| View previous topic :: View next topic |

| Author |

NVK SET UP |

ashis

White Belt

Joined: 28 Mar 2010

Posts: 75

|

Post: #421  Posted: Sun Apr 11, 2010 7:17 am Post subject: Posted: Sun Apr 11, 2010 7:17 am Post subject: |

|

|

Dear sir

Can you guide me for perfact FIBO range ?

I found it was 23%, 38.2%, 50%, 61.8%, 75% ,85%, 100% and 200%

Is it right?

Also guide me this calculation is bases on what? previous high and low or anything else?

Regards

Ashis

| saikat wrote: | Hello all,

My EOD NF view.

No NVK here - but thought to post here in this thread only so that I can easily monitor and discuss.

5479 is 78.6% of the big fall.

And 1-2% error in that big FIBO range is quite normal

5398 is within 2% of 5479. So a big correction may come.

Lets see......

Hold onto shorts and watch

Cheers !!! |

|

|

| Back to top |

|

|

|

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

Post: #422  Posted: Sun Apr 11, 2010 11:16 am Post subject: Posted: Sun Apr 11, 2010 11:16 am Post subject: |

|

|

Hello Ashis,

The FIBO ratios mostly used in mkt are 23.6 / 38.2 / 61.8 / 78.6 / 100 / 127.2 / 161.8

These are derived from the FIBO series. 0 1 1 2 3 5 8 13 21 34 ........

You try different ratios and their sqr roots or sqr - U will find them pretty easily.

For FIBO retracements - You take last swing high/low and calculate.

You can find many charts posted in this thread having FIBO retracements marked on them. Observe them - you should get the idea.

Regards,

Saikat

| ashis wrote: | Dear sir

Can you guide me for perfact FIBO range ?

I found it was 23%, 38.2%, 50%, 61.8%, 75% ,85%, 100% and 200%

Is it right?

Also guide me this calculation is bases on what? previous high and low or anything else?

Regards

Ashis

| saikat wrote: | Hello all,

My EOD NF view.

No NVK here - but thought to post here in this thread only so that I can easily monitor and discuss.

5479 is 78.6% of the big fall.

And 1-2% error in that big FIBO range is quite normal

5398 is within 2% of 5479. So a big correction may come.

Lets see......

Hold onto shorts and watch

Cheers !!! |

|

|

|

| Back to top |

|

|

Kamalesh

White Belt

Joined: 20 Sep 2008

Posts: 4

|

Post: #423  Posted: Sat Apr 17, 2010 1:49 pm Post subject: Posted: Sat Apr 17, 2010 1:49 pm Post subject: |

|

|

| saikat wrote: | Hello Ashis,

The FIBO ratios mostly used in mkt are 23.6 / 38.2 / 61.8 / 78.6 / 100 / 127.2 / 161.8

These are derived from the FIBO series. 0 1 1 2 3 5 8 13 21 34 ........

You try different ratios and their sqr roots or sqr - U will find them pretty easily.

For FIBO retracements - You take last swing high/low and calculate.

You can find many charts posted in this thread having FIBO retracements marked on them. Observe them - you should get the idea.

Regards,

Saikat

| ashis wrote: | Dear sir

Can you guide me for perfact FIBO range ?

I found it was 23%, 38.2%, 50%, 61.8%, 75% ,85%, 100% and 200%

Is it right?

Also guide me this calculation is bases on what? previous high and low or anything else?

Regards

Ashis

| saikat wrote: | Hello all,

My EOD NF view.

No NVK here - but thought to post here in this thread only so that I can easily monitor and discuss.

5479 is 78.6% of the big fall.

And 1-2% error in that big FIBO range is quite normal

5398 is within 2% of 5479. So a big correction may come.

Lets see......

Hold onto shorts and watch

Cheers !!! |

|

|

|

|

| Back to top |

|

|

mvnm

White Belt

Joined: 15 Aug 2008

Posts: 54

|

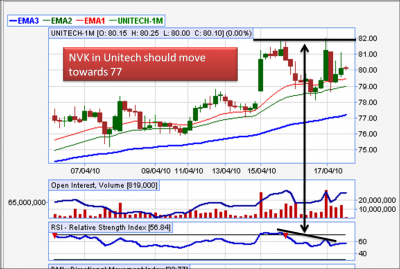

Post: #424  Posted: Mon Apr 19, 2010 12:18 pm Post subject: nkv in Unitech Posted: Mon Apr 19, 2010 12:18 pm Post subject: nkv in Unitech |

|

|

NVK in unitech

M.Sri Mahidar

| Description: |

|

| Filesize: |

312.92 KB |

| Viewed: |

463 Time(s) |

|

|

|

| Back to top |

|

|

ashis

White Belt

Joined: 28 Mar 2010

Posts: 75

|

Post: #425  Posted: Tue Apr 20, 2010 8:25 am Post subject: Re: nkv in Unitech Posted: Tue Apr 20, 2010 8:25 am Post subject: Re: nkv in Unitech |

|

|

Dear sir

Good observation.

Can you guide that how much candles you've calculated for EMA-1, 2 and 3.? I observed that your target is EMA-3 is it right?

Regards

Ashis

| msrimahidar wrote: | NVK in unitech

M.Sri Mahidar |

|

|

| Back to top |

|

|

nvksrinivas

White Belt

Joined: 14 Aug 2006

Posts: 6

|

Post: #426  Posted: Tue Apr 20, 2010 10:07 pm Post subject: Posted: Tue Apr 20, 2010 10:07 pm Post subject: |

|

|

After long time visiting the thread initiated by SAIKAT . Good going

and Good observation too Mr Mahidar - keep it up lets see how it unfolds in

Unitech

nvksrinivas

|

|

| Back to top |

|

|

sunrays

White Belt

Joined: 19 Dec 2009

Posts: 71

|

Post: #427  Posted: Wed Apr 21, 2010 1:46 am Post subject: impact of a guru Posted: Wed Apr 21, 2010 1:46 am Post subject: impact of a guru |

|

|

how deep n meaningful is the impact of nvksrinivas on saikat....

it clearly shows how a guru can impact the trading style of his student

saikat has done a fabulous job in forum........hats off both nvk srinivas n saikat .............great going

|

|

| Back to top |

|

|

tripathi_manu

White Belt

Joined: 27 Dec 2008

Posts: 62

|

Post: #428  Posted: Wed Apr 21, 2010 8:10 am Post subject: Posted: Wed Apr 21, 2010 8:10 am Post subject: |

|

|

| nvksrinivas wrote: | After long time visiting the thread initiated by SAIKAT . Good going

and Good observation too Mr Mahidar - keep it up lets see how it unfolds in

Unitech

nvksrinivas |

Respected NVK sir,

People are very thankful to u and Saikat.

Regards

manu

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

|

| Back to top |

|

|

sandythehellboy

White Belt

Joined: 15 Dec 2007

Posts: 21

|

Post: #430  Posted: Tue Apr 27, 2010 5:37 pm Post subject: NVK in Nifty Today Posted: Tue Apr 27, 2010 5:37 pm Post subject: NVK in Nifty Today |

|

|

| [img]http://ichart.finance.yahoo.com/z?s=%5ENSEI&t=1d&q=c&l=on&z=l&p=&a=r14[/img]

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #431  Posted: Tue Apr 27, 2010 6:16 pm Post subject: Posted: Tue Apr 27, 2010 6:16 pm Post subject: |

|

|

Hi,

Here is Banknifty-1m EOD chart.

SHEKHAR

| Description: |

|

| Filesize: |

41.57 KB |

| Viewed: |

440 Time(s) |

|

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #432  Posted: Tue Apr 27, 2010 11:10 pm Post subject: Posted: Tue Apr 27, 2010 11:10 pm Post subject: |

|

|

Shekar

How do you trade this setup, kind of Doji too at the top... Do you go short with a SL = High of 26 Apr 2010 (9900)? or wait for some retracement before going short

Regards

Ravi

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #433  Posted: Wed Apr 28, 2010 9:13 am Post subject: Posted: Wed Apr 28, 2010 9:13 am Post subject: |

|

|

Ravi,

I generally take positon when STS gives a sell and take high as the SL. In this case SL will be quite far. I wont take. If per chance it retraces and gives an opportunity to short with manageable SL, one should.

If you beleive it can go deep you can buy puts.

SHEKHAR

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

Post: #435  Posted: Wed Apr 28, 2010 12:56 pm Post subject: Posted: Wed Apr 28, 2010 12:56 pm Post subject: |

|

|

| raghavacc wrote: | | saikat wrote: | Hello,

Today NVK worked very beautifully - the set up was quite good looking.

As I was not in SB that time - I couldn't shout

But I hope it was too easy to notice and trade.

As I was already swing short since yesterday in April @ 5307

so I took intra long in May and as I was to go out for some time I had kept

a limit Sqr off order 5 points below morning high - which got hit after just 7 candles - thanks to 20 odd points premium in May that time

That's why though on NS chart the high it made after trade entry doesn't look like anywhere near morning high - but the MAY future almost reached morning high.

Cheers !!!!!!!

Saikat |

Hello Saikat,

A novice type of question. Hope you wont mind.

The chart you have been attaching like one above are crystal clear.But in Finance.yahoo.com when I open interactive charts display of charts is somewhat differnt? Can you pls guide me how to customise the settings to make it appear like the one above?

Regards

Raghav |

Hello,

Asking 'novice type' questions are necessary steps of learning.

I don't use interactive chart.

The one I use is the one I post here.

Just go through latest 4-5 pages of this thread - I had given the link to somebody here.

Regards,

Saikat

|

|

| Back to top |

|

|

|