy. please tell me.

what pattern you have used and what is the fibbonacci percentage used

to find the values 63.50, 65.20 and the top out area 67.20?

How to find the top out area?

Krish.

|

|

| Back to top |

|

|

intra.trader

White Belt

Joined: 25 Sep 2012

Posts: 402

|

Post: #404  Posted: Thu Aug 22, 2013 1:08 pm Post subject: Posted: Thu Aug 22, 2013 1:08 pm Post subject: |

|

|

This what i did and came out with these numbers..

A triangle brake out and took 161, 200 and 261 of the triangle range.

| Description: |

|

| Filesize: |

107.93 KB |

| Viewed: |

409 Time(s) |

|

|

|

| Back to top |

|

|

krish_pm

White Belt

Joined: 12 Nov 2012

Posts: 44

|

Post: #405  Posted: Thu Aug 22, 2013 9:56 pm Post subject: Posted: Thu Aug 22, 2013 9:56 pm Post subject: |

|

|

Thank you sir.

I understand the stratergy. The triangle breakout first target 200% @63.3970

and next target 261.8% @ 67

krish.

|

|

| Back to top |

|

|

|