| View previous topic :: View next topic |

| Author |

Option Query |

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #1  Posted: Mon Sep 05, 2016 8:52 pm Post subject: Option Query Posted: Mon Sep 05, 2016 8:52 pm Post subject: Option Query |

|

|

Posting my Query, so that anyone can help

I am planning to play Verticals Spread on Stock Options, But as you people know that Options on Stock is not liquid.

I want to know that what will happen if I am unable to close my vertical spread till the day of Expiry.

I will take here an example

Lets taks RELIANCE. On 30th May Reliance LTP is 968.7 and on 30th June Reliance LTP is 969.15

On 30th May, I decided to create a Vertical Spread

I purchased June 980CE @ 21 and Sold june 1020 CE @ 8.90

On 30th June (Expiry Date) I want to Square of my position

Sell June 980 CE @ 0.05 & Cover June 1020 CE @ 0.05

But I found that there are no buyers and Sellers and I am not able to Square off my position till the end of day.

On 30th June I am making a loss of -12 on my above Trade. What will happen after that.

I know that Since the option never went into in the Money, It will expire at 0.

How much STT will be charged on me. In the above example I am in Loss.

If suppose in the above example If I am in profit, how much STT will be charged.

Can I keep the option and let them expire on it's own, If there are no buyers & Sellers

|

|

| Back to top |

|

|

|

|

|

jk99

White Belt

Joined: 20 May 2013

Posts: 81

|

Post: #2  Posted: Mon Sep 05, 2016 9:13 pm Post subject: Posted: Mon Sep 05, 2016 9:13 pm Post subject: |

|

|

| i hoped option is not for trading ,it is only for insurance used /regards

|

|

| Back to top |

|

|

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #3  Posted: Tue Sep 06, 2016 9:35 am Post subject: Posted: Tue Sep 06, 2016 9:35 am Post subject: |

|

|

| jk99 wrote: | | i hoped option is not for trading ,it is only for insurance used /regards |

Hi JK9

At Small level it can be used for Trading.

|

|

| Back to top |

|

|

Gemini

White Belt

Joined: 28 Apr 2009

Posts: 166

|

Post: #4  Posted: Tue Sep 06, 2016 11:46 am Post subject: Posted: Tue Sep 06, 2016 11:46 am Post subject: |

|

|

Hydrogen:

Situations and suggested actions at expiry

Call Options-

- If Market price (Spot) is lower than Sold / bought strike price, do nothing. (In your example - nothing needs to be done).

- If market price (spot) is more than sold / bought strike price, square off.

Put Options-

- If Market price (spot) is higher than Sold / bought strike price, do nothing. (In your example - nothing needs to be done).

- If market price (spot) is lower than sold / bought strike price, square off.

JK99: Options are used for trading ..

Regards.

|

|

| Back to top |

|

|

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #5  Posted: Sat Sep 10, 2016 10:22 am Post subject: Posted: Sat Sep 10, 2016 10:22 am Post subject: |

|

|

| Gemini wrote: | Hydrogen:

Situations and suggested actions at expiry

Call Options-

- If Market price (Spot) is lower than Sold / bought strike price, do nothing. (In your example - nothing needs to be done).

- If market price (spot) is more than sold / bought strike price, square off.

Put Options-

- If Market price (spot) is higher than Sold / bought strike price, do nothing. (In your example - nothing needs to be done).

- If market price (spot) is lower than sold / bought strike price, square off.

JK99: Options are used for trading ..

Regards. |

Thanks Gemini

|

|

| Back to top |

|

|

jk99

White Belt

Joined: 20 May 2013

Posts: 81

|

Post: #6  Posted: Sat Sep 10, 2016 8:25 pm Post subject: Posted: Sat Sep 10, 2016 8:25 pm Post subject: |

|

|

hi hydrogen,

now clossed is 8866,

let us apply one technique as,

buy 3 times put of8700 and 1 time call of 8900 for oct expiry ,

after market settle on (when market open)

we will exit near about double our investment or if market goes up ...let us see how put adjust ,,,(i am leaner not expert)

regards

*learner

|

|

| Back to top |

|

|

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #7  Posted: Mon Sep 12, 2016 12:47 am Post subject: Posted: Mon Sep 12, 2016 12:47 am Post subject: |

|

|

| jk99 wrote: | hi hydrogen,

now clossed is 8866,

let us apply one technique as,

buy 3 times put of8700 and 1 time call of 8900 for oct expiry ,

after market settle on (when market open)

we will exit near about double our investment or if market goes up ...let us see how put adjust ,,,(i am leaner not expert)

regards

*learner |

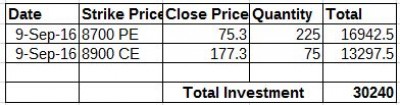

Well, I don't know what is your strategy behind the technique you have given. Just to Document it I am attaching the Investment. This is the EOD value of the option taken from NSE India site.

Will See it after expiry.

| Description: |

|

| Filesize: |

22.43 KB |

| Viewed: |

417 Time(s) |

|

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #8  Posted: Mon Sep 12, 2016 7:21 pm Post subject: Posted: Mon Sep 12, 2016 7:21 pm Post subject: |

|

|

Hi - In your original example you have said you want to exit both options at 5 paisa which clearly means both options are expiring OTM and eventually will expire at 0. No additional STT is payable if you let them expire worthless as both legs are expiring OTM

What if either or both options are expiring ITM? read on ...

http://zerodha.com/z-connect/queries/stock-and-fo-queries/stt-options-nse-bse-mcx-sx

Cheers

SH

|

|

| Back to top |

|

|

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #9  Posted: Mon Sep 12, 2016 8:37 pm Post subject: Posted: Mon Sep 12, 2016 8:37 pm Post subject: |

|

|

| Alchemist wrote: | Hi - In your original example you have said you want to exit both options at 5 paisa which clearly means both options are expiring OTM and eventually will expire at 0. No additional STT is payable if you let them expire worthless as both legs are expiring OTM

What if either or both options are expiring ITM? read on ...

http://zerodha.com/z-connect/queries/stock-and-fo-queries/stt-options-nse-bse-mcx-sx

Cheers

SH |

Hi Alchemist

Thanks, for the link

This is what I was expecting the answer. Wanted to know the STT part and you have showed the way.

|

|

| Back to top |

|

|

|