| View previous topic :: View next topic |

| Author |

Learning the Elliott Waves is difficult but not impossible |

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #1  Posted: Thu Aug 21, 2014 10:41 am Post subject: Learning the Elliott Waves is difficult but not impossible Posted: Thu Aug 21, 2014 10:41 am Post subject: Learning the Elliott Waves is difficult but not impossible |

|

|

Hi Guys,

I am starting this new platform so that we can all learn and share our learnings in Elliott waves. There are many reasons to start this tread which are follows:

1. 80% of the Institutional investing takes based on Elliott waves.

2. Many indicators such as RSI, Stockastics and MACD fail when the market is trending and many people buy when the RSI, stockastics etc are oversold, but even after being oversold market tends to move lower. Because the market is trending these indicators fail. They have limitations and they only work in consolidating or trading market.

3. As normal investor tendency I can understand why every doesnt wants to learn Elliott wave, I learned easy indicators such as RSI, MACD, Stockastics and never tried to learn Elliot wave because it was difficult. But I was very often amazed by many people predicting market so accurately that I also developed a burning desire to learn Elliott waves. So is with every 1 of us here. we also want to predict the markets and know how they may act.

Many, years ago I did not had resources to learn it but now I have accumulated the resources as well. WHich I am sharing with you all.

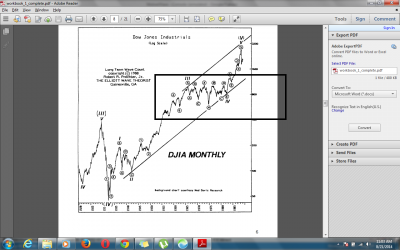

1. THe wave Prinipal - Robert Prechter and AJ Frost (book available on Torrent)

2. Elliott wave Educational Video Series - by Robert Prechter

3. Elliott wave Educational Video will require the workbook as well which is availble on http://www.elliottwave.com/dvdworkbooks/

I wanted to discuss the elliottwaves but I did not find relevnt forum. Actually there are many on Foriegn markets but no proper forum for Indian. Here on icharts also I found few people sharing thier views based Elliott waves but learning resource was still missing.

Hope that we will enhance our learning and not restrict ourselfs to orthodox easy technical methods but come out of our comfort zones to learn something new. Bang the markets

Last edited by Ruchirgupta2000 on Tue May 19, 2015 5:32 pm; edited 1 time in total |

|

| Back to top |

|

|

|

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #2  Posted: Thu Aug 21, 2014 11:09 am Post subject: Posted: Thu Aug 21, 2014 11:09 am Post subject: |

|

|

Bank Nifty seems to be in a wave 4 Consolidation and may move 3000- 3500 from here. see the attached images. Experts please comment your views.

| Description: |

|

| Filesize: |

177.66 KB |

| Viewed: |

929 Time(s) |

|

| Description: |

|

| Filesize: |

33.52 KB |

| Viewed: |

846 Time(s) |

|

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #3  Posted: Mon Aug 25, 2014 11:47 pm Post subject: Bank Nifty Wave 1 is complete and wave 2 correction in progr Posted: Mon Aug 25, 2014 11:47 pm Post subject: Bank Nifty Wave 1 is complete and wave 2 correction in progr |

|

|

Hi all,

I thought I did not learn any thing but, I cought a full 5 wave move in Banknity. this wave from 14700 till 15950 is a wave one of a much bigger wave 5. Reffer to previous chtart posted on 21st March.

Mind that it will have 3 waves of correction AB and C and A wave is in progress right now. B wave will pull upwards and then C will again go down. Now this correction could retrace til following levels.

23.6% 15675 ( which is already passed

38.2% 15491

50% 15342

61.8% 15193

Please dont take it as any recommendation since i am just a beginner in Elliott waves.

| Description: |

|

| Filesize: |

43.35 KB |

| Viewed: |

838 Time(s) |

|

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #4  Posted: Tue Aug 26, 2014 9:58 am Post subject: Posted: Tue Aug 26, 2014 9:58 am Post subject: |

|

|

We can see 300 points down from here or 1.618* 300=485.4 points down from here.. just see dont trade. I am very new.

Trget 1 -15352

Target2- 15167

| Description: |

|

| Filesize: |

34.88 KB |

| Viewed: |

698 Time(s) |

|

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #5  Posted: Tue Aug 26, 2014 10:12 am Post subject: Posted: Tue Aug 26, 2014 10:12 am Post subject: |

|

|

15343 is a 50% retracement of this move from 14700 to 15950.

Wave A is over with about 300 points of correction.

Wave B is in progress and has retraced some part of Wave A.

Wave C is expected to be = WAve A or 1.618 times Wave A.

if Wave C = Wave A if will find support at 15340 levels as there will be fibonacci cluster , 1 is 50% retracement of the recent upmove and 2nd Wave A and Wave C length match.

I am not trading on any these moves because I am not confident right now and whould also like the comments from seinier members on what all improvements I can make .

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #6  Posted: Tue Aug 26, 2014 11:16 am Post subject: Posted: Tue Aug 26, 2014 11:16 am Post subject: |

|

|

After reading the Elliott Wave Principle- AJ Frost and Robert Prechter I jumped to "How to identify high profit Elliott waves in real time" Myles Wilson Walker that is too different from original Elliott waves.

and this second book is based on "Mastering Elliott Waves" by by Gleen Neely..

I read comments from many people who just want to stick to original Elliott waves as those who were practing original Elliott waves were finding the other books that have been written by other authors very different.

From lot of reaserach I came to know about few authors who have written well explained Elliott wave books that are

1. Five waves to financial freedom by Ramakrishan Ramki

2. Mastering wave Priniclpe by Constance Brown

3. Books by Jeffery Kenedy (trainer at Elliott wave International)

4. Books by Wayne Gorman (trainer at Elliott wave International)

Looking up to build a solid foundation of Elliot Waves.

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #7  Posted: Tue Aug 26, 2014 11:23 am Post subject: Posted: Tue Aug 26, 2014 11:23 am Post subject: |

|

|

Wave C seems to be in action

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #8  Posted: Fri Sep 05, 2014 9:50 pm Post subject: Posted: Fri Sep 05, 2014 9:50 pm Post subject: |

|

|

Impressed by experts pin pointing the market on the exact turns and predicting Exact prices I decided to learn Elliott wave. But I found that there was no teaching material available.

Where I have reached so far is...

I have completed "Elliott Wave Principle" by Robert Prechter

I got cought up by reading the name of this book , "How to find High Profitabilty Elliott Wave in real time" which is not a actuall Elliott wave. I must have the reviews.

Then I started reviews of people purchasing Elliott wave books and found that there were few people who said that they wanted to learn the pure Elliott Waves as tought by Preachter (Elliott Wave International) and they said that many analyst have further analysed Elliott waves and have twisted the rules which they say is not Elliott Wave.

Reading all such Comments I decided not to Read Gleen Neely's "Mastering Elliott Wave" THough I will read it but after having expertise in original Elliott wave so that I can Distinguis the differences.

Then What to read? reading the comments of old traders are ratings I decided to read 2 Books- "Mastering Elliott wave Prinicple" by Constance Brown and Robert Miner's "Dynamic Trading"

Good thing about Constance Brown Books reviews were that the book teaches how to really identify Waves against all the Theroies tought in the earlier books. and they said it answers the questions left over by Robert Precter's Elliott wave book. I started reading it but left it coz I was more fascinated by Robert Miner Book which was teach the comprihensive approach of not just the Elliot wave but Time prediction and price prediotn and converging them all much more high probabilty trade rather than just based on Elliott wave. I have finish this book. The first book in life with 500 pages. I was mesmersied by the kind of information he has revealed and the book kept me reading itself.

Lets get united to defeat the bigger players.

Last edited by Ruchirgupta2000 on Tue May 19, 2015 5:42 pm; edited 1 time in total |

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #9  Posted: Fri Sep 05, 2014 11:34 pm Post subject: Posted: Fri Sep 05, 2014 11:34 pm Post subject: |

|

|

Great show and admirable learning.

You say you don't want to read glen Neely- wonder whether you or me can understand glen Neely so quick. With 4-5 scenarios of each situation and which unfolds much latter

You say u left Constance Brown book. She I was told charges INR 15 lakhs for a trading course. Hope it's not mistaken identity.

Looking for an excel of miners time projections

I am encouraged by your words and hope me and everyone can do like you and read more..........

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #10  Posted: Sat Sep 06, 2014 12:47 am Post subject: Posted: Sat Sep 06, 2014 12:47 am Post subject: |

|

|

And u would be amazed to know that behind our novice attempts to learn EW basics, the "most important fight" is being played out with sensex at 27000 and nifty at 8050 ...........

Which will determine what the scenario wad there post 2003-2008 rally.......,,,, a 5 legged ascending triangle or a 7 legged diametric

Point is only after the action in these 2-3 months of 2014, we would be able to label the moves post 2008...........

Just imagine .!!!!

Fii fund flow for me shallbe the most critical factor in guess this

I am certainly in 0-1 percent of EW learning stage...... May be less.... For a true fact..... And your topic of thread is well thought out

|

|

| Back to top |

|

|

opportunist

White Belt

Joined: 27 Apr 2010

Posts: 356

|

Post: #11  Posted: Sat Sep 06, 2014 7:11 pm Post subject: Posted: Sat Sep 06, 2014 7:11 pm Post subject: |

|

|

| Ruchirgupta2000 wrote: | Impressed by experts pin pointing the market on the exact turns and predicting Exact prices I decided to learn Elliott wave. But I found that there was no teaching material available.

Where I have reached so far is...

I have completed "Elliott Wave Principle" by Robert Prechter

I got cought up by reading the name of this book , "How to find High Profitabilty Elliott Wave in real time" which is not a actuall Elliott wave. I must have the reviews.

Then I started reviews of people purchasing Elliott wave books and found that there were few people who said that they wanted to learn the pure Elliott Waves as tought by Preachter (Elliott Wave International) and they said that many analyst have further analysed Elliott waves and have twisted the rules which they say is not Elliott Wave.

Reading all such Comments I decided not to Read Gleen Neely's "Mastering Elliott Wave" THough I will read it but after having expertise in original Elliott wave so that I can Distinguis the differences.

Then What to read? reading the comments of old traders are ratings I decided to read 2 Books- "Mastering Elliott wave Prinicple" by Constance Brown and Robert Miner's "Dynamic Trading"

Good thing about Constance Brown Books reviews were that the book teaches how to really identify Waves against all the Theroies tought in the earlier books. and they said it answers the questions left over by Robert Precter's Elliott wave book. I started reading it but left it coz I was more fascinated by Robert Miner Book which was teach the comprihensive approach of not just the Elliot wave but Time prediction and price prediotn and converging them all much more high probabilty trade rather than just based on Elliott wave. I have finish this book. The first book in life with 500 pages. I was mesmersied by the kind of information he has revealed and the book kept me reading itself.

Mind that Robert Miner book must be read only after reading "Elliott Wave Principle".

Right now I am making the Time prediction based on Miner's methods on Excel and will share it soon.

Hope many of you had given up learning Elliott wave may start reading this book. just google search miner's Book and you will get it.

Robert Preachter book can be found on "Elliott Wave International Website"

I Will Upload Constance Brown's Book here in few days.

Lets get united to defeat the bigger players.

|

It raises my hope to learn this arcane subject finally. Your valuable advice cleared me to at least try valiantly once more ( this time more methodically) taking heart from the fact that somebody had been able to make use of this method which I had resigned to look like an elaborate hoax.

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #12  Posted: Sat Sep 06, 2014 9:03 pm Post subject: Posted: Sat Sep 06, 2014 9:03 pm Post subject: |

|

|

.......Lets get united to defeat the bigger players......

Ruchir, while I am all for learning whatever possible to master the art of trading/investing, IMHO, if by 'big players' you mean FIIs, no one can defeat them technically. One has to learn to think like that they do. At least that is what my attempt has been for last 2 years but I got to nowhere ...... yet and with God's grace, if I learn even 20% of that, I think I will have achieved something.

|

|

| Back to top |

|

|

singh.ravee

Yellow Belt

Joined: 12 Aug 2010

Posts: 678

|

Post: #13  Posted: Sun Sep 07, 2014 10:34 am Post subject: Posted: Sun Sep 07, 2014 10:34 am Post subject: |

|

|

| Ruchirgupta2000 wrote: |

Lets get united to defeat the bigger players.

|

what a wishful thinking

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #14  Posted: Sun Sep 07, 2014 6:41 pm Post subject: Posted: Sun Sep 07, 2014 6:41 pm Post subject: |

|

|

Nothing can be more true .... That wrong expression " defeat" but as Vinay pointed, even if one learns 20 percent ...... May be much less..... He atleast would be trying to be above the "general crowd..".....

In any subject in life, learning would have " coincidental ancillary and intextrically linked" benefits from learning .......... That would help the trader for sure.

Obviously the target is truly and truly unrealistic but the journey would yield the " desired benefits an individual trader wishes to have".

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #15  Posted: Sun Sep 07, 2014 6:48 pm Post subject: Posted: Sun Sep 07, 2014 6:48 pm Post subject: |

|

|

| amitagg wrote: | Nothing can be more true .... That wrong expression " defeat" but as Vinay pointed, even if one learns 20 percent ...... May be much less..... He atleast would be trying to be above the "general crowd..".....

In any subject in life, learning would have " coincidental ancillary and intextrically linked" benefits from learning .......... That would help the trader for sure.

Obviously the target is truly and truly unrealistic but the journey would yield the " desired benefits an individual trader wishes to have". |

Why I say because for example, my trade on crude this Friday itself.....

From 6500 it is charting EW pattern. 3rd was particular level ( in think 61.8 ) of 1st... Was not sure whether it was an impulse from 6500 to be there in 5 waves OR some complex corrective having completed and that is 3 rd already at 5640.... I just saw on two timeframe charts of " a triangle forming" and big bearish candles and bull candles were smaller.... And therefor expected break down as I posted in morning on Friday.

This knowledge as everyone is aware is 0.0000001 percent of what EW/ neo wave is..... Yet it helped. ...... Little knowledge is dangerous but then we in our lifetimes cannot or may be not grasp the knowledge universe has in itself.....

|

|

| Back to top |

|

|

|