| View previous topic :: View next topic |

| Author |

Option trading: few questions |

x2y2z2xyz3

White Belt

Joined: 27 Dec 2011

Posts: 25

|

Post: #1  Posted: Mon Apr 15, 2013 11:01 am Post subject: Option trading: few questions Posted: Mon Apr 15, 2013 11:01 am Post subject: Option trading: few questions |

|

|

Hi Friends,

I am new option trading and currently doing paper trade for past 1 month. I have few doubts about writing put or call options( I know it is very risky  ). ).

Example: Suppose I have SHORT HEROHONDA CE1540 at 10.95 on Friday. I have received the premium for the same.

Now, today is around 8.75.

Firstly, I can buy it back now? If yes, then how the settlement happens and when?

How profit or loss is calculated in this case.

Regards

SK

|

|

| Back to top |

|

|

|

|

|

apka

Black Belt

Joined: 13 Dec 2011

Posts: 6137

|

Post: #2  Posted: Mon Apr 15, 2013 11:06 am Post subject: Posted: Mon Apr 15, 2013 11:06 am Post subject: |

|

|

1. yes you can buy now or anytime lower also.

2. immediately it will reflect in your trading margin and your blocked margin for shorting the call will also be added back.

3. profit will be same difference between your buy and sell price. only sequence has changed of the trade from buying first to selling first. just like incase of shorting / longing futures.

|

|

| Back to top |

|

|

x2y2z2xyz3

White Belt

Joined: 27 Dec 2011

Posts: 25

|

Post: #3  Posted: Mon Apr 15, 2013 11:13 am Post subject: Posted: Mon Apr 15, 2013 11:13 am Post subject: |

|

|

Thanks Apka for such a prompt reply

So, now I am in profit as I have to only pay 125 ( lot size )*8.75.

Profit will be = (10.95 - 8.75)*125

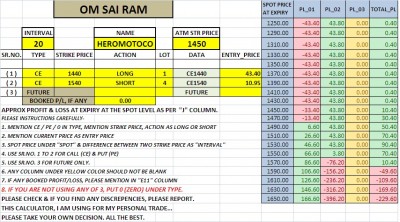

What do you think about below Vertical Bull spread?

Hero Honda

LONG 1 CE1440 43.40

SHORT 4 CE1540 10.95

SPOT PRICE AT EXPIRY PL_01 PL_02 TOTAL_PL

1350.00 -43.40 43.80 0.40

1370.00 -43.40 43.80 0.40

1380.00 -43.40 43.80 0.40

1390.00 -43.40 43.80 0.40

1400.00 -43.40 43.80 0.40

1410.00 -43.40 43.80 0.40

1420.00 -43.40 43.80 0.40

1430.00 -43.40 43.80 0.40

1440.00 -43.40 43.80 0.40

1450.00 -33.40 43.80 10.40

1460.00 -23.40 43.80 20.40

1470.00 -13.40 43.80 30.40

1480.00 -3.40 43.80 40.40

1490.00 6.60 43.80 50.40

1500.00 16.60 43.80 60.40

1510.00 26.60 43.80 70.40

1520.00 36.60 43.80 80.40

1530.00 46.60 43.80 90.40

1540.00 56.60 43.80 100.40

1550.00 66.60 3.80 70.40

1560.00 76.60 -36.20 40.40

1570.00 86.60 -76.20 10.40

1580.00 96.60 -116.20 -19.60

|

|

| Back to top |

|

|

apka

Black Belt

Joined: 13 Dec 2011

Posts: 6137

|

Post: #4  Posted: Mon Apr 15, 2013 11:20 am Post subject: Posted: Mon Apr 15, 2013 11:20 am Post subject: |

|

|

i dont keep track on hero honda so anything i say maybe unuseful!

i checked its chart and it has fallen 300 points already and its below its weekly bollinger band. little risky short call i say. its oversold and could bounce.

|

|

| Back to top |

|

|

ndpotade

Yellow Belt

Joined: 05 Feb 2010

Posts: 580

|

Post: #5  Posted: Mon Apr 15, 2013 11:28 am Post subject: Posted: Mon Apr 15, 2013 11:28 am Post subject: |

|

|

Thanks for strategy...

| Description: |

|

| Filesize: |

230.95 KB |

| Viewed: |

497 Time(s) |

|

|

|

| Back to top |

|

|

x2y2z2xyz3

White Belt

Joined: 27 Dec 2011

Posts: 25

|

Post: #6  Posted: Mon Apr 15, 2013 11:29 am Post subject: Posted: Mon Apr 15, 2013 11:29 am Post subject: |

|

|

That's what I cannot understand..... cannot I sell all the positions when it is at 1540 before expiry? I see 1430 is good support for it.

I am playing protective as results are around corner for Hero honda too. Another fall will not impact this strategy as . I am also bullish about it

Total premium is zero while buy this leg

1 lot 1440 CE long at 43 - 4 lot 1540 CE short at 10.95

43 - 44 = 1 ( got a premium ).

Regards,

SK

|

|

| Back to top |

|

|

x2y2z2xyz3

White Belt

Joined: 27 Dec 2011

Posts: 25

|

Post: #7  Posted: Mon Apr 15, 2013 11:36 am Post subject: Posted: Mon Apr 15, 2013 11:36 am Post subject: |

|

|

Ndpotade,

I guess we need to account the premium rise for 1540 CE also. For example if we short at 10.95 and when stock price rise to 1540...sure the premium will be high for example 35.95. So buying back at higher premium is not accounted.

we might loss (35.95 -10.95)*4 = 20*4 = 80 *125

Regards,

SK

|

|

| Back to top |

|

|

apka

Black Belt

Joined: 13 Dec 2011

Posts: 6137

|

Post: #8  Posted: Mon Apr 15, 2013 11:37 am Post subject: Posted: Mon Apr 15, 2013 11:37 am Post subject: |

|

|

| x2y2z2xyz3 wrote: | That's what I cannot understand..... cannot I sell all the positions when it is at 1540 before expiry? I see 1430 is good support for it.

I am playing protective as results are around corner for Hero honda too. Another fall will not impact this strategy as . I am also bullish about it

Total premium is zero while buy this leg

1 lot 1440 CE long at 43 - 4 lot 1540 CE short at 10.95

43 - 44 = 1 ( got a premium ).

Regards,

SK |

where do you expect expiry to happen for hero honda?

|

|

| Back to top |

|

|

x2y2z2xyz3

White Belt

Joined: 27 Dec 2011

Posts: 25

|

Post: #9  Posted: Mon Apr 15, 2013 11:47 am Post subject: Posted: Mon Apr 15, 2013 11:47 am Post subject: |

|

|

It is a neutral strategy. Max profit I have it around 1540.

Zero Loss as no premium paid by me. In case, I see price is going above 1540... I will sell off everything.

Regards,

SK

|

|

| Back to top |

|

|

apka

Black Belt

Joined: 13 Dec 2011

Posts: 6137

|

Post: #10  Posted: Mon Apr 15, 2013 12:03 pm Post subject: Posted: Mon Apr 15, 2013 12:03 pm Post subject: |

|

|

| ok. i dont do shorting in options, so would be interested to know how this goes if you can update.

|

|

| Back to top |

|

|

x2y2z2xyz3

White Belt

Joined: 27 Dec 2011

Posts: 25

|

Post: #11  Posted: Mon Apr 15, 2013 12:12 pm Post subject: Posted: Mon Apr 15, 2013 12:12 pm Post subject: |

|

|

I am also doing paper trade  . Will update this thread . Will update this thread

|

|

| Back to top |

|

|

apka

Black Belt

Joined: 13 Dec 2011

Posts: 6137

|

Post: #12  Posted: Mon Apr 15, 2013 12:28 pm Post subject: Posted: Mon Apr 15, 2013 12:28 pm Post subject: |

|

|

| x2y2z2xyz3 wrote: | I am also doing paper trade  . Will update this thread . Will update this thread |

LOL... my excitement to learn from an actual trade of profit loss just dimmed a little.

|

|

| Back to top |

|

|

x2y2z2xyz3

White Belt

Joined: 27 Dec 2011

Posts: 25

|

Post: #13  Posted: Mon Apr 15, 2013 3:36 pm Post subject: Posted: Mon Apr 15, 2013 3:36 pm Post subject: |

|

|

P/L as today if take out the money

Spot = 1439

1440 CE = 34.20 Long

1540 CE = 6.25 Short

= Credit - debit

= 4 * ( 10.95 - 6.25 ) - ( 43.40 - 34.20 )

= 18.8 - 9.20

= 9.60

= 9.60 * 125 ( lot size )

= 1200 rs

|

|

| Back to top |

|

|

x2y2z2xyz3

White Belt

Joined: 27 Dec 2011

Posts: 25

|

Post: #14  Posted: Tue Apr 16, 2013 10:38 am Post subject: Posted: Tue Apr 16, 2013 10:38 am Post subject: |

|

|

New Spot : 1475

P/L

1440 CE = 52.95 Long

1540 CE = 11.40 Short

= Credit - debit

= 4 * ( 10.95 - 11.40 ) - ( 43.40 - 52.95 )

= 7.75

= 7.75 * 125 ( lot size )

= 975 rs

|

|

| Back to top |

|

|

apka

Black Belt

Joined: 13 Dec 2011

Posts: 6137

|

Post: #15  Posted: Tue Apr 16, 2013 12:06 pm Post subject: Posted: Tue Apr 16, 2013 12:06 pm Post subject: |

|

|

| 16th april u have taken fresh entry or continued?

|

|

| Back to top |

|

|

|