| View previous topic :: View next topic |

| Author |

FUTURES MKT TRADING STRATEGY- CONSERVATIVE METHOD VER. 3.0 |

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #76  Posted: Thu Sep 15, 2011 11:28 am Post subject: Posted: Thu Sep 15, 2011 11:28 am Post subject: |

|

|

| dijyya wrote: | | Educomp-1M, has crossed 13-21 EMA now, already crossed 5-8 EMA.... |

HERE SL IS WHEN EMA 5 GOES BELOW EMA 8 BECAUSE EMA 20/50 OF EOD CHART IS DOWN (DOWNTREND)

REGARDS,

S I D

|

|

| Back to top |

|

|

|

|

|

Allwell

White Belt

Joined: 24 Jan 2010

Posts: 183

|

Post: #77  Posted: Thu Sep 15, 2011 11:54 am Post subject: Posted: Thu Sep 15, 2011 11:54 am Post subject: |

|

|

Thanks Sid Sir,

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #78  Posted: Thu Sep 15, 2011 12:08 pm Post subject: Posted: Thu Sep 15, 2011 12:08 pm Post subject: |

|

|

| dijyya wrote: | Thanks Sid Sir,  |

ur welcome.... I hope u are earning from the system....

Regards,

S I D

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #79  Posted: Thu Sep 15, 2011 12:20 pm Post subject: Posted: Thu Sep 15, 2011 12:20 pm Post subject: |

|

|

| SID2060 wrote: | Latest strategy rules Summary VRY IMP:

Scenario 1: Ema 20/50 of EOD Chart Down (downtrend) :-

Buy or short cover : when on 60min tf, ema 13/21 and ema 5/8 both r up

Sell or shortsell: when on 60 min tf, Ema 5/8 is down

Scenario 2: Ema 20/50 of EOD Chart up (uptrend) :-

Buy or Shortcover: When on 60min tf, Ema 5/8 is up

Sell or Shortsell: When on 60min tf, Ema 5/8 and Ema 13/21 both are down

Regards,

S I D  |

THESE ARE THE GOLDEN RULES OF MY STRATEGY... PLEASE KEEP THEM IN MIND AND FOLLOW THEM EXACTLY AS GIVEN.....

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #80  Posted: Thu Sep 15, 2011 12:36 pm Post subject: Posted: Thu Sep 15, 2011 12:36 pm Post subject: |

|

|

| SID are these rules in addition to what you had given earlier? Can you please write all your rules in the excel file itself as a note so that we have everything in one file right in front of us?

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #81  Posted: Thu Sep 15, 2011 12:47 pm Post subject: Posted: Thu Sep 15, 2011 12:47 pm Post subject: |

|

|

| vinay28 wrote: | | SID are these rules in addition to what you had given earlier? Can you please write all your rules in the excel file itself as a note so that we have everything in one file right in front of us? |

These rules are not in addition but my strategy and excel file is based on these rules only.... I will include these rules along with the new version launch in the future excel file ....

Regards,

S I D

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #82  Posted: Thu Sep 15, 2011 1:02 pm Post subject: Posted: Thu Sep 15, 2011 1:02 pm Post subject: |

|

|

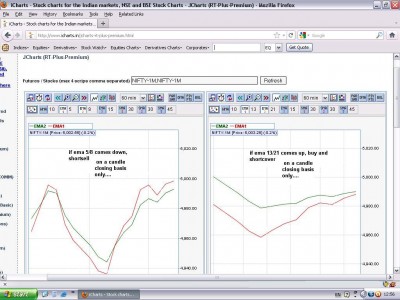

nifty analysis

| Description: |

|

| Filesize: |

127.07 KB |

| Viewed: |

618 Time(s) |

|

Last edited by SID2060 on Thu Sep 15, 2011 1:16 pm; edited 1 time in total |

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #83  Posted: Thu Sep 15, 2011 1:12 pm Post subject: Posted: Thu Sep 15, 2011 1:12 pm Post subject: |

|

|

| dijyya wrote: | | SID2060 wrote: | | dijyya wrote: | | dijyya wrote: | | Infy is up in all three condition....Please confirm it... |

,

Well, Sid Sir, I have taken 60tf in all three parameter, so its looks up....but if taken daily chart in 20/50 EMA, it till down,.... so the Final position for infosys is ......

EMA 20/50 Daily down

EMA 13/21 60TF UP

EMA 5/8 60 TF UP

Please guide what trade should be carried out.... |

DEAR DIJYYA,

I am glad that u are going the right way as now u understand the setup well..... A buy signal came in infy at 2325 level.... Stoploss is when ema 5 goes below ema 8..... I am sorry for the late reply as u might have missed the 5 percent rally in infosys after a buy signal due to nonconformation by me.... Let me tell u that conformation is not required and just follow the result..... Always keep in mind that majority wins everywhere.... If two things giving the same signal then follow that signal only.....

Regards,

S I D  |

Thanks Sid Sir, for your encouragement,

One small query

When Trade or S/L should Applied ? At the time of crossover or end of candle ? |

Dear Dijyya,

Trade or S/L should Apply at the end of candle only.....

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #85  Posted: Thu Sep 15, 2011 2:45 pm Post subject: Posted: Thu Sep 15, 2011 2:45 pm Post subject: |

|

|

| thanks SID. Now that we have the file as well as instructions, we can study and test. Hope all rules are covered

|

|

| Back to top |

|

|

Allwell

White Belt

Joined: 24 Jan 2010

Posts: 183

|

Post: #86  Posted: Thu Sep 15, 2011 3:18 pm Post subject: Posted: Thu Sep 15, 2011 3:18 pm Post subject: |

|

|

| Axis Bank cross-0ver 13-21 EMA.....alreeady cross 5-8 EMA

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #87  Posted: Thu Sep 15, 2011 5:55 pm Post subject: Posted: Thu Sep 15, 2011 5:55 pm Post subject: |

|

|

| dijyya wrote: | | Axis Bank cross-0ver 13-21 EMA.....alreeady cross 5-8 EMA |

GR8 FIND DIJYYA

|

|

| Back to top |

|

|

prbansal

White Belt

Joined: 19 Mar 2009

Posts: 1

|

Post: #88  Posted: Thu Sep 15, 2011 10:27 pm Post subject: How to download the file ? Posted: Thu Sep 15, 2011 10:27 pm Post subject: How to download the file ? |

|

|

When I am trying to download the attachment, it is downloading a .zip and not .xlsx file.

Can you help..how to get the excel file ?

Regards

Pradeep

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #89  Posted: Fri Sep 16, 2011 12:53 am Post subject: Re: How to download the file ? Posted: Fri Sep 16, 2011 12:53 am Post subject: Re: How to download the file ? |

|

|

| prbansal wrote: | When I am trying to download the attachment, it is downloading a .zip and not .xlsx file.

Can you help..how to get the excel file ?

Regards

Pradeep |

Pradeep make sure that u have excel 2007 or later version. Secondly download the file again after login into this website and before opening this file, start excel and than browse this file to open. U might have wrongly set zip application to handle .xlsx extension.

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #90  Posted: Fri Sep 16, 2011 1:01 am Post subject: Stoploss is compulsory! Posted: Fri Sep 16, 2011 1:01 am Post subject: Stoploss is compulsory! |

|

|

Dear Friends,

Plz keep a stoploss of 1 percent whenever u buy or shortsell nifty future. The 1 percent stoploss (price based) or the crossover stoploss ( end of candle based) whichever hits 1st is the stoploss for ur trade.

For example: u have shorted nifty at 5000 level with s/l 5050 when ema 5 goes below ema 8 at 10 am 60min tf candle ending basis... Nw at 11 am (candle end basis), ema 5 crosses above ema 8 and nifty future was at 5027 level... In this case crossover s/l hits 1st so u should shortcover at 5027 level only and not wait for 5050 levels to hit...

U can increase or decrease the 1 percent stoploss as per ur risk appetite but to keep a STOPLOSS is important here. Keep a realistic stoploss, a loss which u can digest...

Regards,

S I D

|

|

| Back to top |

|

|

|