| View previous topic :: View next topic |

| Author |

How to change Psycology knowingly for trading |

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #1  Posted: Mon Jun 23, 2014 1:36 pm Post subject: How to change Psycology knowingly for trading Posted: Mon Jun 23, 2014 1:36 pm Post subject: How to change Psycology knowingly for trading |

|

|

Hi all,

Just have discovered few Psycological tools that can help us in following areas:

1. Solving the loss making behaviours.

2. Strengthening the Profit making feelings.

3. Deleting bad emotions from mind to trade better.

Underlying factor in all these exercises is that all the resources are lying with in us. we only need to identify them.

Here is an small example to showcase the exercise. when I enter into the trade and I am making profits my mind says to keep waiting because it seems that the stock has a lot of potential. But as soon I see a bit of a weakness in the stock my mind generates another thought which says exit the trade as soon as possible to freeze the profits.

Since, both the thoughts have been generated by my mind and the purpose of both the thoughts is my benefit. I mould them in a way that both of them start helping me in my trading with the help of these psycological exercises.

Eager to answer related questions. As this thing can revolutionize our trading.

Regards,

Ruchir

|

|

| Back to top |

|

|

|

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #2  Posted: Mon Jun 23, 2014 2:00 pm Post subject: Posted: Mon Jun 23, 2014 2:00 pm Post subject: |

|

|

The whole approach runs around Neuro Linguistic Programming.

When you can make yourself cheer by listening to your fav song and avoid the bad state of mind. you can also do that for trading.

Psycologically proven that if you keep thinking about the mistakes you will keep doing them again and again. while if you realize that mistake and think that what could be done better and even what all good things I did good even in this bad trade thats when the change starts coming in.

Also the name stop loss is a negative term in it self. when you are said not to think of a white elephant. what do you do? you first think of white elephant only. In the same manner you can start using the term just " stop" instead of stop.

Hope its helpful.

Regards

Ruchir

|

|

| Back to top |

|

|

pkholla

Black Belt

Joined: 04 Nov 2010

Posts: 2890

|

Post: #3  Posted: Mon Jun 23, 2014 2:20 pm Post subject: Posted: Mon Jun 23, 2014 2:20 pm Post subject: |

|

|

Ruchir, very interesting. Please keep posting and start giving specifics also so we can learn how to improve our trading behavior. It is a fact that doctors and particularly psychologists do very well in share trading probably because of the dominance of psychology in share trading

Prakash Holla

|

|

| Back to top |

|

|

paa

White Belt

Joined: 28 Sep 2010

Posts: 178

|

Post: #4  Posted: Mon Jun 23, 2014 6:53 pm Post subject: Posted: Mon Jun 23, 2014 6:53 pm Post subject: |

|

|

Ruchir

Please keep posting. I think this treatment is essential for new traders like me! Please keep posting. I think this treatment is essential for new traders like me!

Parmod

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #5  Posted: Mon Jun 23, 2014 7:54 pm Post subject: Some example of psychological challenges that traders face Posted: Mon Jun 23, 2014 7:54 pm Post subject: Some example of psychological challenges that traders face |

|

|

Learning how to trade is just one part of the game. Another much bigger part is psychology. This is why I have been struggling many a times in stock market. Even now many a times those situations come but now I know how to overcome these situations. I have developed a series of psychological exercises over the past 6 months which help me Trade much much better than I use to trade earlier I have been trading for 8 years now.

Examples on kind of cases we can treat with these exercises are :

1. If you are facing problem in persevering your capital

2. If you are facing problems in Putting Stops

3. If you are facing problems making profits

4. If you are facing problem in disciplining yourself to invest in diversifying your portfolio and instead investing higher percentage in one specific stock which increases your portfolio risk

5. Intuition based decisions vs blunt mad decisions to trade

6. If you are facing problem in taking patient decisions Vs while actually taking eagerness based decisions

7. If you are facing any contradicting behaviours in your trading for eg. Exiting the trades early thinking market may turn from here and it turned out to be bigger in profit and then you regret that why you exited and when you hold the position thinking anticipating bigger profits it started shaving your profits and then you exited in loss.

8. If you are not feeling that you are not good enough to make the profits.

9. If you are willing to achieve some financial gaol.

10. If you are facing problems in sticking to your rules.

I will keep posting the Exercises here , but I want you to sincerely do it that is how you will go ahead in your trading journey. And ask the questions, which will help me in understanding the other people’s trading psycology and invent more exercises. You can also share the kind of problem you are facing and I will tell the exercise if already present in my arsenal or will invent it.

Regards,

Ruchir

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #6  Posted: Mon Jun 23, 2014 7:58 pm Post subject: Posted: Mon Jun 23, 2014 7:58 pm Post subject: |

|

|

| pkholla wrote: | Ruchir, very interesting. Please keep posting and start giving specifics also so we can learn how to improve our trading behavior. It is a fact that doctors and particularly psychologists do very well in share trading probably because of the dominance of psychology in share trading

Prakash Holla |

Great analysis Prakash, this happens coz these people know how our mind functions and once you know how it functions you can also play around those specifics.

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #7  Posted: Mon Jun 23, 2014 8:01 pm Post subject: Posted: Mon Jun 23, 2014 8:01 pm Post subject: |

|

|

| paa wrote: | Ruchir

Please keep posting. I think this treatment is essential for new traders like me! Please keep posting. I think this treatment is essential for new traders like me!

Parmod |

Sure Sir!

This is also essential so that the traders keep standing tenaciously in the market and instead trust their study, analysis and instead of quitting just coz of few losing trades.

|

|

| Back to top |

|

|

lakshay

White Belt

Joined: 04 Oct 2011

Posts: 39

|

Post: #8  Posted: Mon Jun 23, 2014 8:35 pm Post subject: Posted: Mon Jun 23, 2014 8:35 pm Post subject: |

|

|

1) get your technicals right.

2) problem comes when system is not followed . to layman these mistakes sound stupid, they say when you know mistakes why do you make them .

i told such mistakes to my father , and after few time stop making them since i was afraid of embarrasment of listening "you commited same mistake again".

but i didn't tell him the technincals , because then he would have also become intelligent trader commiting stupid mistakes

i was just loyal to tell him when i made such mistake.

|

|

| Back to top |

|

|

meherp

White Belt

Joined: 26 Feb 2012

Posts: 67

|

Post: #9  Posted: Tue Jun 24, 2014 10:21 am Post subject: Posted: Tue Jun 24, 2014 10:21 am Post subject: |

|

|

This is what I would suggest.

- Make you trading plan fixed. I made my chart setup and I know when to buy/sell, what is my SL Tgt etc.

- During trading hours I only watch the chart and when its gave any signal I put buy/sell order or modify SL etc.

- Never see the M2M figure. Its give me a lot of tension wheather I am in profit or loss. So I simply follow the technical.

- Please note I am an intraday trader in crude only.

Thanks

Pradeep

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #10  Posted: Tue Jun 24, 2014 11:25 am Post subject: Example of preserving capital n making profits Posted: Tue Jun 24, 2014 11:25 am Post subject: Example of preserving capital n making profits |

|

|

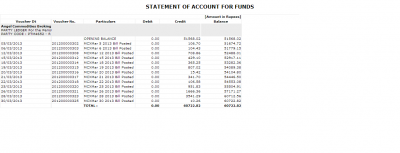

Hi all just sharing a statement of account of one of my friend's. I have made it desktop background which keeps me motivated to preserve capital and earning the profits at the same time.

This image made me fell and think consistently for profits as I have established it in my long term memory. Putting the stops, minimizing the risk, is some thing that automatically started flashing in my mind.

We must surround ourselves with the images like this which we want to actually see. So, after looking this statement every day before starting my trading I was neurologically training my mind to just trade with profits. How to make profits was another thing which my mind was automatically thinking of.

Regards,

Ruchir

Hope this method may work for some of you as well.

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #11  Posted: Tue Jun 24, 2014 11:31 am Post subject: Re: Example of preserving capital n making profits Posted: Tue Jun 24, 2014 11:31 am Post subject: Re: Example of preserving capital n making profits |

|

|

| Ruchirgupta2000 wrote: | Hi all just sharing a statement of account of one of my friend's. I have made it desktop background which keeps me motivated to preserve capital and earning the profits at the same time.

This image made me fell and think consistently for profits as I have established it in my long term memory. Putting the stops, minimizing the risk, is some thing that automatically started flashing in my mind.

We must surround ourselves with the images like this which we want to actually see. So, after looking this statement every day before starting my trading I was neurologically training my mind to just trade with profits. How to make profits was another thing which my mind was automatically thinking of.

Regards,

Ruchir

Hope this method may work for some of you as well. |

| Description: |

|

| Filesize: |

35.22 KB |

| Viewed: |

880 Time(s) |

|

|

|

| Back to top |

|

|

yoginishreyas

White Belt

Joined: 03 Dec 2012

Posts: 80

|

Post: #12  Posted: Tue Jun 24, 2014 12:07 pm Post subject: Posted: Tue Jun 24, 2014 12:07 pm Post subject: |

|

|

Plan the trade and trade the plan, It is easy to say but equally difficult to follow.

I plan my trade and backtest that on historical charts also but when it comes to second phase of trade the plan, I confuse my self in M2M statements.

I appreciate your efforts to start this new thread for beginners like me.

Shreyas

|

|

| Back to top |

|

|

prabit

White Belt

Joined: 02 Jul 2009

Posts: 133

|

Post: #13  Posted: Tue Jun 24, 2014 4:29 pm Post subject: Posted: Tue Jun 24, 2014 4:29 pm Post subject: |

|

|

| Thanks Ruchir for starting the thread. I am sure this thread will help many members. I am struggling to master the psychology. I believe that successful trading is 90% mind and 10% setup. With mastery of mind, money can be made even with simple set up. Personally I prefer KISS, because there mind does not have much role. But there again mind will come and play mischief.

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #14  Posted: Thu Jun 26, 2014 12:05 pm Post subject: Posted: Thu Jun 26, 2014 12:05 pm Post subject: |

|

|

Guys I never thought of that I would be starting this thread.

Though I did exercises on myself very easily because I knew the basic of psychology researching for many years and received neurological training this year.

I am finding a bit difficult to write those exercises as of now, since I see that you guys also need to have some extent of basic knowledge about how our brain functions and psychological aspects of the trading.

I am doing brain storming to find out how can I present the exercises in a structured manner so that you all understand step by step. For this reason

I have searched for few basic videos on youtube for you all to view before I start with the exercises and I am sharing these youtube video links which you guys can start viewing and get the basic knowledge of what I am referring to.

Trading the Markets with NLP LESSON 1 Introduction https://www.youtube.com/watch?v=98RMCqFaync

Trading the Markets with NLP LESSON 2 Maps and Anchors

https://www.youtube.com/watch?v=ZpETQV5hsCM

NLP for Traders - Practical Methods for Enhanced Trading Performance

https://www.youtube.com/watch?v=FLcSs3qxXcA

L2ST NLP for Traders Part 1

https://www.youtube.com/watch?v=wM7rViUCDX0

Meanwhile I am once again going for my neurological training and will return with a structure for training.

Thanks for all the appreciation.

Regards,

Ruchir

|

|

| Back to top |

|

|

taruj

White Belt

Joined: 20 Apr 2011

Posts: 260

|

Post: #15  Posted: Fri Jun 27, 2014 10:25 pm Post subject: Posted: Fri Jun 27, 2014 10:25 pm Post subject: |

|

|

| good stuff. pls continue!

|

|

| Back to top |

|

|

|