| View previous topic :: View next topic |

| Author |

Greater Fool Zone |

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #16  Posted: Tue Mar 13, 2012 10:00 pm Post subject: Posted: Tue Mar 13, 2012 10:00 pm Post subject: |

|

|

| sherbaaz wrote: | Hi RVG,

Your idea of using elder's channel with SSPS is really good. I have chked at couple of places on chart and it works well in tightening stop loss or taking profits.

|

Its an effective Contra strategy that works on principle of reverse to mean and can be used along with any other system.

Since GFZ occurs rarely, its best to use it when you can

|

|

| Back to top |

|

|

|

|

|

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #17  Posted: Wed Mar 14, 2012 4:25 pm Post subject: GFZ Posted: Wed Mar 14, 2012 4:25 pm Post subject: GFZ |

|

|

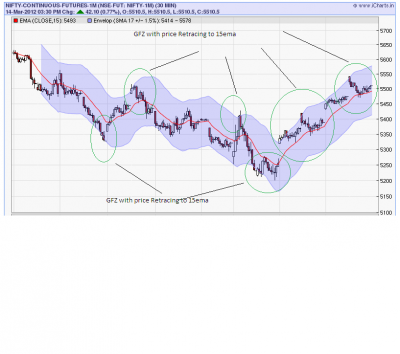

Frequency of GFZ has increased ; Don't know whether it is coincidental or part of the system.

| Description: |

|

| Filesize: |

50.66 KB |

| Viewed: |

676 Time(s) |

|

|

|

| Back to top |

|

|

bharatpatel

White Belt

Joined: 26 Oct 2011

Posts: 401

|

Post: #18  Posted: Wed Mar 14, 2012 8:38 pm Post subject: hi Posted: Wed Mar 14, 2012 8:38 pm Post subject: hi |

|

|

the name of the thread should be RVG's WISE TRADING SET UP.

RVG ,

thanks for sharing all the great trading plans. new traders like me can have the best guidence through yr posts.

pls keep it up and keep posting.

Regards

Bharat Patel,

Ahmedabad.

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #19  Posted: Thu Mar 15, 2012 9:09 am Post subject: Posted: Thu Mar 15, 2012 9:09 am Post subject: |

|

|

Hi RVG

How about 20 EMA with 1.618% setup for envelope?

|

|

| Back to top |

|

|

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #20  Posted: Thu Mar 15, 2012 9:13 am Post subject: Posted: Thu Mar 15, 2012 9:13 am Post subject: |

|

|

| rameshraja wrote: | Hi RVG

How about 20 EMA with 1.618% setup for envelope? |

What timeframe would you recommend this setting for ?

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #21  Posted: Thu Mar 15, 2012 9:15 am Post subject: Posted: Thu Mar 15, 2012 9:15 am Post subject: |

|

|

| 30 Minutes time fame

|

|

| Back to top |

|

|

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #22  Posted: Thu Mar 15, 2012 9:20 am Post subject: Posted: Thu Mar 15, 2012 9:20 am Post subject: |

|

|

| rameshraja wrote: | | 30 Minutes time fame |

Thanks.. will test it

|

|

| Back to top |

|

|

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #23  Posted: Tue Mar 20, 2012 9:12 am Post subject: Re: Greater Fool Zone Posted: Tue Mar 20, 2012 9:12 am Post subject: Re: Greater Fool Zone |

|

|

| rvg wrote: | NF is known to retrace to 15ema on the 30 min tf after reentering the envelope.

On strong trends there maybe a time correction where 15 ema catches up with price.

Thanks to Alchemist for this study |

For those who feel GFZ has failed yesterday.. Pls re-read the statement above.

On Strong trends, 15EMA catches up with price with time correction. Today, we may see that happen. As this is a Contra trade strategy, our position size has to be managed accordingly

All the best

|

|

| Back to top |

|

|

Arjun20

Yellow Belt

Joined: 23 Jun 2011

Posts: 945

|

Post: #24  Posted: Tue Mar 20, 2012 9:36 am Post subject: Posted: Tue Mar 20, 2012 9:36 am Post subject: |

|

|

RVG Sir,

price touched EMA15

|

|

| Back to top |

|

|

shivaaji143

White Belt

Joined: 16 Feb 2012

Posts: 1

|

Post: #25  Posted: Fri Mar 23, 2012 10:15 pm Post subject: gfz Posted: Fri Mar 23, 2012 10:15 pm Post subject: gfz |

|

|

| can u plz tell me how to set indiacators of gfz envelop parameterssma17 +-1.5%---as it was prefixed and not able to change the parameters

|

|

| Back to top |

|

|

prabit

White Belt

Joined: 02 Jul 2009

Posts: 133

|

Post: #26  Posted: Tue Jun 19, 2012 10:48 am Post subject: Re: gfz Posted: Tue Jun 19, 2012 10:48 am Post subject: Re: gfz |

|

|

| shivaaji143 wrote: | | can u plz tell me how to set indiacators of gfz envelop parameterssma17 +-1.5%---as it was prefixed and not able to change the parameters |

open live chart premium,click indicator,under upper indicator open envelop, next column write 17,0.015

|

|

| Back to top |

|

|

prst

White Belt

Joined: 24 Sep 2011

Posts: 87

|

Post: #27  Posted: Tue Jun 19, 2012 11:17 am Post subject: Posted: Tue Jun 19, 2012 11:17 am Post subject: |

|

|

have a query regd gfz buying.

if price goes against us, should we buy more and avg, till it hits the 15 ema?

|

|

| Back to top |

|

|

opportunist

White Belt

Joined: 27 Apr 2010

Posts: 356

|

Post: #28  Posted: Thu Jun 28, 2012 11:04 am Post subject: Addition to GFZ method Posted: Thu Jun 28, 2012 11:04 am Post subject: Addition to GFZ method |

|

|

Dear all,

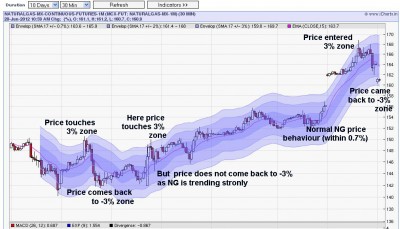

By using 3 envelopes simultaneously instead of one (of say 1.5%) the accuracy of projection increases manifold. I have used 3 envelopes for attached chart on NG 0.7%,2%,3%. if price goes to +3% then it MUST come back to -3% that is the theory. For NG when it went to 169 on 27th June it had to come back to 161 today. I had successfully predicted a gapdown at 161 on 27th June at around closing time on 27th June based on this theory. (Refer to SB archives)

Also GFZ may not work accordingly in strong trends. In a bull trend for example in the attached chart when price rises to 2% zone it may come to only -0.7% before rebounding.

Also each time we need to fine tune for each scrip.

Regards,

Opportunist

| Description: |

|

| Filesize: |

304.51 KB |

| Viewed: |

568 Time(s) |

|

|

|

| Back to top |

|

|

amitsaraf31

White Belt

Joined: 06 Jun 2011

Posts: 3

|

Post: #29  Posted: Thu Jun 28, 2012 11:09 am Post subject: Re: Addition to GFZ method Posted: Thu Jun 28, 2012 11:09 am Post subject: Re: Addition to GFZ method |

|

|

Sahi hai bhai lage raho

All the best to you

| opportunist wrote: | Dear all,

By using 3 envelopes simultaneously instead of one (of say 1.5%) the accuracy of projection increases manifold. I have used 3 envelopes for attached chart on NG 0.7%,2%,3%. if price goes to +3% then it MUST come back to -3% that is the theory. For NG when it went to 169 on 27th June it had to come back to 161 today. I had successfully predicted a gapdown at 161 on 27th June at around closing time on 27th June based on this theory. (Refer to SB archives)

Also GFZ may not work accordingly in strong trends. In a bull trend for example in the attached chart when price rises to 2% zone it may come to only -0.7% before rebounding.

Also each time we need to fine tune for each scrip.

Regards,

Opportunist |

|

|

| Back to top |

|

|

|