| View previous topic :: View next topic |

| Author |

MASTER THE ART OF SWING TRADING..... |

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #16  Posted: Wed Sep 29, 2010 8:22 pm Post subject: Re: SWING TRADING FOR DUMMIES!!!!! Posted: Wed Sep 29, 2010 8:22 pm Post subject: Re: SWING TRADING FOR DUMMIES!!!!! |

|

|

| SID2060 wrote: | Hi friends,

I have started this new Thread to share some good strategies which is useful both for swing trading as well as short term trading views.. The strategy is very simple and it works. It uses the most widely used technical tool that is Exponential moving averages...

In this strategy we will use two different ema combinations in daily charts....

1) ema 5 and ema 13 crossover

2) ema 13 and ema 20 crossover

WHEN TO BUY????

A ) Suppose ema 5 have crossed ema 13 from bottom to upside but ema 13 have not yet crossed ema 20 from bottom to upside. In this case one should wait for the confirmation of ema 13 to cross above ema 20.....

Stoploss or profit booking is when ema 13 cross below ema 20 from upside down.........

B ) Suppose ema 13 is still above ema 20 but ema 5 have crossed ema 13 from upside to the bottom side. In this case two things can happen afterwards:

1 - ema 13 also crosses ema 20 from upside to the bottom side

2 - ema 5 reverses and crosses ema 13 from bottom to upside

If No-1 happens its the confirmation to do short selling. The scrips having futures can be shorted for swing trading as short positions in cash scrips without F&O have to be squared off the same trading day.....

If No-2 happens then its a new BUY SIGNAL and one can take fresh LONG positions............

WHEN TO SELL?????

C ) Suppose ema 5 have crossed ema 13 from UPSIDE to DOWNSIDE but ema 13 have not yet crossed ema 20 from UPSIDE to DOWNSIDE. In this case one should wait for the confirmation of ema 13 to cross BELOW ema 20.....

Stoploss or Profit Booking is when ema 13 crosses ema 20 from DOWN TO UPSIDE.........

D ) Suppose ema 13 is still BELOW ema 20 but ema 5 have crossed ema 13 from BOTTOM to UPSIDE. In this case two things can happen afterwards:

1 - ema 13 also crosses ema 20 from BOTTOM TO UPSIDE

2 - ema 5 reverses and crosses ema 13 from UPSIDE DOWN

If No-1 happens its the confirmation to TAKE FRESH BUY POSITIONS........

If No-2 happens then its a new SHORTSELL SIGNAL and one can take fresh SHORT positions............

|

MODIFIED AND IMPROVED STRATEGY AS QUOTED ABOVE.......

SID

Last edited by SID2060 on Wed Sep 29, 2010 9:19 pm; edited 1 time in total |

|

| Back to top |

|

|

|

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #17  Posted: Wed Sep 29, 2010 9:14 pm Post subject: Posted: Wed Sep 29, 2010 9:14 pm Post subject: |

|

|

IMPORTANT ANNOUNCEMENT

Friends,

Since my strategy uses ema 9 and ema 18 combination. I request my followers to change it with ema 13 and ema 20 combination... All OTHER COMBINATION OR RULES WILL REMAIN THE SAME........

The reason behind such change is that ema 13 and ema 20 are available in "screener eod" whereas ema 9 and ema 18 are unavailable.... So those who have made any excel based systems can take advantage of it. Secondly this combination is bit more better and stable than the previous combination.....

I hope that i am clear..

Regards,

SID

Last edited by SID2060 on Wed Sep 29, 2010 11:22 pm; edited 1 time in total |

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #18  Posted: Wed Sep 29, 2010 9:24 pm Post subject: Posted: Wed Sep 29, 2010 9:24 pm Post subject: |

|

|

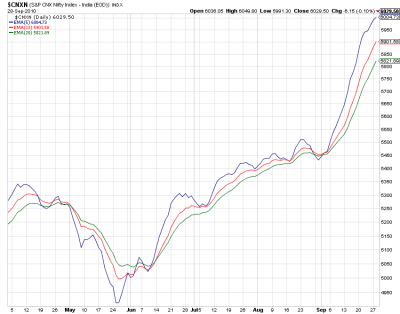

NIFTY 6 MONTHS DAILY CHART WITH EMA 5, 13 AND 20 WITHOUT PRICE FOR A CLEAR VIEW........

| Description: |

|

| Filesize: |

30.25 KB |

| Viewed: |

547 Time(s) |

|

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #19  Posted: Wed Sep 29, 2010 9:28 pm Post subject: Posted: Wed Sep 29, 2010 9:28 pm Post subject: |

|

|

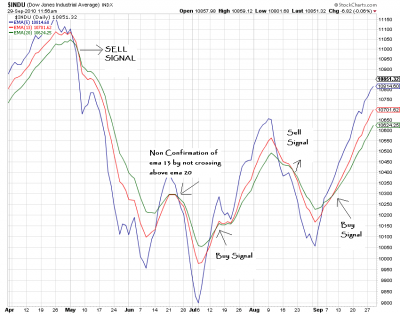

DOWJONES 6 MONTHS DAILY CHART WITH EMA 5, 13 AND 20 WITHOUT PRICE FOR A CLEAR VIEW........

| Description: |

|

| Filesize: |

42.73 KB |

| Viewed: |

684 Time(s) |

|

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #20  Posted: Thu Sep 30, 2010 2:58 pm Post subject: Posted: Thu Sep 30, 2010 2:58 pm Post subject: |

|

|

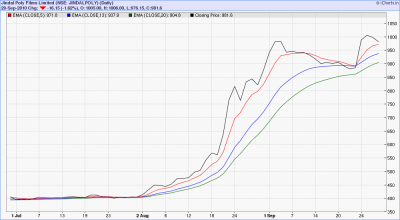

JINDALPOLY DAILY CHART

| Description: |

|

| Filesize: |

38.24 KB |

| Viewed: |

463 Time(s) |

|

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #22  Posted: Sun Oct 03, 2010 12:51 pm Post subject: Re: SWING TRADING FOR DUMMIES!!!!! Posted: Sun Oct 03, 2010 12:51 pm Post subject: Re: SWING TRADING FOR DUMMIES!!!!! |

|

|

| SID2060 wrote: | | SID2060 wrote: | Hi friends,

I have started this new Thread to share some good strategies which is useful both for swing trading as well as short term trading views.. The strategy is very simple and it works. It uses the most widely used technical tool that is Exponential moving averages...

In this strategy we will use two different ema combinations in daily charts....

1) ema 5 and ema 13 crossover

2) ema 13 and ema 20 crossover

WHEN TO BUY????

A ) Suppose ema 5 have crossed ema 13 from bottom to upside but ema 13 have not yet crossed ema 20 from bottom to upside. In this case one should wait for the confirmation of ema 13 to cross above ema 20.....

Stoploss or profit booking is when ema 13 cross below ema 20 from upside down.........

B ) Suppose ema 13 is still above ema 20 but ema 5 have crossed ema 13 from upside to the bottom side. In this case two things can happen afterwards:

1 - ema 13 also crosses ema 20 from upside to the bottom side

2 - ema 5 reverses and crosses ema 13 from bottom to upside

If No-1 happens its the confirmation to do short selling. The scrips having futures can be shorted for swing trading as short positions in cash scrips without F&O have to be squared off the same trading day.....

If No-2 happens then its a new BUY SIGNAL and one can take fresh LONG positions............

WHEN TO SELL?????

C ) Suppose ema 5 have crossed ema 13 from UPSIDE to DOWNSIDE but ema 13 have not yet crossed ema 20 from UPSIDE to DOWNSIDE. In this case one should wait for the confirmation of ema 13 to cross BELOW ema 20.....

Stoploss or Profit Booking is when ema 13 crosses ema 20 from DOWN TO UPSIDE.........

D ) Suppose ema 13 is still BELOW ema 20 but ema 5 have crossed ema 13 from BOTTOM to UPSIDE. In this case two things can happen afterwards:

1 - ema 13 also crosses ema 20 from BOTTOM TO UPSIDE

2 - ema 5 reverses and crosses ema 13 from UPSIDE DOWN

If No-1 happens its the confirmation to TAKE FRESH BUY POSITIONS........

If No-2 happens then its a new SHORTSELL SIGNAL and one can take fresh SHORT positions............

|

MODIFIED AND IMPROVED STRATEGY AS QUOTED ABOVE.......

SID  |

Its my request to Plz read the strategy carefully before going thru the charts..........

|

|

| Back to top |

|

|

smartcancerian

Yellow Belt

Joined: 07 Apr 2010

Posts: 542

|

Post: #23  Posted: Mon Oct 04, 2010 7:39 am Post subject: Posted: Mon Oct 04, 2010 7:39 am Post subject: |

|

|

| what i undertand in dis system is that Entry & Exits are primarily based on 13/20...5/13 is being used for re-entry only...its very late..in case of 3-4 whipsaws(nontrend patch as per these ema's) quite considerable has to be sacrificed..Secondly postion timing has not been mentioned..whether its to b seen/taken during the day, just before the closing bell or the next day of crossover..Backtest results with actual pts gained/lost will only give confidence in system...so pl share ur results..charts without price always luks fine...just to feel good..try Daryl Guppy multiple Ma in 5 & 15 mint charts without price..bt actual points pockted will make heart shrink..ofcourse profits will be there in DG & your suggested as well...bt lets us try how we can maximise gains in 13/20 system & minimise losses..money mangement rules etc...readers/experts contribution required...

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #24  Posted: Sun Oct 10, 2010 6:38 pm Post subject: Posted: Sun Oct 10, 2010 6:38 pm Post subject: |

|

|

BUY CAMLIN LIMITED (CAMLIN)

My strategy has given a fresh buy signal as shown in the chart below.....

| Description: |

|

| Filesize: |

51.14 KB |

| Viewed: |

485 Time(s) |

|

|

|

| Back to top |

|

|

anupama

White Belt

Joined: 19 Jun 2011

Posts: 1

|

Post: #25  Posted: Sat Jun 25, 2011 5:07 pm Post subject: Posted: Sat Jun 25, 2011 5:07 pm Post subject: |

|

|

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #26  Posted: Sat Jun 25, 2011 8:12 pm Post subject: Posted: Sat Jun 25, 2011 8:12 pm Post subject: |

|

|

Thanks SID.

Chirag - In view of my little knowledge, please confirm that this is "similar" to your 55 sma strategy except that the basis is different.

|

|

| Back to top |

|

|

chiragbvyas

White Belt

Joined: 18 Feb 2010

Posts: 469

|

Post: #27  Posted: Sun Jun 26, 2011 11:30 am Post subject: vinay Posted: Sun Jun 26, 2011 11:30 am Post subject: vinay |

|

|

vinay ,

if not getting confused then u can use this plan also.

|

|

| Back to top |

|

|

|