| View previous topic :: View next topic |

| Author |

NVK SET UP |

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #286  Posted: Fri Mar 05, 2010 1:23 pm Post subject: Posted: Fri Mar 05, 2010 1:23 pm Post subject: |

|

|

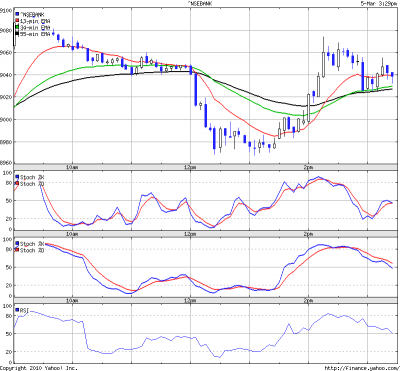

BNF 5min on 5-Mar-2010 in NVK setup

vin

| Description: |

|

| Filesize: |

13.77 KB |

| Viewed: |

410 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #287  Posted: Fri Mar 05, 2010 3:41 pm Post subject: Posted: Fri Mar 05, 2010 3:41 pm Post subject: |

|

|

successful result of BNF NVK set-up in 5min charts of 5-Mar-2010

vin

| Description: |

|

| Filesize: |

15.34 KB |

| Viewed: |

424 Time(s) |

|

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

Post: #288  Posted: Fri Mar 05, 2010 8:30 pm Post subject: Posted: Fri Mar 05, 2010 8:30 pm Post subject: |

|

|

| saikat wrote: | Hello again,

SUZLON formed NVK yesterday on hourly.

Entered @ 68.50 yesterday

SL - hourly close below 67.5

TGT 1 - 75

TGT 2 - 79 (from FIBO of last swing 95.4 - 68.2)

Here I have taken the swing seeing from EOD chart - though

actually I sud see only hourly. Problem is that hourly swing

is very small - 75-68 - so used the EOD swing.

75 level matches with EOD 34 EMA also - so if I see that level

I will book 75%

Lets see how it works out

Cheers !!!!! |

Hello,

Targets met nicely

Now if holding above 79 - it will run to 85

I am holding my 25% delivery with now SL 79 - EOD close basis

Cheers!!!

Saikat

| Description: |

|

| Filesize: |

80.91 KB |

| Viewed: |

443 Time(s) |

|

|

|

| Back to top |

|

|

sadanandpurav

White Belt

Joined: 11 Sep 2009

Posts: 1

|

Post: #289  Posted: Mon Mar 08, 2010 6:55 am Post subject: nvk set up explain pl Posted: Mon Mar 08, 2010 6:55 am Post subject: nvk set up explain pl |

|

|

dear sir,

sadanand purav here, goood morning. i m newly joined in this website. ur study on technicals is very cast and informative to new comers. pl explain nvk set up once again and how and where it can be useful to us. i have completed a course in technicals and trading in market.

thanks

| saikat wrote: | | saikat wrote: | Hello again,

SUZLON formed NVK yesterday on hourly.

Entered @ 68.50 yesterday

SL - hourly close below 67.5

TGT 1 - 75

TGT 2 - 79 (from FIBO of last swing 95.4 - 68.2)

Here I have taken the swing seeing from EOD chart - though

actually I sud see only hourly. Problem is that hourly swing

is very small - 75-68 - so used the EOD swing.

75 level matches with EOD 34 EMA also - so if I see that level

I will book 75%

Lets see how it works out

Cheers !!!!! |

Hello,

Targets met nicely

Now if holding above 79 - it will run to 85

I am holding my 25% delivery with now SL 79 - EOD close basis

Cheers!!!

Saikat |

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #290  Posted: Mon Mar 08, 2010 10:02 am Post subject: Re: nvk set up explain pl Posted: Mon Mar 08, 2010 10:02 am Post subject: Re: nvk set up explain pl |

|

|

| sadanandpurav wrote: | dear sir,

sadanand purav here, goood morning. i m newly joined in this website. ur study on technicals is very cast and informative to new comers. pl explain nvk set up once again and how and where it can be useful to us. i have completed a course in technicals and trading in market.

thanks |

sadanandpurav,

Please make little efforts go through the thread completely, you will get the feel of the setup.

Saikat has very lucidly explained the setup in the first post of this thread hope you will be benefited by it.

SHEKHAR

Last edited by shekharinvest on Tue Mar 09, 2010 3:02 pm; edited 1 time in total |

|

| Back to top |

|

|

mvnm

White Belt

Joined: 15 Aug 2008

Posts: 54

|

Post: #291  Posted: Mon Mar 08, 2010 12:30 pm Post subject: Re: clarification by saiket Posted: Mon Mar 08, 2010 12:30 pm Post subject: Re: clarification by saiket |

|

|

saiket not clarified till now

| msrimahidar wrote: | Dear saiket,

In SB you have said that Educomp is not a NVK set up.

I require some clarification on this aspect. You are referring to Class A divergence and Class B Divergence. After going though the thread from begenning i have been able to infer the following.

1. Class A Divergence - when Price has made a double bottom or top and RSI is making higher bottom or lower high

2.Class B Divergence - when Price has hade a lower low or Higher high and RSI has made Higher low and Lower high.

If the above is correct which one is better?

a i correct?

another clarification whether the positive or -ve divergence whould be made above the oversold line or and below the over bought line.

Please clarify the above.

i the case of Educomp you have said that it is not an NVK. i am herewith attaching the chart of EDUcomp and as per me it has formed NVK and also confirmed the same if not an NVK why it would held me in fine tuning my self in identification of the same.

Thanking you in Advance

M.Sri mahidar  |

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

|

| Back to top |

|

|

tripathi_manu

White Belt

Joined: 27 Dec 2008

Posts: 62

|

Post: #293  Posted: Tue Mar 09, 2010 8:49 am Post subject: Re: clarification by saiket Posted: Tue Mar 09, 2010 8:49 am Post subject: Re: clarification by saiket |

|

|

ms chart kidhar hai ?

manu

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

Post: #295  Posted: Tue Mar 09, 2010 6:46 pm Post subject: Re: Apollo Tyres Short Posted: Tue Mar 09, 2010 6:46 pm Post subject: Re: Apollo Tyres Short |

|

|

| Ravi_S wrote: | Worked magically well... 23.6% target achieved (64) we would have to wait for more downside.

I entered at 66.15 and came out at 65.15 (One Rupee and One Lot)

Regards

Ravi  |

Hi Ravi,

Target logics for swing trades using NVK were defined in my one of my initial posts. It is same as what you have done - ie using FIBO.

Now you need to know the scrips strength and volatilty to decide where to book profit.

If the scrip is too strong - then 23.6 may be good enuf

If the scrip is volatile and having high Beta - u can even get 61.8

Regards,

Saikat

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #297  Posted: Tue Mar 09, 2010 7:19 pm Post subject: Re: Apollo Tyres Short Posted: Tue Mar 09, 2010 7:19 pm Post subject: Re: Apollo Tyres Short |

|

|

Hi Saikat

Thanks for the clarifications. I have a few more questions based on your reply.

1. When you say Strength of a stock, how is it measured? Are you talking about the absolute volumes or something else?

2. When you say high beta what is the numbers we are looking for. For e.g., Apollo Tyres has a beta of 0.97.

Regards

Ravi

| saikat wrote: | | Ravi_S wrote: | Worked magically well... 23.6% target achieved (64) we would have to wait for more downside.

I entered at 66.15 and came out at 65.15 (One Rupee and One Lot)

Regards

Ravi  |

Hi Ravi,

Target logics for swing trades using NVK were defined in my one of my initial posts. It is same as what you have done - ie using FIBO.

Now you need to know the scrips strength and volatilty to decide where to book profit.

If the scrip is too strong - then 23.6 may be good enuf

If the scrip is volatile and having high Beta - u can even get 61.8

Regards,

Saikat |

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

Post: #299  Posted: Tue Mar 09, 2010 8:04 pm Post subject: Re: Apollo Tyres Short Posted: Tue Mar 09, 2010 8:04 pm Post subject: Re: Apollo Tyres Short |

|

|

| Ravi_S wrote: | Hi Saikat

Thanks for the clarifications. I have a few more questions based on your reply.

1. When you say Strength of a stock, how is it measured? Are you talking about the absolute volumes or something else?

2. When you say high beta what is the numbers we are looking for. For e.g., Apollo Tyres has a beta of 0.97.

Regards

Ravi

| saikat wrote: | | Ravi_S wrote: | Worked magically well... 23.6% target achieved (64) we would have to wait for more downside.

I entered at 66.15 and came out at 65.15 (One Rupee and One Lot)

Regards

Ravi  |

Hi Ravi,

Target logics for swing trades using NVK were defined in my one of my initial posts. It is same as what you have done - ie using FIBO.

Now you need to know the scrips strength and volatilty to decide where to book profit.

If the scrip is too strong - then 23.6 may be good enuf

If the scrip is volatile and having high Beta - u can even get 61.8

Regards,

Saikat |

|

Hi Ravi,

Hmmm... What I was trying to say was not by seeing any datasheet. I really have no idea of actual beta values of the scrips I trade.

Whatever I gather - I gather from chart only.

It becomes relatively easy when u trade only same few srcips every day ..for many years.... you know how they behave - you can have good guess whether it will retrace from 13 or a dip will come to 34 ..... Many times you can feel the move coming in the scrips even before it occurs  and I am not joking. That is advantage of trading same thing again and again. and I am not joking. That is advantage of trading same thing again and again.

You have to observe - I can't say anything more...

Regards,

Saikat

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #300  Posted: Tue Mar 09, 2010 10:47 pm Post subject: Re: Apollo Tyres Short Posted: Tue Mar 09, 2010 10:47 pm Post subject: Re: Apollo Tyres Short |

|

|

hmm... now that is what is called Jaadu ki Jhappi according to Dr. Munnabhai MBBS...

| saikat wrote: | | Ravi_S wrote: | Hi Saikat

Thanks for the clarifications. I have a few more questions based on your reply.

1. When you say Strength of a stock, how is it measured? Are you talking about the absolute volumes or something else?

2. When you say high beta what is the numbers we are looking for. For e.g., Apollo Tyres has a beta of 0.97.

Regards

Ravi

| saikat wrote: | | Ravi_S wrote: | Worked magically well... 23.6% target achieved (64) we would have to wait for more downside.

I entered at 66.15 and came out at 65.15 (One Rupee and One Lot)

Regards

Ravi  |

Hi Ravi,

Target logics for swing trades using NVK were defined in my one of my initial posts. It is same as what you have done - ie using FIBO.

Now you need to know the scrips strength and volatilty to decide where to book profit.

If the scrip is too strong - then 23.6 may be good enuf

If the scrip is volatile and having high Beta - u can even get 61.8

Regards,

Saikat |

|

Hi Ravi,

Hmmm... What I was trying to say was not by seeing any datasheet. I really have no idea of actual beta values of the scrips I trade.

Whatever I gather - I gather from chart only.

It becomes relatively easy when u trade only same few srcips every day ..for many years.... you know how they behave - you can have good guess whether it will retrace from 13 or a dip will come to 34 ..... Many times you can feel the move coming in the scrips even before it occurs  and I am not joking. That is advantage of trading same thing again and again. and I am not joking. That is advantage of trading same thing again and again.

You have to observe - I can't say anything more...

Regards,

Saikat |

|

|

| Back to top |

|

|

|