| View previous topic :: View next topic |

| Author |

KPIT - Hourly - Can we see a 30% jump |

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #1  Posted: Thu Apr 01, 2010 6:02 pm Post subject: KPIT - Hourly - Can we see a 30% jump Posted: Thu Apr 01, 2010 6:02 pm Post subject: KPIT - Hourly - Can we see a 30% jump |

|

|

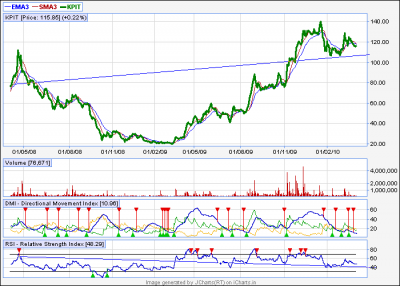

Based on repetitive patterns.. can we see a 30% jump in KPIT ?

| Description: |

|

| Filesize: |

21.38 KB |

| Viewed: |

542 Time(s) |

|

|

|

| Back to top |

|

|

|

|  |

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #2  Posted: Sat Apr 03, 2010 10:06 am Post subject: Posted: Sat Apr 03, 2010 10:06 am Post subject: |

|

|

Good find.

regards,

vin

|

|

| Back to top |

|

|

sandew

White Belt

Joined: 02 Feb 2009

Posts: 174

|

Post: #3  Posted: Sat Apr 03, 2010 8:50 pm Post subject: KPIT Posted: Sat Apr 03, 2010 8:50 pm Post subject: KPIT |

|

|

| on eod break of 128 will confirm

|

|

| Back to top |

|

|

ajdavid

White Belt

Joined: 08 Jan 2010

Posts: 5

|

Post: #4  Posted: Sat Apr 03, 2010 8:59 pm Post subject: downside expected Posted: Sat Apr 03, 2010 8:59 pm Post subject: downside expected |

|

|

sir i feel as per the pattern it will break downwards

this is my view sir.. you may be right

|

|

| Back to top |

|

|

kishorepatnaik

White Belt

Joined: 13 Dec 2009

Posts: 5

|

Post: #5  Posted: Sat Apr 03, 2010 9:24 pm Post subject: KPIT Posted: Sat Apr 03, 2010 9:24 pm Post subject: KPIT |

|

|

With RSI breaking below 50 and DMI also seems to be indicating a downtrend

In any case, the moving averages are pierced downwards.

But certainly, we can watch this scrip and buy in dips say around 103/- to 107/=

Kishore patnaik

| Description: |

|

| Filesize: |

17.86 KB |

| Viewed: |

444 Time(s) |

|

|

|

| Back to top |

|

|

kishorepatnaik

White Belt

Joined: 13 Dec 2009

Posts: 5

|

Post: #6  Posted: Sat Apr 03, 2010 9:25 pm Post subject: Posted: Sat Apr 03, 2010 9:25 pm Post subject: |

|

|

refer to my earlier post. It is my personal opinion and please follow it at your own risk

Kishore patnaik

|

|

| Back to top |

|

|

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #7  Posted: Sun Apr 04, 2010 9:56 am Post subject: Extract from latest issue of a financial magazine Posted: Sun Apr 04, 2010 9:56 am Post subject: Extract from latest issue of a financial magazine |

|

|

I have pasted an extract from the latest issue of a leading Financial Magazine hitting stands tomorrow.

KPIT Cummins Infosystems: Catering to the manufacturing, automobile and semi-conductor industries, KPIT Cummins Infosystems was impacted by the slowdown in the two segments. The company reported forex losses of Rs 57.38 crore in FY 2009 due to rupee depreciation from about Rs 40 to Rs 49 a US dollar. It had taken hedges at Rs 40 a US dollar due to which it had to bear such a big loss. Largest customer Cummins, which accounted for about 41% of revenue end December 2008, has seen a major impact of the global slowdown, with revenue falling 33% to 30.6% end December 2009 over end December 2008. KPIT Cummins Infosystems’ revenue dipped 8% in Indian rupees and 16% in US dollars in the nine months ended December 2009 mainly on fall in volumes from Cummins.

The news from Cummins is that the bottom has been reached and the current run-rate will continue but there will be no growth. Along with this, the global automobile industry is seeing some stability returning and spending happening in the small car and newer fuel efficient technologies. It expects this spent to continue for the next three years. However, uncertainty remains in the manufacturing industry.

KPIT Cummins Infosystems made a strategic acquisition of Sparta Consulting in October 2009, cementing its position in the enterprise space. It has targeted revenue of US$ 80 million in three years and improvement in margin at company average.

Going forward, the growth will be triggered by the growth in the Sparta business as well as spent in the automobile industry. The company has hedged at Rs 45 to the dollar, which means not much impact if the rupee appreciates. Currently, on a diluted equity of Rs 15.7 crore, the share price is trading at 11 times FY 2010 earning and at 9.5 times one year forward earning as against an average of 11.4 times over the last five years.

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|