| View previous topic :: View next topic |

| Author |

Modified 315 Strategy for swing trading |

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #1  Posted: Thu Apr 10, 2014 3:47 pm Post subject: Modified 315 Strategy for swing trading Posted: Thu Apr 10, 2014 3:47 pm Post subject: Modified 315 Strategy for swing trading |

|

|

The first step is to understand what is 315 .. its advatages and disadvantages.

The second step is to understand some rules I have derived to use it effectively. Rules are related to effective entries, effective SL management, effective profit bookings, effective re-entries and in the end effective money management or effective safeguarding the capital.

In this post I would focus on step 1 i.e what is 315 etc.

315 Strategy for swing trading

315 is a simple swing technique which tries to identify a trend very early. In this strategy we use only EMAs name EMA 3 & EMA 15 (hence the name 315).

People ask me why EMA 3 and EMA 15 .... for me last 3 days define the immediate average price ... to find the slightly longer term trend i use the factor of 5. This is becuase 5 has an interesting relevance to markets.... we have approx 5 hours of trading everyday, 5 trading days in a week, almost 5 trading weeks in a month .... So I simply multiple 3 by 5 to get my 15 EMA which defines my medium term average price.

Now in simple terms, if our immediate average price is higher than the medium term average price that means we are entering in a bull swing ... and visa versa. Hence the strategy entries are:

We are using Total 3 Moving averages :-

Ema 15 based on High.

Ema 15 based on Low.

Ema 3 based on close.(signal line)

1 Enter Long when 3 EMA goes above 15 EMA (High)

2 Enter Short when 3 EMA goes below 15 EMA (Low)

Advantages of following 315 strategy

1. A simple technique using just 2 EMAs, no other oscilattors or indicators required. NO advanced charting softwares required.

2. System is based on following the ULTIMATE indicator available i.e price action.

3. Keeps a trader in the trend, lets the full swing to complete. Never gets a trader against the trend.

4. Since we are just following price action, we dont need to worry about divergences etc.

Disadvantages of 315 Strategy

1. Works brilliantly in a trending market but can whipsaw in extremely ranging markets. However this can be overcome by certain rules and money management to be explained later in this thread.

~~~~~~~~~~~~~~~~~~~~~~~

Asper Icharts ~ java charts you cannot apply this Formula in java charts.

You can apply this setup in icharts Platinum charts.

|

|

| Back to top |

|

|

|

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

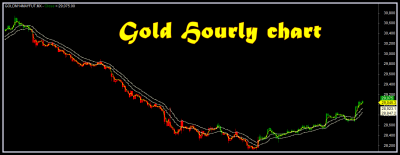

Post: #2  Posted: Thu Apr 10, 2014 3:55 pm Post subject: Gold hourly chart Posted: Thu Apr 10, 2014 3:55 pm Post subject: Gold hourly chart |

|

|

Gold hourly chart

| Description: |

|

| Filesize: |

40.29 KB |

| Viewed: |

559 Time(s) |

|

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #3  Posted: Thu Apr 10, 2014 4:40 pm Post subject: Posted: Thu Apr 10, 2014 4:40 pm Post subject: |

|

|

| what tf?

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #4  Posted: Thu Apr 10, 2014 4:48 pm Post subject: Posted: Thu Apr 10, 2014 4:48 pm Post subject: |

|

|

Intraday trades : 5 Min and 15 min Time frame.

Positional trades : 1 Hour charts for nse. 1 hour ,2 hour and 4 hours for commodities.

short term and long term (Delivery calls ) :: Eod chart.

Do paper trade some days for understand this trading concept.

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #6  Posted: Thu Apr 10, 2014 6:57 pm Post subject: ABIRLANUVO Posted: Thu Apr 10, 2014 6:57 pm Post subject: ABIRLANUVO |

|

|

Risky lowers : Aditya Birla Nuvo Limited - ABIRLANUVO

Buy 1160 call option .

Stoploss : 5.00

Target : Book profit as if you wish.

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #7  Posted: Thu Apr 10, 2014 7:06 pm Post subject: Posted: Thu Apr 10, 2014 7:06 pm Post subject: |

|

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #8  Posted: Thu Apr 10, 2014 8:08 pm Post subject: Posted: Thu Apr 10, 2014 8:08 pm Post subject: |

|

|

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #9  Posted: Thu Apr 10, 2014 8:37 pm Post subject: Posted: Thu Apr 10, 2014 8:37 pm Post subject: |

|

|

| welgro wrote: |

Intraday trades : 5 Min and 15 min Time frame.

Positional trades : 1 Hour charts for nse. 1 hour ,2 hour and 4 hours for commodities.

short term and long term (Delivery calls ) :: Eod chart.

Do paper trade some days for understand this trading concept. |

guess that 3-15 ema for 5 min to 15 min shall be "dangerous" even for intra day.......pls comment......better to look at 60 tf [for trend] and follow entry exit signals on 15tf (pr 5 tf]

|

|

| Back to top |

|

|

vishyvaranasi

Green Belt

Joined: 11 Jul 2011

Posts: 1159

|

Post: #10  Posted: Thu Apr 10, 2014 9:45 pm Post subject: Posted: Thu Apr 10, 2014 9:45 pm Post subject: |

|

|

Amit

Dont think so.Intraday we will be using 15 or max 30. Hourly ,as said we mite not get an early entry as staed by welgro

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #11  Posted: Thu Apr 10, 2014 10:18 pm Post subject: Posted: Thu Apr 10, 2014 10:18 pm Post subject: |

|

|

[/img] [/img]

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #12  Posted: Thu Apr 10, 2014 10:23 pm Post subject: Posted: Thu Apr 10, 2014 10:23 pm Post subject: |

|

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #13  Posted: Fri Apr 11, 2014 8:30 am Post subject: Posted: Fri Apr 11, 2014 8:30 am Post subject: |

|

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #14  Posted: Fri Apr 11, 2014 10:26 am Post subject: Posted: Fri Apr 11, 2014 10:26 am Post subject: |

|

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #15  Posted: Fri Apr 11, 2014 11:56 am Post subject: Posted: Fri Apr 11, 2014 11:56 am Post subject: |

|

|

|

|

| Back to top |

|

|

|