| View previous topic :: View next topic |

| Author |

NVK SET UP |

natarajmtech

White Belt

Joined: 13 Oct 2008

Posts: 61

|

Post: #106  Posted: Tue Sep 29, 2009 1:55 pm Post subject: Posted: Tue Sep 29, 2009 1:55 pm Post subject: |

|

|

| simran8998 wrote: | Hi all,

See NVK setup below |

Hi Simran,

Good, yes I tried so ahead to predict the double bottom...yes you are right there is no double bottom formed and I belive your setup going to rock today...it is a perfect setup.

Is the icharts forum works fine there ? I have been struggling to post the messages but the messages not get posted here.

Regards,

Nataraj

|

|

| Back to top |

|

|

|

|

|

simran8998

White Belt

Joined: 19 Mar 2009

Posts: 34

|

Post: #107  Posted: Tue Sep 29, 2009 2:29 pm Post subject: Posted: Tue Sep 29, 2009 2:29 pm Post subject: |

|

|

natarajmtech,

It is working fine

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #108  Posted: Tue Sep 29, 2009 3:47 pm Post subject: Posted: Tue Sep 29, 2009 3:47 pm Post subject: |

|

|

HI,

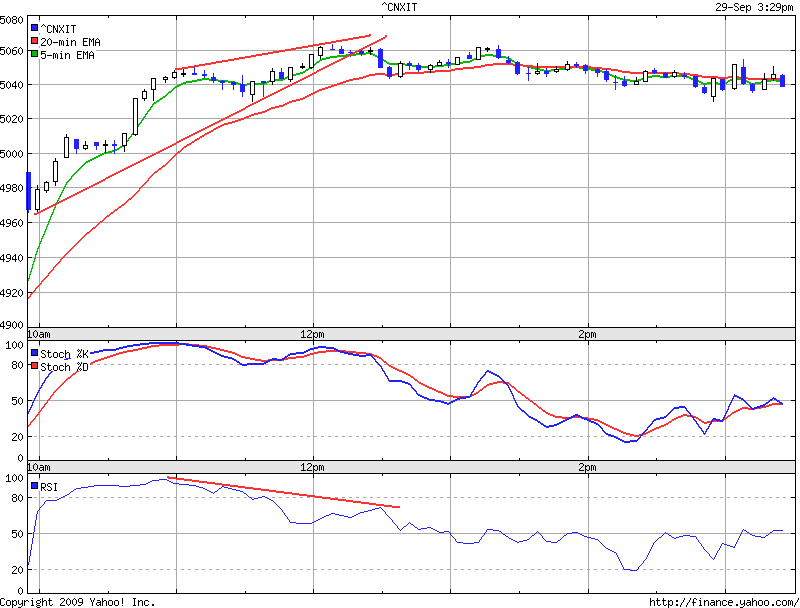

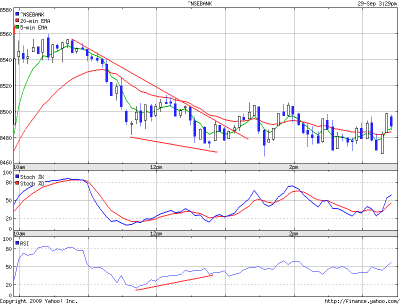

Today, NVK formed on two charts, Bank Nifty and CNX IT. charts posted below. One offered opportunity to long and another to short.

Whole of the day it did nothing, only the SL's were respected on both the charts.

SHEKHAR

| Description: |

|

| Filesize: |

11.57 KB |

| Viewed: |

2399 Time(s) |

|

| Description: |

|

| Filesize: |

13.36 KB |

| Viewed: |

501 Time(s) |

|

|

|

| Back to top |

|

|

simran8998

White Belt

Joined: 19 Mar 2009

Posts: 34

|

Post: #109  Posted: Wed Sep 30, 2009 12:16 pm Post subject: Posted: Wed Sep 30, 2009 12:16 pm Post subject: |

|

|

Hi,

Today's NVK setup

| Description: |

|

| Filesize: |

53.58 KB |

| Viewed: |

2400 Time(s) |

|

|

|

| Back to top |

|

|

natarajmtech

White Belt

Joined: 13 Oct 2008

Posts: 61

|

Post: #110  Posted: Wed Sep 30, 2009 12:31 pm Post subject: Posted: Wed Sep 30, 2009 12:31 pm Post subject: |

|

|

| simran8998 wrote: | Hi,

Today's NVK setup |

Hi Simran,

Obsolutely, since the market looks strong today, I have set two different target today based on fibonacci retracement level of 38.2%

See my plot

Regards,

Nataraj

| Description: |

|

| Filesize: |

60.2 KB |

| Viewed: |

2453 Time(s) |

|

|

|

| Back to top |

|

|

simran8998

White Belt

Joined: 19 Mar 2009

Posts: 34

|

Post: #111  Posted: Wed Sep 30, 2009 1:10 pm Post subject: Posted: Wed Sep 30, 2009 1:10 pm Post subject: |

|

|

| natarajmtech wrote: | | simran8998 wrote: | Hi,

Today's NVK setup |

Hi Simran,

Obsolutely, since the market looks strong today, I have set two different target today based on fibonacci retracement level of 38.2%

See my plot

Regards,

Nataraj |

Hi,

I think today it will hit SL. What do you think?

|

|

| Back to top |

|

|

n11211

White Belt

Joined: 14 Jul 2009

Posts: 9

|

Post: #112  Posted: Wed Sep 30, 2009 2:19 pm Post subject: nvksetup Posted: Wed Sep 30, 2009 2:19 pm Post subject: nvksetup |

|

|

Hi Natraj !

Badluck today sl got hit.

I want to know how did u calculate fibb ret of 38.2% ? And which 2 points(High & low) u have considered for calculating retracement ?

I shorted NF @5053 & kept sl 5 ponts above days high of 5060 so my sl was 5065 which got hit.

Regards,

Nilesh

|

|

| Back to top |

|

|

natarajmtech

White Belt

Joined: 13 Oct 2008

Posts: 61

|

Post: #113  Posted: Wed Sep 30, 2009 3:05 pm Post subject: Re: nvksetup Posted: Wed Sep 30, 2009 3:05 pm Post subject: Re: nvksetup |

|

|

| n11211 wrote: | Hi Natraj !

Badluck today sl got hit.

I want to know how did u calculate fibb ret of 38.2% ? And which 2 points(High & low) u have considered for calculating retracement ?

I shorted NF @5053 & kept sl 5 ponts above days high of 5060 so my sl was 5065 which got hit.

Regards,

Nilesh |

Hi Nilesh,

Yes , indeed a bad luck.. at least it could have sold upto first target to have a confidence over this setup...since you are trading on this setup do you see it profitable as on date ?

Well, I always consider day’s low and high of the current NVK setup under consideration for fibonacci retracement calculation.

Say today's low as 5004.35 and high of today's proposed NVK setup is 5061.85 so the difference = 5061.85 - 5004.35 = 57.5

then the 38.2% retracement is = 0.382 X 57.5 = 21.965

So the retracement level is 5061.85 - 21.965 = 5039.885 ~ 5040.00

This way I am computing it.

Regards,

Nataraj

|

|

| Back to top |

|

|

n11211

White Belt

Joined: 14 Jul 2009

Posts: 9

|

Post: #114  Posted: Wed Sep 30, 2009 4:17 pm Post subject: nvk setup Posted: Wed Sep 30, 2009 4:17 pm Post subject: nvk setup |

|

|

Hi nataraj,

Thanks for explaining how u calculate fib ret. Yes i have found nvk setup so far very good. I did follow almost 14 trades(all were not as per nvk but as per the price & indicator diversion) out of which only 3 occassions sl got hit. But actually i couldn't trade all of them.

I use cci & ultimate oscilator also bcoz on some occassions they give good diversions. For example on 25/09 between 1.30pm-1.55pm +ve divergence, on 29/09 between 10.15am-11.15am -ve divergence on both indicators .

Regards,

Nilesh.

|

|

| Back to top |

|

|

natarajmtech

White Belt

Joined: 13 Oct 2008

Posts: 61

|

Post: #115  Posted: Thu Oct 01, 2009 12:28 pm Post subject: Posted: Thu Oct 01, 2009 12:28 pm Post subject: |

|

|

Todays NVK setup for shorting opertunity

Refer chart attached

Regards,

Nataraj

| Description: |

|

| Filesize: |

66.27 KB |

| Viewed: |

2511 Time(s) |

|

|

|

| Back to top |

|

|

simran8998

White Belt

Joined: 19 Mar 2009

Posts: 34

|

Post: #116  Posted: Thu Oct 01, 2009 2:38 pm Post subject: Posted: Thu Oct 01, 2009 2:38 pm Post subject: |

|

|

Hi,

Today's short trade acc to NVK.

Target also achieved

| Description: |

|

| Filesize: |

67.15 KB |

| Viewed: |

2461 Time(s) |

|

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

Post: #117  Posted: Thu Oct 01, 2009 3:24 pm Post subject: Posted: Thu Oct 01, 2009 3:24 pm Post subject: |

|

|

Hello again,

Lots of discussion here and lots of customization over the original set up.

Customizations are always good as long as they don't add more complexities.

Lots of complex strategies with lots of indicators are readily available - BUT which are DIFFICULT to trade.

The whole idea of behind posting this set up was that is was SIMPLE and Tradable.

And it is a SET UP.... we can't force it to happen. We need to look for the patterns.. wait for it... and when it comes - trade it with faith and conviction.

Yes... many times SL will be hit.

But I believe you absolutely trade as per my original post - the reward is always 7-15 times the risk ie with 8-10 points SL you can earn 60-120 or even more points.

Many charts posted here are NOT at all as per the set up. I am not referring any names but instead just posting my today's trade - which was a classic NVK SET UP.

Wait for it and when it comes trade it.

Again I am telling - this set up is purely for intraday seeing yahoo NS chart.

Cheers!!!!

Saikat

| Description: |

|

| Filesize: |

51.67 KB |

| Viewed: |

2437 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #118  Posted: Thu Oct 01, 2009 4:18 pm Post subject: Posted: Thu Oct 01, 2009 4:18 pm Post subject: |

|

|

Hello Saikat,

The beauty of the SETUP lies in its simplicity and obvious visibility.

A novice can trade it.

SHEKHAR

|

|

| Back to top |

|

|

jps.nifty

White Belt

Joined: 22 Dec 2008

Posts: 5

|

Post: #119  Posted: Sun Oct 04, 2009 9:05 pm Post subject: what is NVK SETUP Posted: Sun Oct 04, 2009 9:05 pm Post subject: what is NVK SETUP |

|

|

Hello mr.saikat

I am new for this forum. can u explain me please what is NVK SETUP

Please sir i am very intresting

|

|

| Back to top |

|

|

natarajmtech

White Belt

Joined: 13 Oct 2008

Posts: 61

|

Post: #120  Posted: Tue Oct 06, 2009 4:35 pm Post subject: Proposing additional rule to trace the NVK setup Posted: Tue Oct 06, 2009 4:35 pm Post subject: Proposing additional rule to trace the NVK setup |

|

|

Hi,

I have been studying role of slow stochastic plot available in yahoo RT chart along with NVK setup proposed originally by Saikat. I believe the slow stochastic technical indicator often quite useful in conforming the NVK setup and also helpful in spotting the setup earlier on. I have noticed that the bullish crossover (blue curve crossover the red curve) happened at or near the oversold territory corresponding to the first bottom of the double bottom in price chart of an NVK setup. I am presenting today's Nifty (spot) yahoo RT chart along with my proposed observation with an illustration for you.

One caveat for today’s setup is the stoploss would have not been 10 points.

And there is no need to say that the same indicator can also be interpreted for a " NVK setup for Short trade" in the vice versa manner.

Hope the NVK setup in coming days will be helpful to see the usefulness of the new proposed indicator.

Regards and happy trading.

Nataraj

| Description: |

|

| Filesize: |

90.1 KB |

| Viewed: |

2203 Time(s) |

|

|

|

| Back to top |

|

|

|