|

|

| View previous topic :: View next topic |

| Author |

Nifty analysis - Welgro corner |

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #76  Posted: Fri Jun 13, 2014 12:35 pm Post subject: Posted: Fri Jun 13, 2014 12:35 pm Post subject: |

|

|

| welgro wrote: |

Yesterday Nifty spot "intraday trend" trading at range bound. Today once if trade and hold above 7658 then intraday trend will be change in bullish. Next important resistance saw at 7683 -7388 level (Master candle pattern high) if nifty spot sustain this level with good volume then we may see fresh breakout target 7729.

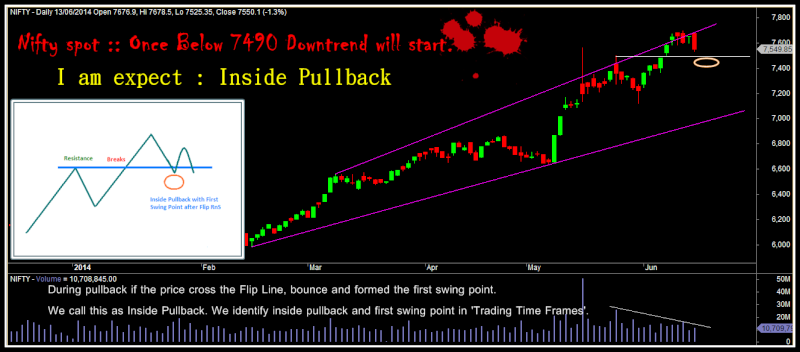

Important note: Nifty spot once if hold below 7610 (Parallel pattern) then bears fresh breakout target 7500 level. Once nifty spot if trade below 7490 nifty long term trend will enter bearish mode. Down side first target 7000.

Bank nifty spot now it’s trading below the “head and shoulders” pattern neckline. Once if hold below the neckline then bears will be control the bank nifty trend. At the same time Bank nifty spot once if trade and hold above 15530 (Previous day high) then intraday trend will be turned in bullish, Short covering rally try to test 15660 levels. Today Bank nifty spot if close above 15660, angry bulls (sharp rally) target 16100. |

NS 7610...hlding below ur bearish target to 7500 is open |

|

| Back to top |

|

|

|

|  |

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #77  Posted: Fri Jun 13, 2014 2:34 pm Post subject: Posted: Fri Jun 13, 2014 2:34 pm Post subject: |

|

|

|

|

| Back to top |

|

|

riteshucha

Green Belt

Joined: 19 May 2012

Posts: 1292

|

Post: #78  Posted: Fri Jun 13, 2014 5:48 pm Post subject: Posted: Fri Jun 13, 2014 5:48 pm Post subject: |

|

|

| is 7490 closing basis or just breach of 7490 level? |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #79  Posted: Fri Jun 13, 2014 7:16 pm Post subject: Posted: Fri Jun 13, 2014 7:16 pm Post subject: |

|

|

| riteshucha wrote: | | is 7490 closing basis or just breach of 7490 level? |

Yes... just breach of 7490 level.

wait some times i will update the details today or tomorrow.

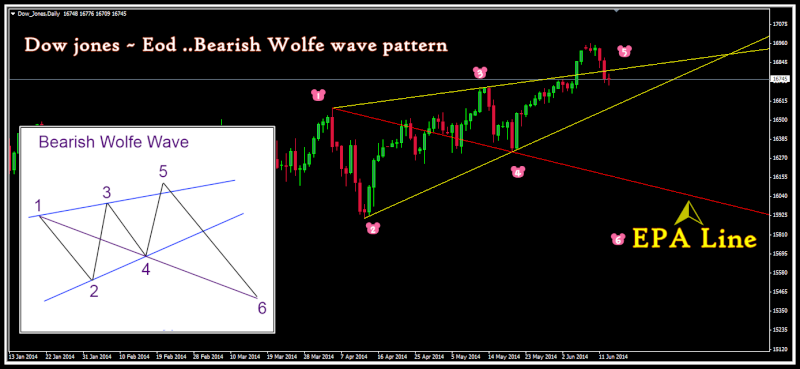

Currently i am Concentrating in Dow and Crude Movements. |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #80  Posted: Fri Jun 13, 2014 7:17 pm Post subject: Posted: Fri Jun 13, 2014 7:17 pm Post subject: |

|

|

|

|

| Back to top |

|

|

reachchirag

White Belt

Joined: 28 Nov 2012

Posts: 102

|

Post: #81  Posted: Fri Jun 13, 2014 7:19 pm Post subject: Adani power and adani enterprise Posted: Fri Jun 13, 2014 7:19 pm Post subject: Adani power and adani enterprise |

|

|

Dear sir,

Your views on adani power and adani enterprise for medium to long term. |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #82  Posted: Fri Jun 13, 2014 7:41 pm Post subject: Re: Adani power and adani enterprise Posted: Fri Jun 13, 2014 7:41 pm Post subject: Re: Adani power and adani enterprise |

|

|

| reachchirag wrote: | Dear sir,

Your views on adani power and adani enterprise for medium to long term. |

Dear friends,

Please don't ask any script or related question in this thread.Please keep this thread neat and clean.I will start sup rite thread for stock related query.

Important : as well don't update "thanks" or related quotes.please make this thread clean it will be more help in learners for view charts continuity. |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #83  Posted: Sat Jun 14, 2014 7:18 am Post subject: Posted: Sat Jun 14, 2014 7:18 am Post subject: |

|

|

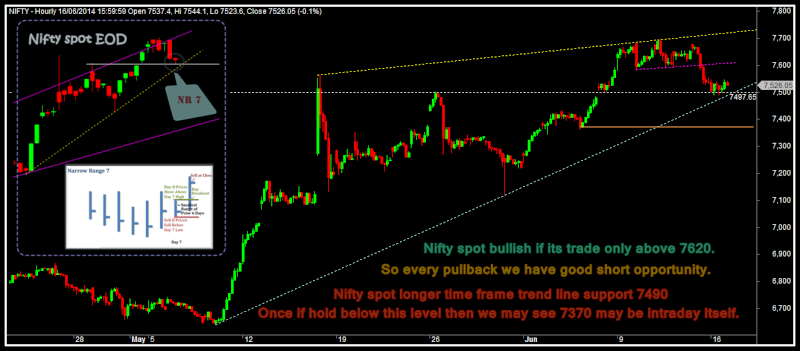

Nifty spot next important support at 7490(previous swing pivot) Once if trade below this level next important support at 7400 (Parallel pattern).

Important note: Nifty spot hourly chart negative breakout line resistance 7620 level. Nifty spot if close (Hourly close) above the trend line then exit all positional shorts. Bulls are waiting in that level.

Bank nifty spot head and shoulder pattern target 14965.i am expect some small profit booking pullback here. Pullback wave if not break the top parallel line then positional bears let’s start next counter attack.

Note: Key Resistance Level: 15400 (Bulls can shine when bank nifty spot once if trade above KRL)

Today bank nifty spot if close below 14965 then downside first target 14475 (Eod BOF) then parallel pattern target 14000.

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #84  Posted: Sat Jun 14, 2014 10:12 am Post subject: Posted: Sat Jun 14, 2014 10:12 am Post subject: |

|

|

One friend asked me “Sir, you told 8‘Th June 2014 in Nifty spot long term target 10086.but now you are told nifty spot downside target 7000 etc … I am not get clear view. Please clarify my doubts”

Dear friend,

First understand basic chart analysis. Chart analysis has a total three types of trend analysis.

1. Long term analysis (Monthly charts).

2. Medium term analysis (EOD – Daily and weekly charts)

3. Short term analysis (Hourly in index 4 Hr chart for commodities)

Now nifty spot reached the medium term trend channel breakout target. Some profit booking (Supply) going on this level. Therefore nifty spot currently struggle to cross at this level (7700).In-case nifty spot once close (Eod) above 7700 then current bullish trend will continue.

Long term target still be valid. Nifty spot seems long term trend positive breakout line support at 5900 level. Nifty spot once close below (Weekly) this level then only long term trend will be enter bearish mode. Otherwise every throwback is buying opportunity for long term investors. |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #85  Posted: Sun Jun 15, 2014 11:28 am Post subject: Posted: Sun Jun 15, 2014 11:28 am Post subject: |

|

|

Risk Management of Portfolio using Derivatives

This article is surely for you if you invest in Equities (Direct shares or Equity Mutual funds) . Many people might have seen there investments go down to anywhere between 20-50% , if they invested in Indian Stock markets around Dec 2007 or Jan 2008 , and they might be wondering if it will go more down in value .

Just like we know take life Insurance to cover the risk of Life , Home insurance or car insurance to cover the risk if anything goes wrong , Can we also take Portfolio insurance ?

What does insuring the portfolio means ?

What does insurance means ? It means securing something from some event which can cause loss or damage . We ensure our Lives , our homes , our Car . What happens when nothing happens to our lives , Home or Car . We pay a small price for it and that is a kind of fees , which we pay for the security .

In the same way , we can also insure our portfolio , We can make sure that our loss is limited, The loss is always limited. If you are one of those who invested in Equity mutual funds or Shares during 2007 or Jan 2008 , And you are sitting on a loss of 30-60% , you will understand this very well . Any one who invested Rs 1,00,000 in stocks or mutual funds has loss of anything from 30,000 to 60,000 (depending on his investments) . Just wonder if they could insure there portfolio and make sure that there loss can not go beyond a certain limit . That would be wonderful . We are going to discuss this today .

How to insure your portfolio ?

There is no specific product or service for this , you have to manage it using Options (Derivative Products). ( Read it in Detail)

I assume that you now understand what are Options and how do they work , what are call and put options and what is expiry date , in case you have not read about it , please read it at above links (try first link to get basic info).

If you have invested in Mutual Funds

Ajay has invested Rs 2,00,000 In Equity mutual funds in Aug 2008 , Nifty is around 4,200 . He has invested his money for 4 months and would like to withdraw his investments in Jan 2009 . He is a smart investor and knows that markets can crash and there is no limit to how much down it can go , So he decides to minimize his risk . For this he has bought Nifty 4200 PA DEC-2008 trading at 200 , for which he spent Rs 10,000 (Rs 200 * 50 lot size.)

Now lets see 3 different cases and what happens to his portfolio

1. Markets boom and goes up to 5,000 : Nifty has gone up by 20%

I am assuming that his investments followed and his Rs 2,00,000 has grown to 2,50,000

Value of his Nifty PUTS : 0

Profit from investments : 50,000

Loss in Puts : 10,000

Total Profit : 50,000 – 10,000 = Rs 40,000

2. Markets Crash by 25% and nifty goes down to 3,100 .

His investments follow and now its value is around 1,40,000 , but his PUTS will be valued at 1,100 (4200-3100) . So its value at the end would be 1,100 * 50 = 55,000.

Loss in investments : 60,000

Profit in PUTS = 45,000 (55,000 – 10,000 investment)

Loss = Rs 15,000

Here you can see that Out of his loss of 60,000 , 45,000 is covered from PUTS .

3. Nothing happens and markets are still at 4,200 .

His investments will be almost same , and his PUTS will expire with value 0 .

Profit from investments : 0

Loss from Options : 10,000

Total loss : Rs 10,000

In all the 3 cases , we should note that in all the cases his Losses are minimized .

Thanks to : jagoinvestor |

|

| Back to top |

|

|

pkveenu

White Belt

Joined: 21 Apr 2009

Posts: 106

|

Post: #86  Posted: Sun Jun 15, 2014 11:49 pm Post subject: Posted: Sun Jun 15, 2014 11:49 pm Post subject: |

|

|

| welgro wrote: | | riteshucha wrote: | | is 7490 closing basis or just breach of 7490 level? |

Yes... just breach of 7490 level.

wait some times i will update the details today or tomorrow.

Currently i am Concentrating in Dow and Crude Movements. |

dear welgro

dow is up

sgx nifty dead flat

what will be our nifty on monday

will this go around ur level 7490

or will try to climb up

if goes down below 7490

then how midcap will react

crashing

or proportionately down

or flat with upward bias

just analyse and write some

regards |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #87  Posted: Mon Jun 16, 2014 5:26 am Post subject: Posted: Mon Jun 16, 2014 5:26 am Post subject: |

|

|

| pkveenu wrote: |

dear welgro

1)dow is up

2)sgx nifty dead flat

3)what will be our nifty on monday

will this go around ur level 7490

or will try to climb up

4)if goes down below 7490

then how midcap will react

crashing

or proportionately down

or flat with upward bias

just analyse and write some

regards |

1) Dow future hourly chart currently create head and shoulder pattern in hourly chart if trade and hold below 16700 then we get fresh downside breakout target 16500.

2) Sgxnifty will help for opening range clue. So no need consider sgxnifty with our market live trend.

3) Today we need to watch 3 important things. a) USDINR weakness b)NYMEX Crudeoil C) inflation data. this things only can change intraday trend.lets see in live market hour.If i get any reverse sign i will update.

4) CNX MIDCAP already triggered positional short "trend reversal point level". I am expected CNX MIDCAP Downside first target 10,000. |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #88  Posted: Mon Jun 16, 2014 9:39 am Post subject: Posted: Mon Jun 16, 2014 9:39 am Post subject: |

|

|

| welgro wrote: |  |

50 % Qty exited at 65.00 .. |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #89  Posted: Mon Jun 16, 2014 1:04 pm Post subject: Posted: Mon Jun 16, 2014 1:04 pm Post subject: |

|

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #90  Posted: Mon Jun 16, 2014 7:55 pm Post subject: Posted: Mon Jun 16, 2014 7:55 pm Post subject: |

|

|

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You cannot attach files in this forum

You cannot download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|