|

|

| View previous topic :: View next topic |

| Author |

NIFTY ELLIOTT WAVE INTERPRETATIONS |

marne.vivek

White Belt

Joined: 11 Apr 2008

Posts: 244

Location: Pune / Mumbai

|

Post: #1  Posted: Fri Aug 08, 2008 4:57 pm Post subject: NIFTY ELLIOTT WAVE INTERPRETATIONS Posted: Fri Aug 08, 2008 4:57 pm Post subject: NIFTY ELLIOTT WAVE INTERPRETATIONS |

|

|

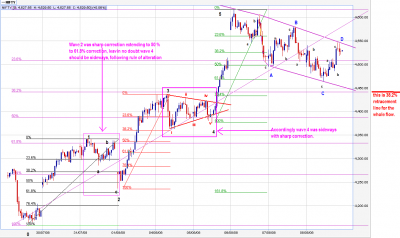

hi all,

pls find the attached chart 15 min nifty chart for current wave formation, pls correct me if i am wrong

regards

| Description: |

|

| Filesize: |

62.46 KB |

| Viewed: |

1289 Time(s) |

|

_________________

Vivek |

|

| Back to top |

|

|

|

|  |

marne.vivek

White Belt

Joined: 11 Apr 2008

Posts: 244

Location: Pune / Mumbai

|

Post: #2  Posted: Fri Aug 08, 2008 6:00 pm Post subject: NIFTY (contd) Posted: Fri Aug 08, 2008 6:00 pm Post subject: NIFTY (contd) |

|

|

In continuation of previous chart, i present an hourly chart and an excel file giving workings of the Nifty possible levels.

regards,

| Description: |

|

| Filesize: |

57.98 KB |

| Viewed: |

890 Time(s) |

|

| Description: |

|

Download |

| Filename: |

nifty data based on hrly and 15 min charts.xls |

| Filesize: |

16.5 KB |

| Downloaded: |

838 Time(s) |

_________________

Vivek |

|

| Back to top |

|

|

mbn

White Belt

Joined: 29 Nov 2007

Posts: 27

|

Post: #3  Posted: Mon Aug 18, 2008 12:06 pm Post subject: Very Nice ! Posted: Mon Aug 18, 2008 12:06 pm Post subject: Very Nice ! |

|

|

Thanks for all the effort to post waves so detailed.

it's helpful to newbies in elliot like me .

Please keep doing the good work.

Regards,

mbn

|

|

| Back to top |

|

|

kiran.jain

White Belt

Joined: 31 Jan 2008

Posts: 47

Location: mumbai

|

Post: #4  Posted: Mon Aug 18, 2008 5:07 pm Post subject: Posted: Mon Aug 18, 2008 5:07 pm Post subject: |

|

|

thnks marne.vivek

any newbies in elliot can read msg clearly....

regards

kiran

_________________

keep smiling  |

|

| Back to top |

|

|

marne.vivek

White Belt

Joined: 11 Apr 2008

Posts: 244

Location: Pune / Mumbai

|

Post: #5  Posted: Fri Sep 05, 2008 12:20 am Post subject: NIFTY WAVE COUNT BASED ON 1 HOUR CHART Posted: Fri Sep 05, 2008 12:20 am Post subject: NIFTY WAVE COUNT BASED ON 1 HOUR CHART |

|

|

hi

| Description: |

|

| Filesize: |

56.19 KB |

| Viewed: |

812 Time(s) |

|

_________________

Vivek |

|

| Back to top |

|

|

marne.vivek

White Belt

Joined: 11 Apr 2008

Posts: 244

Location: Pune / Mumbai

|

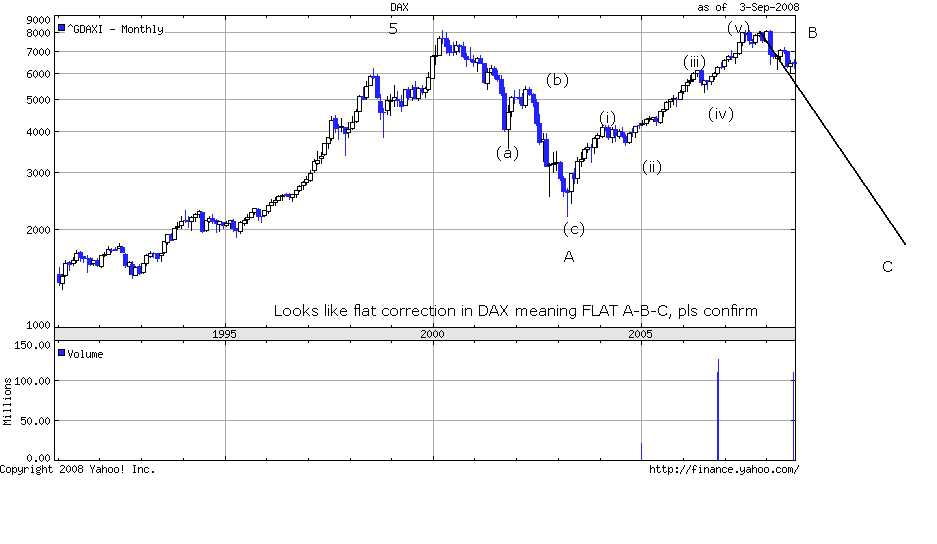

Post: #6  Posted: Fri Sep 05, 2008 12:28 am Post subject: DAX PROBABILITY Posted: Fri Sep 05, 2008 12:28 am Post subject: DAX PROBABILITY |

|

|

DAX probability, pls confirm

| Description: |

|

| Filesize: |

8.1 KB |

| Viewed: |

7588 Time(s) |

|

_________________

Vivek |

|

| Back to top |

|

|

marne.vivek

White Belt

Joined: 11 Apr 2008

Posts: 244

Location: Pune / Mumbai

|

Post: #7  Posted: Sun Sep 14, 2008 12:59 pm Post subject: NIFTY GOING FORWARD Posted: Sun Sep 14, 2008 12:59 pm Post subject: NIFTY GOING FORWARD |

|

|

Nifty Targets:

The chart attached herewith is the nifty hourly charts, and my attempt to understand the path of market:

I will not go into nitty-gritty of Waves, but just a background of which wave we are in ideally, just to understand the behavioral aspects of the wave.

Looking at the chart attached, there are three different types of lines that I have drawn. These I believe are the possible out comes of Nifty.

I believe we are in Wave 3 of Wave 5, of which we have completed the minor wave 1 at 4200 on 12th September 2008 closing. However, one cannot rule out a further downside. But for the time being, I’ll assume that 4200, is the low for now.

In that case, we should begin our journey upwards. Please, don’t get confused with my word UPWARDS, upwards here only means that we will only come up to go down further south

I think we have three options for market to give retracement which I now discuss:

Option Description

A Depicted by a RED LINE

Under this option, nifty should retrace to end of wave 4, which is 4309. This could an ideal point, provided we get a sell signal here based on candlesticks and supported by RSI / MACD / Slow Stochastic.

B Depicted in BLUE Line

Under this option, nifty should retrace around 38.2% to which is 4329, which is not too far from end of wave 4.

Under this option, there is one other formation that need to be considered, been a DOUBLE BOTTOM, which pegs Nifty targets to 4379. So this is more likely in next 3.5 days. This is assuming 4200 is the base / end of wave 1.

C Depicted in BROWN Line

Under this option, Nifty can retrace to 4409 been 61.8% retracement. This as well seems likely, assuming the fact we are in wave ii of wave 3, it is always likely that nifty would retrace to 61.8% of the length of wave i.

That makes three possible scenarios for wave 2 retracement viz.,

A 4309

B 4329 – 4379

C 4409

Following these retracements, the formation should be Lower Top and Lower Bottom, and we maintain the current wave formation.

Going forward, wave 3 would be either of the following options:

3971 3991 4071

3762 3782 3862

3424 3444 3524

Of which I expect 3971 to be an acceptable target.

Once we have wave 3 in place, we would have wave 4, which would be 0.382 retracement to wave 3. The characteristic of wave 4 is based on the Rule of Alteration, which says, wave 4 correction shall be alternate to that of wave 2. Wave 2 has marked around 61.8% retracement, making wave 4 to mark around 38.2% retracement.

Existence of Double Bottom / Head and Shoulder pattern:

This has as well been explained in the Nifty picture named : Nifty A Road

Currenty, looking forward, I assume, at wave 4 end i.e. 4650 we have completed 61.8% of the corrective action of wave A. This, using simple mathematics makes length of wave 5 as 1055 points from wave 4 i.e. from 4650

That puts nifty targets to some where around 3595, which should mark the end of wave A of the entire corrective phase. This would put, us out of our small taste of Bear Market. I expect market to reach 5200 then on and after this reach to 3600 to 2600 odd levels.

| Description: |

|

| Filesize: |

30.39 KB |

| Viewed: |

764 Time(s) |

|

| Description: |

|

| Filesize: |

60.83 KB |

| Viewed: |

744 Time(s) |

|

_________________

Vivek |

|

| Back to top |

|

|

marne.vivek

White Belt

Joined: 11 Apr 2008

Posts: 244

Location: Pune / Mumbai

|

Post: #8  Posted: Sun Sep 14, 2008 4:32 pm Post subject: Posted: Sun Sep 14, 2008 4:32 pm Post subject: |

|

|

I think this would be an apt wave count..

| Description: |

|

| Filesize: |

43.03 KB |

| Viewed: |

839 Time(s) |

|

_________________

Vivek |

|

| Back to top |

|

|

kiran.jain

White Belt

Joined: 31 Jan 2008

Posts: 47

Location: mumbai

|

Post: #9  Posted: Mon Sep 15, 2008 11:14 am Post subject: Posted: Mon Sep 15, 2008 11:14 am Post subject: |

|

|

hello vivek...... done it again.....good going

now a greedy statement which ppl would b thinking........ " hope this was posted on friday market time "[ ] [ ] [ ] ]

thnks

regards

kiran jain

_________________

keep smiling  |

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|