| View previous topic :: View next topic |

| Author |

Option writing with assured Gain on investments |

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #46  Posted: Tue Jul 17, 2012 4:16 pm Post subject: Re: as of 17july 12pm Posted: Tue Jul 17, 2012 4:16 pm Post subject: Re: as of 17july 12pm |

|

|

| rakpeds wrote: | | arnav2007 wrote: | | Vinodz wrote: | pls confirm positions as of 17july

short written

5300PEAUG

5400CEAUG

5300CEAUG

thanks |

sir ji, you are right

find attached option sheet

wishes

arnav |

Arnav sir... i missed this last trade  was busy.. but not no worries... will do it now.. was busy.. but not no worries... will do it now..

also sir what is the maximum number of short we will be keeping open at one time ???

|

dear, currently we are using about two lot of Nifty margin plus exposure margin of about 15 k.

Option writing is mainly counts return on either margin used or kept in safety for using the same in time of needs.

so I do not presume any no of trades but in all margin used shall be restricted to 1.5 -2.00 lac.

one other thing, I generally used concept to reduce trade of opposite side to trend and don't hesitate in writing at trend side.

arnav

|

|

| Back to top |

|

|

|

|

|

jitesh7

White Belt

Joined: 24 Dec 2009

Posts: 24

|

Post: #47  Posted: Tue Jul 17, 2012 4:59 pm Post subject: Posted: Tue Jul 17, 2012 4:59 pm Post subject: |

|

|

Hi Arnav,

At the moment we have 3 open position (2 CE and 1 PE). Here we are hedging one CE by one PE. dont you think that we Should hedge other CE Sell as well. what will happen if tomarrow MACD will give the buy signal? in that case will this CE be simply replaced by PE sell?

regards,

Jitesh

|

|

| Back to top |

|

|

Gemini

White Belt

Joined: 28 Apr 2009

Posts: 166

|

Post: #48  Posted: Tue Jul 17, 2012 6:28 pm Post subject: Posted: Tue Jul 17, 2012 6:28 pm Post subject: |

|

|

Nice thread, interesting discussions.

One word of caution, though... Selling put is more risky as when the market falls, the fall is quite rapid and one may not get chance to cover the position.

For beginners on the thread, I recommend dealing with only writing (i.e. selling) of calls.

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #49  Posted: Tue Jul 17, 2012 6:45 pm Post subject: Posted: Tue Jul 17, 2012 6:45 pm Post subject: |

|

|

| jitesh7 wrote: | Hi Arnav,

At the moment we have 3 open position (2 CE and 1 PE). Here we are hedging one CE by one PE. dont you think that we Should hedge other CE Sell as well. what will happen if tomarrow MACD will give the buy signal? in that case will this CE be simply replaced by PE sell?

regards,

Jitesh |

hi jitesh

about hedging-risk etc. kindly go through full post.

then any  we we

there shall not be presumptive trading.

Wishes

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #50  Posted: Wed Jul 18, 2012 12:53 pm Post subject: Posted: Wed Jul 18, 2012 12:53 pm Post subject: |

|

|

Present value of liability 14150/-

5000 pe and 5400 ce can be bought for hedging

my view of july is still sideways.

arnav

|

|

| Back to top |

|

|

shankaar10

Black Belt

Joined: 01 Apr 2012

Posts: 2739

|

Post: #51  Posted: Thu Jul 19, 2012 11:33 am Post subject: Posted: Thu Jul 19, 2012 11:33 am Post subject: |

|

|

Hi Arnav,

My early stage in trading i have researched and tested subject hedging strategy for months but making money is quite remote and you will end up loosing in brokerage. I am no mean to discourage you guys but encourage you to back test before investing anything in real terms.

One more thing if you are pro with direction than you will make some money or during sideways otherwise not worth.

In July and Oct months you may yield some return.

Wish you all good luck.

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #52  Posted: Fri Jul 20, 2012 10:28 am Post subject: Posted: Fri Jul 20, 2012 10:28 am Post subject: |

|

|

5200 PE AUG Coverd @ 96

no loss in gross 5200 pe written

arnav

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #53  Posted: Mon Jul 23, 2012 9:03 am Post subject: Posted: Mon Jul 23, 2012 9:03 am Post subject: |

|

|

Sq.off 5400 aug call between 18-21

arnav

|

|

| Back to top |

|

|

rakpeds

White Belt

Joined: 24 Jun 2012

Posts: 481

|

Post: #54  Posted: Mon Jul 23, 2012 12:47 pm Post subject: Posted: Mon Jul 23, 2012 12:47 pm Post subject: |

|

|

| arnav2007 wrote: | 5200 PE AUG Coverd @ 96

no loss in gross 5200 pe written

arnav |

wasnt it a 5300pe... sry if i am wrong

|

|

| Back to top |

|

|

rakpeds

White Belt

Joined: 24 Jun 2012

Posts: 481

|

Post: #55  Posted: Mon Jul 23, 2012 12:58 pm Post subject: Posted: Mon Jul 23, 2012 12:58 pm Post subject: |

|

|

| arnav2007 wrote: | Sq.off 5400 aug call between 18-21

arnav |

also arnav sir... currently we have only 5300CE AUG short right...

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #56  Posted: Mon Jul 23, 2012 2:52 pm Post subject: Posted: Mon Jul 23, 2012 2:52 pm Post subject: |

|

|

Sq. off 5400 call aug. @ 23.8

remainging 5300 ca aug cmp 47

Value of liability 2350/-

Value earned 12,950/- profit so far = 10600/-

option trading sheet attached

arnav

| Description: |

|

Download |

| Filename: |

Option Trading Sheet.xls |

| Filesize: |

69.5 KB |

| Downloaded: |

431 Time(s) |

|

|

| Back to top |

|

|

rakpeds

White Belt

Joined: 24 Jun 2012

Posts: 481

|

Post: #57  Posted: Mon Jul 23, 2012 3:09 pm Post subject: Posted: Mon Jul 23, 2012 3:09 pm Post subject: |

|

|

| arnav2007 wrote: | Sq. off 5400 call aug. @ 23.8

remainging 5300 ca aug cmp 47

Value of liability 2350/-

Value earned 12,950/- profit so far = 10600/-

option trading sheet attached

arnav |

yes arnav sir... grt...

So what next only holding 5300 CE AUG...

Waiting for the nxt trades ...

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #58  Posted: Wed Jul 25, 2012 2:36 pm Post subject: Posted: Wed Jul 25, 2012 2:36 pm Post subject: |

|

|

As per Nifty chart unless it not closes below lower band of BB-20, no new trade till expiry except present positions.

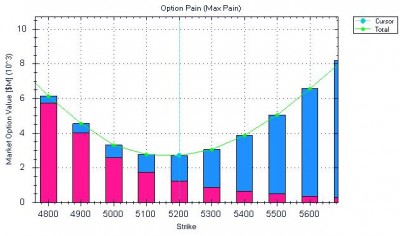

Option data of Aug series is also showing support of 5100 puts and expiry of this month between 5110-5140

see what happens on expiry

so far this series is profitable

arnav

| Description: |

|

| Filesize: |

167.31 KB |

| Viewed: |

512 Time(s) |

|

| Description: |

|

| Filesize: |

38.6 KB |

| Viewed: |

450 Time(s) |

|

|

|

| Back to top |

|

|

rakpeds

White Belt

Joined: 24 Jun 2012

Posts: 481

|

Post: #59  Posted: Wed Jul 25, 2012 2:43 pm Post subject: Posted: Wed Jul 25, 2012 2:43 pm Post subject: |

|

|

| arnav2007 wrote: | As per Nifty chart unless it not closes below lower band of BB-20, no new trade till expiry except present positions.

Option data of Aug series is also showing support of 5100 puts and expiry of this month between 5110-5140

see what happens on expiry

so far this series is profitable

arnav |

Thanks for the update arnav sir... yes this series was good... awaiting the next series and trades sir

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #60  Posted: Tue Jul 31, 2012 2:38 pm Post subject: Posted: Tue Jul 31, 2012 2:38 pm Post subject: |

|

|

Hi

Now we are out of expiry mania and so callled major event 'RBI' policy.

Now back to normal

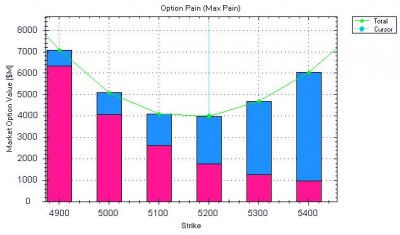

Nifty charts and BB-20 suggest ranged market for options.

If nifty sustain above 5200 and closes today above 5200 short

1 lot Nifty put 5100 sep. series

No aggressive shorting as Indiavix is very low (16.21) and major surprising movement possible either side.

arnav

| Description: |

|

| Filesize: |

37.35 KB |

| Viewed: |

465 Time(s) |

|

| Description: |

|

| Filesize: |

166.45 KB |

| Viewed: |

500 Time(s) |

|

|

|

| Back to top |

|

|

|