| View previous topic :: View next topic |

| Author |

Nifty analysis - Welgro corner |

tinku1699

White Belt

Joined: 22 Jun 2014

Posts: 3

|

Post: #211  Posted: Wed Jul 09, 2014 5:10 pm Post subject: So whats the direction... Posted: Wed Jul 09, 2014 5:10 pm Post subject: So whats the direction... |

|

|

Hi

I'm new to business and from below explanation understood that SHORT is the call for tomorrow.

please advice.

Regards

SA |

|

| Back to top |

|

|

|

|

|

apka

Black Belt

Joined: 13 Dec 2011

Posts: 6137

|

Post: #212  Posted: Wed Jul 09, 2014 5:38 pm Post subject: Posted: Wed Jul 09, 2014 5:38 pm Post subject: |

|

|

| how do you derive live PCR ? |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #213  Posted: Wed Jul 09, 2014 5:58 pm Post subject: Re: So whats the direction... Posted: Wed Jul 09, 2014 5:58 pm Post subject: Re: So whats the direction... |

|

|

| tinku1699 wrote: | Hi

I'm new to business and from below explanation understood that SHORT is the call for tomorrow.

please advice.

Regards

SA |

Dear tinku1699,

I am doing only positional trades.Already i have position in short.

PCR and OI analysis only for understanding market trend.All updates for educational purpose.Once you understand the market trend you can trade with more confident.

How to use PCR and OI ?

For an example if you are following moving average or any other technical strategy just conform trend with PCR and IO change.Once you follow your trades with market trend you will get more accuracy trades and success ratio.

At the same time if you have holding short , Book partial profit when the OI and PCR turned bullish.vice versa long. hence book balance qty as per your exit rule.

Last edited by welgro on Wed Jul 09, 2014 6:06 pm; edited 1 time in total |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #214  Posted: Wed Jul 09, 2014 6:01 pm Post subject: Posted: Wed Jul 09, 2014 6:01 pm Post subject: |

|

|

| apka wrote: | | how do you derive live PCR ? |

Some sites provide live PCR charts,But i cannot update url here.[ Forum rules] |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #215  Posted: Wed Jul 09, 2014 6:02 pm Post subject: Posted: Wed Jul 09, 2014 6:02 pm Post subject: |

|

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #216  Posted: Wed Jul 09, 2014 7:35 pm Post subject: Posted: Wed Jul 09, 2014 7:35 pm Post subject: |

|

|

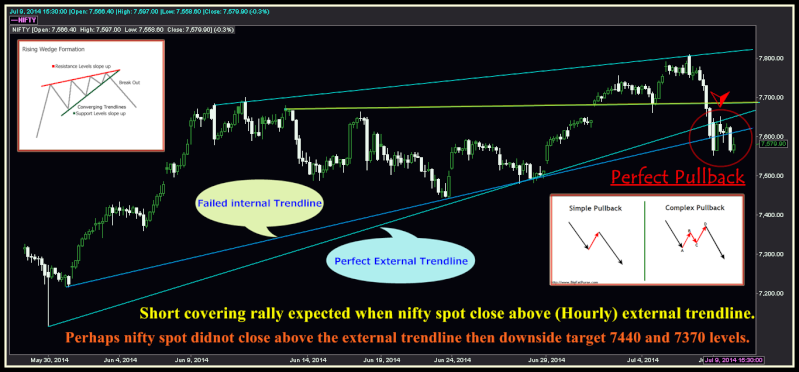

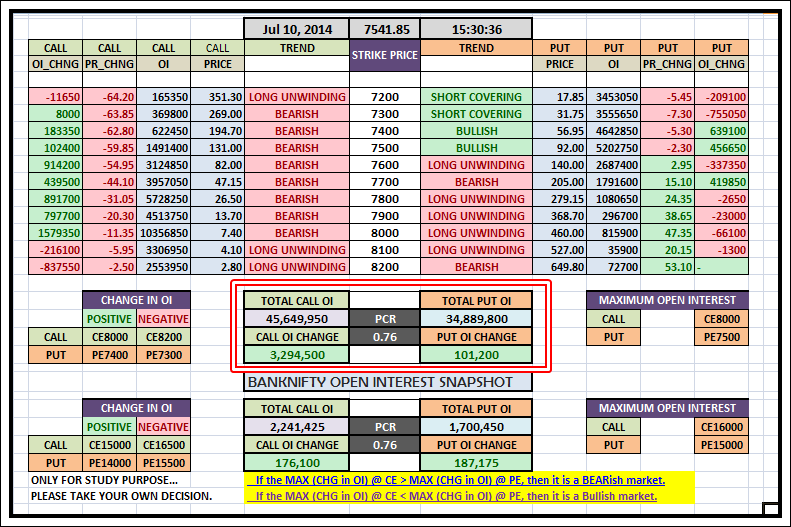

| NIFTY OPTIONS SNAPSHOT |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #217  Posted: Thu Jul 10, 2014 9:08 am Post subject: Re: Rising Wedge in nifty?? Posted: Thu Jul 10, 2014 9:08 am Post subject: Re: Rising Wedge in nifty?? |

|

|

[quote="welgro"] | Ruchirgupta2000 wrote: | The Wedge is already broken, what can I expect as target?

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #218  Posted: Thu Jul 10, 2014 11:31 am Post subject: Posted: Thu Jul 10, 2014 11:31 am Post subject: |

|

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #219  Posted: Thu Jul 10, 2014 1:52 pm Post subject: Posted: Thu Jul 10, 2014 1:52 pm Post subject: |

|

|

| welgro wrote: |  |

Booked 50% qty at key support level.balance 50% Placed stoploss at cost. |

|

| Back to top |

|

|

veerappan

Expert

Joined: 19 Dec 2007

Posts: 3680

|

Post: #220  Posted: Thu Jul 10, 2014 2:19 pm Post subject: Posted: Thu Jul 10, 2014 2:19 pm Post subject: |

|

|

| welgro wrote: | | welgro wrote: |  |

Booked 50% qty at key support level.balance 50% Placed stoploss at cost. |

well grow... welgro... keep rocking ...      |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #221  Posted: Thu Jul 10, 2014 3:59 pm Post subject: Posted: Thu Jul 10, 2014 3:59 pm Post subject: |

|

|

Now i don't have any position. Tomorrow plan to build fresh positions.

Once i take any position,I will update... |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #222  Posted: Thu Jul 10, 2014 4:02 pm Post subject: Posted: Thu Jul 10, 2014 4:02 pm Post subject: |

|

|

| veerappan wrote: |

well grow... welgro... keep rocking ...      |

Thanks Guruji ... |

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #223  Posted: Fri Jul 11, 2014 10:59 am Post subject: Re: Rising Wedge in nifty?? Posted: Fri Jul 11, 2014 10:59 am Post subject: Re: Rising Wedge in nifty?? |

|

|

Welgro thanks for giving such a detailed step by step explaination

Regards,

Ruchir

| welgro wrote: | | Ruchirgupta2000 wrote: | | welgro wrote: | | Ruchirgupta2000 wrote: | | welgro wrote: | | Ruchirgupta2000 wrote: | The Wedge is already broken, what can I expect as target?

|

|

Nifty is going to close even lower from yeserday. Now can I assume Wedge working?

Regards,

Ruchir |

EOD wedge pattern activated when nifty breach the yesterday's low(signal bar).

Already explained wedge stop loss is above the support line EOD close. |

and it has breached yesterdays low at close basis. |

for example you get wedge breakout signal yesterday.

yesterday low was 7595.90 ( Round Num: 7595 )

Today morning after market open you will place "SL Sell order" at 7595.

if price once breach you will get short position..well hold for target.

what about stoploss : just chek everyday 3.25 PM nifty trading price with your chart (pattern lines). Once if its above your support line (Note : after 3.25 PM) then close the position at market price. |

|

|

| Back to top |

|

|

Ruchirgupta2000

White Belt

Joined: 12 Jun 2014

Posts: 297

|

Post: #224  Posted: Fri Jul 11, 2014 11:33 am Post subject: Posted: Fri Jul 11, 2014 11:33 am Post subject: |

|

|

Hi Welgro thanks for your reply.

I some years back learned this but eventualy did not found it to be useful due these reasons:

1. although 90% were the options writters I doubted if in a situation like this (budget or any other big event) people migth be writing options, reason is that in the times like this when so much of volatiity, who would take that unlimited risk.

I understand the rationale of selling options while the markets are range bound.

2. If the FIIs are so smart why whould they sell and make slow money and tying so much of cash in the margins, while taking the one side open positions in options can give huge returns to them and not requiring any margin.

3. Also I dont know if this PCR is based on open interest that day (new open interest) or PCR of that days volume of puts and call or PCR of total open interest of that series. I suppose each of these 3 PCR whould give us differt insights.

Regards,

Ruchir

| welgro wrote: | | Ruchirgupta2000 wrote: |

HI WELGRO . What is the implication of these 2 charts?

Reagrds

Ruchir |

Put call ratio can be used as additional confirmation for taking a trade, moreover it can be found easily on NSE’s website. Before explaining you put call ratio analysis, I will tell you most important fact about options trading it is: “About 95% option contracts expire worthless.” This means most profitable group of option trader is “Option Writers”. Now you will get put call ratio from this NSE’s link, this is updated daily and it’s only for nifty option.

Put call ratio is a ratio of total traded put option against call option for a given day. This is actually contrarian indicator for near term trend, on this indicator a reading above 1 will be a bullish signal on nifty future, while ratio below 1 is a bearish signal. Whenever trader has doubt about the trend he can just look at put call ratio and get a clear trading idea.

Today’s put call ratio is 0.8. Now this fig. is clearly below 1 so call option writing (shorting) is more than put option, in simple words smart people is expecting nifty future will move lower level in coming sessions. Now suppose if Put call ratio is 1.1, here it is above 1 so put writing is more than call writing. This is because large traders are betting that nifty future may correct in near term.

Note: just i updated the logic ,Don’t compare PCR value is in above 1 or below 1, you can understand PCR changes with nifty’s momentum.

See yesterday PCR is 0.84 with today’s PCR is 0.80.

So what do you understand?

Yes, large traders today build heavy short positions in call options.Hmm... They are expect nifty will be go more down levels.

what will we to do ? We can also take short position otherwise Better to avoid open positions in against the trend. |

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #225  Posted: Sat Jul 12, 2014 12:28 pm Post subject: Posted: Sat Jul 12, 2014 12:28 pm Post subject: |

|

|

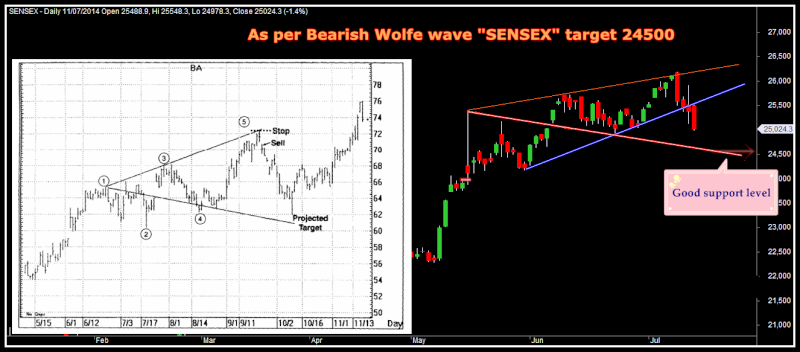

|

|

| Back to top |

|

|

|