| View previous topic :: View next topic |

| Author |

donchains channel and ema high low plan |

chiragbvyas

White Belt

Joined: 18 Feb 2010

Posts: 469

|

Post: #31  Posted: Wed Aug 10, 2011 1:04 am Post subject: hi Posted: Wed Aug 10, 2011 1:04 am Post subject: hi |

|

|

SVKUM Sir,

Really great work.

|

|

| Back to top |

|

|

|

|

|

Allwell

White Belt

Joined: 24 Jan 2010

Posts: 183

|

Post: #32  Posted: Sat Aug 13, 2011 9:31 pm Post subject: Posted: Sat Aug 13, 2011 9:31 pm Post subject: |

|

|

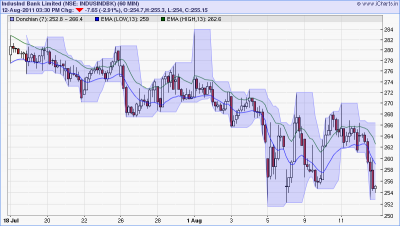

Indus Bank .......good candidate for short....SVKUM Sir please confirm it...

| Description: |

|

| Filesize: |

45.12 KB |

| Viewed: |

529 Time(s) |

|

|

|

| Back to top |

|

|

svkum

White Belt

Joined: 14 Feb 2007

Posts: 321

|

Post: #33  Posted: Sat Aug 13, 2011 10:01 pm Post subject: Posted: Sat Aug 13, 2011 10:01 pm Post subject: |

|

|

| indus has indicated short entry at/below 261 , and no squaring off signal yet, now at 254.

|

|

| Back to top |

|

|

sandew

White Belt

Joined: 02 Feb 2009

Posts: 174

|

Post: #34  Posted: Sun Aug 14, 2011 11:13 am Post subject: SVKUM - on IndusInd Bank Posted: Sun Aug 14, 2011 11:13 am Post subject: SVKUM - on IndusInd Bank |

|

|

Hi SVKum.

Can we carry forward IndusInd Bank as a test study

Can you please add the SL and the level to flip to go long - as per current chart.

We may do this (stating short, SL, flip long levels) over few times over next few days using each time the latest 60M updated chart.

Regards

|

|

| Back to top |

|

|

Allwell

White Belt

Joined: 24 Jan 2010

Posts: 183

|

Post: #35  Posted: Sun Aug 14, 2011 3:20 pm Post subject: Posted: Sun Aug 14, 2011 3:20 pm Post subject: |

|

|

| to me S/L should be 266.40 at this point in Indus Bank......one should carry short position until it trade above 13EMA High on hourly chart......SVKUM Sir may put more light on than.....

|

|

| Back to top |

|

|

svkum

White Belt

Joined: 14 Feb 2007

Posts: 321

|

Post: #36  Posted: Sun Aug 14, 2011 6:54 pm Post subject: Posted: Sun Aug 14, 2011 6:54 pm Post subject: |

|

|

sandew,

as per strategy , there is no signal yet to square off the short position.so you can continue postion as long as its not htting out sl.

SL as per plan is uper edge of donchains channel.

you can flip the position for long , when price crosses 13 ema high and also donchain channels takes out earlier flat edge.

yes what dijjya says is right for sl.

|

|

| Back to top |

|

|

smartcancerian

Yellow Belt

Joined: 07 Apr 2010

Posts: 542

|

Post: #37  Posted: Sun Aug 14, 2011 8:31 pm Post subject: Posted: Sun Aug 14, 2011 8:31 pm Post subject: |

|

|

svkum sir, slight clarification required..

Taking example on upside-

1. price should take out 13 ema high( query on this- shall we wait for that trigger candle to close above 13ema high & take entry on closing basis or breaking level is sufficient)

2. also "price" to cut off latest flattish structure of DC or the "upper band" should change its shape & show rising move or "upper band" should cross the latest flattish structure.??

thanx & regards

|

|

| Back to top |

|

|

svkum

White Belt

Joined: 14 Feb 2007

Posts: 321

|

Post: #38  Posted: Sun Aug 14, 2011 9:50 pm Post subject: Posted: Sun Aug 14, 2011 9:50 pm Post subject: |

|

|

smart-

yes price candle shd close beyond 13 ema high, otherwise it may turnout to be a false alarm .

crossing flattish shape wd give very confirmed signal , thogh one can consider crossing shape(but it has to show sufficient amt of crossing )

in other direction.

upper band croosing the latest flattish shape wd be a confirmed signal .

|

|

| Back to top |

|

|

maooliservice

White Belt

Joined: 04 Aug 2010

Posts: 93

|

Post: #39  Posted: Mon Aug 15, 2011 5:43 pm Post subject: Posted: Mon Aug 15, 2011 5:43 pm Post subject: |

|

|

Dear Svkum sir,

I have few queries about this strategy.

1]how to adjust trailing stop loss

2]how to find stocks for trading from EOD charts with this method.

3]what is the use of RSI & Donchain indicators

4]If this strategy to be used for daily/weekly charts then what should be the

settings

Regards

Mohan

|

|

| Back to top |

|

|

svkum

White Belt

Joined: 14 Feb 2007

Posts: 321

|

Post: #40  Posted: Tue Aug 16, 2011 7:42 am Post subject: Posted: Tue Aug 16, 2011 7:42 am Post subject: |

|

|

maooliservice,

1)sl is opposite side of donchain channel , upper edge in short, and lower edge in long.

2)YOU can search stocks in trending pattern from eod chart,those stocks would be better traded in this strategy.

same strategy with same prameters can be applied for eod charts.

3)donchain channels are used to highlight the HH AND LL BREAKOUTS

RSI can be used to entry and exit actions.

4) i have not tried for daily weekly charts with various parameters,

you can have various combinations , for yourself.

|

|

| Back to top |

|

|

sriki_r

White Belt

Joined: 05 Apr 2009

Posts: 15

|

Post: #41  Posted: Tue Aug 16, 2011 10:39 am Post subject: Posted: Tue Aug 16, 2011 10:39 am Post subject: |

|

|

Svkum,

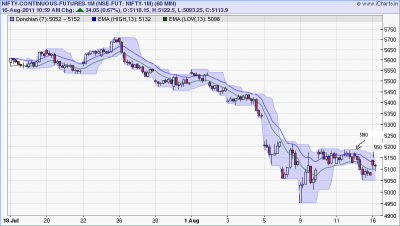

Attached the chart for Nifty-1m. With respect to the chart, where will you take long position?

1] Is it 5190 that is the last flattish DC? Or

2] Is it 5150 that is the current DC?

Thanks,

Sriki

| Description: |

|

| Filesize: |

42.77 KB |

| Viewed: |

508 Time(s) |

|

|

|

| Back to top |

|

|

opportunist

White Belt

Joined: 27 Apr 2010

Posts: 356

|

Post: #42  Posted: Tue Aug 16, 2011 12:19 pm Post subject: Posted: Tue Aug 16, 2011 12:19 pm Post subject: |

|

|

To sriki_r:

Although Svkum Sir is the best person to answer this and he no doubt will... I would like to point out that nifty at this point is not trending much (note the flat 13 EMAs). Donchian Channels work best in trends that is when the EMA lines are either markedly sloping up or down.

Secondly as per the rule one should short only after candle has crossed low 13 EMA...as at this moment nifty is yet to do that.

Thanks and Regards,

Opportunist

|

|

| Back to top |

|

|

svkum

White Belt

Joined: 14 Feb 2007

Posts: 321

|

Post: #43  Posted: Tue Aug 16, 2011 9:23 pm Post subject: Posted: Tue Aug 16, 2011 9:23 pm Post subject: |

|

|

sriki,

chart as opportunist said is not in trending pattern , its showing sideways shape.

you have asked , where to go long ,

as per plan dchannel upper edge has to take out earler falltish shape , and cross(close) 13 ema high as well.

since both the conditions are not fulfilled , no action for long.

|

|

| Back to top |

|

|

tans987

White Belt

Joined: 12 May 2010

Posts: 8

|

Post: #44  Posted: Wed Aug 17, 2011 9:48 pm Post subject: Donchains channels for EOD charts? Posted: Wed Aug 17, 2011 9:48 pm Post subject: Donchains channels for EOD charts? |

|

|

Svkum Sir,

Where can I find Donchains channels, for checking EOD charts?

Please help me regarding this, as donchains channel is available in Premium

Charts only and I think, we can not check EOD charts there.

Waiting for your reply,

Regards,

Tans987

|

|

| Back to top |

|

|

amitkbaid1008

Yellow Belt

Joined: 04 Mar 2009

Posts: 540

|

Post: #45  Posted: Wed Aug 17, 2011 10:31 pm Post subject: Posted: Wed Aug 17, 2011 10:31 pm Post subject: |

|

|

For EOD charts there is no need of premium charts for Donchain Channels they are also available at Charts

or follow this link

http://www.icharts.in/charts.html

|

|

| Back to top |

|

|

|