| View previous topic :: View next topic |

| Author |

It's as simple as 1-2-3 |

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #1  Posted: Wed Nov 16, 2011 6:08 pm Post subject: It's as simple as 1-2-3 Posted: Wed Nov 16, 2011 6:08 pm Post subject: It's as simple as 1-2-3 |

|

|

Hi All,

Sharing a very simple set up known as 1-2-3. Once comprehend, it is very easy to apply and results are profitable. Works well at tops and bottoms and also during the trend.

No indicators are used but to support one can use STS or MACD, MA which align well with the set up. You can use you any indicator of your choice if you get the logic right. Floor pivots goes well with the set up

It's one of the oldest ways of trading one can call it peak and tough method also.

Lets roll the dice.

Chart Type: Bar Chart

Indicator: None

Time Frame: Works well on both intra day and EOD, weekly, monthly. Higher the time frame higher the probability of successful trade.

What is 1-2-3 set up ?

A typical 1-2-3 high is formed at the end of an up trending market. Price making final high and then goes down wards which will create a point 2 and from there an upward correction begins and bar making point 3 remember that the correction must not go above the high of bar making point 1, it looks like a M pattern.

A typical 1-2-3 low is formed at the end of a down trending. Price making final low and then goes up creating point 2 and from there a down ward correction begins whose low is not below the low of point 1 bar thus completing 1-2-3 formation. It looks like W pattern.

In between points 1-2 or 2-3 there can be any number of bars.

Entry:

In the bullish 1-2-3 set up enter at the breakout of point 2 or few ticks above the bar making point 2. Always remember that point 3 low must not be below the low of point 1.

In the bearish 1-2-3 set up enter at the breakdown of point 2 or few ticks below point 2. Always remember that point 3 high must not be higher than point 1.

[b]Stop Loss

In the bullish 1-2-3 keep the stop loss below the low of point 3 bar.

In the bearish 1-2-3 keep the stop loss above the high of point 3 bar.

for exit trail your stop loss once in a profit and keep doing partial booking.

Some examples:

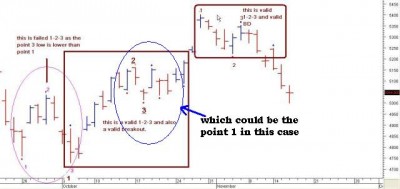

1) UCOBANK FUTURE EOD chart bearish 1-2-3

2) Failed bullish 1-2-3 UCOBANK EOD chart

3) Nifty intraday 5 min tf date 16-11-11

There are certain in the trend 1-2-3's also which I have not marked.

Regards,

Last edited by sherbaaz on Wed Nov 16, 2011 7:44 pm; edited 1 time in total |

|

| Back to top |

|

|

|

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #2  Posted: Wed Nov 16, 2011 7:25 pm Post subject: Posted: Wed Nov 16, 2011 7:25 pm Post subject: |

|

|

Sherbaaz, I think your description is reversed for the two figures thereby causing confusion e.g. description of 1-2-3 for bullish W is actually for bearish M. If you agree, please repost.

Also, please clarify how one can know when the end of a trend has arrived.

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #3  Posted: Wed Nov 16, 2011 7:29 pm Post subject: Posted: Wed Nov 16, 2011 7:29 pm Post subject: |

|

|

| vinay28 wrote: | Sherbaaz, I think your description is reversed for the two figures thereby causing confusion e.g. description of 1-2-3 for bullish W is actually for bearish M. If you agree, please repost.

Also, please clarify how one can know when the end of a trend has arrived. |

both of them are right. if the set up works the end of the current trend has arrived.

regds,

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #4  Posted: Wed Nov 16, 2011 7:41 pm Post subject: Posted: Wed Nov 16, 2011 7:41 pm Post subject: |

|

|

Sherbaaz, see this part of your description for example

"A typical 1-2-3 high is formed at the end of an up trending market. Price making final high and then goes down wards which will create a point 2 and from there an upward correction begins and bar making point 3 remember that the correction must not go above the high of bar making point 1, it looks like a W pattern."

Point 2 can not be below point 1 and 3 for a bullish W? It is for bearish M. Am I right?

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #5  Posted: Wed Nov 16, 2011 7:45 pm Post subject: Posted: Wed Nov 16, 2011 7:45 pm Post subject: |

|

|

| vinay28 wrote: | Sherbaaz, see this part of your description for example

"A typical 1-2-3 high is formed at the end of an up trending market. Price making final high and then goes down wards which will create a point 2 and from there an upward correction begins and bar making point 3 remember that the correction must not go above the high of bar making point 1, it looks like a W pattern."

Point 2 can not be below point 1 and 3 for a bullish W? It is for bearish M. Am I right? |

Got your point. Corrected the same. Earlier i thought u were referring to the image.

thanks for pointing it out.

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #6  Posted: Wed Nov 16, 2011 7:55 pm Post subject: Posted: Wed Nov 16, 2011 7:55 pm Post subject: |

|

|

| One more doubt. If I understand correctly, sometimes (or may be many times) a firm trend reversal is indicated after a lower low (or high) or a double bottom (or top). How do you deal with such situations?

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #7  Posted: Wed Nov 16, 2011 8:18 pm Post subject: Posted: Wed Nov 16, 2011 8:18 pm Post subject: |

|

|

[quote="vinay28"]One more doubt. If I understand correctly, sometimes (or may be many times) a firm trend reversal is indicated after a lower low (or high) or a double bottom (or top). How do you deal with such situations?[/quote

As long as the set up is valid trade it. I dont know how you identify double top/bottom there are couple of variations to it.

Trend reversal is indicated for me as follows:

price breaking the higher low up trend ends and price taking out lower high down trend ends.

Kindly find below the eod chart of nf, with explainations.

Regards,

|

|

| Back to top |

|

|

S.S.

White Belt

Joined: 09 Feb 2011

Posts: 241

|

Post: #8  Posted: Wed Nov 16, 2011 8:24 pm Post subject: Posted: Wed Nov 16, 2011 8:24 pm Post subject: |

|

|

hi sherbaazbhai

its a good trading method u had shared..... one thing i want to ask u how do you calculate target or where to book profit ????( i normally booked at the top of the wave where u marked point 1)

| Description: |

|

| Filesize: |

11.45 KB |

| Viewed: |

4072 Time(s) |

|

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #9  Posted: Wed Nov 16, 2011 8:47 pm Post subject: Posted: Wed Nov 16, 2011 8:47 pm Post subject: |

|

|

| Thanks

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #10  Posted: Wed Nov 16, 2011 9:14 pm Post subject: Posted: Wed Nov 16, 2011 9:14 pm Post subject: |

|

|

| S.S. wrote: | hi sherbaazbhai

its a good trading method u had shared..... one thing i want to ask u how do you calculate target or where to book profit ????( i normally booked at the top of the wave where u marked point 1) |

Hi,

I dont know where to book profits normally i normally trail my my stop loss and if you do good position sizing then u can stay in the trade for long.

Regrds,

|

|

| Back to top |

|

|

smith06

White Belt

Joined: 05 May 2009

Posts: 12

|

Post: #11  Posted: Wed Nov 16, 2011 10:56 pm Post subject: Posted: Wed Nov 16, 2011 10:56 pm Post subject: |

|

|

1-2-3 system is also very effective with line charts. Which one is more

effective -- line charts or bar charts? Pl. comment.

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #12  Posted: Wed Nov 16, 2011 11:10 pm Post subject: Posted: Wed Nov 16, 2011 11:10 pm Post subject: |

|

|

| smith06 wrote: | 1-2-3 system is also very effective with line charts. Which one is more

effective -- line charts or bar charts? Pl. comment.  |

yes it is very effective with line charts as it clearly shows you the thing. but the problem is, line chart is based on closing price it does not take into consideration high and low, which make's its a risky thing to handle as the high/low of the said time frame may take out yr sl. this is my personal opinion if one knows how to use line chart then it is useful on line chart also.

regds,

|

|

| Back to top |

|

|

S.S.

White Belt

Joined: 09 Feb 2011

Posts: 241

|

Post: #13  Posted: Wed Nov 16, 2011 11:31 pm Post subject: Posted: Wed Nov 16, 2011 11:31 pm Post subject: |

|

|

| sherbaaz wrote: | | S.S. wrote: | hi sherbaazbhai

its a good trading method u had shared..... one thing i want to ask u how do you calculate target or where to book profit ????( i normally booked at the top of the wave where u marked point 1) |

Hi,

I dont know where to book profits normally i normally trail my my stop loss and if you do good position sizing then u can stay in the trade for long.

Regrds, |

ok...thankx

|

|

| Back to top |

|

|

S.S.

White Belt

Joined: 09 Feb 2011

Posts: 241

|

Post: #14  Posted: Thu Nov 17, 2011 12:12 am Post subject: Posted: Thu Nov 17, 2011 12:12 am Post subject: |

|

|

sharebaazbhai i want to ask u one thing from ur chart(first square marked by u)

regards,

| Description: |

|

| Filesize: |

26.82 KB |

| Viewed: |

574 Time(s) |

|

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #15  Posted: Thu Nov 17, 2011 8:44 am Post subject: Posted: Thu Nov 17, 2011 8:44 am Post subject: |

|

|

| Sherbaaz, you have identified circled area as a "failed" one probably because 3 is below 1. If so, the price did go up. That was one of my doubts earlier where I had asked whether 3 being lower than 1 also may mean bullish or not.

|

|

| Back to top |

|

|

|