| View previous topic :: View next topic |

| Author |

Intraday Trading Strategy |

guptak03

White Belt

Joined: 03 May 2011

Posts: 50

|

Post: #406  Posted: Thu Jun 09, 2011 12:05 am Post subject: Posted: Thu Jun 09, 2011 12:05 am Post subject: |

|

|

| As on 8th v traded twice ,.nd both sl triggered so how it wil b showed on sheet nd if v hve profit nd loss on sheet it will b helpfull 4 new traders ...avibhai plz ur sugg!!

|

|

| Back to top |

|

|

|

|

|

sethu45

White Belt

Joined: 06 Aug 2009

Posts: 168

|

Post: #407  Posted: Thu Jun 09, 2011 4:43 am Post subject: Posted: Thu Jun 09, 2011 4:43 am Post subject: |

|

|

Hi Avinash,

On 8th June stop triggered as per the plan. Why dont you test my suggestion. After finding the trend can enter in sell if cuts low and enter long if cuts high whichever the case may be. I am under the impression that only the entry point makes perfect. But in this volatile market nothing can be done have to take trade as per the market condition.

sethuraman

|

|

| Back to top |

|

|

rainbow

White Belt

Joined: 25 Feb 2010

Posts: 202

|

Post: #408  Posted: Thu Jun 09, 2011 7:55 am Post subject: avi intra Posted: Thu Jun 09, 2011 7:55 am Post subject: avi intra |

|

|

Sethu:

u got it on the dot. volatile market conditions is right.

and in light of that, if on break of dh till then on nf, which was 5558.7, if one had gone long it would have gone up to ~5565 and it reversed from there.

so more tweaking with *that* method is required, IMO. early days, but i must say this method sounds very plausible for intra. HT to avinash

btw, would someone populate the excel spreadsheet with gain/loss in the last column? thank you.

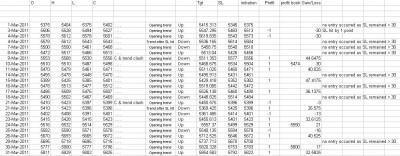

btw, here is another excel spreadsheet made by another ichartian. mostly identical to the one sriki has posted. let us look to add one more variable to the sheet, that is cmp at 9:30 and auto computation of the cmp from SL in any direction (benchmark here being sl should be less than 30 or as few points as possible) so that if one is trading more than one counter (say stocks for eg) it becomes easier, since for intra, timing is imp and those few extra seconds/mins count, as everyone here knows.

btw, two sls of mine got hit yday both long and short. however, i had placed a buy at 5530 and sold at 5545 at open. this was just a discretionary trade.

have a great trading day all

Cheers

Rainbow

| sethu45 wrote: | Hi Avinash,

On 8th June stop triggered as per the plan. Why dont you test my suggestion. After finding the trend can enter in sell if cuts low and enter long if cuts high whichever the case may be. I am under the impression that only the entry point makes perfect. But in this volatile market nothing can be done have to take trade as per the market condition.

sethuraman |

| Description: |

|

Download |

| Filename: |

AVI.xls |

| Filesize: |

14 KB |

| Downloaded: |

344 Time(s) |

|

|

| Back to top |

|

|

avinash02

White Belt

Joined: 22 Feb 2009

Posts: 343

|

Post: #409  Posted: Thu Jun 09, 2011 8:44 am Post subject: Posted: Thu Jun 09, 2011 8:44 am Post subject: |

|

|

| sethu45 wrote: | Hi Avinash,

On 8th June stop triggered as per the plan. Why dont you test my suggestion. After finding the trend can enter in sell if cuts low and enter long if cuts high whichever the case may be. I am under the impression that only the entry point makes perfect. But in this volatile market nothing can be done have to take trade as per the market condition.

sethuraman |

sethu

sethu mere bhai plz try to understand agar trend change nahi hoga to opposite side kese buy/sell kar sakta hu...yesterday 2 sl hit bcoz of market volatile....ok nd let me one mnth check ok this mnth we will check our system if the system not return good point then we sure some modifiction....ok ? nd i one more intraday method share on this weekend ..hope its goods for intraday player ...

avinash

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #410  Posted: Thu Jun 09, 2011 9:11 am Post subject: Posted: Thu Jun 09, 2011 9:11 am Post subject: |

|

|

Hi,

I am posting results of tests for March-2011.

Good returns !!

From these, I could get one prominent question: Sometimes NF does more than 0.75% in opening 15minutes. In such case market runs-away in trend direction without giving entry and we miss large gains. Such things are more likely when open=Low or open=high. Also, even if we get entry, target is close to high or low of opening bar as we have targets scaled to 0.75% of opening price.

regards

| Description: |

|

| Filesize: |

168.67 KB |

| Viewed: |

402 Time(s) |

|

|

|

| Back to top |

|

|

avinash02

White Belt

Joined: 22 Feb 2009

Posts: 343

|

Post: #411  Posted: Thu Jun 09, 2011 9:30 am Post subject: NIFTY INTRA Posted: Thu Jun 09, 2011 9:30 am Post subject: NIFTY INTRA |

|

|

trnd is up

sl=5507.05

tg=5560.40

avinash

|

|

| Back to top |

|

|

bablya

White Belt

Joined: 31 May 2011

Posts: 38

|

Post: #412  Posted: Thu Jun 09, 2011 9:34 am Post subject: Re: NIFTY INTRA Posted: Thu Jun 09, 2011 9:34 am Post subject: Re: NIFTY INTRA |

|

|

| avinash02 wrote: | trnd is up

sl=5507.05

tg=5560.40

avinash |

avibhai can u pls give me/chk OHL figures. No need to do calculation again . Just OHL will do

regards

|

|

| Back to top |

|

|

smartcancerian

Yellow Belt

Joined: 07 Apr 2010

Posts: 542

|

Post: #413  Posted: Thu Jun 09, 2011 9:35 am Post subject: Posted: Thu Jun 09, 2011 9:35 am Post subject: |

|

|

| Open 5519..high 5529.95...low 5515

|

|

| Back to top |

|

|

bablya

White Belt

Joined: 31 May 2011

Posts: 38

|

Post: #414  Posted: Thu Jun 09, 2011 9:37 am Post subject: Posted: Thu Jun 09, 2011 9:37 am Post subject: |

|

|

| smartcancerian wrote: | | Open 5519..high 5529.95...low 5515 |

thx smartc and avibhai,

|

|

| Back to top |

|

|

DEWGH

White Belt

Joined: 20 Feb 2011

Posts: 119

|

Post: #415  Posted: Thu Jun 09, 2011 9:39 am Post subject: Posted: Thu Jun 09, 2011 9:39 am Post subject: |

|

|

Hi Avinashji,

Icharts is showing diff values which to follow?

As per ur instructions m following odin levels.

O 5529.85

H 5529.85

L 5516.10

|

|

| Back to top |

|

|

sharemuthu

White Belt

Joined: 21 Aug 2009

Posts: 154

|

Post: #416  Posted: Thu Jun 09, 2011 9:39 am Post subject: Posted: Thu Jun 09, 2011 9:39 am Post subject: |

|

|

| bought 2 lots @ 5528

|

|

| Back to top |

|

|

ongc123

White Belt

Joined: 02 Dec 2010

Posts: 75

|

Post: #417  Posted: Thu Jun 09, 2011 9:44 am Post subject: Posted: Thu Jun 09, 2011 9:44 am Post subject: |

|

|

| open .5519 high..5528.75.. low is 5515 as par Nse Terminal

|

|

| Back to top |

|

|

bablya

White Belt

Joined: 31 May 2011

Posts: 38

|

Post: #418  Posted: Thu Jun 09, 2011 9:45 am Post subject: Posted: Thu Jun 09, 2011 9:45 am Post subject: |

|

|

| DEWGH wrote: | Hi Avinashji,

Icharts is showing diff values which to follow?

As per ur instructions m following odin levels.

O 5529.85

H 5529.85

L 5516.10 |

Dew Bhai, 5 min ago i was also confused and asked avibhai. Smartc gave me levels.

now see, in some ODINs if u login late (ie. suppose u login at 9.20), then candle chart plots data from tht point onwards. So beter to watch ODIN levels on market watch

|

|

| Back to top |

|

|

DEWGH

White Belt

Joined: 20 Feb 2011

Posts: 119

|

Post: #419  Posted: Thu Jun 09, 2011 9:48 am Post subject: Posted: Thu Jun 09, 2011 9:48 am Post subject: |

|

|

Hi Bablyabhai

I have posted ichart levels. I suppose Icharts should not show diff values than odin, what u think?

|

|

| Back to top |

|

|

ongc123

White Belt

Joined: 02 Dec 2010

Posts: 75

|

Post: #420  Posted: Thu Jun 09, 2011 9:49 am Post subject: Posted: Thu Jun 09, 2011 9:49 am Post subject: |

|

|

Low 5515

Open 5519

High 5529

Trend Uptrend

If trend is up, utilise sl- long side and tgt- buy only

If trend is down, utilise sl- short side and tgt- sell only.

sl - long side 5508

sl - short side 5524

tgt- buy 5560

tgt- sell 5478

|

|

| Back to top |

|

|

|