| View previous topic :: View next topic |

| Author |

how to make 60 crores in 5 years with 20000 investment |

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #196  Posted: Wed Jul 13, 2011 9:05 pm Post subject: Posted: Wed Jul 13, 2011 9:05 pm Post subject: |

|

|

Chirag

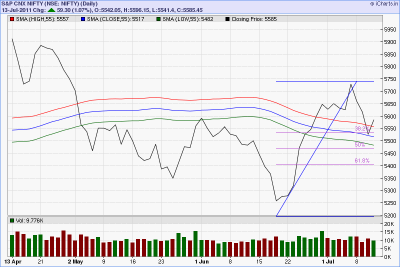

See attached chart. As per your 55 sma theory, if nifty closes above about 5570 tomorrow, it comes in a buy but it is not so as per this 3-34 ema thory of rahul.

I personally feel that nifty has bounced off 38.2% line and it will now go to 5700.......to begin with

| Description: |

|

| Filesize: |

48.66 KB |

| Viewed: |

472 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #197  Posted: Thu Jul 14, 2011 9:12 am Post subject: Posted: Thu Jul 14, 2011 9:12 am Post subject: |

|

|

| sorry 5520 and not 5570

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #198  Posted: Thu Jul 14, 2011 12:38 pm Post subject: Posted: Thu Jul 14, 2011 12:38 pm Post subject: |

|

|

| NF30 min, 3e still below 34e

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #199  Posted: Thu Jul 14, 2011 1:19 pm Post subject: Posted: Thu Jul 14, 2011 1:19 pm Post subject: |

|

|

NF 30min

3e>34e at 13:00 bar, level; 5627.

previous short trade was iniitiated at 5650

Last edited by vinst on Fri Jul 15, 2011 10:43 am; edited 1 time in total |

|

| Back to top |

|

|

adsingh101

White Belt

Joined: 09 Nov 2010

Posts: 242

|

Post: #200  Posted: Thu Jul 14, 2011 3:02 pm Post subject: Posted: Thu Jul 14, 2011 3:02 pm Post subject: |

|

|

| sambhaji_t wrote: | PNB-1M READY FOR 3/34 30MIN SETUP

WATCHOUT  |

Sambhaji thanks for drawing attention on PNB i made 30 points today in PNB Future.

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #201  Posted: Thu Jul 14, 2011 6:39 pm Post subject: Recognising stocks with possible trend Posted: Thu Jul 14, 2011 6:39 pm Post subject: Recognising stocks with possible trend |

|

|

Dear Rahul,

I have back tested your 3 EMA 34 EMA cross over strategy on EOD basis. It is making wonders with trending stocks and it is capturing even some small moves. The whipsaws are minimal, but the sucess key lies in identifying some stock which have a bright prospectus of trending either up/down.I chartians can help each other in identifying such stocks, other wise if we apply this method on some rangebound stock we may get punished with series of whipsaws.

To start with I found IOC as a possible entry. Reason - It is india's no 1 company in the list of 500 fortune company's of the world. I think there are only a few other companys from India in this list.It is a Leader in OMC's. The Indian govt started deregularisation of oil subsidies , sooner or later it has to be in uptrend. At the time of recent price hike from indian govt it gave a buy signal with 3 ema crossing 34 ema from below .It is still hovering at the same range ,therefore we can long this stock and continue the course with this scrip.

I invite all I chartians to post there findings and views at a regular intervels to help each other.

Especially I request Mr Rahulshrma.

Thanks and regards,

RK

| Rahulsharmaat wrote: | Point No 4 is

i follow 3 EMA--34 EMA cross over in 30min TF-- to buy n sell-- Nifty as well as Stock futures.

Point No 5 is--

Its a templete Fxtradepro-- which is a histogram--green candle is buy and red candle is short-- This is just below the chart you watch

10 day Trading\\

Its silver-- note high and low made between 12--1 pm--

Buy above high--Stop loss low-- book in 150 points

Short below low-- Stop loss High-- book in 150 points |

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #202  Posted: Thu Jul 14, 2011 8:13 pm Post subject: Posted: Thu Jul 14, 2011 8:13 pm Post subject: |

|

|

One of the large cap stocks to watch is SBI. Here are a few midcap/smallcap stocks, which need to be studied

Glenmark, JB Chem & pharma, Petronet, Lakshmi Vilas Bank, SPARC, Neha Intnl, Kavveri Tele, and BEML. Careful of low volumes on some days.

|

|

| Back to top |

|

|

anantha

White Belt

Joined: 18 Feb 2011

Posts: 96

|

Post: #203  Posted: Thu Jul 14, 2011 8:33 pm Post subject: Posted: Thu Jul 14, 2011 8:33 pm Post subject: |

|

|

| in large cap stocks 3/8/34 emas are good one. but in small and low volume stocks 8/34/55 ema for short to long term. its also use in futures.

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #204  Posted: Thu Jul 14, 2011 8:49 pm Post subject: Posted: Thu Jul 14, 2011 8:49 pm Post subject: |

|

|

| Thanks

|

|

| Back to top |

|

|

amitsaraf21

White Belt

Joined: 20 Feb 2009

Posts: 76

|

Post: #205  Posted: Fri Jul 15, 2011 10:08 am Post subject: Re: Recognising stocks with possible trend Posted: Fri Jul 15, 2011 10:08 am Post subject: Re: Recognising stocks with possible trend |

|

|

| rk_a2003 wrote: | Dear Rahul,

I have back tested your 3 EMA 34 EMA cross over strategy on EOD basis. It is making wonders with trending stocks and it is capturing even some small moves. The whipsaws are minimal, but the sucess key lies in identifying some stock which have a bright prospectus of trending either up/down.I chartians can help each other in identifying such stocks, other wise if we apply this method on some rangebound stock we may get punished with series of whipsaws.

To start with I found IOC as a possible entry. Reason - It is india's no 1 company in the list of 500 fortune company's of the world. I think there are only a few other companys from India in this list.It is a Leader in OMC's. The Indian govt started deregularisation of oil subsidies , sooner or later it has to be in uptrend. At the time of recent price hike from indian govt it gave a buy signal with 3 ema crossing 34 ema from below .It is still hovering at the same range ,therefore we can long this stock and continue the course with this scrip.

I invite all I chartians to post there findings and views at a regular intervels to help each other.

Especially I request Mr Rahulshrma.

Thanks and regards,

RK

| Rahulsharmaat wrote: | Point No 4 is

i follow 3 EMA--34 EMA cross over in 30min TF-- to buy n sell-- Nifty as well as Stock futures.

Point No 5 is--

Its a templete Fxtradepro-- which is a histogram--green candle is buy and red candle is short-- This is just below the chart you watch

10 day Trading\\

Its silver-- note high and low made between 12--1 pm--

Buy above high--Stop loss low-- book in 150 points

Short below low-- Stop loss High-- book in 150 points |

|

How do we know in advance this stock will trend/move in one particular direction.

Dont expect too much from a simple cross over, there are millions out there who trade cross overs.

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #206  Posted: Fri Jul 15, 2011 10:40 am Post subject: Posted: Fri Jul 15, 2011 10:40 am Post subject: |

|

|

| vinst wrote: | NF 30min

3e>34e at 13:00 bar |

NF 30min

3e < 34e at 10:30 bar, level 5572

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #207  Posted: Fri Jul 15, 2011 12:14 pm Post subject: Posted: Fri Jul 15, 2011 12:14 pm Post subject: |

|

|

| Vinst, that means it's a buy?

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #208  Posted: Fri Jul 15, 2011 12:18 pm Post subject: Posted: Fri Jul 15, 2011 12:18 pm Post subject: |

|

|

| vinay28 wrote: | | Vinst, that means it's a buy? |

NF 30min

3e < 34e at 10:30 bar, level 5572 means 3e is lesser than 34e. it is sell.

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #209  Posted: Fri Jul 15, 2011 12:32 pm Post subject: Posted: Fri Jul 15, 2011 12:32 pm Post subject: |

|

|

| Now I am confused. I thought previously it became a sell at 5690 when 3 crossed above 34 from below?

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #210  Posted: Fri Jul 15, 2011 12:46 pm Post subject: Posted: Fri Jul 15, 2011 12:46 pm Post subject: |

|

|

| vinay28 wrote: | | Now I am confused. I thought previously it became a sell at 5690 when 3 crossed above 34 from below? |

how can something become a sell when short term ema crosses above longer term ema?

|

|

| Back to top |

|

|

|