| View previous topic :: View next topic |

| Author |

how to make 60 crores in 5 years with 20000 investment |

greatshiva

White Belt

Joined: 15 Dec 2009

Posts: 16

|

Post: #31  Posted: Sat Jan 09, 2010 3:54 pm Post subject: Posted: Sat Jan 09, 2010 3:54 pm Post subject: |

|

|

| vijayakannan wrote: | hi guys

When CMP is crossing 34 ema from below, we go long. and we exit the long position when it is crossing 8ema from above.

and same way we short when cmp is cutting 34 ema from above and we square off when cmp is crossing 8ema from below.

|

Vijaykannan,

Thanks.

Last edited by greatshiva on Sat Jan 09, 2010 4:20 pm; edited 1 time in total |

|

| Back to top |

|

|

|

|

|

sandew

White Belt

Joined: 02 Feb 2009

Posts: 174

|

Post: #32  Posted: Sat Jan 09, 2010 4:01 pm Post subject: Posted: Sat Jan 09, 2010 4:01 pm Post subject: |

|

|

May i join the "Great Indian Market-Crossover Debate".

We all know the power of EMA crossover on higher time frames - daily and above;and the slant of the EMA. The key is discovering what combination of EMA works best in our given NSE set up.

Pick up any USA technical analysis book, go to any usa website, they all swear by 20 / 50 crossover. Singapore / Australia writer have their own set ups. Commodity and Exchange pairs their own..

Here is our Mr. Newton who tells us 'why and when' Apple is falling and (rising) with 8 / 34 crossover. Back Test it.

I tested 8/34 set up , daily time frame, on all my favourite stocks. It works miracles. It works on Nifty futures too.

Minor tweeting whether to enter at 1520 hrs or at 0900 hours , how much and where or whether at all there be a SL, when to flip and go reverse - are all function of your risk profile and capital disposal for MtoM. Few points here and there do not matter in the larger frame.

For intraday huge swing protection in emergency situations, I am currently trying to see whether and how we can supplement with 60 minute time frame (which happens once in 2 months / quarter).

On the whole, I am a convert to 8 / 34 EOD EMA. Thank You.

|

|

| Back to top |

|

|

sandy975

White Belt

Joined: 22 Jul 2009

Posts: 9

|

Post: #33  Posted: Sat Jan 09, 2010 5:07 pm Post subject: Since how long have you been trading,are you close to 25 cr? Posted: Sat Jan 09, 2010 5:07 pm Post subject: Since how long have you been trading,are you close to 25 cr? |

|

|

| QuickGMurugun wrote: | Shiva

Lemme explain it to you again....

this is a system which has no targets....it is a trading system which helps you be in the right direction of the market most of the times.

I am a supporter of EMA crossover strategy but the EMAs that I use to do the trades are different and the method is also different. So I cant comment on where to book profits.

Lemme tell you as per my larger TF system...

Short at 5042 on Dec 16 covered at 5145 (-103 pts) & reversed at 5145 (buy on 23rd dec) and continuing to hold the positions. These levels are Nifty Spot levels

Regards

QGM....

Note: When I back tested my system basis EMA crossover I got only Rs.25 crores for 20k investment in 5 years |

|

|

| Back to top |

|

|

pipstocks

White Belt

Joined: 02 Jan 2009

Posts: 29

|

Post: #34  Posted: Sat Jan 09, 2010 6:49 pm Post subject: Posted: Sat Jan 09, 2010 6:49 pm Post subject: |

|

|

Hello guys. NICE THREAD. EMA CROSSOVER.

One can adopt following system based on EMA crossover :::

Entry based on 5/34 EMA crossover on eod. Profit booking can be done when hourly 5/34 EMA crossover give opposite signal.

If you look at jan'08 fall on 21 & 22 jan.2008.; actual eod bearish crossover was on 17 jan.2008 but the intraday trend was bearish from 9 jan 2008 based on hourly 5/34 EMA crossover.

One can back test this system from july 2008 to dec.2009 based on intraday historical charts.

|

|

| Back to top |

|

|

jimmie

Expert

Joined: 13 Aug 2007

Posts: 357

|

Post: #35  Posted: Sat Jan 09, 2010 7:19 pm Post subject: Nice Thread Posted: Sat Jan 09, 2010 7:19 pm Post subject: Nice Thread |

|

|

Finally someone has talked about growth using simple techniques.. Yes everyone should concentrate on growth terms than levels... whatever method he uses for that.. whether be it EMA or anything else, he should have a compunding target in mind, begining with the least possible capital, i suggest betweeb 20-50K ...

though i am not much sure about 60 crores.. not even about 1 crore.. but yes one can target 100 times return over a period of time starting with 20K and reaching 2000K.. Even then its not a bad return.. With bigger sums, above 20 lots of NF.. the trader will need great mental strenght.. so wont bet on anything larger than 20 lots...

Wish u all a Happy Growing Capital...

|

|

| Back to top |

|

|

vijayakannan

White Belt

Joined: 10 Aug 2009

Posts: 15

|

Post: #36  Posted: Sun Jan 10, 2010 1:24 pm Post subject: Posted: Sun Jan 10, 2010 1:24 pm Post subject: |

|

|

greatshiva

once you finalised 5125 (which is 8ema) thats all. we are not going to check ema again and again for that day. thats the exit point. say, nifty is reaching 5125 at 2pm on monday. at that time 8ema will be certainly different. but we are not going to see that at all. 5125 once it is fixed in our mind (of course in your trading log) thats all. dont even think about changing that (as per this strategy). hope i clarified your doubts

another one point here is, with allocating 30000 in trading a/c, and you are starting with one mini nifty position (i hope the current margin requirement is less than 12000 as of now) 18000 is more than enough to cover all your MTM losses upto 900 points loss (20*900=18000).

when the capital reaches higher limits (say 1 crore) we are considering number of lots allocating 20% towards margin. hence always there is enough money to cover mtm losses.

moreover as veterans like Jimmie pointed out in this thread, this strategy is about creating wealth by compounding effect. hence reaching 20 or 30 lacs in some time with an investment of 30000 itself is something great(ok, i believe). but also remember, if reaching 20 lacs with 20000 investment is possible, why not 60 crores with 20 lacs(becos you are going to have 20lacs at that time in your a/c)

|

|

| Back to top |

|

|

caprimannu

White Belt

Joined: 13 Apr 2009

Posts: 5

|

Post: #37  Posted: Mon Jan 11, 2010 4:45 pm Post subject: Need a little more info Posted: Mon Jan 11, 2010 4:45 pm Post subject: Need a little more info |

|

|

Hey Vijay...

Good to see that you shared a strategy that aims to make people rich (in due course) but it does have many issues...

If one has to go with the illustration you posted in your 1st post (the .pdf) file... one can't link it with what you say.

A. You talk about going long and short.. but your illustration showed only the long positions..!!

B. You Did Not mention any dates on which you intend to take those positions... So people here are left guessing when to enter and when to exit.

C. I am not making these statements out of no where.. I did read all the discussions and thought of applying it on the historical data... and it DOES NOT give the same results as claimed by you..!!

So, if you have some time... or anyone who has really understood this strategy... can illustrate me (with dates) when to enter and when to exit (and also covering cases of going Long and Short) then it will greatly help..!!

Lets do it only for one year... that should suffice..!!

- Trade Safe.

|

|

| Back to top |

|

|

mbn

White Belt

Joined: 29 Nov 2007

Posts: 27

|

Post: #38  Posted: Mon Jan 11, 2010 6:36 pm Post subject: 1800000000000 Posted: Mon Jan 11, 2010 6:36 pm Post subject: 1800000000000 |

|

|

180000000000000 (i.e. almost 7 times the total mkt cap of RIL as of today) is what u get in 10 yeras if u make 60crores from 20000 in 5 years.

So somebody spell 1800000000000 for me.its going above my head.

all the best,

mbn

|

|

| Back to top |

|

|

sandew

White Belt

Joined: 02 Feb 2009

Posts: 174

|

Post: #39  Posted: Mon Jan 11, 2010 7:49 pm Post subject: Posted: Mon Jan 11, 2010 7:49 pm Post subject: |

|

|

Let this strategy be viewed as Return to Basics. The first lesson in TA. the moving averages.

we just need to find the best fit. Various options

13/34/55

3/15 (stockhunter)

3/15/34 (our own ST)

3/13/39 (traderji)

5/13/34

5/20/50

10/30

10/30/50

50/200

The list goes on. we just need to discover the script , the right combination, the time frame and lots of patience.

Here we have 8/34 on time frame 'daily' for nse listings. Lets use it and locate our own exit and money management trigger points.

These are thoughts to myself.

Thank You.

|

|

| Back to top |

|

|

spattavayal

White Belt

Joined: 25 Feb 2007

Posts: 7

|

Post: #40  Posted: Tue Jan 12, 2010 11:21 am Post subject: 8/34 EMA setup for RCOM Posted: Tue Jan 12, 2010 11:21 am Post subject: 8/34 EMA setup for RCOM |

|

|

8/34 EMA setup for RCOM

There are negetive things such as why it is wobbling at 34 EMA ? The sector itself is not doing that well. Market is stretched a bit.

So we need to look at the big picture and take a decision on buying

- OOP ! .. looks like breaking 34 EMA .. Setting up short ???

| Description: |

|

| Filesize: |

188.61 KB |

| Viewed: |

1139 Time(s) |

|

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #41  Posted: Wed Jan 13, 2010 5:18 pm Post subject: Posted: Wed Jan 13, 2010 5:18 pm Post subject: |

|

|

Hi,

I tried to do my calculation .

1. I found one shortcoming in the pdf file given in this thread. In that file, nifty lots like 1.2, 1.5 etc are used to take position. this is not possible. So the compunding given by such trades needs to be reduced.

2nd: My calulation from 2007 showed much lesser profit growth. I'll re-check on this.

3. I am getting much larger number of trades.

vin

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #42  Posted: Wed Jan 13, 2010 9:21 pm Post subject: Posted: Wed Jan 13, 2010 9:21 pm Post subject: |

|

|

Hi,

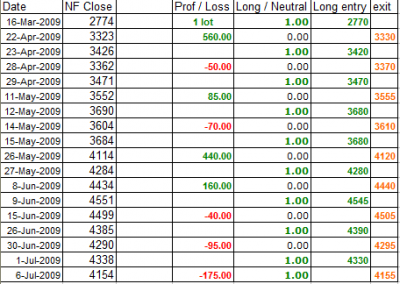

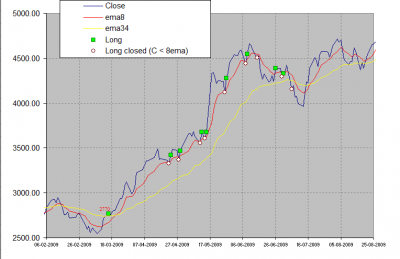

I am taking example of trade shown in pdf file from 2777 to 4492 with profit of 1715. I have scrolled through NF data and judged that this trade was started in March 2009. I am giving my calculation for the same.

Two figures are attached. One shows graph of NF close, 8ema, 34 ema and Long entry as well as long close when close < 8ema

Same trades are shown in table where dates are also shown. The total profit is 815 points. NF closed below 34ema at last row.

Where am I going wrong?

regards,

vin

| Description: |

|

| Filesize: |

17.73 KB |

| Viewed: |

831 Time(s) |

|

| Description: |

|

| Filesize: |

17.13 KB |

| Viewed: |

977 Time(s) |

|

|

|

| Back to top |

|

|

caprimannu

White Belt

Joined: 13 Apr 2009

Posts: 5

|

Post: #43  Posted: Thu Jan 14, 2010 11:29 am Post subject: Founder of this strategy is missing !! :) Posted: Thu Jan 14, 2010 11:29 am Post subject: Founder of this strategy is missing !! :) |

|

|

Hey Vijay...

I guess you should be the one answering the queries here..

Where are you missing ??

- Trade Safe

|

|

| Back to top |

|

|

vijayakannan

White Belt

Joined: 10 Aug 2009

Posts: 15

|

Post: #44  Posted: Thu Jan 14, 2010 5:54 pm Post subject: Posted: Thu Jan 14, 2010 5:54 pm Post subject: |

|

|

hi friends

lot of questions i believe. will post the replies along with an excel sheet. pls bear for one or two days

Happy pongal

rgds

vijay

|

|

| Back to top |

|

|

parandwals

White Belt

Joined: 31 Jul 2008

Posts: 8

|

Post: #45  Posted: Thu Jan 14, 2010 6:44 pm Post subject: Posted: Thu Jan 14, 2010 6:44 pm Post subject: |

|

|

hi vijay sir,

i m from mumbai and watching urs messages here by 1 months nice to having all these things and getting knowledge from u here keep it up have a happy pongal sunil parandwal

|

|

| Back to top |

|

|

|