|

|

| View previous topic :: View next topic |

| Author |

OPEN INTEREST |

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #1  Posted: Tue Jul 09, 2013 10:49 pm Post subject: OPEN INTEREST Posted: Tue Jul 09, 2013 10:49 pm Post subject: OPEN INTEREST |

|

|

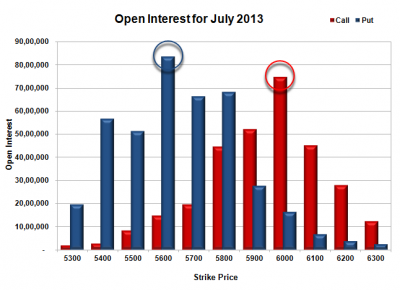

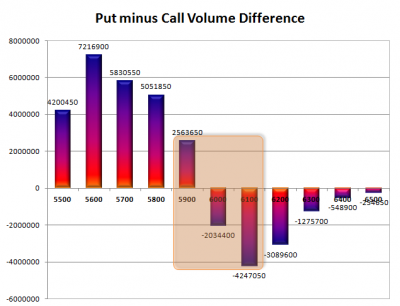

OPEN INTEREST ( 09 / 07 )

| Description: |

|

| Filesize: |

24.46 KB |

| Viewed: |

406 Time(s) |

|

| Description: |

|

| Filesize: |

20.21 KB |

| Viewed: |

389 Time(s) |

|

| Description: |

|

| Filesize: |

33.3 KB |

| Viewed: |

389 Time(s) |

|

|

|

| Back to top |

|

|

|

|  |

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #2  Posted: Tue Jul 09, 2013 11:00 pm Post subject: Posted: Tue Jul 09, 2013 11:00 pm Post subject: |

|

|

| Thanks Hemant Sir...

|

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #3  Posted: Thu Jul 11, 2013 12:05 am Post subject: Posted: Thu Jul 11, 2013 12:05 am Post subject: |

|

|

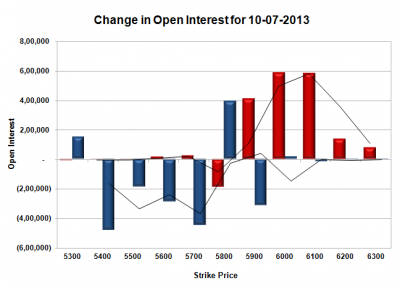

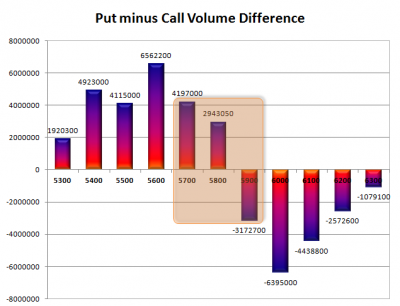

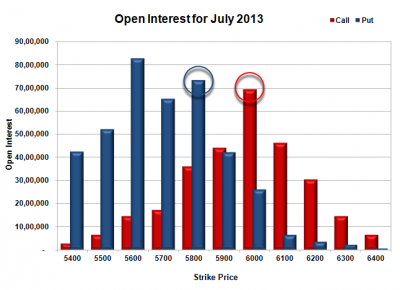

OPEN INTEREST ( 10 / 07 )

| Description: |

|

| Filesize: |

24 KB |

| Viewed: |

399 Time(s) |

|

| Description: |

|

| Filesize: |

21.85 KB |

| Viewed: |

387 Time(s) |

|

| Description: |

|

| Filesize: |

34.62 KB |

| Viewed: |

397 Time(s) |

|

|

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #4  Posted: Thu Jul 11, 2013 11:39 pm Post subject: Posted: Thu Jul 11, 2013 11:39 pm Post subject: |

|

|

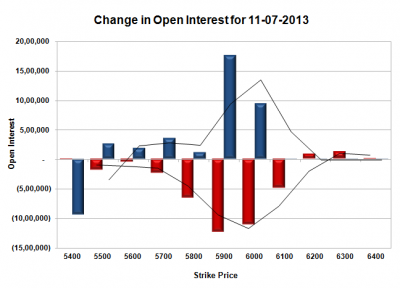

OPEN INTEREST ( 11 / 07 )

| Description: |

|

| Filesize: |

24.08 KB |

| Viewed: |

390 Time(s) |

|

| Description: |

|

| Filesize: |

20.89 KB |

| Viewed: |

383 Time(s) |

|

| Description: |

|

| Filesize: |

33.47 KB |

| Viewed: |

386 Time(s) |

|

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #5  Posted: Fri Jul 12, 2013 12:38 am Post subject: Posted: Fri Jul 12, 2013 12:38 am Post subject: |

|

|

hemant_parikh,

Why do you have two "OPEN INTEREST" topics running?

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #6  Posted: Fri Jul 12, 2013 12:47 am Post subject: Posted: Fri Jul 12, 2013 12:47 am Post subject: |

|

|

This thread has been move to "Futures & Options" as it was in the wrong section "Education".

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #7  Posted: Sun Jul 14, 2013 11:48 am Post subject: Posted: Sun Jul 14, 2013 11:48 am Post subject: |

|

|

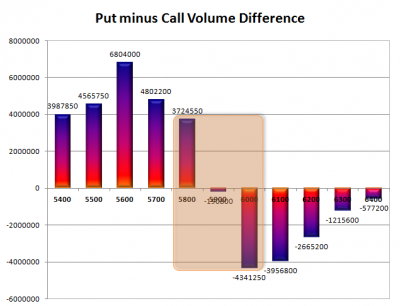

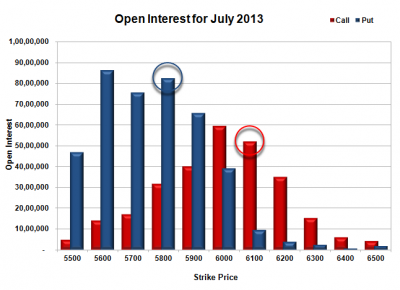

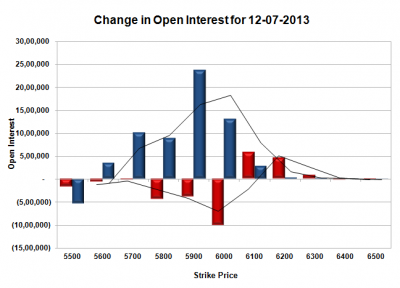

OPEN INTEREST ( 12 / 07 )

| Description: |

|

| Filesize: |

24.51 KB |

| Viewed: |

403 Time(s) |

|

| Description: |

|

| Filesize: |

20.98 KB |

| Viewed: |

390 Time(s) |

|

| Description: |

|

| Filesize: |

33.42 KB |

| Viewed: |

397 Time(s) |

|

|

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #8  Posted: Wed Jul 17, 2013 12:13 am Post subject: OPEN INTEREST Posted: Wed Jul 17, 2013 12:13 am Post subject: OPEN INTEREST |

|

|

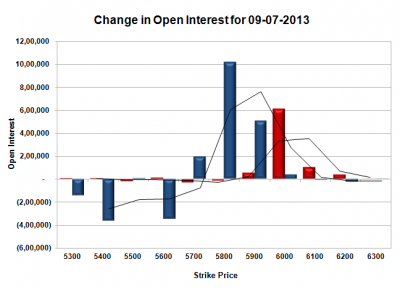

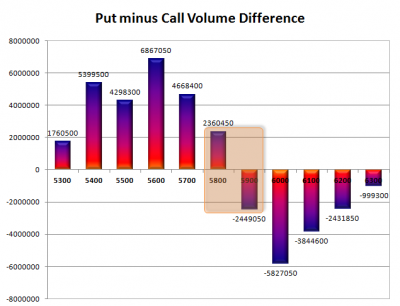

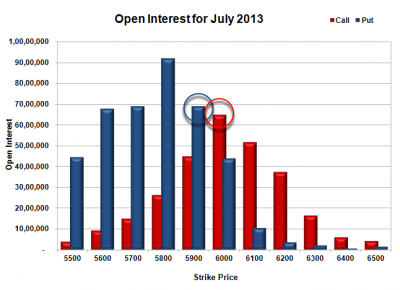

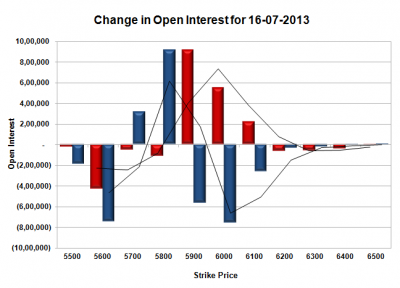

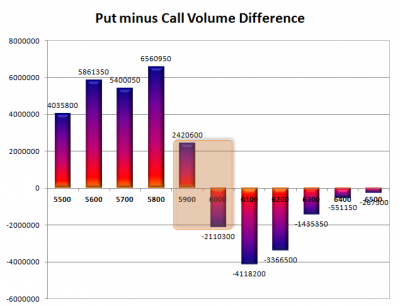

OPEN INTEREST ( 16 / 07 ) ::::::

Nifty opened exactly 100 points down as RBI raised lending rates to commercial banks by 2 per cent to 10.25 per cent making the loans costlier.

Bank Nifty was down by about 5%, but Nifty recovered some lost ground to close at 5955.25, still a huge loss 75.55 points. The broader market was also very negative, with just 341 advances to 825 declines. OI table saw huge resistance building up around 6000 level.

Call option 5900-6100 added 16.90 lacs huge amount OI with profit booking seen at 6200 and above strike prices.

Put option 5800-5700 added 12.36 lacs huge amount of OI with short covering seen at 5900 and above strike prices.

Highest accumulation on Call option 6000 at 64.95 lacs & 6100 at 51.64 lacs whereas Put option 5800 at 91.92 lacs & 5900 at 69.00 lacs.

Nifty Open Interest is at 1,65,72,900 down by 14,12,750, with decrease in price, most probably huge long liquidation.

Bank Nifty Open Interest is at 13,84,450, down by 7,350, with decrease in price, most probably long liquidation.

FII’s sold 4.64 lacs Futures, mostly long liquidation, as their net OI decreased by 5265 contracts and the average price per contract comes to around 5934.26.

FII’s future open contract as on date is 464355.

PCR Open Interest (Volume) has gone down a bit to 1.640.

Support still very much at 5900, with huge OI of 69.00 lacs and below that at 5800 with highest OI of 91.92 lacs.

Resistance building up at 6000, with OI now above 64.94 lacs and above that at 6100, with OI of 51.64 lacs.

Range as per Option Table is 5882 - 6012 and as per VIX is 5896 - 6014 with 5944 as the Pivot.

SOURCES ::: KANAK ( EMAIL )

| Description: |

|

| Filesize: |

23.58 KB |

| Viewed: |

397 Time(s) |

|

| Description: |

|

| Filesize: |

24.91 KB |

| Viewed: |

367 Time(s) |

|

| Description: |

|

| Filesize: |

32.3 KB |

| Viewed: |

401 Time(s) |

|

|

|

| Back to top |

|

|

manojkr78

Green Belt

Joined: 07 Mar 2011

Posts: 1014

|

Post: #9  Posted: Wed Jul 17, 2013 8:59 am Post subject: Posted: Wed Jul 17, 2013 8:59 am Post subject: |

|

|

hemant,

thanks for posting.....

manoj

|

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #10  Posted: Thu Jul 18, 2013 12:19 am Post subject: NIFTY FUTURE TECHNICAL VIEW FOR JULY ' 2013 Posted: Thu Jul 18, 2013 12:19 am Post subject: NIFTY FUTURE TECHNICAL VIEW FOR JULY ' 2013 |

|

|

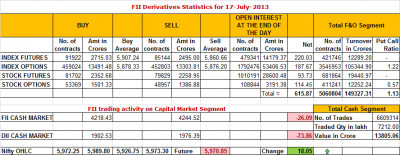

FII STATISTICS

| Description: |

|

| Filesize: |

30.58 KB |

| Viewed: |

410 Time(s) |

|

|

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #11  Posted: Thu Jul 18, 2013 12:48 am Post subject: OPEN INTEREST Posted: Thu Jul 18, 2013 12:48 am Post subject: OPEN INTEREST |

|

|

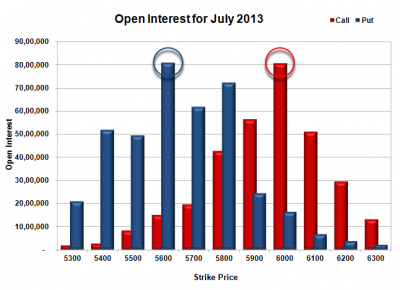

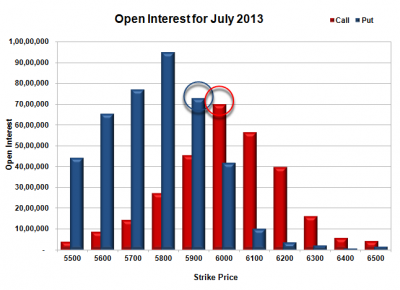

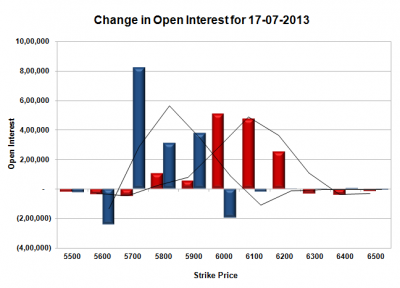

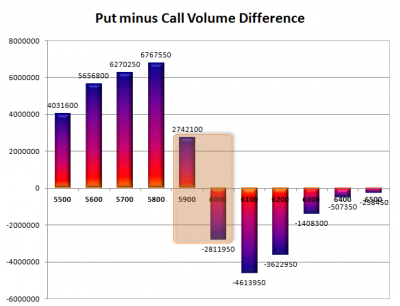

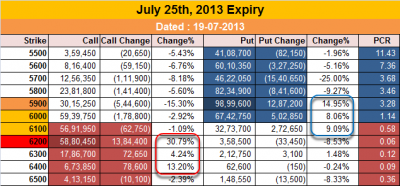

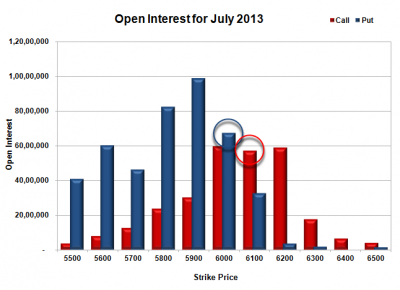

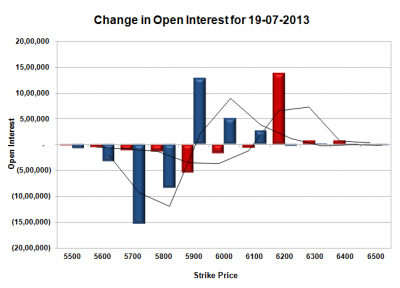

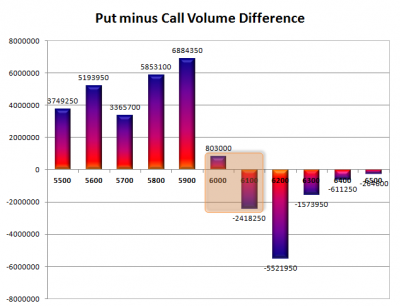

OPEN INTEREST ( 17 / 07 ) :::

Nifty opened positive and meandered within a narrow range of 30 points for the better part of day to see a dip towards 5927 around Europe exchange open time. The dip was promptly bought by the responsive buyers and the index closed in the green at 5973.30, a small gain of 18.05 points. The broader market though was weak, with just 457 advances to 722 declines. OI table is delicately poised at 5900-6000 range with a breakout or breakdown eminent in the next few days.

Call option 5800-6200 added 13.89 lacs huge amount OI with profit booking seen at 6300 and above strike prices.

Put option 5900-5700 added 15.07 lacs huge amount of OI with short covering seen at 6000 and above strike prices.

Highest accumulation on Call option 6000 at 69.99 lacs & 6100 at 56.37 lacs whereas Put option 5800 at 95.02 lacs & 5700 at 77.13 lacs.

Nifty Open Interest is at 1,64,62,700 down by 1,10,200, with not much change in price, most probably long liquidation.

Bank Nifty Open Interest is at 16,47,175, up by 2,62,725, with decrease in price, most probably huge short build-up.

FII’s bought 3.39 lacs Futures, mostly long build-up, as their net OI increased by 14986 contracts and the average price per contract comes to around 5916.19.

FII’s future open contract as on date is 479341.

PCR Open Interest (Volume) is still very good at 1.600.

Support getting better at 5900, with OI now above 72.75 lacs and below that at 5800 with highest OI of 95.02 lacs.

Good Resistance now at 6000, with OI just below 70 lacs and above that at 6100, with OI of 56.37 lacs.

Range as per Option Table is 5904 - 6028 and as per VIX is 5913 - 6034 with 5963 as the Pivot.

SOURCES : EMAIL

| Description: |

|

| Filesize: |

23.56 KB |

| Viewed: |

381 Time(s) |

|

| Description: |

|

| Filesize: |

20.92 KB |

| Viewed: |

373 Time(s) |

|

| Description: |

|

| Filesize: |

33.57 KB |

| Viewed: |

375 Time(s) |

|

|

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #12  Posted: Thu Jul 18, 2013 11:07 pm Post subject: Posted: Thu Jul 18, 2013 11:07 pm Post subject: |

|

|

OPEN INTEREST ( 18 / 07 ) ::::

Nifty opened positive but lazily traded within a narrow range for the entire morning session, but saw huge buying interest in the afternoon session which carried the index above 6000 to the highs of the day around 6050.

The index ultimately closed at 6038.05, a huge gain of 64.75 points. The broader market was also strong, with 639 advances to 512 declines. OI table saw the breakout as discussed yesterday and the PE writers are in very strong position.

Call option 6100-6300 added 7.19 lacs huge amount OI with short covering seen at 6000 and below strike prices.

Put option 6100-5900 added 53.67 lacs huge amount of OI with profit booking seen at 5800 and below strike prices.

Highest accumulation on Call option 6000 at 61.19 lacs & 6100 at 57.55 lacs whereas Put option 5800 at 90.76 lacs & 5900 at 86.12 lacs.

Nifty Open Interest is at 1,61,90,850 down by 2,71,850, with increase in price, most probably short covering.

Bank Nifty Open Interest is at 17,85,300, up by 1,38,125, with increase in price, most probably huge long build-up.

FII’s sold just 3500 Futures, mostly short build-up, as their net OI increased by 27232 contracts and the average price per contract comes to around 5995.39.

FII’s future open contract as on date is 506573.

PCR Open Interest (Volume) is at the highest point of the series at 1.774.

Support gathering steam at 6000, with OI now above 62.40 lacs and below that at 5900 with huge OI of 86.12 lacs.

Only Resistance now at 6100, with OI just above 57.54 lacs.

Range as per Option Table is 5963 - 6087 and as per VIX is 5980 - 6096 with 6021 as the Pivot.

SOURCES l EMAIL

|

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #13  Posted: Sun Jul 21, 2013 11:02 pm Post subject: OPEN INTEREST Posted: Sun Jul 21, 2013 11:02 pm Post subject: OPEN INTEREST |

|

|

OPEN INTEREST ( 19 / 07 )

| Description: |

|

| Filesize: |

38.71 KB |

| Viewed: |

384 Time(s) |

|

| Description: |

|

| Filesize: |

21.61 KB |

| Viewed: |

358 Time(s) |

|

| Description: |

|

| Filesize: |

21.23 KB |

| Viewed: |

354 Time(s) |

|

| Description: |

|

| Filesize: |

30.61 KB |

| Viewed: |

339 Time(s) |

|

|

|

| Back to top |

|

|

smartcancerian

Yellow Belt

Joined: 07 Apr 2010

Posts: 542

|

Post: #14  Posted: Mon Jul 22, 2013 7:20 am Post subject: Posted: Mon Jul 22, 2013 7:20 am Post subject: |

|

|

| Can you help to understand (not the narration) these statistics..?? Where do you think the chances are more(since its a game of probability) for the markets to go by reading this OI data...

|

|

| Back to top |

|

|

hemant_parikh

White Belt

Joined: 22 Sep 2010

Posts: 66

|

Post: #15  Posted: Wed Jul 24, 2013 1:02 am Post subject: OPEN INTEREST Posted: Wed Jul 24, 2013 1:02 am Post subject: OPEN INTEREST |

|

|

Nifty opened positive above the crucial resistance zone of 6060 and stayed in a narrow range of 32 points for the entire session of trade. The index after making a high of 6093 and a low of 6061 ultimately closed at 6077.80, a huge gain of 46.00 points.The broader market was just positive, with just 593 advances to 566 declines. OI table support is now at 6000 level.

Call option 6200 added 2.73 lacs huge amount OI with short covering seen at 6100 and below strike prices.

Put option 6200-6000 added 19.67 lacs huge amount of OI with profit booking seen at 5900 and below strike prices.

Highest accumulation on Call option 6200 at 60.98 lacs & 6100 at 55.48 lacs whereas Put option 6000 at 88.64 lacs & 5900 at 88.40 lacs.

Nifty Open Interest is at 1,18,68,250 down by 22,42,050, whereas August series added 42.12 lacs, with huge increase in price, most probably 100% rollover with huge long addition in next series.

Bank Nifty Open Interest is at 16,63,150, down by 1,60,075, whereas August series added 5.85 lacs, with increase in price, most probably 100% rollover with huge long build-up in next series.

FII’s bought huge 16.90 lacs Futures, mostly probably long build-up, as their net OI increased by 69450 contracts and the average price per contract comes to around 6022.07.

FII’s future open contract as on date is 626010.

PCR Open Interest (Volume) is up at 1.958, the highest of the series and one of the highest in recent times.

Super Support now at 6000, with highest OI of 88.64 lacs and below that at 5900 with huge OI of 88.40 lacs.

Resistance at 6100, but looking weak and above that at 6200 with OI of 60.98 lacs.

Range as per Option Table is 6021 - 6132 and as per VIX is 6025 - 6131 with 6077 as the Pivot.

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|