| View previous topic :: View next topic |

| Author |

Nifty option strategy |

bismillah

White Belt

Joined: 25 Sep 2009

Posts: 35

|

Post: #16  Posted: Thu Oct 04, 2012 10:27 am Post subject: Nifty option strategy Posted: Thu Oct 04, 2012 10:27 am Post subject: Nifty option strategy |

|

|

Hi all

I Just cant stop myself from commenting abt ur discussion of option trading,

As per My little knowledge which i got from the markets as an arbitrageur & analyst i would like to share my views.

If u want to trade options then plz go through the options strategies which u will find on google.

As per me, first decide the mood of the mkts & trade according to that.

I love to use a strategy & have taken following positions yesterday.

1) Short 1 lot 5700 Call @ 114.90

2) Long 2 lots 5800 Call @ 63.95,

Following was the options components @ time

Delta = 11

Gamma = 0.04

Theta slightly positive

Vega positive

Maximum loss risk = 5650

Maximum Profit = unlimited

Maximum Loss range = 5700 - 5900, BELOW 5700 LOSS OF ONLY 650 RS.

Profit above 5900 till expiry, currently getting 900 rs.

Hope it will help u

Best of luck

|

|

| Back to top |

|

|

|

|

|

Gemini

White Belt

Joined: 28 Apr 2009

Posts: 166

|

Post: #17  Posted: Thu Oct 04, 2012 7:19 pm Post subject: Posted: Thu Oct 04, 2012 7:19 pm Post subject: |

|

|

Bismillah : Interesting post. Thanks for sharing.

I have noted today's parameters and calculated Theoretical call and put prices using Black Scholes calculator. Can you please let me know if the parameters that I have taken are correct and values arrived at are correct ? If no, please let me know corrections required.

Nifty Spot : 5787, 5800 Call Volatility ( taken value shown as Implied Volatility from NSE India Call price table) : 15.2, 5800 Put Volatility : 14.6

Theoretical Values : 5800 Call : Rs. 91, Actual : Rs. 97.95, 5800 Put : Rs. 74.11 Actual: Rs. 69.3

Interpretation: Bullish trend as Calls are overpriced, Puts are underpriced.

Thanks in advance. .

|

|

| Back to top |

|

|

bismillah

White Belt

Joined: 25 Sep 2009

Posts: 35

|

Post: #18  Posted: Fri Oct 05, 2012 12:46 am Post subject: Nifty option strategy Posted: Fri Oct 05, 2012 12:46 am Post subject: Nifty option strategy |

|

|

Hi

Sorry but i m out of station, will it be ok to revert u back on saturday

Regards

|

|

| Back to top |

|

|

Gemini

White Belt

Joined: 28 Apr 2009

Posts: 166

|

Post: #19  Posted: Fri Oct 05, 2012 11:51 pm Post subject: Posted: Fri Oct 05, 2012 11:51 pm Post subject: |

|

|

Bismillah : Thanks. Take your time but do respond in detail.

|

|

| Back to top |

|

|

bismillah

White Belt

Joined: 25 Sep 2009

Posts: 35

|

Post: #20  Posted: Sat Oct 06, 2012 11:24 am Post subject: Nifty option strategy Posted: Sat Oct 06, 2012 11:24 am Post subject: Nifty option strategy |

|

|

hi Gemini

Could u plz plz tell me wht value u have entered in stock price cloumn, if possible then calculate it now, i m online, & will share views

|

|

| Back to top |

|

|

drsureshbs

White Belt

Joined: 22 Oct 2008

Posts: 58

|

Post: #21  Posted: Sat Oct 06, 2012 11:58 pm Post subject: Re: Nifty option strategy Posted: Sat Oct 06, 2012 11:58 pm Post subject: Re: Nifty option strategy |

|

|

| bismillah wrote: | Hi all

I Just cant stop myself from commenting abt ur discussion of option trading,

As per My little knowledge which i got from the markets as an arbitrageur & analyst i would like to share my views.

If u want to trade options then plz go through the options strategies which u will find on google.

As per me, first decide the mood of the mkts & trade according to that.

I love to use a strategy & have taken following positions yesterday.

1) Short 1 lot 5700 Call @ 114.90

2) Long 2 lots 5800 Call @ 63.95,

Following was the options components @ time

Delta = 11

Gamma = 0.04

Theta slightly positive

Vega positive

Maximum loss risk = 5650

Maximum Profit = unlimited

Maximum Loss range = 5700 - 5900, BELOW 5700 LOSS OF ONLY 650 RS.

Profit above 5900 till expiry, currently getting 900 rs.

Hope it will help u

Best of luck

|

sir how is that above 5800 u will vb in loss range pl explain .pl do note my knowldge in this is limited my understanding is that loss is offset by the 2 lot5800calls u hav bought

regards

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #22  Posted: Sun Oct 07, 2012 8:18 am Post subject: Re: Nifty option strategy Posted: Sun Oct 07, 2012 8:18 am Post subject: Re: Nifty option strategy |

|

|

| drsureshbs wrote: | sir how is that above 5800 u will vb in loss range pl explain .pl do note my knowldge in this is limited my understanding is that loss is offset by the 2 lot5800calls u hav bought

regards |

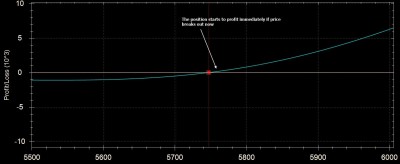

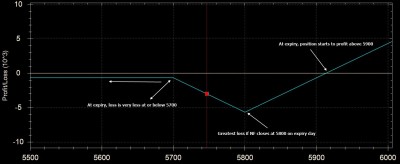

Even though the two lots of 5800 calls offset the short 5700 call, they are continuously losing value due to time decay. The scenario bismillah has explained is at expiry. If one plans to hold this position until expiry then the price will have to close a bit above 5900 for this position to breakeven and profit. There is risk between 5700 & 5900 with greatest risk at 5800 (if NF closes here at expiry) as both long calls will expire worthless and short call will be in loss by 100 pts.

This position is basically a volatility play. If NF breaks out to upside then position will quickly profit (it will profit immediately too if price moves to upside quickly). If NF breaks down then below 5700 the risk is quite limited.

I have attached two graphs - first one is the position profitability as of today (this shows how position profits if price starts moving immediately). The second one is the position profitability at expiry.

| Description: |

|

| Filesize: |

81.7 KB |

| Viewed: |

512 Time(s) |

|

| Description: |

|

| Filesize: |

92.01 KB |

| Viewed: |

521 Time(s) |

|

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

bismillah

White Belt

Joined: 25 Sep 2009

Posts: 35

|

Post: #23  Posted: Sun Oct 07, 2012 10:15 am Post subject: Re: Nifty option strategy Posted: Sun Oct 07, 2012 10:15 am Post subject: Re: Nifty option strategy |

|

|

| drsureshbs wrote: | | bismillah wrote: | Hi all

I Just cant stop myself from commenting abt ur discussion of option trading,

As per My little knowledge which i got from the markets as an arbitrageur & analyst i would like to share my views.

If u want to trade options then plz go through the options strategies which u will find on google.

As per me, first decide the mood of the mkts & trade according to that.

I love to use a strategy & have taken following positions yesterday.

1) Short 1 lot 5700 Call @ 114.90

2) Long 2 lots 5800 Call @ 63.95,

Following was the options components @ time

Delta = 11

Gamma = 0.04

Theta slightly positive

Vega positive

Maximum loss risk = 5650

Maximum Profit = unlimited

Maximum Loss range = 5700 - 5900, BELOW 5700 LOSS OF ONLY 650 RS.

Profit above 5900 till expiry, currently getting 900 rs.

Hope it will help u

Best of luck

|

sir how is that above 5800 u will vb in loss range pl explain .pl do note my knowldge in this is limited my understanding is that loss is offset by the 2 lot5800calls u hav bought

regards |

Dear

Suppose, today is expiry & nifty is going to expire @ 5880 level,

now calculate each of ur call price theoretically

5700 ce will be 180 points

5700 ce will be 80 points means 2 lots = 160 points

we have shorted 5700 ce & long in 5800 ce

now u can see, we r still getting loss in the above strategy

but if this will be the seen in next few days say 20 oct.

then we will be able to recover from loss

|

|

| Back to top |

|

|

drsureshbs

White Belt

Joined: 22 Oct 2008

Posts: 58

|

Post: #24  Posted: Sun Oct 07, 2012 5:31 pm Post subject: Posted: Sun Oct 07, 2012 5:31 pm Post subject: |

|

|

Dear S T and Bismilla sir thank u sparing ur timme and sharing the knowldge with me Thank u again

Regards

|

|

| Back to top |

|

|

|