| View previous topic :: View next topic |

| Author |

Low Risk Option Strategy |

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #1  Posted: Sat Jul 27, 2013 1:21 pm Post subject: Low Risk Option Strategy Posted: Sat Jul 27, 2013 1:21 pm Post subject: Low Risk Option Strategy |

|

|

Option trade posted by Nitin in F&O section, refreshed my memories about a fellow trader AW10 who has narrated this low risk strategy and shown how to trade it real time.

This is not for people who are interested in fast pace - heart pumping trading but for those who would like to generate a regular profit albeit in small measures in a laid back style, while taking a limited risk.

In the following posts I shall be posting the broad contour of the strategy (most of it from the notes I have taken courtesy AW10) and the trade which I took on July 24 and how it develops in the coming days.

Happy Trading !

SHEKHAR

|

|

| Back to top |

|

|

|

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #2  Posted: Sat Jul 27, 2013 6:27 pm Post subject: Posted: Sat Jul 27, 2013 6:27 pm Post subject: |

|

|

You might be in for some surprises here by knowing that:

i) you can use PUTs to take bullish position and can use CALLs to

take bearish position.

ii) time decay can't hurt you

iii) market can pay you partially for taking a trade and reduce your risk

iv) you can execute trades with very high probability on your side

and generate regular income

v) you can play against market (contrarian ) with very limited risk

vi) you can have a position in the market which has a leg which is 100% winner.

So starting this thread to discuss SPREADS...

Last edited by shekharinvest on Sat Jul 27, 2013 6:40 pm; edited 1 time in total |

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #3  Posted: Sat Jul 27, 2013 6:38 pm Post subject: Posted: Sat Jul 27, 2013 6:38 pm Post subject: |

|

|

What are Spreads ?

Spreads are Limited Risk / Limited Reward strategies.

They can be constructed using either PUT or CALL options.

They are directional strategy - Bullish or Bearish

It involves 2 options trades - Buying Option of a given strike and at the same time selling another option of different strike price.

Cost of the trade = Difference of premium that you pay for buying first leg minus the premium you collect for selling the other leg.

Maximum Risk = LIMITED. Cost of trade that is calculated above. (Isn't it less risky then buying naked call where whole of your premium is at risk)

Maximum Reward = LIMITED. Difference of the two strike prices minus the money that you have paid to open this trade.

|

|

| Back to top |

|

|

sambhaji_t

White Belt

Joined: 31 Mar 2008

Posts: 135

|

Post: #4  Posted: Sat Jul 27, 2013 6:48 pm Post subject: Posted: Sat Jul 27, 2013 6:48 pm Post subject: |

|

|

Thank you very much

I was looking for such a setup which can give small but regular income

|

|

| Back to top |

|

|

paa

White Belt

Joined: 28 Sep 2010

Posts: 178

|

Post: #5  Posted: Sat Jul 27, 2013 7:09 pm Post subject: Posted: Sat Jul 27, 2013 7:09 pm Post subject: |

|

|

| Keep it up good show!

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #6  Posted: Sun Jul 28, 2013 11:53 am Post subject: Posted: Sun Jul 28, 2013 11:53 am Post subject: |

|

|

I tried and practiced it, most probably you may not be able to realize your profit till the end and most of the times even you may not be able to square of the position on your own at a rational level. Due to this reason quite often I kept my positions without closing, leaving it to exchange settlement. In this way at least my both options closed at the same price. I paid some fine to exchange for not closing ITM options, which was far better than squaring of my positions on my own at irrational levels which makes serious dents to my profits.

Due to this very reason the directional move should stay valid till the end of the expiry which increases our risk level.

This is the case when I traded in RPOWER and RCOM options taking a call on the directional movement. It may not be valid for the highly liquid options like Nifty.

|

|

| Back to top |

|

|

svkum

White Belt

Joined: 14 Feb 2007

Posts: 321

|

Post: #7  Posted: Sun Jul 28, 2013 1:17 pm Post subject: Posted: Sun Jul 28, 2013 1:17 pm Post subject: |

|

|

nifty was at 5900 on 1/7/13

in case of bullish view

spread wd be

buy 5900call -- at 92

sell 6000call--at 52 (net outflow-40)

at expiry nifty was 5907

loss on buy call =85

gain on sell call =52

net loss =33

overall gain 7 ????? in initial position ??

but ultimately loss is 33 pts

any improvement would have been made ????

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #8  Posted: Sun Jul 28, 2013 2:58 pm Post subject: Posted: Sun Jul 28, 2013 2:58 pm Post subject: |

|

|

| rk_a2003 wrote: | I tried and practiced it, most probably you may not be able to realize your profit till the end and most of the times even you may not be able to square of the position on your own at a rational level. Due to this reason quite often I kept my positions without closing, leaving it to exchange settlement. In this way at least my both options closed at the same price. I paid some fine to exchange for not closing ITM options, which was far better than squaring of my positions on my own at irrational levels which makes serious dents to my profits.

Due to this very reason the directional move should stay valid till the end of the expiry which increases our risk level.

This is the case when I traded in RPOWER and RCOM options taking a call on the directional movement. It may not be valid for the highly liquid options like Nifty. |

rk,

In Indian market options are thinly traded except for Nifty hence the spread (difference between Ask and Bid) is usually absurd and the moment you move to OTM options you won't even find enough volume to trade. Hence it is very difficult to earn thru options even by buying naked calls/puts. You should not be surpised, if I tell you that when I started 5-6 years back I was being charged Rs 150 per lot (broker's default rate) liquidity and cost has always been an issue.

We get reasonable spread in NIFTY options even 300-400 points OTM therefore, I would be concentrating on them only.

Trading options is cheap now

Last edited by shekharinvest on Sun Jul 28, 2013 4:12 pm; edited 1 time in total |

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #9  Posted: Sun Jul 28, 2013 3:28 pm Post subject: Posted: Sun Jul 28, 2013 3:28 pm Post subject: |

|

|

| svkum wrote: |

any improvement would have been made ???? |

SVKUM sir, nice to you here.

Answer to your question is emphatic yes, and I shall come to it later in my posts.

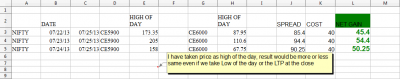

Please see the attached file you will notice that on three days July 22, 23 & 24 there was a reasonable gain where one could have booked.

| Description: |

|

| Filesize: |

17.66 KB |

| Viewed: |

831 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #10  Posted: Sun Jul 28, 2013 4:06 pm Post subject: Posted: Sun Jul 28, 2013 4:06 pm Post subject: |

|

|

Where to Start in Options Trading

To make money in any trading (stocks, goods, options or anything), very first thing to know is the direction of the market. Can you make money by buying something, when market is falling. So very first thing you need to learn is to identify the current trend of the market (up, down or sideway). Better you are in this, solid is your foundation. E.g. If you are in Nagpur and want to go to Delhi, then first thing you have to do is to be on platform where Northbound trains are arriving, and then you need to board the right train for your destination. No great deal but just common sense.. But you will surprised to see how often it is not followed in market where people buy, when market is going south.

Once you know the direction of market or stock that you want to trade, then choose appropriate option strategy for this.

There are 6 basic risk graphs in core option and stock strategy. All other strategy is just combination of these 6 basics. They are Buy Stock, Sell stock, Buy Call, Sell Call, Buy Put, Sell Put. Spend as much time as required to understand them on parameters I am going to mention in next point.

For any strategy (including the 6 basic one), know how they are constructed, what is max risk, what is max reward, where is BREAK-EVEN point, How the risk graph looks like at expiry, suitable market condition favourable for these strategies. Once, you should be able to draw risk graph without any option analysis tool, then u pass out from this stage.

Understand the concept of option pricing, intrinsic value and time value, the factors that affect option premium. Focus on not the theory, but how change in those factors will affect the premium. Watch them in real life, experiment with them using option calculator.

This is just to give base in option trading, so that you can plan an option trade properly. Remember, that doesnt make you a trader still. Trading involves Money mgmt, psychology, risk mgmt, system testing etc which is beyond the scope of this post.

If you know stock trading (better have good track record in stock trading), then few initial steps are not required.

But that is not limitation, even if you have never traded stocks. As long as you learn to read market trend, you can start with options trading.

Last edited by shekharinvest on Mon Jul 29, 2013 7:35 am; edited 3 times in total |

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #11  Posted: Sun Jul 28, 2013 4:42 pm Post subject: Posted: Sun Jul 28, 2013 4:42 pm Post subject: |

|

|

| what do you mean by drawing risk graph?

|

|

| Back to top |

|

|

saumya12

Brown Belt

Joined: 21 Dec 2011

Posts: 1509

|

Post: #12  Posted: Mon Jul 29, 2013 1:03 am Post subject: Posted: Mon Jul 29, 2013 1:03 am Post subject: |

|

|

| Thanks Shekhar for starting this thread.

|

|

| Back to top |

|

|

saumya12

Brown Belt

Joined: 21 Dec 2011

Posts: 1509

|

Post: #13  Posted: Mon Jul 29, 2013 1:06 am Post subject: Posted: Mon Jul 29, 2013 1:06 am Post subject: |

|

|

| rk_a2003 wrote: | I tried and practiced it, most probably you may not be able to realize your profit till the end and most of the times even you may not be able to square of the position on your own at a rational level. Due to this reason quite often I kept my positions without closing, leaving it to exchange settlement. In this way at least my both options closed at the same price. I paid some fine to exchange for not closing ITM options, which was far better than squaring of my positions on my own at irrational levels which makes serious dents to my profits.

Due to this very reason the directional move should stay valid till the end of the expiry which increases our risk level.

This is the case when I traded in RPOWER and RCOM options taking a call on the directional movement. It may not be valid for the highly liquid options like Nifty. |

Hi RK

You said you pay some fine to the exchange for not closing ITM options.

Cant believe.

You paid fine to the exchange OR paid the hefty STT on the trade that was closed by exchange, being in ITM.

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #14  Posted: Mon Jul 29, 2013 6:51 am Post subject: Posted: Mon Jul 29, 2013 6:51 am Post subject: |

|

|

| Thanks Shekhar...

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

|

| Back to top |

|

|

|