| View previous topic :: View next topic |

| Author |

Low Risk Option Strategy |

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #31  Posted: Thu Aug 01, 2013 8:05 am Post subject: Posted: Thu Aug 01, 2013 8:05 am Post subject: |

|

|

| SwingTrader wrote: |

** shekharinvest, actually the max reward for this trade would be 68 pts (max reward = diff btw strikes minus cost of trade) since you have paid 32 pts as cost of the trade. But still max reward would probably come to around 18% on trade margin which is great!

Keep posting! |

Thanks ST for correction. What is meant is- the max a given Spread can achieve is 100, the net gain in the present scenario will be 68.

On the lighter note ones we have committed ourselves to a trade what ever we get in the end is a REWARD only

SHEKHAR

|

|

| Back to top |

|

|

|

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #32  Posted: Thu Aug 01, 2013 8:23 am Post subject: Posted: Thu Aug 01, 2013 8:23 am Post subject: |

|

|

druzva,

This strategy does not use time decay to make money, in fact the spread is used to help avoid any loss due to time decay and it also neutralize any change in premium because of change in volatility. Of course, it does gain money as the time passes and market moves in our direction.

The strategy is purely a directional call.

With following two objective in mind

1) If we take a position in Nifty future, is our risk limited ?

No, although we have a defined SL but with Gap's of nearly 90-100 points against you, one may end with double the anticipated loss and god forbid if have Circuit filter kind of a situation … loss could be much more. This strategy limits our loss the moment we take a trade.

2) If our direction is right why not go for a naked CALL/PUT ?

a) Option looses its time value on daily basis however small it may be, suppose Nifty stays that way (at the same level) for 15 days without much movement you will notice that half of you premium have been consumed.

b) You buy option when the market was in a high volatilty phase, premium are more and the volatility subsides in next few days you will again see that the worth of the option is reduced by substantial amount.

c) By selling an option against a buy we are bringing down the cost of trade / risk too.

So what we do here

We buy Option to limit the loss from scenrio 1 and we create a Spreads to Limit the loss due to time decay and change in volatility as in scenerio 2, the loss in one leg is almost covered by an equal gain in the other leg and bring down the risk to still lower level.

So long as our direction is right we will end up making money. Limited though.

SHEKHAR

Last edited by shekharinvest on Thu Aug 01, 2013 8:36 am; edited 1 time in total |

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #33  Posted: Thu Aug 01, 2013 8:35 am Post subject: Posted: Thu Aug 01, 2013 8:35 am Post subject: |

|

|

| the important aspect of this trade is that loss is limited even if one goes completely wrong about the trend as compared to only writing an option in a wrong trade, particularly in case of a big gap up/down open.

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #34  Posted: Thu Aug 01, 2013 8:43 am Post subject: Posted: Thu Aug 01, 2013 8:43 am Post subject: |

|

|

| shekharinvest wrote: |

....

....

On the lighter note ones we have committed ourselves to a trade what ever we get in the end is a REWARD only

SHEKHAR |

So true, very well said.

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #35  Posted: Thu Aug 01, 2013 1:45 pm Post subject: Posted: Thu Aug 01, 2013 1:45 pm Post subject: |

|

|

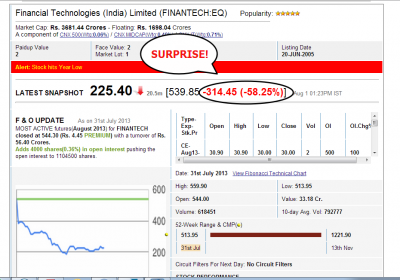

No trader likes these kind of surprises. Please note these are no two bit companies, still there is no verifiable adverse news about them.

NB: Closed my spread will write on it latter.

SHEKHAR

| Description: |

|

| Filesize: |

68.25 KB |

| Viewed: |

544 Time(s) |

|

| Description: |

|

| Filesize: |

66.86 KB |

| Viewed: |

529 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #36  Posted: Fri Aug 02, 2013 7:24 am Post subject: Posted: Fri Aug 02, 2013 7:24 am Post subject: |

|

|

EXITs

This part is for addressing the most important components of trade planning.

Stoploss point – Price wise : When value of spread falls below 12 (i.e. out of initial investment of 32, we are not ready to loose more then 32-12 = 20 Rs) Note: I took trade nearly at 6000 NS approx and stop would have been recent high about 80-90 pts above, my rough estimate that spread will loose about 20 points if it proves me wrong in short term. Or we can also keep high as SL and come out whatever the market decides to gives us back

Stoploss point – Time wise :When 4 -6 days are remaining for expiry and position is still in loss

Profit taking – Direction wise :When my view about market's direction has changed from bearish to bullish or sideway.

Profit taking – Price wise : When atleast 80% of potential max profit is achieved. Better to move on to next opportunity rather then waiting for last bit of profit.

EXITs is something that depends from trader to trader hence there is no single correct solution for it. But above points will help you in preparing in advance for eventuality. Once we are in trade, emotions start impacting our decision making capability hence it is better to think about them right now when there is nothing is at stake.

|

|

| Back to top |

|

|

pkholla

Black Belt

Joined: 04 Nov 2010

Posts: 2890

|

Post: #37  Posted: Fri Aug 02, 2013 10:22 am Post subject: Posted: Fri Aug 02, 2013 10:22 am Post subject: |

|

|

| shekharinvest wrote: | | Profit taking – Price wise: When atleast 80% of potential max profit is achieved. Better to move on to next opportunity rather then waiting for last bit of profit. |

Shekhar: Please continue posting. Great stuff. Rgds, Prakash Holla

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #38  Posted: Sun Aug 04, 2013 6:53 am Post subject: Posted: Sun Aug 04, 2013 6:53 am Post subject: |

|

|

Selection of the right strike price

One of the important consideration for options system is the selection of strike and right strategy.. Keeping in mind the objective.

One can use TA to form the view about the market and get trading bias but that's where TA's job is over and one has to wear the hat of option trader from now on.

Let us take the trade posted by SVKUM here..

http://www.icharts.in/forum/low-risk-option-strategy-t5280,start,30.html as an example

Trade1: The spread that was selected – 5900/6000 Bullish Call spread @ cost of 40. and Nifty was at 5898 on July 01, 2013,

Max value that this spread can achieve is 100, and that's too when

1) One holds this till expiry and

2) market expires above 6000.

If mkt goes above 6000 before expiry, the spread will not be worth 100 because of the time value component of the option.

Max profit potential is 100 - 40 = 60 points.

Trade2: Compare this with the 5800/5900 Call spread . At closing on July 01, 2013, it was available at net price of 59 Rs (i.e. =156 - 97 ). The spread is already in the money.

There is a higher probability that mkt closing will be above 5900 than say it closing above 6000.

So you have much higher probability of this strike giving you full value of

100 (i.e. profit of 41 Rs) than your spread which still has to see the light of the day. With each passing day, OTM spreads will have lesser probability of getting into the Green whereas the probability of ITM spread keeps going up with each passing day..

Hope you are able to see my point here.. The trade off of both spreads from options traders mindset will be

Trade 1 = 60 Rs profit on the risk of 40 but low probability of success

Trade 2 = 41 Rs profit on the risk of 59 but much higher probability of success

Another points is important to notice with Spreads is that they are slow moving trade. Ex. in 5900-6000 spread to gain 60pts market needs to move 150 points and stay there for next 15 days. On July 18, @ NS 6038 Trade 2 spread was giving us 95 whereas trade 1 spread was still at 79. and on July 25 expiry trade 2 yeilded full 100 points and trade 1 ended in a loss with nifty closing at 5907.

Trading Deep ITM spreads is a favourite strategy for limited risk income generation.

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #39  Posted: Sat Sep 28, 2013 11:07 am Post subject: Posted: Sat Sep 28, 2013 11:07 am Post subject: |

|

|

By the time Aug series came to a close Market had entered a volatile phase. I gave a miss to the spread trade in Sept series for the obvious reasons. Still VIX is at 24 but slowly coming down indicating a comparatively calmer phase (hopefully)

Sept Series closed at 5882 and the Oct. series started on a negative note Bias is negative (my view).

Trade:

Buy PUT 6000 @ 220 Oct Series Closer to EOD on 27/09/13

Sell PUT 5900 @ 169

Breakeven point: 5949 @ Expiry

Cost of Trade: 51

Profit Potential: 49 Nifty expiry @ or below 5900

Stop loss: Nifty moving above 6040 in next few days or Roughly half the premium loss.

Required Margin: 15450

Max Loss: 2550

Max Gain: 2450

Happy Trading !

|

|

| Back to top |

|

|

paa

White Belt

Joined: 28 Sep 2010

Posts: 178

|

Post: #40  Posted: Sun Sep 29, 2013 11:51 am Post subject: Posted: Sun Sep 29, 2013 11:51 am Post subject: |

|

|

Shekhar

Thanks for posting this stuff!

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #41  Posted: Mon Oct 28, 2013 7:38 pm Post subject: Posted: Mon Oct 28, 2013 7:38 pm Post subject: |

|

|

Before I post fresh trade here is the summary of the previous trade as it happened, all on the Chart. Chart is an old one with notes, when the trade was closed. Could not post then.

| Description: |

|

| Filesize: |

89.68 KB |

| Viewed: |

550 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #42  Posted: Mon Oct 28, 2013 7:59 pm Post subject: Posted: Mon Oct 28, 2013 7:59 pm Post subject: |

|

|

Although, next expiry is yet to begin It seems market has turned down for now hence initiating fresh trade with bearish view.

Trade:

Buy PUT 6100 @ 118 Nov Series Closer to EOD on 28/10/13

Sell PUT 6000 @ 86

Breakeven point: 6068 @ Expiry

Cost of Trade: 32

Profit Potential: 68 Nifty expiry @ or below 6000

Stop loss: Nifty moving above 6200 in next few days or Roughly Rs 20 premium loss or Trend reversal any time (as per my understanding)

Required Margin: 16990

Max Loss: 1600

Max Gain: 3400

Happy Trading ! Mr. Green

|

|

| Back to top |

|

|

|