| View previous topic :: View next topic |

| Author |

MY FAILED WOLVE WAVE SET-UP - ANY TF |

chetan83

Brown Belt

Joined: 19 Feb 2010

Posts: 2037

|

|

| Back to top |

|

|

|

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #2  Posted: Thu Oct 11, 2012 8:42 pm Post subject: Posted: Thu Oct 11, 2012 8:42 pm Post subject: |

|

|

don't worry chetan, it will come one day!

|

|

| Back to top |

|

|

vishyvaranasi

Green Belt

Joined: 11 Jul 2011

Posts: 1159

|

Post: #3  Posted: Thu Oct 11, 2012 9:00 pm Post subject: hi chetan Posted: Thu Oct 11, 2012 9:00 pm Post subject: hi chetan |

|

|

hi chetan,

nice thread to start.This will give us a chance to analyse our trades failed.Nice move man.Wish everyone interested GENUINELY in WW's will participate in this thread

vishy

|

|

| Back to top |

|

|

singh.ravee

Yellow Belt

Joined: 12 Aug 2010

Posts: 678

|

Post: #4  Posted: Thu Oct 11, 2012 9:00 pm Post subject: Posted: Thu Oct 11, 2012 9:00 pm Post subject: |

|

|

hi,

i cud see it this way.

kindly clarify whats wrong in it ?

rgds

| Description: |

|

| Filesize: |

158.63 KB |

| Viewed: |

511 Time(s) |

|

|

|

| Back to top |

|

|

Arjun20

Yellow Belt

Joined: 23 Jun 2011

Posts: 945

|

Post: #5  Posted: Thu Oct 11, 2012 9:14 pm Post subject: Posted: Thu Oct 11, 2012 9:14 pm Post subject: |

|

|

| singh.ravee wrote: | hi,

i cud see it this way.

kindly clarify whats wrong in it ?

rgds |

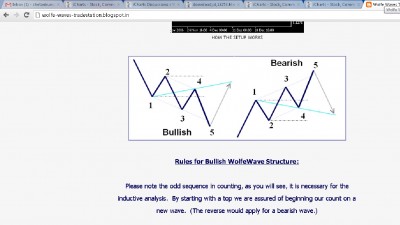

Singh praaji....The way you had drawn is not bullish set up. Bullish set up can be obtained in falling channel.

|

|

| Back to top |

|

|

Arjun20

Yellow Belt

Joined: 23 Jun 2011

Posts: 945

|

Post: #6  Posted: Thu Oct 11, 2012 9:17 pm Post subject: Posted: Thu Oct 11, 2012 9:17 pm Post subject: |

|

|

| Great initiative Chetan bhai.....

|

|

| Back to top |

|

|

chetan83

Brown Belt

Joined: 19 Feb 2010

Posts: 2037

|

Post: #7  Posted: Thu Oct 11, 2012 9:19 pm Post subject: Posted: Thu Oct 11, 2012 9:19 pm Post subject: |

|

|

| singh.ravee wrote: | hi,

i cud see it this way.

kindly clarify whats wrong in it ?

rgds |

Hi ravee paji,

I saw the bearish WW as below figure, where point 1 came in up and 2 in down, yours is opposite.

Chetan.

| Description: |

|

| Filesize: |

161.77 KB |

| Viewed: |

521 Time(s) |

|

|

|

| Back to top |

|

|

chetan83

Brown Belt

Joined: 19 Feb 2010

Posts: 2037

|

Post: #8  Posted: Thu Oct 11, 2012 9:27 pm Post subject: Re: hi chetan Posted: Thu Oct 11, 2012 9:27 pm Post subject: Re: hi chetan |

|

|

| vishyvaranasi wrote: | hi chetan,

nice thread to start.This will give us a chance to analyse our trades failed.Nice move man.Wish everyone interested GENUINELY in WW's will participate in this thread

vishy |

Hi Vishy/Arjun,

This initiative is from the great pain we take to identify a pattern in so many TF's/searching stocks.........but we fail in our endevours, at least......by any mean IF if are trading, SORRY TRADED  , a wrong set-up, then we can get a rectification here......and all can learn.... , a wrong set-up, then we can get a rectification here......and all can learn....

Thanks to Rk, Vinay, Ravee Paji, Sumesh, adsingh, prst, chandru, amitkbaid and you people (sorry, if i missed any name - cant find other names beyond last 6 WW page  ) )

Hope to learn more, so please contribute.

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #9  Posted: Thu Oct 11, 2012 10:05 pm Post subject: Posted: Thu Oct 11, 2012 10:05 pm Post subject: |

|

|

| one slight correction. Correct WWs are found in wedges and not channels. That's how Wolfe discovered them

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #10  Posted: Thu Oct 11, 2012 10:35 pm Post subject: Posted: Thu Oct 11, 2012 10:35 pm Post subject: |

|

|

The Dilemma here is how we decide the overshoot length. The overshoot can be of varied length. Sometimes after certain overshoot a COG happens and again reverse and go up further to come back and meet the targets down side, in such cases if we go long we may have to bite the SL twice.

Quite often I found double tops and double bottoms at point 5. If at all we need to go long/short at failed ww’s we need to have some other method/indicator which can confirm our action. Simply a failed ww may not be suffice for this.

Last edited by rk_a2003 on Thu Oct 11, 2012 10:43 pm; edited 1 time in total |

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #11  Posted: Thu Oct 11, 2012 10:40 pm Post subject: Posted: Thu Oct 11, 2012 10:40 pm Post subject: |

|

|

Unluckily, I traded JSWSTEEL 10 min TF - WW, Sell at 755, SL - 757, for 745.

SL was taken at 757 and JSWSTEEL rallied to new intra high of 775, almost Rs.20 from my short positions or Rs.18 from SL point.

That’s the discipline a trader needs to have. Well done Chetan for containing a possible 20 points loss for just to 2.

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #12  Posted: Fri Oct 12, 2012 8:54 am Post subject: Posted: Fri Oct 12, 2012 8:54 am Post subject: |

|

|

I have one more suggestion for day trading with ww in lower time frames. Check the advance decline ratio and overall advances are more than declines take up only long trades and vice versa. There could be exceptions like if a scrip which is in long term uptrend and forms a +ww during correction may outperform the market and the reverse is also true.

It’s a general guide line which may help in improving success rate. So, every time before you trade a ww in LTF check the market breadth.

|

|

| Back to top |

|

|

chetan83

Brown Belt

Joined: 19 Feb 2010

Posts: 2037

|

Post: #13  Posted: Fri Oct 12, 2012 8:57 am Post subject: Posted: Fri Oct 12, 2012 8:57 am Post subject: |

|

|

| rk_a2003 wrote: | I have one more suggestion for day trading with ww in lower time frames. Check the advance decline ratio and overall advances are more than declines take up only long trades and vice versa. There could be exceptions like if a scrip which is in long term uptrend and forms a +ww during correction may outperform the market and the reverse is also true.

It’s a general guide line which may help in improving success rate. So, every time before you trade a ww in LTF check the market breadth.  |

Hi Rk,

where to check this data in real time from??

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #14  Posted: Fri Oct 12, 2012 9:12 am Post subject: Posted: Fri Oct 12, 2012 9:12 am Post subject: |

|

|

| chetan83 wrote: | | rk_a2003 wrote: | I have one more suggestion for day trading with ww in lower time frames. Check the advance decline ratio and overall advances are more than declines take up only long trades and vice versa. There could be exceptions like if a scrip which is in long term uptrend and forms a +ww during correction may outperform the market and the reverse is also true.

It’s a general guide line which may help in improving success rate. So, every time before you trade a ww in LTF check the market breadth.  |

Hi Rk,

where to check this data in real time from?? |

I check it from a website.I think it's aavailable on nse website in the form of heat map,not very sure.

May be Vinay can help in this regard.

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #15  Posted: Fri Oct 12, 2012 9:36 am Post subject: Posted: Fri Oct 12, 2012 9:36 am Post subject: |

|

|

| rk_a2003 wrote: | | chetan83 wrote: | | rk_a2003 wrote: | I have one more suggestion for day trading with ww in lower time frames. Check the advance decline ratio and overall advances are more than declines take up only long trades and vice versa. There could be exceptions like if a scrip which is in long term uptrend and forms a +ww during correction may outperform the market and the reverse is also true.

It’s a general guide line which may help in improving success rate. So, every time before you trade a ww in LTF check the market breadth.  |

Hi Rk,

where to check this data in real time from?? |

I check it from a website.I think it's aavailable on nse website in the form of heat map,not very sure.

May be Vinay can help in this regard. |

NSE website--Livemarket--Overall Advances/Declines.

|

|

| Back to top |

|

|

|