|

|

| View previous topic :: View next topic |

| Author |

How to gain confidence ? |

akpanicker

White Belt

Joined: 27 Dec 2008

Posts: 11

|

Post: #1  Posted: Thu Apr 30, 2009 12:32 pm Post subject: How to gain confidence ? Posted: Thu Apr 30, 2009 12:32 pm Post subject: How to gain confidence ? |

|

|

| You know everything about markets, trading stocks or derivatives , you have made solid trading plans based on the best strategies, you have all the right tools like realtime data , direct access to trade online etc and you have been trading for quite some time too – still , do you face difficulty in pulling the trigger , have second thoughts while you see the right set ups or if you manage to enter the trade you have difficulty in staying the course ie you are so much on the edge the slightest wiggle in the market makes you quit the position with a small profit , but that would have been a phenomenal winner if only you held on for some more time ? Well you are not alone – these are classic emotions that almost all the traders go through – now if you think about it , what is happening is that this type of behaviour indicates a lack of confidence – confidence in your system /yourself. The only way you can acquire confidence is by having the competence in the task at hand – remember the time you were learning to ride a bike / drive a car – even though you got your license and you were doing it all alone for some time along the way your level competence crossed that invisible barrier to reach the unconscious competence where you could perform the task without actually thinking through the steps – that is when you really became a confident driver. The same principle applies here once you acquire that level of unconscious competence in trading you become a confident trader. Now how do you acquire such a level of competence – the answer is – by repetition. Yes it is a bit of a catch 22 – like you do not enter water unless you know swimming , but you cannot learn swimming unless you enter the water ! Here the key is to keep your position size so small that the loss incurred would not affect your trading capital in a big way – keep on doing a number of trades as per your system and as time goes by you would automatically acquire the competence and confidence and the trade size would keep getting larger accordingly !

|

|

| Back to top |

|

|

|

|  |

RKM

White Belt

Joined: 06 Apr 2009

Posts: 137

|

Post: #2  Posted: Thu Apr 30, 2009 6:47 pm Post subject: Posted: Thu Apr 30, 2009 6:47 pm Post subject: |

|

|

Hi!

You have posted a very useful comment on what the novice trader experiences while trading, and also offered a very encouraging and hopefully effective solution to help to keep him going and give him the courage to stick to his trading system, come what may.

Many of us may be still experiencing the problems and fears that you have spoken about even though we have read and been taught that while trading it is we who must be in control of our emotions and not the other way round, but human nature is hard to beat.

Great work! Keep it up.

Cheers,

Makhijani

|

|

| Back to top |

|

|

Garsit0Pfaff

White Belt

Joined: 20 Aug 2009

Posts: 7

|

Post: #3  Posted: Thu Aug 27, 2009 6:28 pm Post subject: Posted: Thu Aug 27, 2009 6:28 pm Post subject: |

|

|

| I've come to think that confidence is an in-born quality. You either have it or you don't. Some people, who are very successful, still are not confident while others who lose, are sure that one day they'll be experts and they continue to learn to trade.

|

|

| Back to top |

|

|

akpanicker

White Belt

Joined: 27 Dec 2008

Posts: 11

|

Post: #4  Posted: Tue Nov 03, 2009 8:31 pm Post subject: Posted: Tue Nov 03, 2009 8:31 pm Post subject: |

|

|

The question - whether confidence ( or for that matter the ability to trade successfully itself ) is something innate or something that can be cultivated - is not a yes or no question in my opinion. As I see it, if by success you mean achieving world class results, yes it would take some innate ablities say for instance if you aspire to be a formula one driver , there are certain qualities that you must be born with. However if you define success as achieving a level of proficiency equivalent to say becoming a taxidriver I suppose everyone ( with very few exceptions) would be able to achieve that with training and dedication . The earlier post referred to confidence to execute a trade – for which one must develop the competence through practice/iteration..

What I understand form your reference to successful traders being not confident while learners are full of it – you are referring to the confidence about the outcome of a trade. True – successful professional traders are well aware of the probabilistic nature of trading edges and as such while they are very confident about the success of their system over a large sample size they would be very clear that one can never be confident about the outcome of any particular trade - amateurs would generally not enter a trade unless they are confident about the outcome of the trade !

|

|

| Back to top |

|

|

athani

White Belt

Joined: 19 Jun 2009

Posts: 6

|

Post: #5  Posted: Wed Nov 04, 2009 7:41 am Post subject: Re: How to gain confidence ? Posted: Wed Nov 04, 2009 7:41 am Post subject: Re: How to gain confidence ? |

|

|

Hi akpanicker,

You hit the nail on the head with your post. This is a very real problemm that I'm facing.

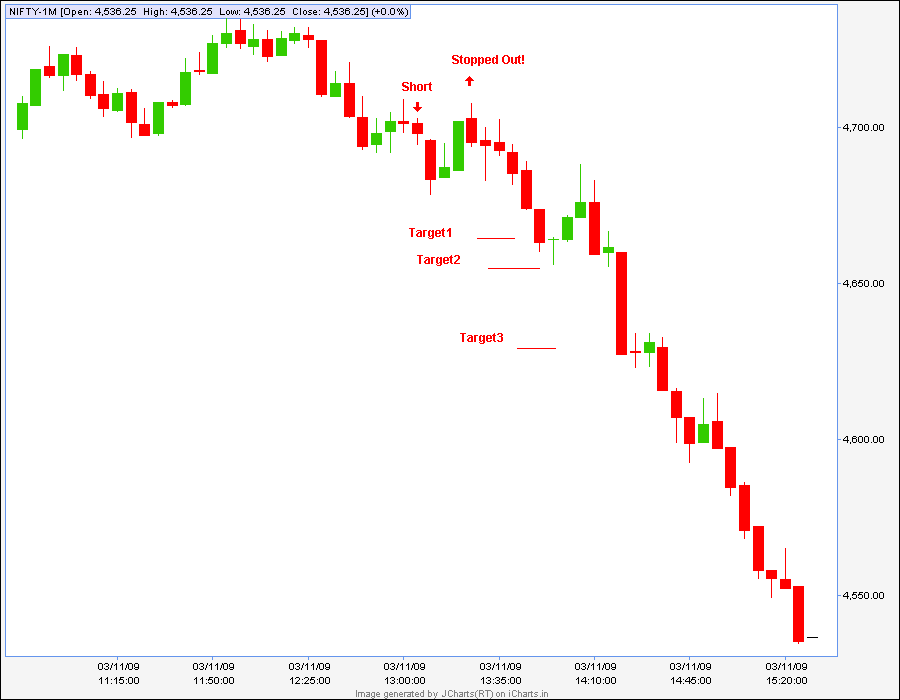

I'm feeling confused about how to manage an ongoing trade. If your Nifty position is in a 20 point profit (Target 36 points), should you move your SL to breakeven or should the SL be based on technicals (like recent support/resistance)

Please see the enclosed chart dated 3rd november of NF 5-min.

Short position entered at 13:05 at 4698 was in profit at 4678 after 2 candles, so moved SL to 4700 at 13:15. Stopped out at 13:25 and NF went on to targets.

What strategy would you suggest to avoid this kind of situation, which has now started repeating again and again with me ?

Regards,

Athani

| akpanicker wrote: | | You know everything about markets, trading stocks or derivatives , you have made solid trading plans based on the best strategies, you have all the right tools like realtime data , direct access to trade online etc and you have been trading for quite some time too – still , do you face difficulty in pulling the trigger , have second thoughts while you see the right set ups or if you manage to enter the trade you have difficulty in staying the course ie you are so much on the edge the slightest wiggle in the market makes you quit the position with a small profit , but that would have been a phenomenal winner if only you held on for some more time ? Well you are not alone – these are classic emotions that almost all the traders go through – now if you think about it , what is happening is that this type of behaviour indicates a lack of confidence – confidence in your system /yourself. The only way you can acquire confidence is by having the competence in the task at hand – remember the time you were learning to ride a bike / drive a car – even though you got your license and you were doing it all alone for some time along the way your level competence crossed that invisible barrier to reach the unconscious competence where you could perform the task without actually thinking through the steps – that is when you really became a confident driver. The same principle applies here once you acquire that level of unconscious competence in trading you become a confident trader. Now how do you acquire such a level of competence – the answer is – by repetition. Yes it is a bit of a catch 22 – like you do not enter water unless you know swimming , but you cannot learn swimming unless you enter the water ! Here the key is to keep your position size so small that the loss incurred would not affect your trading capital in a big way – keep on doing a number of trades as per your system and as time goes by you would automatically acquire the competence and confidence and the trade size would keep getting larger accordingly ! |

| Description: |

|

| Filesize: |

7.83 KB |

| Viewed: |

2046 Time(s) |

|

|

|

| Back to top |

|

|

akpanicker

White Belt

Joined: 27 Dec 2008

Posts: 11

|

Post: #6  Posted: Wed Nov 04, 2009 8:06 am Post subject: Re: How to gain confidence ? Posted: Wed Nov 04, 2009 8:06 am Post subject: Re: How to gain confidence ? |

|

|

| This question ought to be posted in the trading strategy section of the forum. Though I would not like to digress from the theme of this thread , let me give you a quick answer - you need to stick to the original stoploss till you reach the first target and take some partial profits - before you move the stop. Hope this helps.

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|