|

|

| View previous topic :: View next topic |

| Author |

how to make 60 crores in 5 years with 20000 investment |

bull4me

White Belt

Joined: 02 Feb 2010

Posts: 11

|

Post: #76  Posted: Sat May 14, 2011 2:47 pm Post subject: Ultimate Jokes Posted: Sat May 14, 2011 2:47 pm Post subject: Ultimate Jokes |

|

|

Ultimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate Jokes

|

|

| Back to top |

|

|

|

|  |

grizzlybull

White Belt

Joined: 26 Sep 2010

Posts: 80

|

Post: #77  Posted: Sat May 14, 2011 3:33 pm Post subject: Re: Ultimate Jokes Posted: Sat May 14, 2011 3:33 pm Post subject: Re: Ultimate Jokes |

|

|

| bull4me wrote: | Ultimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate JokesUltimate Jokes  |

yep, works much better in theory

|

|

| Back to top |

|

|

shukra

White Belt

Joined: 21 Feb 2010

Posts: 18

|

Post: #78  Posted: Wed May 18, 2011 1:45 am Post subject: Posted: Wed May 18, 2011 1:45 am Post subject: |

|

|

| what is that ultimate joke?

|

|

| Back to top |

|

|

grizzlybull

White Belt

Joined: 26 Sep 2010

Posts: 80

|

Post: #79  Posted: Wed May 18, 2011 8:32 am Post subject: Posted: Wed May 18, 2011 8:32 am Post subject: |

|

|

| shukra wrote: | | what is that ultimate joke? |

that someone can turn 20 k into 60 crores.

|

|

| Back to top |

|

|

shukra

White Belt

Joined: 21 Feb 2010

Posts: 18

|

Post: #80  Posted: Wed May 18, 2011 9:02 am Post subject: Posted: Wed May 18, 2011 9:02 am Post subject: |

|

|

May be a good idea to ask the one who started this string. He must show how to achieve it.

Simply writing off an idea because it is not easy to conceive it is premeture act.

|

|

| Back to top |

|

|

shukra

White Belt

Joined: 21 Feb 2010

Posts: 18

|

Post: #81  Posted: Wed Jul 06, 2011 8:30 am Post subject: Posted: Wed Jul 06, 2011 8:30 am Post subject: |

|

|

Hello everybody.

Some work on this system reveals this is a feasible strategy. Hitting 60crores should not be the objective. The system designer clearly said that 60 crores is feasible THEORITICALLY.

It is prudent to explore the possibility of taking benefit from the strategy rathr than just ignoring it or joking about it. There is for sure value in tis approach. I am looking at it rather seriously though.

Here are a few points for discussion for those wh are seriously conidering this strategy:

1. Do we chart the NIFTY composite Index (not the future) and trade the NIFTY future?

2. If yes, then what month future contract we trade, Immediate month contract or 2-month / 3-month contract?

3. When we say "the index value crosses the ema", does it mean (i) it is enough if the index value high goes above the ema value or (i) the index value should close above (or below) the ema?

Please respond, let us open up communication channel.

-C

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #82  Posted: Wed Jul 06, 2011 9:17 am Post subject: Posted: Wed Jul 06, 2011 9:17 am Post subject: |

|

|

| shukra wrote: | Hello everybody.

Some work on this system reveals this is a feasible strategy. Hitting 60crores should not be the objective. The system designer clearly said that 60 crores is feasible THEORITICALLY.

It is prudent to explore the possibility of taking benefit from the strategy rathr than just ignoring it or joking about it. There is for sure value in tis approach. I am looking at it rather seriously though.

Here are a few points for discussion for those wh are seriously conidering this strategy:

1. Do we chart the NIFTY composite Index (not the future) and trade the NIFTY future?

2. If yes, then what month future contract we trade, Immediate month contract or 2-month / 3-month contract?

3. When we say "the index value crosses the ema", does it mean (i) it is enough if the index value high goes above the ema value or (i) the index value should close above (or below) the ema?

Please respond, let us open up communication channel.

-C |

Shukra,

I had made some tests with the strategy but i could not feel satisfied with the results. perhaps there were gaps in my understanding. I am prepared to star afresh.

As for your questions: we should trade futures and so chart the futures. take near month contract. i am not clear about 3rd point at the moment since i need to read the strategy again.

|

|

| Back to top |

|

|

zritesh

White Belt

Joined: 03 Apr 2010

Posts: 53

|

Post: #83  Posted: Wed Jul 06, 2011 9:57 am Post subject: Posted: Wed Jul 06, 2011 9:57 am Post subject: |

|

|

This strategy make sense. If you will follow this,i don know about crores but you will make handsome profit. Just few things which i have added from my side:

*Use stoch with this strategy. when price crosses 34 ema just check if stoch is overbought or not.if its overbought then avoid the crossover as it can come back below 34 next day or two.90% time you will be on the right side of the market.

*For swing you can add 8 ema. After pullback from up or down either you can use 8 ema cross or stoch to see whether its a valid swing.But if you will fix your target on the both side either 300 points or may be 400.most of the times you will hit your target after cross over(it depends whether you want to drive your profit longer or you want to fix.)

This is what i am doing(but just from past 6 months both in nifty and commo)Experts opinion is welcomed

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #84  Posted: Wed Jul 06, 2011 10:00 am Post subject: Posted: Wed Jul 06, 2011 10:00 am Post subject: |

|

|

Can you pls post your buy/sell data for NF so that we can clear our understanding against that.

thanks

|

|

| Back to top |

|

|

shukra

White Belt

Joined: 21 Feb 2010

Posts: 18

|

Post: #85  Posted: Wed Jul 06, 2011 1:47 pm Post subject: Posted: Wed Jul 06, 2011 1:47 pm Post subject: |

|

|

when we say nifty crosses the ema (8 or 34), does it mean the 'close value' of nifty crosses the ema?

Thanks.

-C

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #86  Posted: Wed Jul 06, 2011 3:57 pm Post subject: Posted: Wed Jul 06, 2011 3:57 pm Post subject: |

|

|

| shukra wrote: | when we say nifty crosses the ema (8 or 34), does it mean the 'close value' of nifty crosses the ema?

Thanks.

-C |

as per vijay, it should be 'close' value.

I am reproducing relevant old posts from this thread.

...........................................

In EOD chart

1. Buy above 34 EMA. Sell when price cuts 8EMA from above.

Again buy when price crosses above 8EMA (provided it is above 34ema) and sell when again it comes down 8EMA

2. Short sell below 34 EMA. Buy back when price goes above 8EMA. again short sell when price goes below 8ema (provided it is still below 34 ema)

Posted: 28 Dec 2009 09:46 Post subject: Reply with quote

kalsree, i dont know how to save a chart in icharts and upload it here. it is very simple. just open jcharts EOD. select last 5 years data. in EMA select 8 and 34. when ever crossing happens do the trade. thats all.

rajamani i have not tested this for other stocks or other indices like bank nifty. but for bank nifty i think we have to choose a higher EMa as it is very volatile and will give u a lot of whipsaws and wrong signals (Losses) . but i have not tested it.

thanks Quick gun murugan. it is correct. we dont know whether we will allow profits to accrue and continue the same trade. but if we have a mind set that what ever it is we are going to lose only 20000 , then may be we would have.

.....................

Posted: 28 Dec 2009 13:08 Post subject: Reply with quote

sundar, u dont need to predict market trend. EMA will not predict market but follows it. . so when following EMA you will follow market. It is wiser to follow market than to predict it.

Manu, in a sideways market we will not gain more in this strategy. but sameway you wont loose much . since market is in sideways the EMA will be more or less same. the only issue will be there will be lot of trades, but with no big profit or no big gain. you may see that from that chart or from calculation that during those periods we may have lost some points say around 150 pts but normally once this whipsaw is over there will be a big move and you will be able to catch of that which will be much higher than the 150 pts loss.

sanghvi, sorry, i dont give any calls here. it is just a simple thing. pls read charts and you will understand when to start the trade. i am not an expert to give calls.

vijay

...............................

greatshiva

White Belt

White Belt

Joined: 15 Dec 2009

Posts: 16

PostPosted: 07 Jan 2010 15:59 Post subject: Reply with quote

Hi tirupathi_manu,

Whatever you are calculating now is the EOD EMA but during live mkt , the daily EMA cannot be looked back after the day is over.

Hence you cannot back test this method.

The EMA might give a crossover signalduring live mkt hours signalling to buy at 12 PM but at 15:00 PM , the ema might turn back and at EOD what you see is a diff EMA.

Crossing of EMAs work but has lot of whipsaws

Sometimes , there might be 300 pts loss in a single trade watiing for crossing back due to this whipsaws... If u r ready to bear all that oonly then u hav to trade....

Do paper trading before getting into this....

...........................

vijayakannan

White Belt

White Belt

Joined: 10 Aug 2009

Posts: 15

PostPosted: 09 Jan 2010 11:54 Post subject: Reply with quote

hi guys

thanks for the postings. just want to clarify some thing as per my perception.

1. 20000 margin is not enough for this strategy - please note that when this is started nifty is at around 2000. for 2000 nifty, the margin requirement at 10% will be 10000rs. but i have taken 20000 which is 20% as initial investment considering the losses if any in first trade. also i have considered the same 20% as margin when i am calculating the entire calculations. if we just take the 10% then the returns will be much hgher. now we may require more margin considering cmp at 5250 levels. if anyone wants to just try this, please try it with minifty 1 lot. i am sure you can start that trade with 30000 investment which will take care of margin and also some MTM losses (if any)

2. Booking profits. Here as per this strategy we are not trading 8 and 34 cross overs. the strategy is to trade current market price cross over with 8 and 34 ema.

When CMP is crossing 34 ema from below, we go long. and we exit the long position when it is crossing 8ema from above.

and same way we short when cmp is cutting 34 ema from above and we square off when cmp is crossing 8ema from below.

And another point is please dont see the charts with 30 minutes or 60 minutes time frame. you may get lot of whipsaws. only check the daily charts. The theory goes like this. Daily after market is over check the CMP, 8EMa and 34 EMA. and plan your trade for next day. next day better to see the market at 3.15 to 3.20 pm (only EOD charts).

for eg. as on 8th EOD charts we are long in nifty. CMP is 5245 8EMA is 5225 and 34 EMA is 5116. hence the strategy should be to see the market on monday at 3.20 and if the price is below 5225 then square off at that price. and if suppose it is below 5116 which is 34 ema, then we may square off our long trade and enter a short position at that price.

there should not be any stop loss in this system. but if anyone wants to keep it safe, then they can have their own system for stop loss, and end of the day at 3.15 take a call and carry forward the trade as per this system. ie. if suppose you want to play safe on monday, then the strategy may be like, putting a stop loss sell order at 5225. if suppose that is executed, then wait for the market, how it is closing. if suppose it is recovering then re enter at 5225 ./ hence your profit is saved. and if has not recovered and it is going below 34 ema then short it only if it is at the closing time. And also pls keep in mind that this kinda cross overs happen maximum thrice in a month. so only during that times you can check the market during market hours for this trade. all other times just forget it till 3.20 and leave the trade to grow the profits.

also, if suppose you exited at 5225 and market is closing some where around 5150, high risk traders may use that to go for long as it is still above 34 ema..as lot of times market took support at 34 ema and retraced to new highs (EOD basis only. dont think of intraday)

my current plan is i am having this trade in a seperate demat a/c while all other trades in another demat. and i dont see this at all in market hours.

thanks Anand (Quickgunmurugan) for his valuable insights in this.

..............................

sandew

White Belt

White Belt

Joined: 02 Feb 2009

Posts: 116

PostPosted: 09 Jan 2010 16:01 Post subject: Reply with quote

May i join the "Great Indian Market-Crossover Debate".

We all know the power of EMA crossover on higher time frames - daily and above;and the slant of the EMA. The key is discovering what combination of EMA works best in our given NSE set up.

Pick up any USA technical analysis book, go to any usa website, they all swear by 20 / 50 crossover. Singapore / Australia writer have their own set ups. Commodity and Exchange pairs their own..

Here is our Mr. Newton who tells us 'why and when' Apple is falling and (rising) with 8 / 34 crossover. Back Test it.

I tested 8/34 set up , daily time frame, on all my favourite stocks. It works miracles. It works on Nifty futures too.

Minor tweeting whether to enter at 1520 hrs or at 0900 hours , how much and where or whether at all there be a SL, when to flip and go reverse - are all function of your risk profile and capital disposal for MtoM. Few points here and there do not matter in the larger frame.

For intraday huge swing protection in emergency situations, I am currently trying to see whether and how we can supplement with 60 minute time frame (which happens once in 2 months / quarter).

On the whole, I am a convert to 8 / 34 EOD EMA. Thank You.

................................

pipstocks

White Belt

White Belt

Joined: 02 Jan 2009

Posts: 19

PostPosted: 09 Jan 2010 18:49 Post subject: Reply with quote

Hello guys. NICE THREAD. EMA CROSSOVER.

One can adopt following system based on EMA crossover :::

Entry based on 5/34 EMA crossover on eod. Profit booking can be done when hourly 5/34 EMA crossover give opposite signal.

If you look at jan'08 fall on 21 & 22 jan.2008.; actual eod bearish crossover was on 17 jan.2008 but the intraday trend was bearish from 9 jan 2008 based on hourly 5/34 EMA crossover.

One can back test this system from july 2008 to dec.2009 based on intraday historical charts.

..............................

vijayakannan

White Belt

White Belt

Joined: 10 Aug 2009

Posts: 15

PostPosted: 10 Jan 2010 13:24 Post subject: Reply with quote

greatshiva

once you finalised 5125 (which is 8ema) thats all. we are not going to check ema again and again for that day. thats the exit point. say, nifty is reaching 5125 at 2pm on monday. at that time 8ema will be certainly different. but we are not going to see that at all. 5125 once it is fixed in our mind (of course in your trading log) thats all. dont even think about changing that (as per this strategy). hope i clarified your doubts

another one point here is, with allocating 30000 in trading a/c, and you are starting with one mini nifty position (i hope the current margin requirement is less than 12000 as of now) 18000 is more than enough to cover all your MTM losses upto 900 points loss (20*900=18000).

when the capital reaches higher limits (say 1 crore) we are considering number of lots allocating 20% towards margin. hence always there is enough money to cover mtm losses.

moreover as veterans like Jimmie pointed out in this thread, this strategy is about creating wealth by compounding effect. hence reaching 20 or 30 lacs in some time with an investment of 30000 itself is something great(ok, i believe). but also remember, if reaching 20 lacs with 20000 investment is possible, why not 60 crores with 20 lacs(becos you are going to have 20lacs at that time in your a/c)

..............................

zritesh

White Belt

White Belt

Joined: 03 Apr 2010

Posts: 1

PostPosted: 06 Jul 2011 09:57 Post subject: Reply with quote

This strategy make sense. If you will follow this,i don know about crores but you will make handsome profit. Just few things which i have added from my side:

*Use stoch with this strategy. when price crosses 34 ema just check if stoch is overbought or not.if its overbought then avoid the crossover as it can come back below 34 next day or two.90% time you will be on the right side of the market.

*For swing you can add 8 ema. After pullback from up or down either you can use 8 ema cross or stoch to see whether its a valid swing.But if you will fix your target on the both side either 300 points or may be 400.most of the times you will hit your target after cross over(it depends whether you want to drive your profit longer or you want to fix.)

This is what i am doing(but just from past 6 months both in nifty and commo)Experts opinion is welcomed

...............................................

...............................................

regards

vin

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #87  Posted: Wed Jul 06, 2011 8:42 pm Post subject: Posted: Wed Jul 06, 2011 8:42 pm Post subject: |

|

|

| Am I correct in understanding that, as per this theory, nifty becomes a sell if it close below 5600/5590?

|

|

| Back to top |

|

|

Rahulsharmaat

Black Belt

Joined: 04 Nov 2009

Posts: 2766

|

Post: #88  Posted: Wed Jul 06, 2011 11:26 pm Post subject: Posted: Wed Jul 06, 2011 11:26 pm Post subject: |

|

|

i tested now-- 2007--jan--till 2008 jan--

around 28 trades and gain 1600 points -- so net 1400 points thats 120 points in 1 month

as buy above 34 EMA-- n book when it cross 8 ema from above-- many whipsaws

short below 34 ema-- n book when price cross8 ema from down --

again whipsaws

cant it be simple-- buy abopve 34 ema-- n short below it--and some other system together

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #89  Posted: Thu Jul 07, 2011 9:31 am Post subject: Posted: Thu Jul 07, 2011 9:31 am Post subject: |

|

|

| Rahulsharmaat wrote: | i tested now-- 2007--jan--till 2008 jan--

around 28 trades and gain 1600 points -- so net 1400 points thats 120 points in 1 month

as buy above 34 EMA-- n book when it cross 8 ema from above-- many whipsaws

short below 34 ema-- n book when price cross8 ema from down --

again whipsaws

cant it be simple-- buy abopve 34 ema-- n short below it--and some other system together |

I got similar results from jan 2007 o June 2008. In fact till June 2007, strategy showed mostly loss up to 600 points.

As I continued till Dec 2009, gains continued and reached about 3000 points.

I too observed that 8ema leads to lots of losses.

something else is needed.

Pure 34ema with closing prices seems to be better.

|

|

| Back to top |

|

|

pipstocks

White Belt

Joined: 02 Jan 2009

Posts: 29

|

Post: #90  Posted: Thu Jul 07, 2011 12:34 pm Post subject: Posted: Thu Jul 07, 2011 12:34 pm Post subject: |

|

|

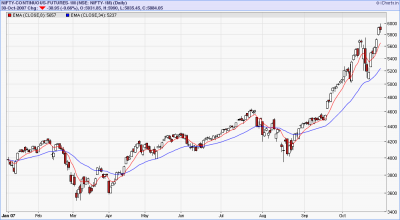

Hello vinstsir,

Plz elaborate that how did u find loss of 600 point till june 2007???

NF Charts with 8/34 ema from 1 jan 2007 to june 2007 shows profit of around 300 points. Plz check n confirm.One can use ema 3 or ema 5 instead of ema 8 which helps us to get exit with minor loss (very near to entry level) during whipsaws.

| Description: |

|

| Filesize: |

33.82 KB |

| Viewed: |

535 Time(s) |

|

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|