| View previous topic :: View next topic |

| Author |

NIFTY WORKING WITH NATURAL LAW OF GANN.... |

rusty_dfc

White Belt

Joined: 27 Oct 2010

Posts: 21

|

Post: #76  Posted: Fri Aug 10, 2012 9:08 am Post subject: Posted: Fri Aug 10, 2012 9:08 am Post subject: |

|

|

Dear shruthi,

good to see you back, I thought this blog is dead.

Back to subject , as per Gann every market has his/her own speed/angle.

As per my little knowledge our market (Long term ) works on 8X1 angle. You can see on long term charts.You can get this angle thru formula.Price to time squaring

|

|

| Back to top |

|

|

|

|

|

sruthi_kulkrni

White Belt

Joined: 06 Jun 2012

Posts: 48

|

Post: #77  Posted: Fri Aug 10, 2012 10:32 am Post subject: Posted: Fri Aug 10, 2012 10:32 am Post subject: |

|

|

| rusty_dfc wrote: | Dear shruthi,

good to see you back, I thought this blog is dead.

Back to subject , as per Gann every market has his/her own speed/angle.

As per my little knowledge our market (Long term ) works on 8X1 angle. You can see on long term charts.You can get this angle thru formula.Price to time squaring |

hello rusty,

if time permits plz post the image so that v can get clear idea of that..........

|

|

| Back to top |

|

|

sruthi_kulkrni

White Belt

Joined: 06 Jun 2012

Posts: 48

|

Post: #78  Posted: Sat Aug 11, 2012 9:12 am Post subject: Posted: Sat Aug 11, 2012 9:12 am Post subject: |

|

|

there is a very gud quote that when more-than 75%ppl says the market is bearish then market will take its turn to bullish and when lessthan 25% ppl says the mrkt is bearish it will continue in bearish....in present scenario since from 2days 95% of ppl saying that market is bearish(i too saying) so it may change to bullish .......... lets see which is taking upper hand either technicals or sentiment indicators..........

|

|

| Back to top |

|

|

umesh1

Brown Belt

Joined: 24 Nov 2008

Posts: 1974

|

Post: #79  Posted: Sat Aug 11, 2012 8:53 pm Post subject: Posted: Sat Aug 11, 2012 8:53 pm Post subject: |

|

|

| sruthi_kulkrni wrote: | there is a very gud quote that when more-than 75%ppl says the market is bearish then market will take its turn to bullish and when lessthan 25% ppl says the mrkt is bearish it will continue in bearish....in present scenario since from 2days 95% of ppl saying that market is bearish(i too saying) so it may change to bullish .......... lets see which is taking upper hand either technicals or sentiment indicators..........  |

Sruthiji

I fully agree with you market always beats the majority view,its like the predator who stay motionless and allow their preys to conclude a view that the water channel is safe now to cross,similarly large majority of analysts,traders conclude at a view looking at the various indicators or patterns that is where the predator comes smoothly makes his move.

Those without the stoploss are swept away along with previous small achievments in one single move .

This is why i believe trade/invest with any indicators,but do incorporate a plan which includes stoploss and targets and goals in your strategy without these three a strategy cannot be complete.occasional stoploss with often targets will make any strategy successful if followed in a disciplined way

Wish all achieve their goals

regrds

Umesh

|

|

| Back to top |

|

|

sruthi_kulkrni

White Belt

Joined: 06 Jun 2012

Posts: 48

|

Post: #80  Posted: Wed Aug 15, 2012 9:53 pm Post subject: Posted: Wed Aug 15, 2012 9:53 pm Post subject: |

|

|

| any time-theory analysts plz post your views your on nifty.. so that v can gain some knowledge on time-theory .i strongly believe that nifty moves with exact time cycles....is anyone to suggest

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #81  Posted: Thu Aug 16, 2012 10:15 am Post subject: Posted: Thu Aug 16, 2012 10:15 am Post subject: |

|

|

| sruthi_kulkrni wrote: | | any time-theory analysts plz post your views your on nifty.. so that v can gain some knowledge on time-theory .i strongly believe that nifty moves with exact time cycles....is anyone to suggest |

nothing in stock market moves with exact time cycles. BUT yes time analysis is a very strong tool. So strong it is that it will give a new dimension to your trading system, set ups.

Any time analysis tool if learned properly can give u an edge over retail traders. Such tools have high probability to anticipate price reversal.

Time analysis is a tool not a set up or system. It cannot work on stand alone basis. One need to use it as a support tool.

There are many easy ways than gann method of time analysis. Gann for me is complex it may work for u .

regds

|

|

| Back to top |

|

|

rusty_dfc

White Belt

Joined: 27 Oct 2010

Posts: 21

|

Post: #82  Posted: Thu Aug 16, 2012 1:52 pm Post subject: Posted: Thu Aug 16, 2012 1:52 pm Post subject: |

|

|

There is definitely some relationship between time & stock price, which gann had took advantage of (Squaring of Time & Price theory). But problem is different gann followers different interpretations.

Take example of speed formula=Distance/Time, same way in stock market study stock price (Up to up,up to down, down to down ) with time taken in calender days as well as trading days.You will get the answer.

|

|

| Back to top |

|

|

shahrachit

White Belt

Joined: 12 Jul 2012

Posts: 117

|

Post: #83  Posted: Thu Aug 16, 2012 1:56 pm Post subject: Posted: Thu Aug 16, 2012 1:56 pm Post subject: |

|

|

| rusty_dfc wrote: | There is definitely some relationship between time & stock price, which gann had took advantage of (Squaring of Time & Price theory). But problem is different gann followers different interpretations.

Take example of speed formula=Distance/Time, same way in stock market study stock price (Up to up,up to down, down to down ) with time taken in calender days as well as trading days.You will get the answer.  |

Thanks Rusty for posting this.

Better if you post with some example... would be useful for all ....

|

|

| Back to top |

|

|

sruthi_kulkrni

White Belt

Joined: 06 Jun 2012

Posts: 48

|

Post: #84  Posted: Thu Aug 16, 2012 2:40 pm Post subject: Posted: Thu Aug 16, 2012 2:40 pm Post subject: |

|

|

| rusty_dfc wrote: | There is definitely some relationship between time & stock price, which gann had took advantage of (Squaring of Time & Price theory). But problem is different gann followers different interpretations.

Take example of speed formula=Distance/Time, same way in stock market study stock price (Up to up,up to down, down to down ) with time taken in calender days as well as trading days.You will get the answer.  |

thank u for posting ur idea........

|

|

| Back to top |

|

|

Dkaur

White Belt

Joined: 16 Jul 2011

Posts: 85

|

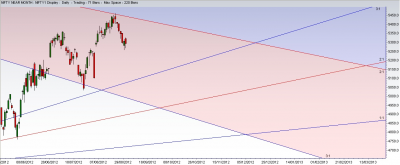

Post: #85  Posted: Thu Aug 23, 2012 6:56 pm Post subject: nifty working with Gann Posted: Thu Aug 23, 2012 6:56 pm Post subject: nifty working with Gann |

|

|

Today nifty found resistence exactly near the resistence level of Gann 2X1 angle. And it should find the support somewhere near 5200 & then 4980 levels. I have shorted @ 5440. Fingers crossed. Lets see

| Description: |

|

| Filesize: |

322.92 KB |

| Viewed: |

684 Time(s) |

|

|

|

| Back to top |

|

|

sruthi_kulkrni

White Belt

Joined: 06 Jun 2012

Posts: 48

|

Post: #86  Posted: Fri Aug 24, 2012 10:11 pm Post subject: Re: nifty working with Gann Posted: Fri Aug 24, 2012 10:11 pm Post subject: Re: nifty working with Gann |

|

|

| Dkaur wrote: | | Today nifty found resistence exactly near the resistence level of Gann 2X1 angle. And it should find the support somewhere near 5200 & then 4980 levels. I have shorted @ 5440. Fingers crossed. Lets see |

hello Dkaur,

nice trade but dont completely rely upon s/w's in gann system bcoz

they had many draw-backs......

ALL THE BEST..............

|

|

| Back to top |

|

|

Dkaur

White Belt

Joined: 16 Jul 2011

Posts: 85

|

Post: #87  Posted: Sat Aug 25, 2012 7:19 pm Post subject: Posted: Sat Aug 25, 2012 7:19 pm Post subject: |

|

|

hi Sruthi,

thanks for concern but i am not totally dependent on s/w I do make Gann charts on graph papers so i was sure for taking the short trade.

|

|

| Back to top |

|

|

Dkaur

White Belt

Joined: 16 Jul 2011

Posts: 85

|

Post: #88  Posted: Sun Aug 26, 2012 12:00 pm Post subject: Ranbaxy Posted: Sun Aug 26, 2012 12:00 pm Post subject: Ranbaxy |

|

|

According to Gann angle theory Ranbaxy has closed above 1X1 angle. There is a buy above 555 in Ranbaxy with a tight sl below 535 and a target of 712.

| Description: |

|

| Filesize: |

253.13 KB |

| Viewed: |

577 Time(s) |

|

|

|

| Back to top |

|

|

chennuru

White Belt

Joined: 07 Jan 2011

Posts: 93

|

Post: #89  Posted: Mon Aug 27, 2012 2:10 am Post subject: Posted: Mon Aug 27, 2012 2:10 am Post subject: |

|

|

I dont have good knowledge about GANN,

as per my expectation, this stock can touch 600 in near, stop loss is same as u mentioned.

|

|

| Back to top |

|

|

Dkaur

White Belt

Joined: 16 Jul 2011

Posts: 85

|

Post: #90  Posted: Sun Sep 02, 2012 1:49 pm Post subject: Posted: Sun Sep 02, 2012 1:49 pm Post subject: |

|

|

Nifty from 5440 to 5290.....

| Description: |

|

| Filesize: |

288.76 KB |

| Viewed: |

512 Time(s) |

|

|

|

| Back to top |

|

|

|