|

|

| View previous topic :: View next topic |

| Author |

magic of macd |

rrk2006hyd

Yellow Belt

Joined: 13 Oct 2010

Posts: 874

|

Post: #31  Posted: Thu Mar 01, 2012 4:18 pm Post subject: Posted: Thu Mar 01, 2012 4:18 pm Post subject: |

|

|

| AJAYHKAUL wrote: | | rrk2006hyd wrote: | | AJAYHKAUL wrote: | | vinay28 wrote: | this is no fight rrk, just a healthy discussion.........one might say "vocational guidance".  |

well said Dr Vinay  |

i dont think so  ...whatever TA or FA ..point is how much ur putting some penny's in ur pocket ..at the end of day..is TRUE... ...whatever TA or FA ..point is how much ur putting some penny's in ur pocket ..at the end of day..is TRUE... |

Trading is a journey rrk2006hyd .... you win some , you lose some and if you are net positive , you are a good trader/investor. There is no tipping service in any of the threads. They are technical and/or fundamental views of the author and it is left to the reader to take a call.

Tips are for waiters -- as the professionals say( no offense meant here ) . You will not see ST provide 'tips' , but he has set up this site and shared his senti indicator so people can get valuable insights from charts and various threads. |

thank you sir, being a learner....i agreed.

|

|

| Back to top |

|

|

|

|  |

ajayhkaul

Yellow Belt

Joined: 18 Jun 2009

Posts: 866

|

Post: #32  Posted: Thu Mar 01, 2012 4:46 pm Post subject: Posted: Thu Mar 01, 2012 4:46 pm Post subject: |

|

|

| Thats the spirit rrk !... everyday is a new day in the market and we all (without exception) must keep learning with an open mind.

|

|

| Back to top |

|

|

Padkondu

White Belt

Joined: 23 Jan 2008

Posts: 120

|

Post: #33  Posted: Thu Mar 01, 2012 11:46 pm Post subject: Posted: Thu Mar 01, 2012 11:46 pm Post subject: |

|

|

"Hence message for padkondu, who has started his journey with MACD , --- its not MAGIC "

There are no young geniuses in this business, TA or FA !

Both require application, patience and discipline - so take what works for you.[/quote]

Dear ajay!

thanks for your insight in to technical indicators, MACD especially. I will always take suggestions from experts.

i neither started my journey with macd nor would i end with it. my journey into technical analysis started 5 years back, when i joined the i charts community.

if the word "magic" is reason for the trouble, here is the explanation. i spotted the 61.8% retracement coinsiding with the crossover of macd with signal line. i did make an attempt to find the relation with fib retracement and the macd cross over. that is all.

regards

Padkondu.

|

|

| Back to top |

|

|

ajayhkaul

Yellow Belt

Joined: 18 Jun 2009

Posts: 866

|

Post: #34  Posted: Fri Mar 02, 2012 12:08 am Post subject: Posted: Fri Mar 02, 2012 12:08 am Post subject: |

|

|

| SwingTrader wrote: | Padkondu,

I will only say....keep going....ignore everybody and keep building & testing trading methods, you will gain invaluable insights into how price & indicators itself behave. Eventually as others have pointed out price is the ultimate indicator and sooner or later one will come back to it and start relying on it for trend direction but you have to go through this process and develop the understanding yourself. There are no shortcuts. Wish you the best!!! |

As ST says ...keep going.... best wishes from all of us !

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #35  Posted: Fri Mar 02, 2012 8:47 am Post subject: Posted: Fri Mar 02, 2012 8:47 am Post subject: |

|

|

| singh.ravee wrote: | padkondu

hello, my limited experience with macd suggests that macd works well with congestion or rangebound markets.

I learned one method from mayur sir on how to use macd in sb long way back.

thanks and regards

ravee |

Hello Ravee,

To take advantage of MACD in rangebound/congestion markets, how to find if mkt is rangebound/in congestion?

|

|

| Back to top |

|

|

Padkondu

White Belt

Joined: 23 Jan 2008

Posts: 120

|

Post: #36  Posted: Sun Mar 04, 2012 9:04 am Post subject: Trend identification using MACD Posted: Sun Mar 04, 2012 9:04 am Post subject: Trend identification using MACD |

|

|

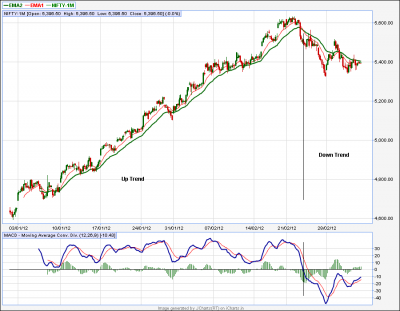

With the inspiration of ST and others, i am now posting this topic of “Capturing trend with MACD”.

1. MACD (moving average convergence and divergence), as the name itself reveals about this "trend indicator", it deals with convergence, divergence and crossover of two emas and consists of three parameter. the default set up for macd is 12/26/9. (to have better understanding about the behaviour of the indicator i suggest to put the 12ema and 26 ema on the chart along with MACD).

2. MACD consists of two lines; MACD line (blue) and the Signal line (red).

the value of MACD at any point = EMA (12) - EMA (26) or

EMA(first parameter) – EMA(second parameter)

the signal line is 9 period ema of MACD line.

3. so, here, i understand that the EMA itself being a lagging indicator of price with a smoothening factor. In macd (a) we are taking two emas and finding their difference for macd line, (b) taking the 9 period ema of macd for signal line. this is the very reason for the laggardness of MACD. thus, if one attempts to use macd for generating the buy/sell actions they are sure to run out of markets owing to this laggardness of indicators and thereby whipsaws. By the time the indicator gives the buy signal the stock may have moved much farther and may start taking a breather or correct or reverse. that is the reason for the several opinions against macd in this thread.

4. the main usage of macd is to identify trend , if there is one, in a particular time frame and then switch to some suitable entry/exit strategies for high probable trades with very good risk return ratio which shall be the ultimate objective of all traders.

5. Identification of trend using macd.

a. Macd line is above 0 and macd line is above signal line (Since macd line is above signal line, the histogram is also above 0 line.); this is a clear indication of up trend.

b. macd line is above 0 line, but belwo signal line (Since the macd line is below the signal line the histogram is also below the 0 line): the up trend is fading; leading to a consolidation (you can observe the continuation patterns such as horizontal price congestion, flags, pennanats, Ascending triangles tec., forming during these periods) which further may or may not lead to reversal of currnet up trend.

c. Macd line is below 0 and macd line is below signal line (since macd line is below signal line the histogram is also below 0): this is a clear indication of down trend.

d. macd line is below 0 but above signal line: this indicates a pull back or consolidation during a down trend which may lead to continuation of previous down trend or reversal of the down trend.

This is the basic interpretation of MACD as far as trend identification is concerned. One must understand the mostly the up trends are slow and rhythmic, while down trends are much faster & stronger, and as such the macd is at its best use during down trends and causes many whipsaws during prolonged sideways market.

This is not over. I would like to discuss a little advanced treatment of MACD, different setups for macd and their usage. Myself being a swing trader, I keep focusing only on swing trading methodologies.

| Description: |

|

| Filesize: |

42.7 KB |

| Viewed: |

626 Time(s) |

|

| Description: |

|

| Filesize: |

38 KB |

| Viewed: |

574 Time(s) |

|

Last edited by Padkondu on Mon Mar 05, 2012 5:24 pm; edited 1 time in total |

|

| Back to top |

|

|

Padkondu

White Belt

Joined: 23 Jan 2008

Posts: 120

|

Post: #37  Posted: Sun Mar 04, 2012 10:59 am Post subject: Posted: Sun Mar 04, 2012 10:59 am Post subject: |

|

|

| ajayhkaul wrote: | Sorry to disappoint you padkondu , but there is NO magic in any of the technical indicators and tools. There is no precision also . They are exactly - INDICATORS- and help you to visualize probable scenarios. However, the next event or catalyst can change everything. For example the GDP news today would have made all technicians revise their views that were formed yeaterday

Almost all indicators are lagging indicators as you are aware. ----

Hence message for padkondu,

--- its not MAGIC .

There are no young geniuses in this business, TA or FA !

Both require application, patience and discipline - so take what works for you. |

Hi ajay!

I am not at all disappointed. this is not just a message for me but for all traders. just uner line the statements by mr ajay and have a hard copy pasted on the wall opp to you trading desk.

I would like to add that there is no magic in MACD or any other tools. magicians do magic using their minds but the tools in their hands are just tools, useless in others hands. it is not easy to get hold on something. and at the end.. there are no young geniouses in this business

I am just trying to turn this laggard in to a leading indicator help us forecast some levels that turn the tables. also use this tool in a different way which i would like to post in the comeing weekends, some exclusive content on macd.

I mostly use macd to have a "feel" of market, sum up the market dynamics and resort to some faster techniques or faster time frames to take my entry/exit. i have never crossed 65-70% of accuracy so far. however, some 20% of the successful trades account of the 80% of the profits i made. then 80% of the money i lost was because of one reason, indiscipline.

regards

padkondu

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|