| View previous topic :: View next topic |

| Author |

HDFC Bank |

ud1981

White Belt

Joined: 21 May 2014

Posts: 14

|

Post: #1  Posted: Wed Jun 18, 2014 11:21 am Post subject: HDFC Bank Posted: Wed Jun 18, 2014 11:21 am Post subject: HDFC Bank |

|

|

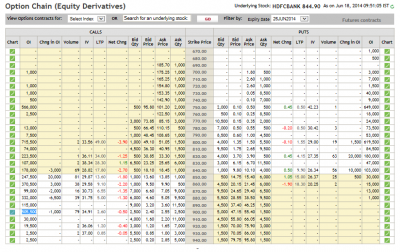

Bought HDFC BANK 860 Call at Rs 8.8. It is trading at Rs 7.

I bought it after looking at the trendline 5DMA & the expansion of Bollinger band that seems to be on the upside. Also, I could see lots of OI builtup at 900 levels, which means this stock should rise in the next 1-2 sessions. Any comments on the buy?

| Description: |

|

| Filesize: |

71.7 KB |

| Viewed: |

554 Time(s) |

|

| Description: |

|

| Filesize: |

113.88 KB |

| Viewed: |

738 Time(s) |

|

|

|

| Back to top |

|

|

|

|  |

venkkatshiv

White Belt

Joined: 16 May 2008

Posts: 90

|

Post: #2  Posted: Thu Jun 19, 2014 1:43 pm Post subject: Re: HDFC Bank Posted: Thu Jun 19, 2014 1:43 pm Post subject: Re: HDFC Bank |

|

|

[quote="ud1981"]Bought HDFC BANK 860 Call at Rs 8.8. It is trading at Rs 7.

SIR , ANY UPDATES IN HDFC BANK 860 CE I TOO HOLD 2 LOTS @ 4.5 PL.REPLY

|

|

| Back to top |

|

|

ud1981

White Belt

Joined: 21 May 2014

Posts: 14

|

Post: #3  Posted: Thu Jun 19, 2014 2:28 pm Post subject: Posted: Thu Jun 19, 2014 2:28 pm Post subject: |

|

|

I sold it at a loss yesterday when Nifty made a dip. I guess you should hold it now as Nifty is holding onto 7500+ levels.

Last edited by ud1981 on Thu Jun 19, 2014 2:43 pm; edited 1 time in total |

|

| Back to top |

|

|

ud1981

White Belt

Joined: 21 May 2014

Posts: 14

|

Post: #4  Posted: Thu Jun 19, 2014 2:38 pm Post subject: Sell HDFC Bank Posted: Thu Jun 19, 2014 2:38 pm Post subject: Sell HDFC Bank |

|

|

HDFC Bank is a clear sell. It could not hold onto the base for the last 5 days which is at 830. Please exit as lower levels may be coming.

I had to exit yesterday, not worth entering in this volatility. Defensive stocks may do better, please look at IT or Pharma.

|

|

| Back to top |

|

|

ud1981

White Belt

Joined: 21 May 2014

Posts: 14

|

Post: #5  Posted: Thu Jun 19, 2014 2:42 pm Post subject: Posted: Thu Jun 19, 2014 2:42 pm Post subject: |

|

|

My comments are based on the attached graphs that I had to analyse.

| Description: |

| Downtrend for the last 2 days |

|

| Filesize: |

79.48 KB |

| Viewed: |

551 Time(s) |

|

| Description: |

|

| Filesize: |

72.74 KB |

| Viewed: |

501 Time(s) |

|

|

|

| Back to top |

|

|

Gemini

White Belt

Joined: 28 Apr 2009

Posts: 166

|

Post: #6  Posted: Thu Jun 19, 2014 6:19 pm Post subject: Posted: Thu Jun 19, 2014 6:19 pm Post subject: |

|

|

One observation: usually, OTM Call ( that is call strike price higher than stock CMP) build-up or OTM Put (that is put strike price lower than stock CMP ) indicates selling of that strike price by the experienced option players who make money by earning on premium that they get by such option sell. (Some people also sell the call to collect "rent" for the stocks they own and sell puts to collect "money" to buy the stock later if the price falls )

For example, the OI build-up that you saw for HDFC Bank 900 strike price indicates that such players sold the 900 call and pocketed the premium. (Please be very careful with such option strategy as there is limited profit and unlimited loss).

Option based strategies are complex and proper study is advised.

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|